Get the free Form 8879: IRS e-File Signature Authorization

Get, Create, Make and Sign form 8879 irs e-file

How to edit form 8879 irs e-file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8879 irs e-file

How to fill out form 8879 irs e-file

Who needs form 8879 irs e-file?

Comprehensive Guide to Form 8879 IRS E-File Form

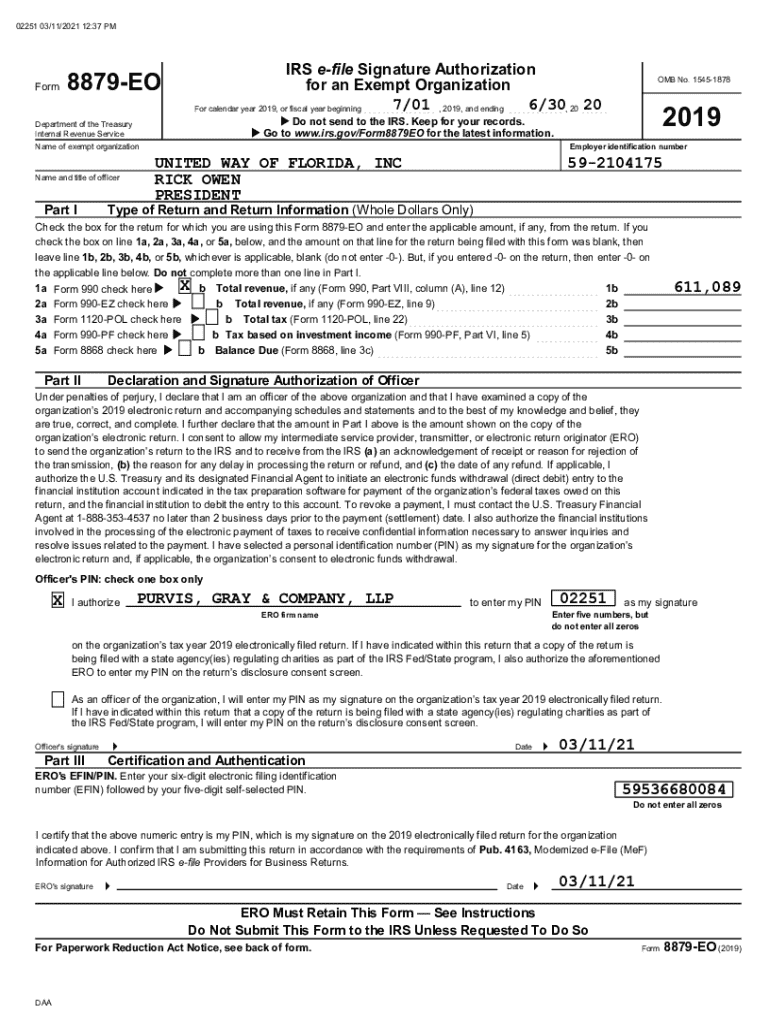

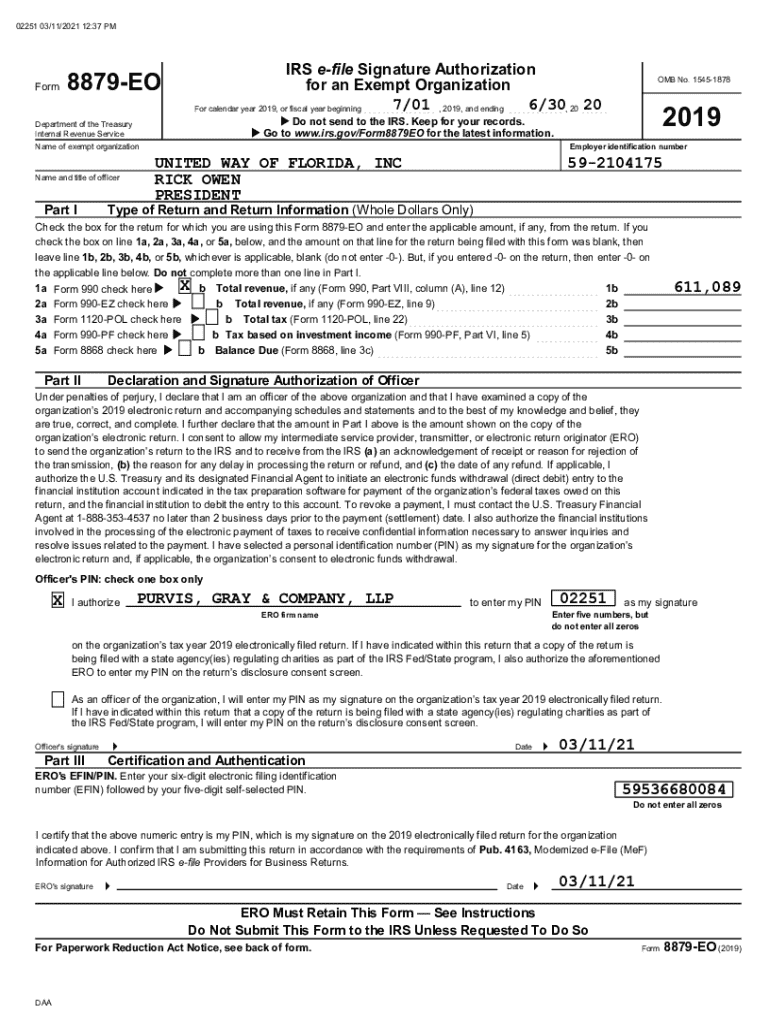

Understanding Form 8879: Overview

Form 8879, also known as the IRS e-file Signature Authorization form, plays a crucial role in the electronic filing of federal tax returns. This form allows taxpayers to grant permission to their chosen Electronic Return Originator (ERO) to electronically file their tax returns on their behalf. Without this authorization, an e-file cannot proceed, making Form 8879 an essential component of the e-filing process.

The primary purpose of Form 8879 is to ensure that taxpayers can securely provide their consent for e-filing, thereby streamlining the tax submission process. This form is vital for all taxpayers who choose to file their returns electronically, ensuring that all submitted data is accurate and authorized.

Who should utilize Form 8879? Primarily, anyone who has their tax returns prepared by a paid tax professional or uses tax preparation software that enables e-filing will need to complete this form. This includes individual taxpayers, couples filing jointly, and small business owners.

Key features of Form 8879

Form 8879 requires several key details to be filled out correctly. Taxpayers must provide their personal information, such as name, Social Security number, and the tax year for which they are filing. Additionally, the form summarizes the essential data from the tax return itself, reinforcing the need for accuracy prior to e-filing.

One notable aspect of Form 8879 is the taxpayer’s declaration, which serves as a crucial affirmation of the accuracy and completeness of the information provided. This declaration not only emphasizes responsibility but also provides assurance to the IRS that the taxpayer has reviewed their return. Furthermore, the user-friendly design of the form simplifies the process, making it accessible to individuals who may not be tax professionals.

Step-by-step instructions for filling out Form 8879

Completing Form 8879 can be straightforward when approached step-by-step. Start by gathering the necessary information, which includes personal details and relevant tax return specifics. Ensure you have your Social Security number, the tax year in question, and any pertinent details regarding the return that will be e-filed.

During the completion phase, you will arrive at Part I of the form—Tax Return Information—where relevant data from your tax return should be filled in. This section includes income information, tax deductions, and any credit details that may affect your filing. Next is Part II, which consists of the taxpayer declaration and signature authorization. Here, you must affirm that the information is complete and accurate before signing off on your consent for the e-filing.

Part III involves certification and authentication, ensuring that the ERO adheres to the Internal Revenue Service guidelines. After filling out the form, it is crucial to review your entries thoroughly to confirm accuracy and consistency with your tax data. Finally, submit Form 8879 by providing it to your ERO, who will handle the electronic filing. Remember that the ERO plays a vital role in ensuring that your e-filing transaction is completed correctly.

Interactive tools for Form 8879 management

Utilizing interactive tools like pdfFiller enhances your experience with Form 8879 tremendously. This platform allows you to edit and customize the form effortlessly. With features designed for seamless form preparation, you can fill out the necessary fields, making edits as needed without the hassle of printing and resubmitting.

Moreover, pdfFiller includes collaboration tools that enhance teamwork, making it an ideal choice for businesses or families working together on tax matters. The platform also offers e-signing capabilities, allowing you to speed up the approval process. Another notable benefit is the incorporation of cloud storage, which ensures that your Form 8879 is easily accessible from anywhere, providing peace of mind during the busy tax season.

Common questions about Form 8879

Even with clear instructions, you may have questions regarding Form 8879. A common concern is what happens if a mistake occurs on the form. If you realize an error after submission, it is possible to correct it by filing an amended return. Always reach out to your ERO for guidance on the most appropriate steps to take.

Another frequent inquiry involves the potential to save the form and complete it later. Fortunately, many platforms, including pdfFiller, allow you to save your progress and return to Form 8879 at your convenience. This flexibility is particularly useful for busy individuals who may not have all information readily available at once.

Additional considerations

As taxpayers adapt to the e-filing landscape, understanding responsibilities is paramount. When utilizing Form 8879, taxpayers must ensure the information provided is honest and precise, as any discrepancies could lead to potential issues down the line, including audits.

It's crucial to pay attention to deadlines associated with Form 8879. Typically, e-filed returns and the corresponding authorization should be submitted by the tax deadline, which varies yearly. Familiarizing yourself with these timelines can save you from unexpected penalties. Additionally, it’s wise to keep copies of all tax forms, including Form 8879, for your records, as this aids in managing any future inquiries you may have with the IRS.

Video walkthrough

Videos can offer helpful insights into filling out Form 8879 efficiently. A detailed video walkthrough can demonstrate the methodical completion of the form, from start to finish, highlighting critical areas that require attention. Seeing the form filled out in real time can demystify the process, making you feel more comfortable when you tackle it yourself.

These visual tips provide strategies for efficient form completion and can serve as useful supplementary material beyond written instructions. Incorporating this dynamic method of learning can cater to diverse preferences, assuring users that they are completing the form correctly.

Resources for further support

For additional assistance regarding Form 8879, accessing resources provided by the IRS is beneficial. The IRS website houses official documentation and FAQs that address common concerns. Moreover, exploring additional IRS forms that might relate to your specific tax situation can further clarify your obligations and rights as a taxpayer.

Engaging with professionals or participating in community forums can also amplify your financial planning strategies, ensuring you maximize the efficiency of the e-filing process. From expert tips to shared lessons learned, connecting with others navigating their tax responsibilities can be invaluable.

User experiences

User testimonials highlight how pdfFiller has transformed the experience of utilizing Form 8879. Many users appreciate the platform's ease of use, detailing how quick edits and e-signing features have expedited their tax preparation process, allowing them to focus on other essential tasks during tax season.

Success stories reveal that users feel more confident in their ability to e-file with precision and accuracy, facilitated by pdfFiller’s intuitive interface. Knowing they have reliable tools at their disposal helps users manage complex tax matters, enhance productivity, and promote accuracy during e-filing.

Engage with our community

Engaging with the pdfFiller community can offer unique insights and collective wisdom on navigating Form 8879. Users are encouraged to leave feedback or pose questions regarding their experiences, fostering a space for shared learning and advice.

Connecting with fellow users can unearth valuable tips and strategies to optimize your e-filing process further. Ultimately, sharing insights helps build a supportive user network, ensuring everyone can benefit from a streamlined experience when managing their tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8879 irs e-file directly from Gmail?

How do I complete form 8879 irs e-file online?

How can I edit form 8879 irs e-file on a smartphone?

What is form 8879 irs e-file?

Who is required to file form 8879 irs e-file?

How to fill out form 8879 irs e-file?

What is the purpose of form 8879 irs e-file?

What information must be reported on form 8879 irs e-file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.