Get the free 2021 Form 541 California Fiduciary Income Tax Return

Get, Create, Make and Sign 2021 form 541 california

Editing 2021 form 541 california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 form 541 california

How to fill out 2021 form 541 california

Who needs 2021 form 541 california?

A Comprehensive Guide to the 2021 Form 541: California Fiduciary Income Tax Return

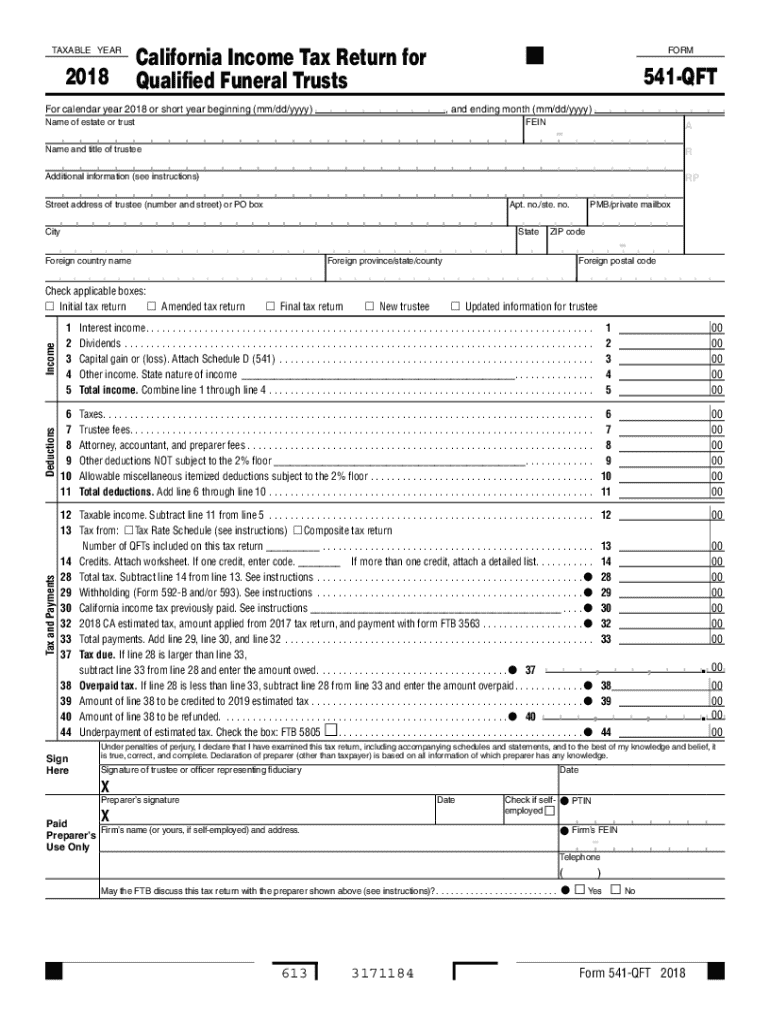

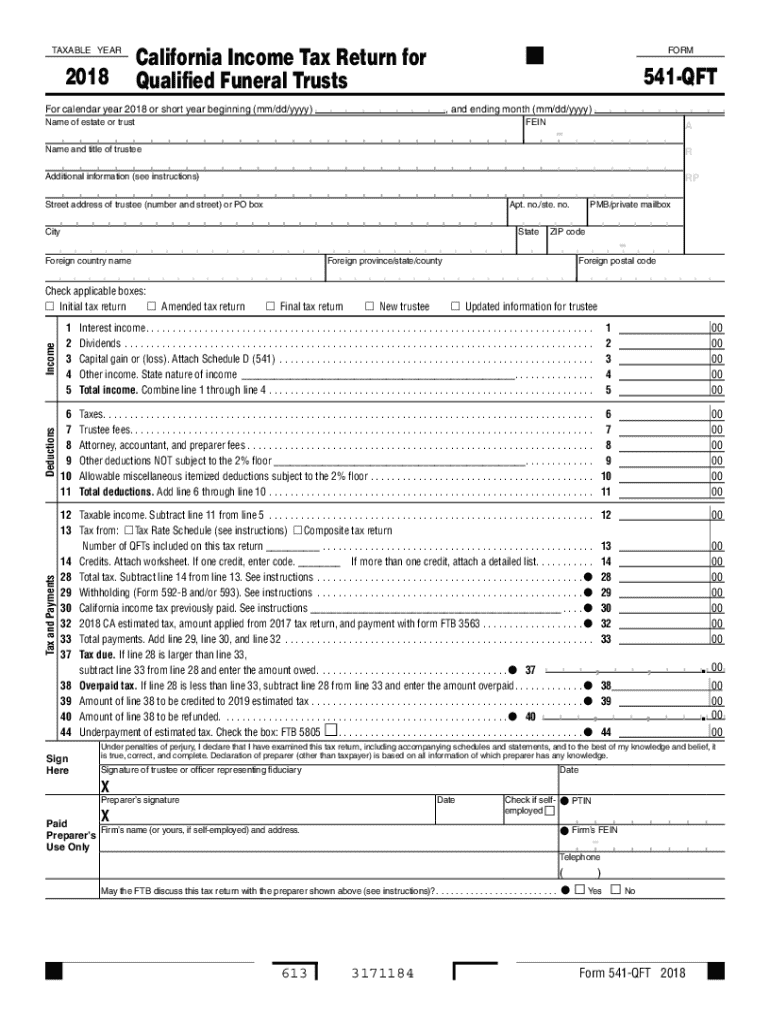

Overview of 2021 Form 541: California Fiduciary Income Tax Return

Form 541 is the California Fiduciary Income Tax Return, essential for reporting income generated by estates and trusts. Fiduciaries, such as executors or trustees, must file this form to ensure that tax obligations are fulfilled accurately on behalf of the estate or trust.

The importance of filing Form 541 cannot be overstated; it not only helps maintain compliance with state laws but also allows fiduciaries to accurately report income. Failure to file could result in penalties, interest, or further legal complications for the estate or trust.

The 2021 version brought several significant changes intending to streamline the filing process and embrace updates pertinent to the ongoing economic landscape. Key features include revised income categories and updated deduction limits.

General information

Anyone who oversees an estate or trust must file Form 541 if the taxable income exceeds the filing threshold. Generally, this includes fiduciaries managing a trust or estate that has derived income within the taxable year, including income from investments or business operations.

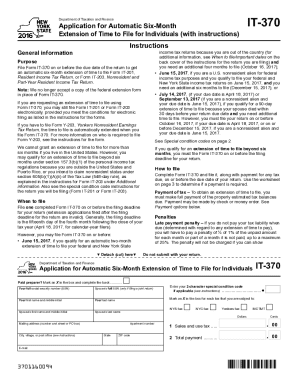

For the filing year 2021, the key deadlines were typically set for April 15, 2022. However, if this date falls on a weekend or holiday, the deadline would extend to the next business day. It's crucial for fiduciaries to be aware of this and file on time to avoid penalties.

Payment options for any associated taxes include direct bank transfers, checks, and online payments through the California Franchise Tax Board's website, allowing flexibility for taxpayers when settling their dues.

Important updates in 2021

There were significant updates to Form 541 in 2021 compared to previous years. One major change was the inclusion of new income categories that simplified the reporting process for certain types of income. For instance, there was a clearer distinction between different sources of income such as dividends and interest.

In addition, new credits and deductions were introduced, providing potentially valuable tax relief for estates and trusts. This included adjustments related to the COVID-19 pandemic, which affected income generation in many cases.

These updates were intended to ease the complexities faced by fiduciaries while ensuring compliance with evolving state regulations. Understanding these changes is crucial for accurate reporting and maximizing potential tax benefits.

Step-by-step guide to completing Form 541

Completing Form 541 requires careful attention to detail. Here's a step-by-step breakdown:

### A. Identifying trusts and estates

Begin by classifying the entity—determine if you're dealing with an estate or a trust. Make sure to gather all necessary documentation that highlights the trust's or estate’s income sources and beneficiaries.

### B. Income reporting

Report different types of income following the guidelines given on the form:

Be vigilant about common errors, such as miscalculating income or neglecting to report certain income categories, as these can lead to audits.

### C. Deductions and credits

Identify allowances for deductions, such as administrative costs or losses, making sure they adhere to recognized categories. Credits, including any newly available ones for 2021, can greatly reduce tax liability.

### D. Tax computation

To calculate tax, follow the linear tax rates as indicated, and be mindful of any Alternative Minimum Tax (AMT) implications that might affect higher-income estates or trusts.

Special considerations

Certain unique scenarios require additional attention when completing Form 541:

Specific line instructions and worksheets

Detailed line-by-line guidance can significantly ease the filing process. Here are key areas of focus within the form:

Utilizing available worksheets can enhance accuracy in tax calculations, and online tools may help in this regard.

Managing complex scenarios

Filing for a decedent's estate comes with specific requirements that vary from standard fiduciary returns. It's important to carefully document all income and expenses attributed to the decedent's estate.

Disputes with the tax board can arise, and understanding your rights as a fiduciary is essential. Seeking professional assistance through tax advisors or attorneys can help navigate these challenging situations.

Tools and resources for efficient filing

Leveraging tools can greatly enhance the filing experience for Form 541. Utilizing PDF editing tools like the ones offered by pdfFiller helps streamline the process of filling out Form 541 accurately.

Online platforms can support collaborative filling, making it easier for teams involved in fiduciary management to efficiently manage document creation. eSignature solutions can further expedite submission processes, ensuring timely filings.

Frequently asked questions (FAQs)

Common questions about Form 541 often arise, reflecting the complex nature of fiduciary tax returns. Here are a few frequently asked questions to clarify common uncertainties:

Staying informed

It's essential to stay updated on any changes to the California income tax landscape. Accessing the latest information from the Franchise Tax Board should be a priority for fiduciaries, ensuring that submissions remain compliant with current regulations.

Ongoing education surrounding tax reforms is vital. This may include participating in webinars or training sessions that address state tax developments. Maintaining a connection with industry updates will reinforce the fiduciary's ability to file accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2021 form 541 california?

Can I create an electronic signature for the 2021 form 541 california in Chrome?

How do I edit 2021 form 541 california on an Android device?

What is 2021 form 541 california?

Who is required to file 2021 form 541 california?

How to fill out 2021 form 541 california?

What is the purpose of 2021 form 541 california?

What information must be reported on 2021 form 541 california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.