Get the free The - Treasury Offset Program - (TOP) is a centralized debt ...

Get, Create, Make and Sign form - treasury offset

How to edit form - treasury offset online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form - treasury offset

How to fill out form - treasury offset

Who needs form - treasury offset?

Understanding the Treasury Offset Form: A Comprehensive Guide

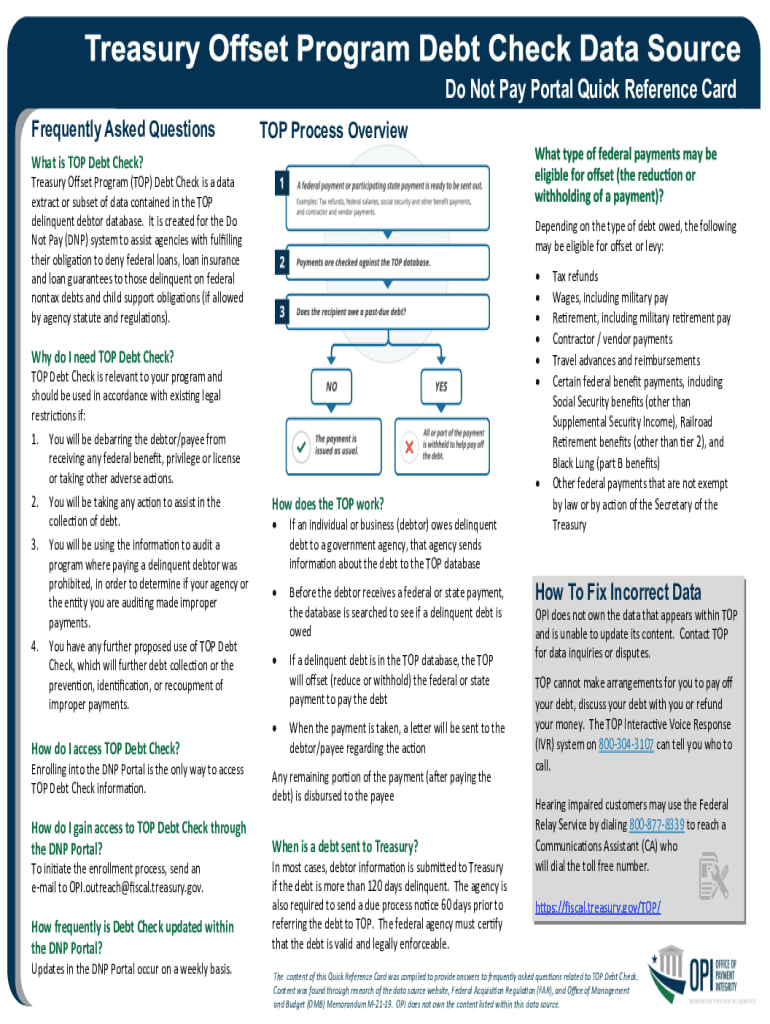

Overview of the Treasury Offset Program (TOP)

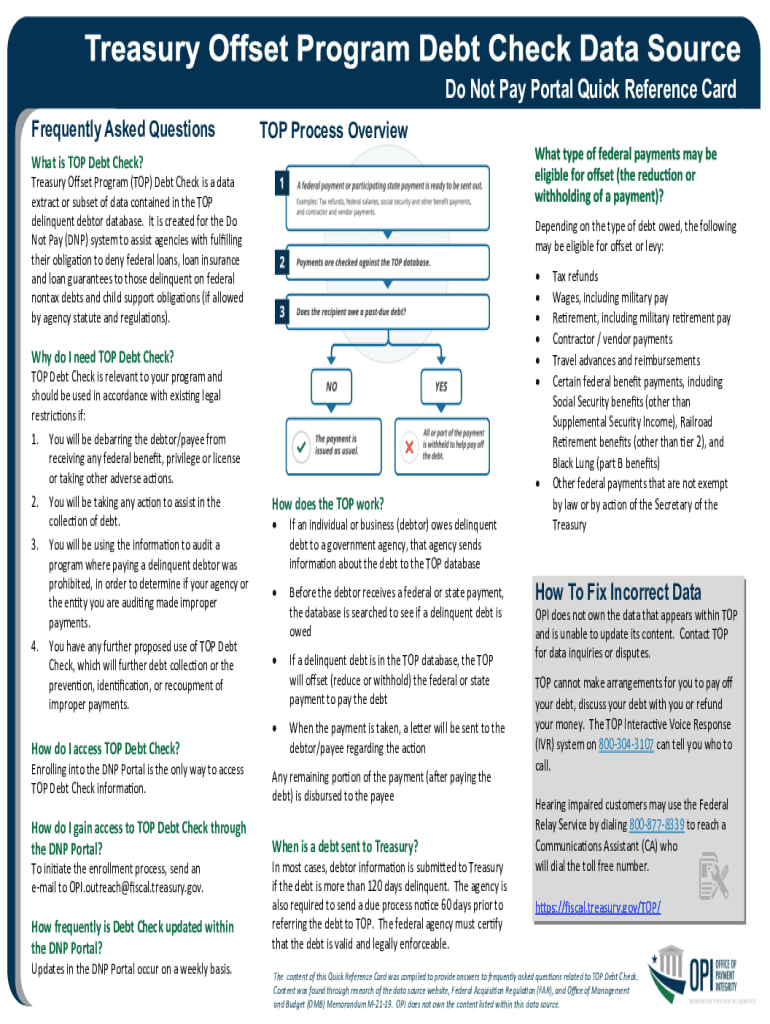

The Treasury Offset Program (TOP) is a powerful tool implemented by the U.S. Department of the Treasury to recover debts owed to federal and state agencies through the interception of various payments, such as tax refunds and federal benefit payments. Essentially, the program acts as a mechanism for ensuring that taxpayers meet their financial obligations, thereby supporting the integrity of the government's financial systems. For individuals and organizations dealing with debts, understanding the Treasury Offset Form becomes crucial, as it facilitates participation in this program.

Understanding the Treasury Offset Form

The Treasury Offset Form is a critical document that plays a vital role in the process of offsetting debts. It is specifically designed for individuals or entities whose payments may be intercepted to settle outstanding debts. By submitting this form, individuals are essentially asserting their right to claim certain exemptions or protections in situations where their federal payments may be withheld due to tax levies or other offsets.

To determine whether you need to use the Treasury Offset Form, it is essential to understand the eligibility criteria. This form is relevant for anyone who has debts categorized as overdue child support, federal taxes, and other governmental obligations. Knowing when and how to fill out this form can significantly affect the resolution of your debt situation.

Detailed breakdown of the Treasury Offset Form sections

Filling out the Treasury Offset Form correctly is vital to ensure that your submission is processed without delay. The form consists of several sections, each requiring accurate information to facilitate the offsets efficiently.

While filling out the form, it's important to double-check that all information is complete and accurate. Common mistakes include omitting required details or providing inaccurate data, which could result in processing delays or denial of the offset.

Interactive tools for filling out the Treasury Offset Form

Getting the Treasury Offset Form right can be simplified using modern tools like pdfFiller. Their platform offers interactive PDF editing features that make filling out the form a breeze. You can easily navigate through the sections, ensuring no detail is overlooked, and the process becomes intuitive and efficient.

Additionally, pdfFiller provides eSignature capabilities, enabling you to sign documents electronically—a crucial aspect of submitting your form. The collaboration features allow multiple team members to review and edit the form together, ensuring accuracy and completeness before final submission.

Managing your Treasury Offset Form once submitted

Once you've submitted your Treasury Offset Form, it's important to know what to expect. Typically, processing times can vary based on several factors, including the specifics of your debt and the current workload of the Treasury Department. Staying informed about the status of your offset claim may require contacting the relevant office occasionally.

If your claim is rejected or denied, several steps can be taken. Reviewing the reasons for denial can offer insights into what corrections need to be made for resubmission. It’s imperative to respond promptly and accurately to resolve the situation effectively.

Resources for further assistance

If you have questions regarding your Treasury Offset Form or the process, the TOP hotline is available for inquiries. Federal and state agencies offer resources to assist taxpayers and agencies can be contacted directly for clarifications surrounding offsets.

In addition, there are numerous government resources online that provide comprehensive information about the program, FAQs, and tools to aid in the completion of tax-related documentation.

Key takeaways

Navigating the Treasury Offset Form is essential for those pursuing debt resolution through governmental offsets. Understanding the key components of the form, knowing eligibility criteria, and using streamlined tools like pdfFiller can enhance your experience. Remember to be thorough and precise to facilitate a smooth submission process.

Ultimately, utilizing pdfFiller can significantly simplify the document management aspect of filling out your Treasury Offset Form. By harnessing cloud-based solutions, you can achieve greater efficiency in completing and submitting your financial documents.

Special situations and FAQs

Certain scenarios may require additional attention when filling out the Treasury Offset Form. For instance, if you have multiple debts or conflicting information as a joint filer, it’s important to ensure you clearly demonstrate the specifics on your form to avoid complications.

It’s common for individuals to have questions about what happens after submitting the form or the likelihood of approval. Addressing these frequently asked questions can alleviate concerns and provide clarity throughout the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form - treasury offset from Google Drive?

How can I send form - treasury offset for eSignature?

How do I execute form - treasury offset online?

What is form - treasury offset?

Who is required to file form - treasury offset?

How to fill out form - treasury offset?

What is the purpose of form - treasury offset?

What information must be reported on form - treasury offset?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.