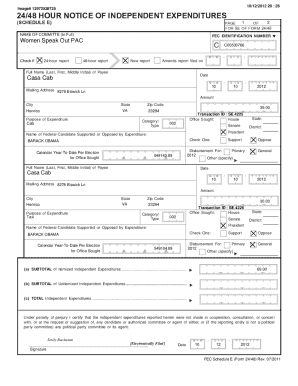

Get the free QB is capping the 401k deduction at $22500/yr even though ...

Get, Create, Make and Sign qb is capping form

Editing qb is capping form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out qb is capping form

How to fill out qb is capping form

Who needs qb is capping form?

QB is capping form: A comprehensive guide to PDF document management

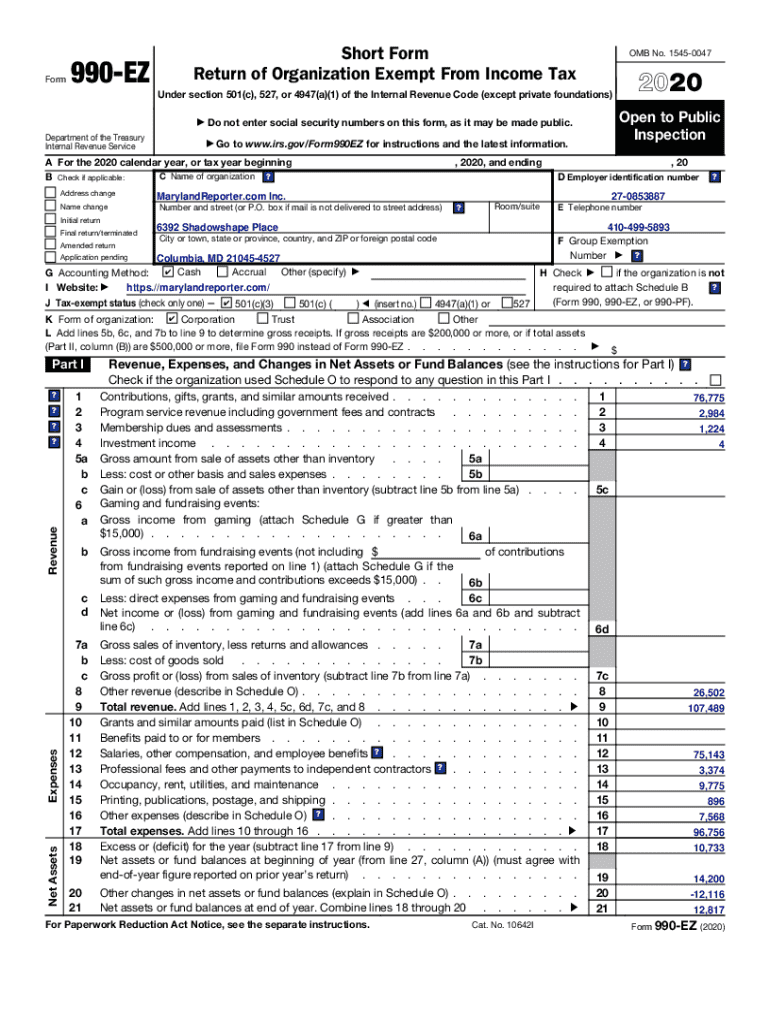

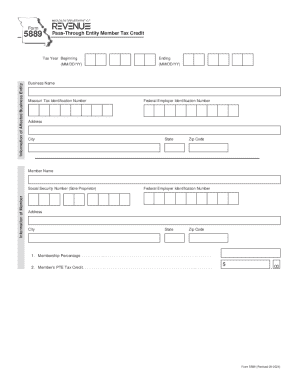

Understanding QB capping forms

QB capping forms, a vital component in managing financial documents, streamline processes for users. They refer to specific forms related to QuickBooks that help in recording and controlling various financial transactions effectively.

Understanding their role in document management is crucial. These forms ensure that essential information is captured accurately, facilitating compliance and reporting needs within organizations.

The features of PDF editing with pdfFiller

pdfFiller offers an array of features that cater specifically to handling PDFs, including QB capping forms. Its seamless PDF editing capabilities allow users to make necessary changes effortlessly.

Users can edit text, modify images, and even import/export images with ease. This means that you can turn a static document into a dynamic, editable file without losing formatting integrity.

Another standout feature is the eSigning capabilities, which not only ensure the legal validity of electronic signatures but also streamline the signing process. With step-by-step guidance, pdfFiller makes it easy to have documents signed by multiple parties in no time.

Finally, the platform's collaborative tools permit real-time editing and commenting. This allows team members to share feedback effortlessly, promoting a collaborative work environment.

Accessing and navigating the QB capping form

Accessing the QB capping form in pdfFiller is a straightforward process. Users can easily find and select this form from the extensive library available. Once located, the user interface aids in navigating efficiently through various editing options.

The pdfFiller dashboard offers an intuitive layout with navigation tools customized for QuickBooks forms, making it easier for users to manage their documents.

Filling out the QB capping form

Filling out the QB capping form correctly is crucial for accurate processing. Begin by downloading the form from pdfFiller. Once downloaded, users should carefully fill in all essential fields to avoid rework later.

Step-by-step instructions include adding necessary attachments or documents that relate to the financial transactions recorded. This increases the reliability of the submitted documents.

To ensure successful submissions, it's essential to avoid common pitfalls such as leaving fields empty or inputting incorrect information. Following best practices in data accuracy can ease the submission process.

Editing the QB capping form

With pdfFiller’s editing tools, modifying the QB capping form becomes a hassle-free experience. Users can add annotations and comments where necessary or reorder pages as required for streamlined documentation.

Additionally, version control allows users to track changes made to the document. This feature is particularly useful when several individuals collaborate on a single form, ensuring that all necessary revisions are documented.

eSigning the QB capping form

To eSign the QB capping form, first, ensure that the form is prepared for signatures. This involves checking all filled fields and any additional documents attached. The eSigning process within pdfFiller is intuitive; it's designed to guide users seamlessly through each step.

Once ready, you can initiate the request for signature by sending the form to relevant parties. Users can conveniently track the status of signature requests within the platform.

Upon completion of the eSigning process, the final document can easily be downloaded, ensuring all parties have access to a legally recognized record.

Managing your documents within pdfFiller

Managing QB capping forms alongside other documents within pdfFiller is efficient. Users can effectively organize their documents using folders and tags for easy retrieval. This feature is particularly valuable for teams working on multiple projects simultaneously.

Moreover, the search functionality allows quick access to all types of documents needed. Whether you're searching for a specific QB form or any other financial document, the intuitive interface helps you find what you need promptly.

Integration options with other tools, such as cloud storage services and project management applications, further enhance document management capabilities for teams using pdfFiller.

Frequently asked questions (FAQs) about QB capping forms

Several questions arise when dealing with QB capping forms, mainly concerning the filling and submission process. One common query is what happens if a mistake is made while filling the form; it's crucial to address errors quickly to avoid potential issues.

Security measures while using pdfFiller also concern many users. Knowing how the platform protects personal and financial information is vital for peace of mind during the document management process.

Real-life scenarios: How teams use QB capping forms effectively

Let's explore some real-life scenarios that demonstrate the effective use of QB capping forms. Many small businesses have found that adopting pdfFiller for their documentation needs streamlines their processes and enhances collaboration.

For instance, a small business greatly improved its document management by transitioning from paper to digital using pdfFiller, resulting in fewer errors and quicker approvals.

The benefits of using pdfFiller over traditional methods are clear, with improved efficiency, accuracy, and collaboration.

Feedback and continuous improvement

pdfFiller values user feedback and continuously seeks to improve its platform. Users are encouraged to submit their experiences, helping shape future updates and enhancements.

Regular software updates ensure that users have access to the latest features, keeping document management efficient and user-friendly. As pdfFiller evolves, it remains committed to empowering users for seamless document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the qb is capping form in Chrome?

How do I edit qb is capping form straight from my smartphone?

How do I complete qb is capping form on an iOS device?

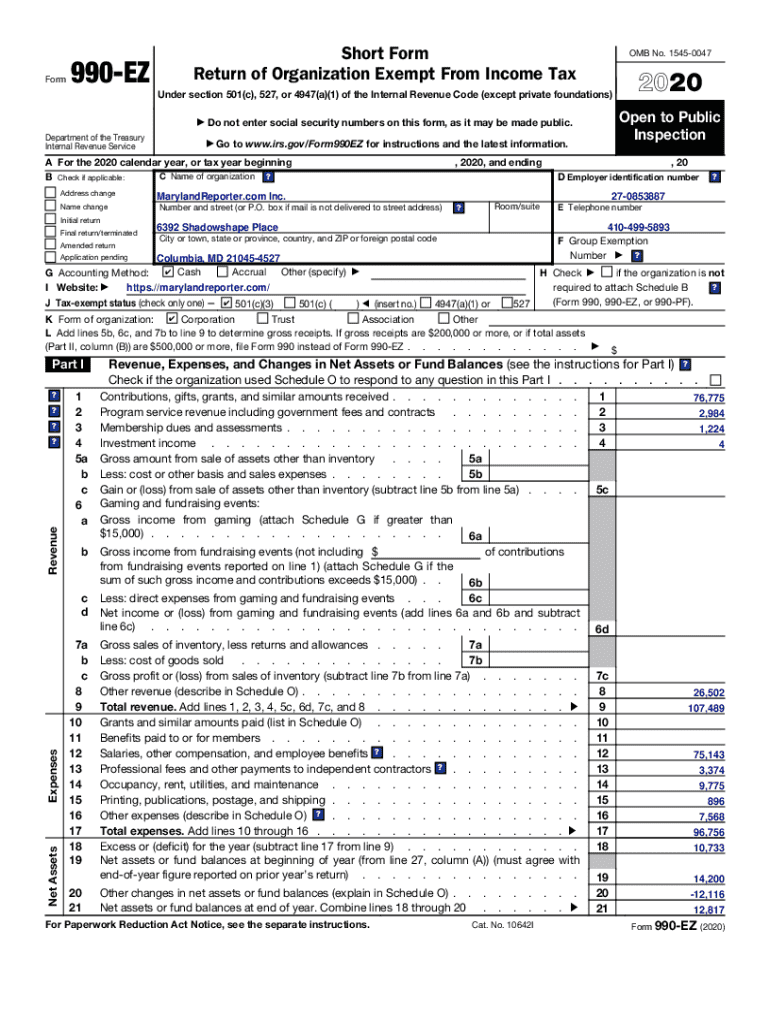

What is qb is capping form?

Who is required to file qb is capping form?

How to fill out qb is capping form?

What is the purpose of qb is capping form?

What information must be reported on qb is capping form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.