Get the free EARTHQUAKE COVERAGE

Get, Create, Make and Sign earthquake coverage

Editing earthquake coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out earthquake coverage

How to fill out earthquake coverage

Who needs earthquake coverage?

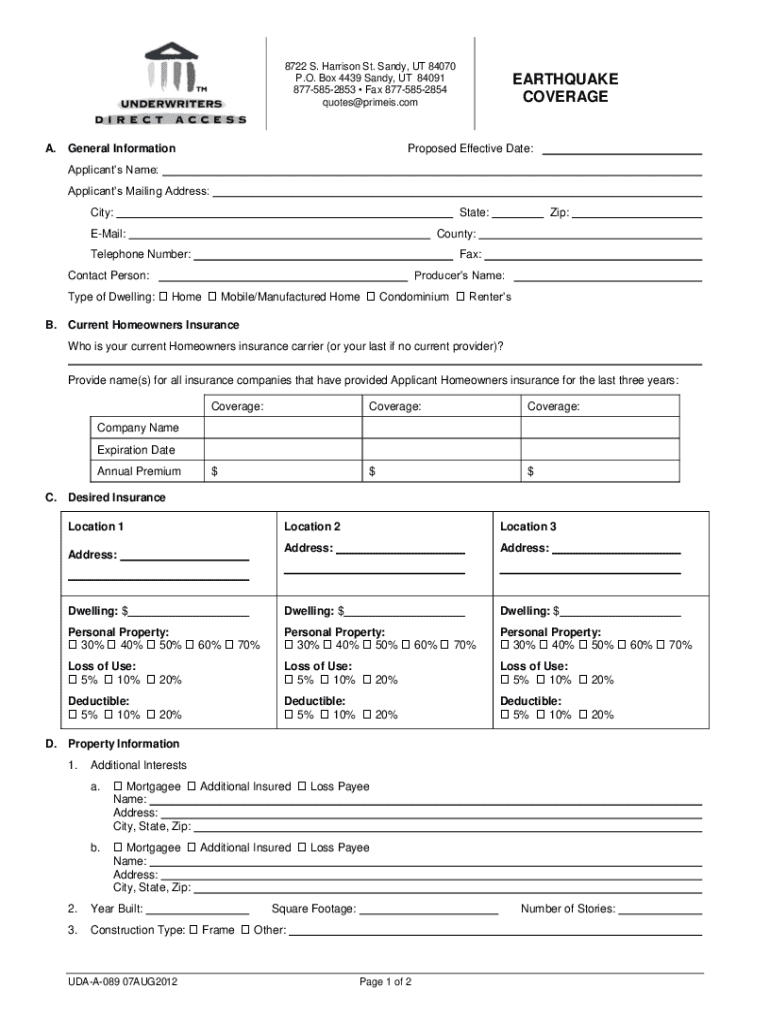

The Complete Guide to Earthquake Coverage Form

Understanding earthquake coverage

Earthquake coverage is a specialized type of insurance that helps protect homeowners from financial losses incurred due to earthquake damage. Unlike standard homeowners insurance, which typically does not cover earthquake-related losses, earthquake insurance offers specific protection for structures, personal property, and additional living expenses incurred while your home is being repaired. Given that earthquakes can cause significant structural damage and loss of property, having earthquake insurance is crucial for homeowners situated in seismically active areas.

The earthquake coverage form is vital as it serves as the official document required to apply for this insurance. It outlines the necessary details needed to evaluate your application and determine your coverage limits, premium costs, and more. Understanding this form is the first step to ensuring adequate protection for your property and peace of mind in the event of an earthquake.

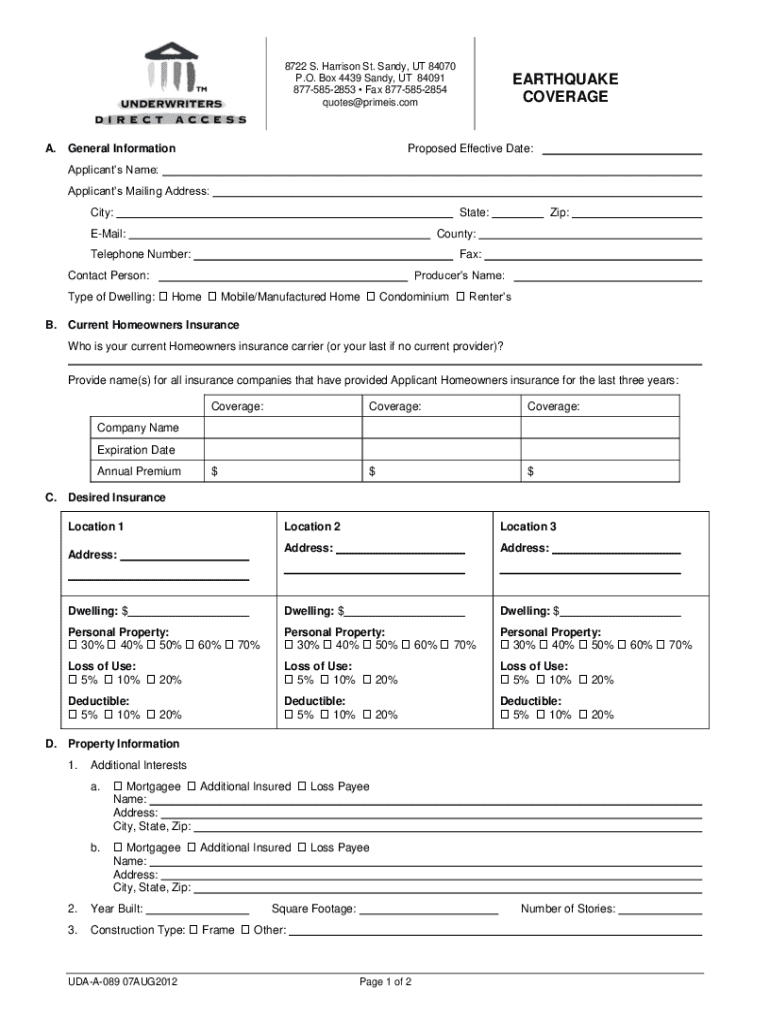

Key components of the earthquake coverage form

The earthquake coverage form comprises several key components that must be accurately completed to garner the intended insurance benefits. These components primarily include personal information about the homeowner, the property details being insured, and the amount of coverage requested. Each of these details informs the insurer about who is seeking coverage and the extent to which they wish to protect their property.

Understanding these components enhances your ability to fill out the earthquake coverage form correctly and ensures you secure the best coverage options.

How to fill out the earthquake coverage form

Filling out the earthquake coverage form might seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide for individual users:

For teams looking to collaborate on completing the form, it's beneficial to invite team members to contribute their insights and knowledge about the property and insurance coverage preferences. Utilizing cloud-based collaboration tools like pdfFiller allows for seamless sharing and editing, making the process efficient.

Editing and managing your earthquake coverage form

Once you have filled out the earthquake coverage form, it’s essential to manage the document effectively. pdfFiller offers several features that can help you edit and improve your document. For instance, if you notice a typo or need to add additional information, pdfFiller’s text editing function allows for quick corrections without the need to start over.

In managing document versions, pdfFiller lets you save and retrieve previous versions easily, ensuring you never lose essential data. Tracking changes automatically simplifies the process of identifying modifications made by different team members.

Signing and submitting the earthquake coverage form

The submission stage is a crucial part of the process, making it necessary to ensure that your earthquake coverage form is signed and submitted correctly. eSigning the document enhances its security and authenticity while also making the signing process much faster than traditional methods.

Following these steps will help you avoid common mistakes and facilitate a seamless submission experience.

Frequently asked questions (FAQs) about earthquake coverage

As with any insurance process, many users have questions or concerns about the earthquake coverage form. Here are some common queries and clarifications regarding earthquake insurance:

Clarifying misconceptions about earthquake insurance can further enhance homeowners' understanding of this crucial coverage.

Additional coverage options you may consider

While purchasing earthquake coverage is essential for those in earthquake-prone areas, homeowners should also consider complementary insurance options. For instance, flood insurance is another critical coverage often overlooked, especially for properties situated near bodies of water, where flooding can occur independently of seismic activity. Homeowners insurance policies may also include basic coverage for various damages, but they rarely extend to earthquakes without specific endorsements.

Understanding how these options complement your earthquake coverage helps create a robust safety net for potential disaster-related expenses.

Resources for understanding earthquake risks and preparedness

Homeowners should not only focus on obtaining insurance but also on understanding the risks associated with earthquakes and being prepared. Organizations like FEMA and the California Earthquake Authority (CEA) offer valuable resources and guidelines on how to minimize risks. Engaging with these resources helps develop an actionable plan that ensures safety and preparedness.

Proactively managing your property's earthquake risk enhances safety while optimizing your insurance coverage.

Engaging with insurance professionals

Consulting with an insurance agent is advisable, especially when navigating the nuances of earthquake coverage. An experienced agent can provide insights on policy options, coverage limits, and the various options available for your specific needs.

Utilizing tools like pdfFiller can simplify this process. By allowing easy sharing and collaboration of the earthquake coverage form, you can effectively communicate your needs with your insurance provider, ensuring all details are polished and accurate.

User testimonials and case studies

Real-life experiences of users who have navigated the earthquake coverage form can provide valuable insights into the process. Many users have reported a smoother experience when utilizing pdfFiller; they emphasized the ability to edit documents easily, collaborate with team members, and ensure that all sections of the form were well-completed before submission.

These testimonials underscore the benefits of using a comprehensive document management solution to facilitate insurance form completion, allowing users to feel confident and prepared in securing the necessary coverage.

Press coverage and media mentions

pdfFiller has been recognized for its role in streamlining the document management process, especially in the context of insurance applications like the earthquake coverage form. Several publications have acknowledged pdfFiller's effectiveness in providing easy access to essential tools and features that enable users to fill, sign, and manage their forms securely.

Interviews and articles discussing insurance planning frequently point out pdfFiller’s unique offerings, highlighting how it empowers users to maintain control over their documents in a user-friendly, cloud-based environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my earthquake coverage in Gmail?

How do I edit earthquake coverage straight from my smartphone?

How do I fill out earthquake coverage on an Android device?

What is earthquake coverage?

Who is required to file earthquake coverage?

How to fill out earthquake coverage?

What is the purpose of earthquake coverage?

What information must be reported on earthquake coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.