Get the free housing development finance corporation limited - RNS Submit

Get, Create, Make and Sign housing development finance corporation

How to edit housing development finance corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out housing development finance corporation

How to fill out housing development finance corporation

Who needs housing development finance corporation?

A Comprehensive Guide to Housing Development Finance Corporation Form

Understanding the housing development finance corporation (HDFC)

The Housing Development Finance Corporation, commonly referred to as HDFC, plays a pivotal role in the housing finance sector in India. Established in 1977, it was one of the first specialized housing finance companies in the country, aimed at promoting home ownership and providing a reliable platform for individuals and businesses seeking to invest in residential properties.

HDFC's mission has evolved over the decades but remains deeply rooted in its original purpose: facilitating access to affordable and diverse housing finance solutions. With a strong emphasis on customer service and innovation, HDFC has managed to cater to the financial needs of a wide clientele, from first-time homebuyers to large real estate developers.

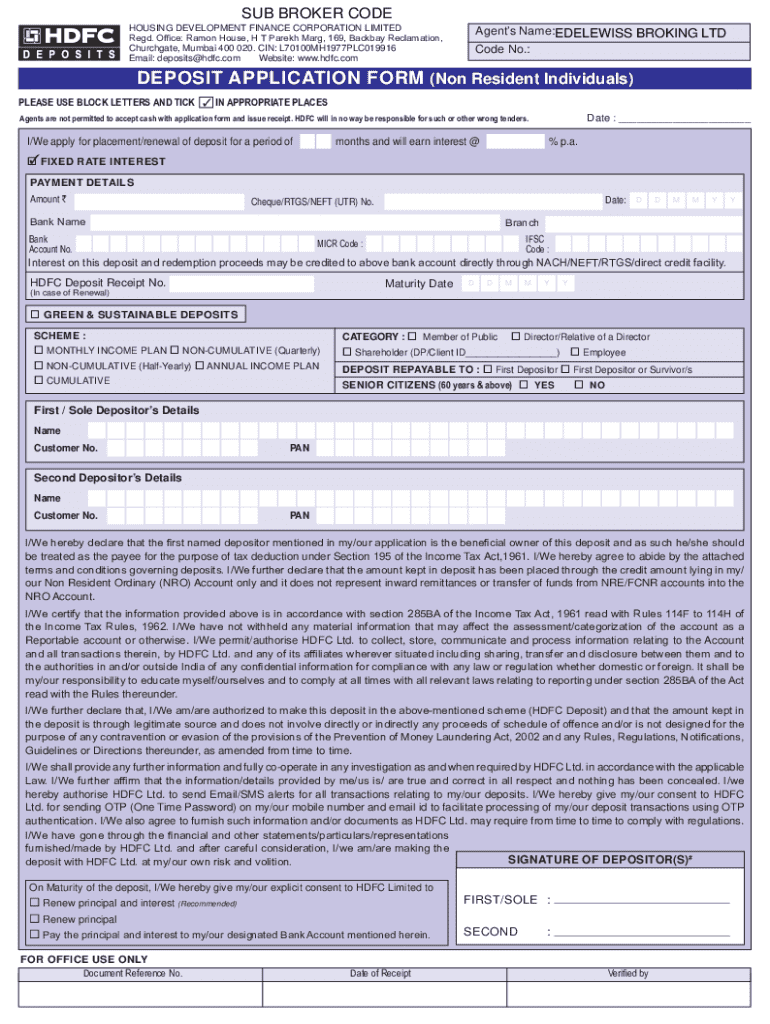

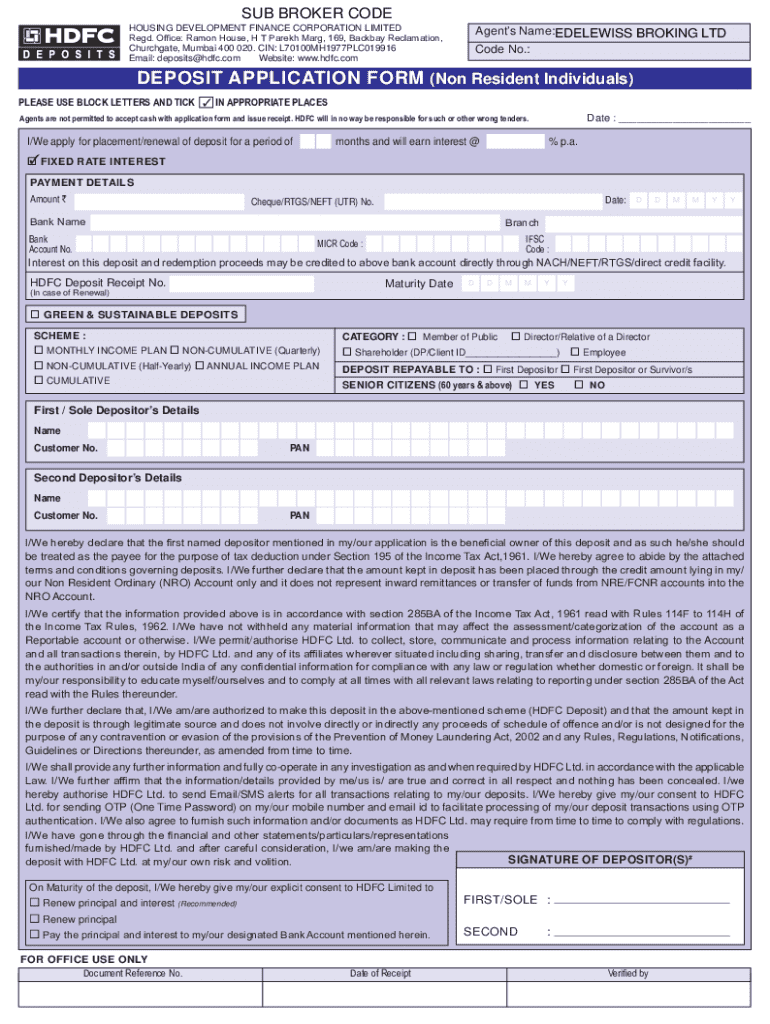

Overview of the housing development finance corporation form

The Housing Development Finance Corporation form is a critical document in the home loan application process. It encapsulates essential information that helps HDFC assess the financial viability of loan requests and determine eligibility for various schemes. Completing this form accurately is key for potential homeowners or developers to secure funds for their housing projects.

Not only does the form streamline communication between applicants and HDFC, but it also ensures that all necessary financial and personal information is collected systematically, reducing the chances of delays in processing applications.

Key components of the HDFC form

Completing the HDFC form entails several components that capture critical information about the applicant and the proposed property purchase. Each section is tailored to collect specific data required for thorough assessment. A breakdown of these essential sections will guide applicants through the process.

In addition to these sections, supporting documentation will be required to validate the claims made in the form. Typically, identification proof, income verification documents, and possibly property agreements need to be appended, contingent on the nature of the financing.

Step-by-step instructions for completing the HDFC form

Successfully navigating the HDFC form begins with preparation. Applicants should aim to gather all necessary documents before starting the form, which ensures a smoother filling process.

When it comes to filling out the form, applicants must pay attention to detail. Misrepresentation or errors can lead to complications. Below are specific guidelines for each section:

Common mistakes include overlooking parts of the form or failing to provide comprehensive documentation. Taking the time to review before submission can significantly enhance the chances of approval.

Editing and managing your HDFC form with pdfFiller

Once the HDFC form is completed, using tools like pdfFiller can greatly simplify the process of editing and managing your documents. With its user-friendly interface, pdfFiller allows for easy modifications without the need to start from scratch.

Moreover, pdfFiller provides functionalities such as adding eSignatures, which streamline the approval process. The benefits of using eSigning include reduced turnaround times and enhanced security.

Signing and submitting the HDFC form

After thorough completion and necessary edits, the next step is understanding the HDFC submission process. This involves specifics on format, timelines, and methods of submission.

Being proactive about submission status can assist in resolving any potential issues quickly.

Frequently asked questions (FAQs)

Many potential applicants often have recurring questions regarding the HDFC form. Clarifying these can assist in streamlining the submission experience.

Troubleshooting and support

Finally, applicants should know where to turn for help during the submission process. HDFC offers numerous support options for their clients, ensuring that assistance is readily available.

Additional considerations

As policies evolve, it is vital to stay updated on any amendments to the HDFC form or housing finance regulations. Keeping informed can assist applicants in maintaining compliance and utilizing available resources effectively.

User experiences and testimonials

Personal experiences can illuminate the intricate details of using the Housing Development Finance Corporation form. Many users have found their process considerably enhanced with tools like pdfFiller.

Current developments and news

Keeping abreast of current developments in the housing financing landscape is crucial for applicants. Regulations can change, impacting eligibility and the types of loans available to potential borrowers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute housing development finance corporation online?

Can I create an electronic signature for the housing development finance corporation in Chrome?

How do I edit housing development finance corporation on an iOS device?

What is housing development finance corporation?

Who is required to file housing development finance corporation?

How to fill out housing development finance corporation?

What is the purpose of housing development finance corporation?

What information must be reported on housing development finance corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.