Get the free 2007 Form 512 Oklahoma Corporation Income Tax Forms Packet & Instructions

Get, Create, Make and Sign 2007 form 512 oklahoma

Editing 2007 form 512 oklahoma online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2007 form 512 oklahoma

How to fill out 2007 form 512 oklahoma

Who needs 2007 form 512 oklahoma?

Your Comprehensive Guide to the 2007 Form 512 Oklahoma Form

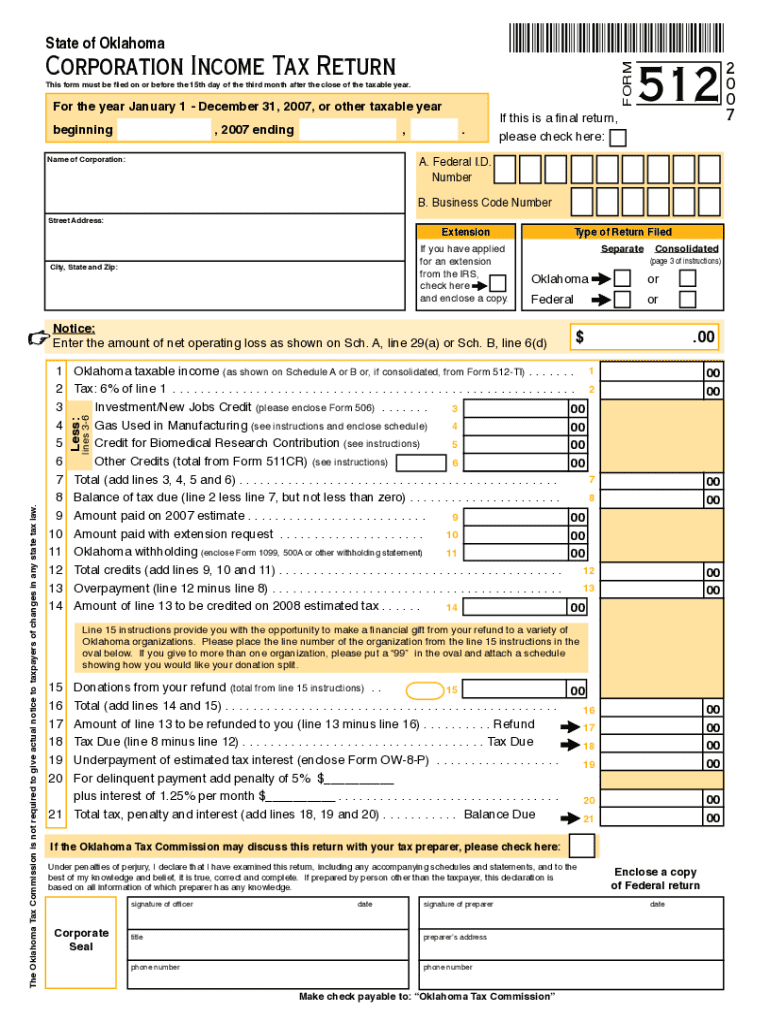

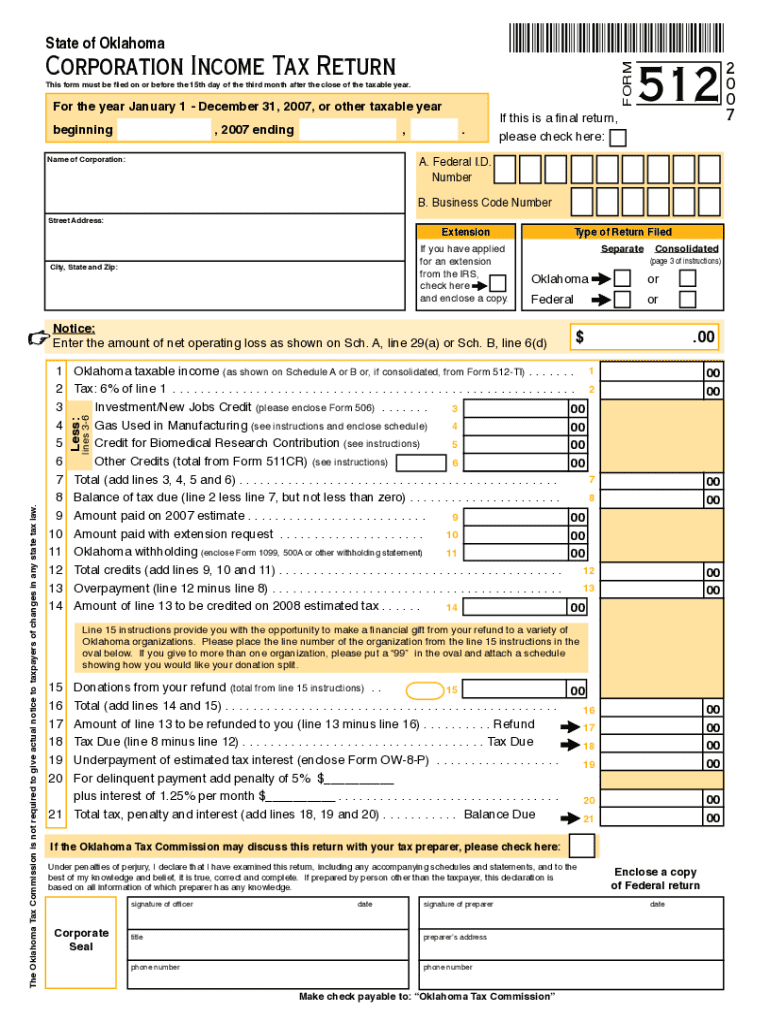

Understanding the 2007 Form 512: Overview

The 2007 Form 512 is a critical document for tax reporting in the state of Oklahoma. This form is designed for individuals and businesses alike to report their income and determine their tax obligations. It serves a dual purpose: enabling taxpayers to fulfill their legal requirements while providing the state with essential revenue for public services.

This form is particularly important for residents who need to regularly file their individual income taxes under state regulations. Completing the 2007 Form 512 accurately is essential for avoiding penalties or issues with the Oklahoma Tax Commission.

Key sections of the 2007 Form 512

The 2007 Form 512 consists of several essential sections that dictate how taxpayers report their information. Understanding these sections is crucial for filling out the form accurately.

Major sections include personal information, income details, and deductions and credits. Every taxpayer must provide accurate details in each section to ensure proper processing of their submission.

Each section must be carefully filled out, as mistakes can lead to delays in processing or adjustments to your tax obligations. Many taxpayers seem to struggle with misreporting in these areas, leading to unnecessary complications.

Step-by-step guide to filling out the form

Properly completing the 2007 Form 512 requires preparation and attention to detail. Before starting, it’s vital to gather all necessary documentation.

Once you have the required materials, follow these steps to complete the form:

Tips for accurate completion

Ensuring that the 2007 Form 512 is filled accurately can save you a lot of time and potential financial penalties. Here are some best practices to consider:

Using resources and tools designed for tax forms can also improve efficiency and accuracy while filing your taxes.

Interactive features for easier form management

Managing the 2007 Form 512 can be more user-friendly with the right tools. Utilizing a platform like pdfFiller provides several interactive features that enhance the filing experience.

Frequently asked questions about the 2007 Form 512

Addressing common queries can boost confidence while filling out the 2007 Form 512. Here are some frequently asked questions:

Commonly encountered scenarios

The 2007 Form 512 may be required in various situations. Understanding these scenarios will help ensure the correct submission.

Each situation demands careful consideration to avoid errors that can lead to complications with tax authorities.

Understanding follow-up procedures

After submitting the 2007 Form 512, it’s crucial to understand the follow-up procedures involved to track your filing and resolve any discrepancies.

Final thoughts on efficient document management

Keeping accurate records of your completed forms is crucial for effective tax management. A good practice is to store copies of your forms securely.

Utilizing tools like pdfFiller can further enhance your experience by providing easy access and editing capabilities for future forms. Embracing paperless document handling not only streamlines your filing process but also aids in preserving the environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2007 form 512 oklahoma?

How can I edit 2007 form 512 oklahoma on a smartphone?

How do I complete 2007 form 512 oklahoma on an Android device?

What is 2007 form 512 oklahoma?

Who is required to file 2007 form 512 oklahoma?

How to fill out 2007 form 512 oklahoma?

What is the purpose of 2007 form 512 oklahoma?

What information must be reported on 2007 form 512 oklahoma?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.