Get the free Home Modification Loan Program Application

Get, Create, Make and Sign home modification loan program

How to edit home modification loan program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home modification loan program

How to fill out home modification loan program

Who needs home modification loan program?

Home Modification Loan Program Form: A Comprehensive Guide

Overview of the home modification loan program

The Home Modification Loan Program is designed to enhance the accessibility of residences for individuals with disabilities or health issues by financing necessary modifications. This program enables families to transform their living spaces, making them safer and more comfortable.

Accessibility is vital for promoting independence and improving quality of life, particularly for individuals with mobility challenges or chronic health conditions. The Home Modification Loan Program not only expands living possibilities but also fosters inclusivity within communities.

Who can benefit from the home modification loan program?

Eligibility for the Home Modification Loan Program primarily targets homeowners or renters making modifications for persons with disabilities. To qualify, applicants must demonstrate financial need and possess a documented disability or health condition.

Families seeking modifications for members with disabilities are encouraged to apply, as numerous options exist to tailor adaptations to individual needs. Additionally, landlords can participate by providing accessible housing for tenants, thus widening opportunities for inclusivity.

Contractors play an essential role in this process, as they are crucial in assessing requirements and ensuring the quality of modifications aligns with program specifications. Their expertise enables homeowners to undertake adaptations that are both effective and compliant.

Types of home modifications covered

The Home Modification Loan Program encompasses a range of modifications aimed at improving accessibility. Common changes include the installation of ramps, grab bars, and wider doorways, allowing for easier navigation throughout the home.

Specific examples of eligible modifications can entail bathroom renovations, stair lifts, and kitchen adaptations, all crucial for accommodating varying levels of disability. Even mobile homes can qualify for modifications, ensuring that all living environments are safe and functional.

Understanding unique needs based on disabilities is integral to effective modifications, ensuring that homes are not just adapted, but truly optimized for the residents' comfort and independence.

Interactive features of the home modification loan program form

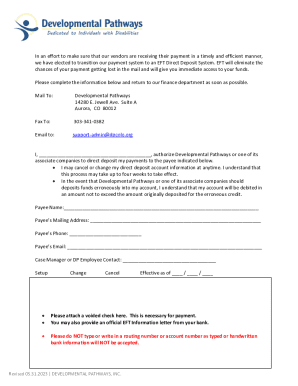

pdfFiller provides an interactive online platform for users to access the Home Modification Loan Program Form seamlessly. Its user-friendly interface simplifies the process significantly, allowing applicants to complete their forms with ease and precision.

With live editing tools available, applicants can customize their forms according to personal requirements. This is particularly useful for variations based on specific disabilities or financial situations, ensuring no detail is overlooked.

This cloud-based management tool empowers users by allowing them to manage all their documents in one location, making the application process efficient and straightforward.

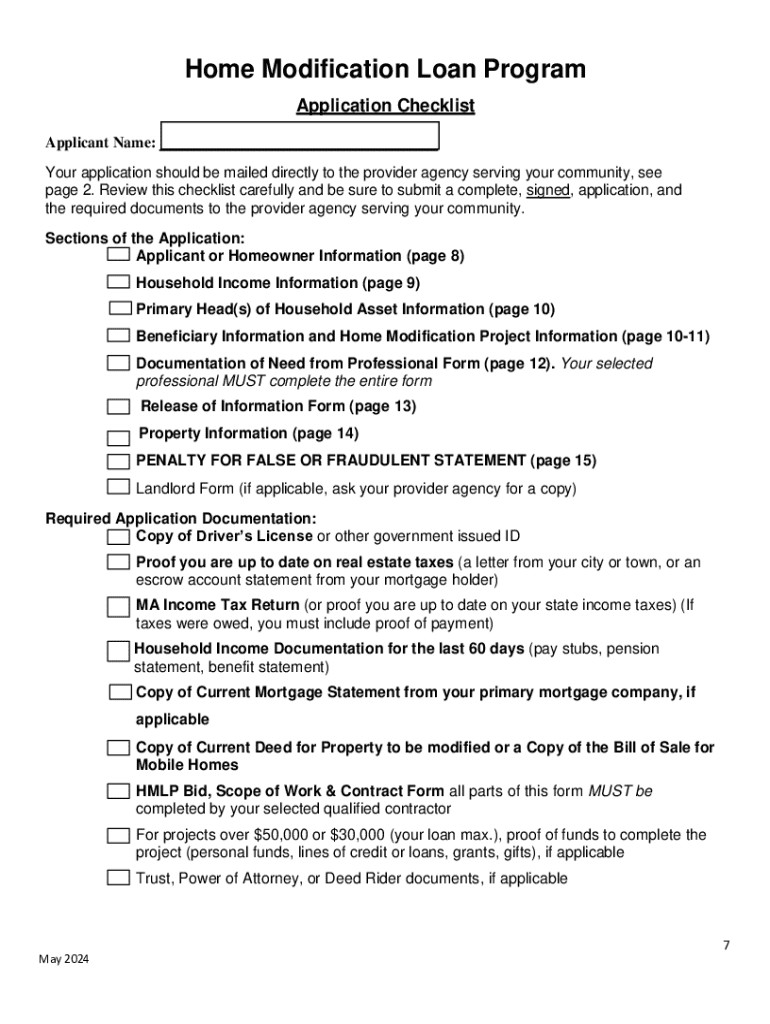

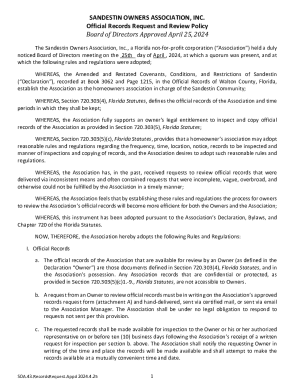

Detailed instructions for filling out the home modification loan program form

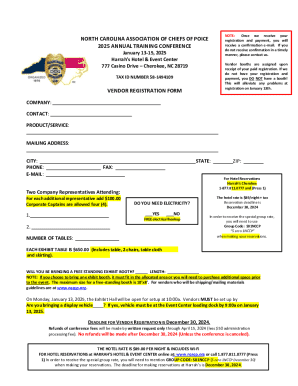

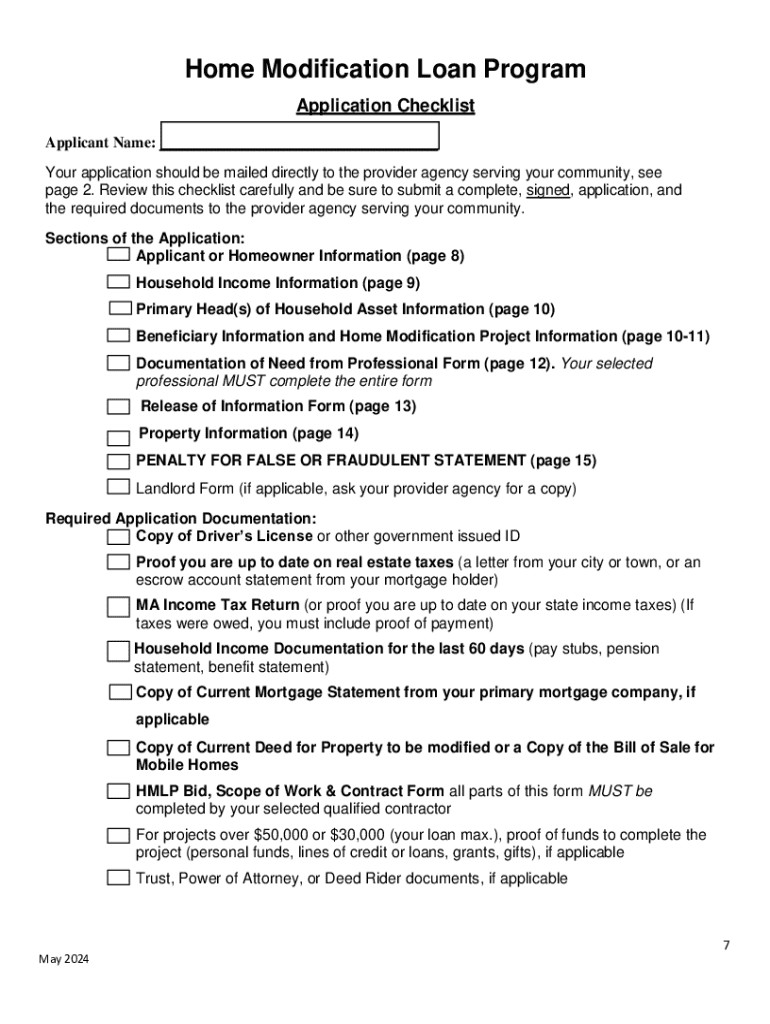

Filling out the Home Modification Loan Program Form requires specific documentation and accurate information. Essential details include personal identification, proof of income, and documentation of disability. Each section must be completed with care to ensure a higher likelihood of approval.

While completing the application, applicants should pay attention to common errors like missing signatures or inaccurate financial details, which can delay the approval process. Follow each instruction provided within the form meticulously.

Submission process and timeline

Once the Home Modification Loan Program Form is complete, it can be submitted online through pdfFiller, by mail, or in-person at designated locations. Each submission method has its advantages, with online submissions generally offering quicker processing times.

The review process can take several weeks, depending on demand and completeness of submissions. Applicants should not hesitate to follow up after their submission to understand the next steps and ensure they remain informed throughout the approval journey.

Financing and repayment options

Understanding the financing aspect of the Home Modification Loan Program is essential for prospective applicants. Loans typically come with favorable terms, which may include lower interest rates compared to conventional loans. This can make a significant difference in monthly payments for families managing tight budgets.

Repayment structures are designed with flexibility, often allowing for extended periods before payment commencement. Potential financial assistance resources may also be available to support applicants in cases of economic hardship.

Helpful links and resources

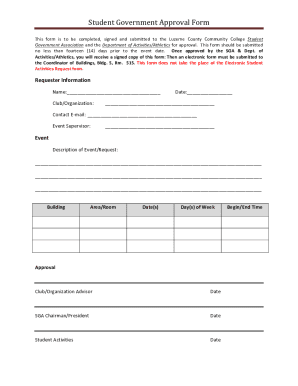

To assist applicants, numerous official program websites feature valuable information regarding the Home Modification Loan Program. These resources include program guidelines, eligibility requirements, and direct access to the loan application form.

Contractor resources are also available for homeowners to connect with professionals experienced in accessibility modifications. Further, financial counseling services can guide applicants through the financial aspects surrounding their modifications and loans.

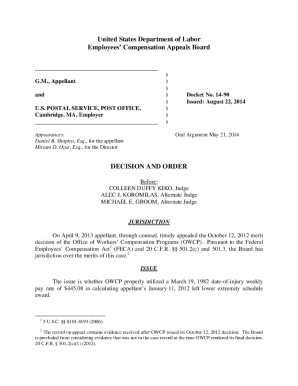

Frequently asked questions (FAQs)

Addressing common inquiries helps clarify many aspects of the Home Modification Loan Program. For instance, applicants often wonder about specific eligible modifications that can be funded under this program. It's essential to consult the guidelines to confirm eligibility.

Landlords interested in participating also may have questions regarding their obligations and the process involved. Furthermore, first-time applicants may benefit from guidance on where to start and which resources are available to them.

Contacting support for assistance

For users needing additional help, reaching out to customer support is a viable option. Typically, support lines are available during standard business hours, providing timely responses to inquiries regarding the Home Modification Loan Program.

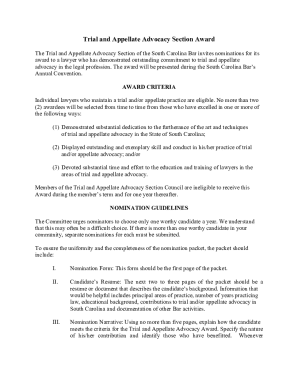

Moreover, community outreach programs may offer resources for those seeking legal or financial advice. It is advisable for applicants to consider consulting with experts to address their specific situations and maximize their chances for approval.

Community impact and success stories

The Home Modification Loan Program has positively impacted numerous families across various communities. Testimonials from homeowners highlight significant improvements in their living conditions, leading not only to enhanced safety but also increased emotional well-being.

Case studies reveal successful modifications that demonstrate the program's transformative effects. From stair lifts allowing independent living to widened doorways ensuring easy access, these stories echo the positive effects of accessible housing on family dynamics.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send home modification loan program to be eSigned by others?

How do I edit home modification loan program on an iOS device?

How do I edit home modification loan program on an Android device?

What is home modification loan program?

Who is required to file home modification loan program?

How to fill out home modification loan program?

What is the purpose of home modification loan program?

What information must be reported on home modification loan program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.