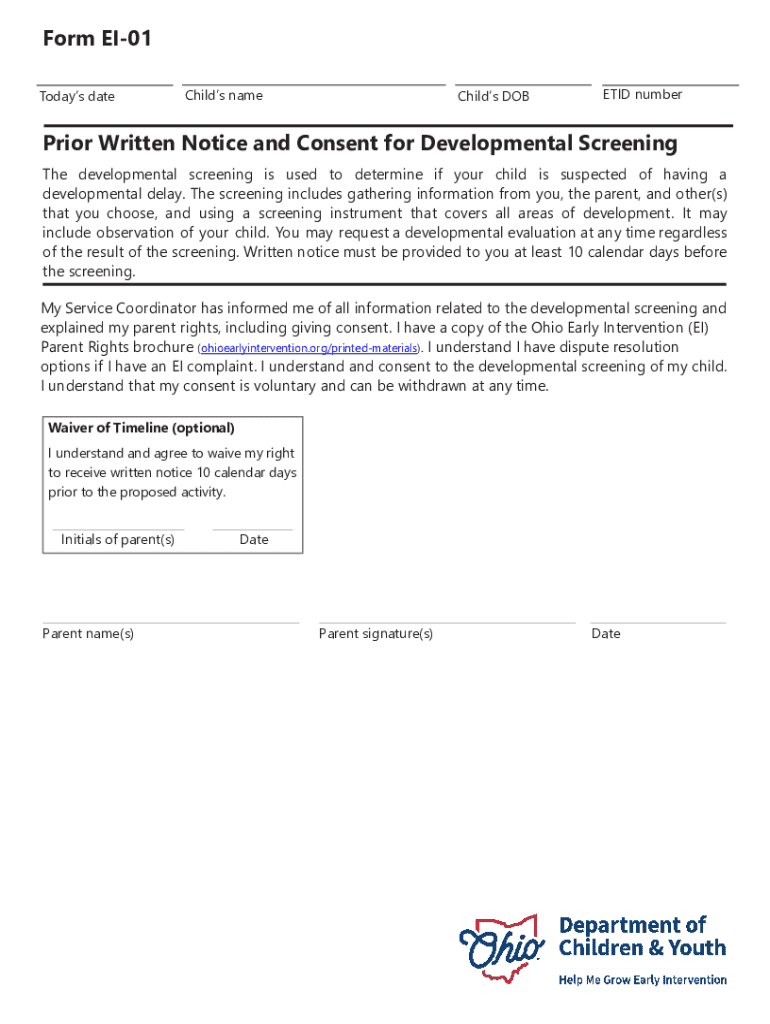

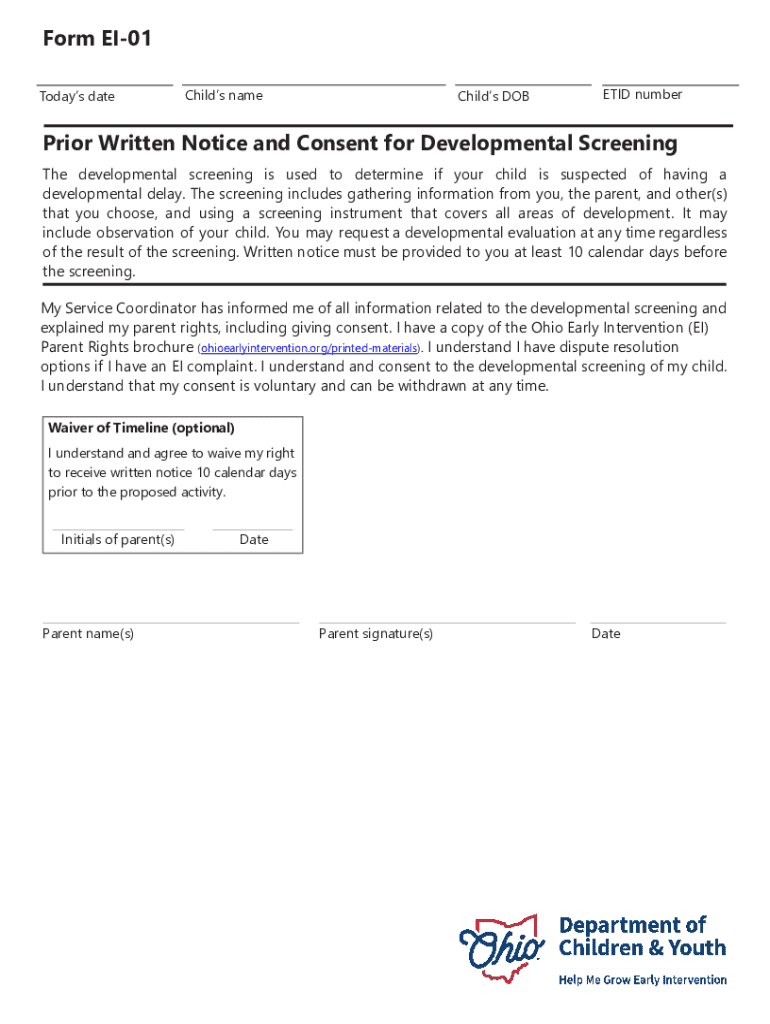

Get the free Form-EI-1-to-EI-17 Binder. OEI Early Intervention Forms

Get, Create, Make and Sign form-ei-1-to-ei-17 binder oei early

Editing form-ei-1-to-ei-17 binder oei early online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form-ei-1-to-ei-17 binder oei early

How to fill out form-ei-1-to-ei-17 binder oei early

Who needs form-ei-1-to-ei-17 binder oei early?

Form EI-1 to EI-17 Binder OEI Early Form: A Comprehensive Guide

Understanding the form EI series

The EI forms, ranging from EI-1 to EI-17, serve a critical role in numerous administrative and regulatory processes. Designed for various business and individual requirements, these forms are essential for maintaining compliance and facilitating efficient operations across sectors. Each form in the EI series targets specific needs, whether for employment insurance, regulatory reporting, or internal documentation.

The importance of these forms cannot be overstated. For individuals, they may represent claims for services or benefits, while for businesses, these forms can be integral to payroll processing, tax compliance, or workforce management. Understanding the nuances of each form allows users to navigate through bureaucratic requirements more effectively.

Specifics of the form EI 1 to EI 17

Each form in the EI series possesses unique attributes, catering to different aspects of employment and administrative procedures.

For each form, specific requirements and details must be adhered to ensure compliance and proper processing of claims or requests.

Step-by-step guide to completing EI forms

Completing the EI forms accurately requires a systematic approach. Start by gathering all necessary information related to your claim or request. This includes personal identification details, employment history, and any other documentation that supports your case.

Gathering required information

When preparing to fill out the EI forms, ensuring you have all required documents is paramount. Commonly needed documents may include:

Collecting these documents enables you to complete the forms efficiently without delays due to missing information.

Detailed instructions on filling each form

Interactive tools for form completion

In the digital age, leveraging technology can streamline the form completion process significantly. pdfFiller’s editing features provide an excellent platform for filling out and customizing your EI forms. Users can easily input data, select pre-formatted templates, and submit forms directly without printing.

Utilizing pdfFiller’s editing features

This cloud-based solution offers various tools, such as conditional logic and auto-complete options, which allow users to create and manage forms more efficiently. Additionally, features like text box editing, annotations, and highlights make it easier to focus on crucial information.

eSigning and collaborating through pdfFiller

Another key feature lies in the electronic signature capability, enabling users to complete their forms securely and conveniently. This functionality allows multiple parties to sign off on documents, ensuring quick approvals for critical claims or submissions.

Cloud-based management of your EI forms

Storing your EI forms in the cloud not only provides accessibility from any device but also offers a layer of security and backup. Users can easily organize and retrieve their forms, track changes, and manage documents effectively, ensuring they remain up to date.

Common challenges and solutions in completing EI forms

Despite the available resources, users often encounter challenges when filling out forms EI-1 to EI-17. These can range from misinterpretations of form requirements to technical issues during submission.

Identifying frequent errors and misunderstandings

Common pitfalls include:

Identifying these errors early can enhance the accuracy of completed forms, minimizing setbacks.

Addressing specific concerns for different audiences

Specific issues may affect various user groups. Individuals seeking benefits need to focus particularly on eligibility documentation, while businesses must ensure compliance with employment regulations. Regular training and workshops can assist in clarifying these areas.

Resources for troubleshooting

Engaging with customer support teams or online communities, such as those found on pdfFiller, can provide quick tips to address challenges encountered during form submission. Users can also access video tutorials to navigate the complexities of completing EI forms.

Advanced tips for efficient document management

Efficient document management is essential for anyone regularly handling EI forms. This involves not only the accurate completion of forms but also ensuring that they are organized and easily accessible.

Best practices for editing and managing forms

To keep your forms updated and organized:

Applying these practices can enhance the overall efficiency of managing EI forms, reducing stress related to administrative tasks.

Leveraging pdfFiller’s features for efficiency

Advanced features within pdfFiller, such as document automation and collaborative tools, allow teams to work together seamlessly. Automating routine tasks can save substantial time while enhancing productivity across various processes.

Updating and resubmitting EI forms

Understanding when and how to update EI forms is vital for ensuring compliance and accuracy in administrative processes. Situations that necessitate updates commonly include changes in personal circumstances or when first submissions are denied.

Understanding the need for updates

Be aware of the formal requirements that govern updates. Following any administrative feedback or changes in personal conditions, it may be essential to revise submissions to reflect current data.

Step-by-step guide to updating existing forms

To effectively update a form using pdfFiller:

Real-world applications and case studies

The practical applications of the EI forms range widely across various sectors. Many users, whether individuals or teams, have successfully navigated the complexities of these forms when leveraging appropriate tools and resources.

Successful use cases of EI forms

For instance, a small business owner utilizing EI forms for employee claims noticed a significant decrease in processing time after implementing pdfFiller's cloud-based solutions. Team collaboration features allowed multiple departments to contribute seamlessly, turning previously cumbersome tasks into efficient workflows.

Insights from real users

User testimonials highlight how pdfFiller has transformed document management. Users often mention improved accuracy, faster processing times, and enhanced collaboration as primary benefits of switching to a digital solution for EI forms.

Frequently asked questions about EI forms

Addressing common queries surrounding EI forms can empower users with confidence and clarity.

General queries regarding EI-1 to EI-17

Common questions often revolve around the completion process, required documents, and timelines for processing forms. Understanding these areas can help alleviate user concerns.

pdfFiller-specific queries

Users frequently inquire about how pdfFiller enhances their experience with EI forms. The ability to edit directly online, collaborate with team members, and the security features in place make pdfFiller an invaluable platform for managing these essential documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form-ei-1-to-ei-17 binder oei early form on my smartphone?

How can I fill out form-ei-1-to-ei-17 binder oei early on an iOS device?

How do I fill out form-ei-1-to-ei-17 binder oei early on an Android device?

What is form-ei-1-to-ei-17 binder oei early?

Who is required to file form-ei-1-to-ei-17 binder oei early?

How to fill out form-ei-1-to-ei-17 binder oei early?

What is the purpose of form-ei-1-to-ei-17 binder oei early?

What information must be reported on form-ei-1-to-ei-17 binder oei early?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.