Get the free APPLICATION SALES AND USE TAX / ITC

Get, Create, Make and Sign application sales and use

Editing application sales and use online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application sales and use

How to fill out application sales and use

Who needs application sales and use?

Understanding the Application Sales and Use Form: A Comprehensive Guide

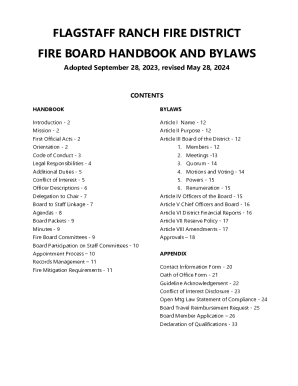

Overview of sales and use tax forms

Sales and use tax forms play an essential role in ensuring compliance with tax obligations for businesses and individuals. Sales tax is levied on the sale of goods and services, while use tax applies to items purchased out-of-state and brought into a state for use. Understanding these distinctions is vital for determining tax liabilities.

The Application Sales and Use Form is a critical document for declaring your tax status. This form helps entities, whether businesses or individuals, to correctly report their sales and use tax liabilities, ensuring compliance and facilitating effective financial planning.

Who needs to use the application sales and use form?

Understanding who is required to use the Application Sales and Use Form is crucial for compliance. Individuals, businesses, and even non-profit organizations may have unique liability scenarios that necessitate this form.

An interactive checklist can facilitate your understanding: Do I need this form? Think about your purchasing habits, whether you're a business owner, nonprofit, or individual.

Step-by-step guide to completing the application sales and use form

Filling out the Application Sales and Use Form can be a meticulous process, but by following this structured approach, you can simplify it.

When filling out Section 1, ensure that all your identification is accurate. In Section 2, provide clear descriptions of your business activities, which helps tax authorities understand your sales tax responsibilities.

Editing and managing your application sales and use form

Managing documents efficiently is key, especially for the Application Sales and Use Form. With pdfFiller, you can leverage various tools to create and edit your forms seamlessly.

This platform enables cloud access, ensuring that you can manage your application from anywhere, which is particularly appealing for businesses operating in multiple locations.

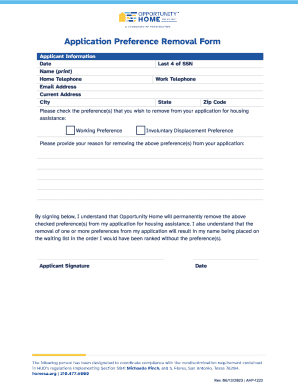

Signing the application sales and use form

Once the Application Sales and Use Form is filled out, the next important step is signing the document. In today’s digital age, pdfFiller allows for electronic signatures, making the process straightforward.

By using electronic signatures, you save time and ensure that your documents are processed swiftly, thus allowing you to focus on your business without unnecessary delays.

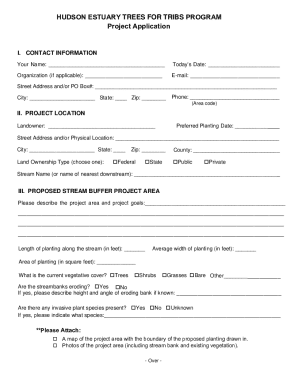

Submitting the application sales and use form

The final step is submitting your completed form. Different states have various submission methods, which you should familiarize yourself with to ensure proper compliance.

Before mailing your form, ensure that it is complete and signed. Following up with the tax department regarding your submission status can also provide peace of mind.

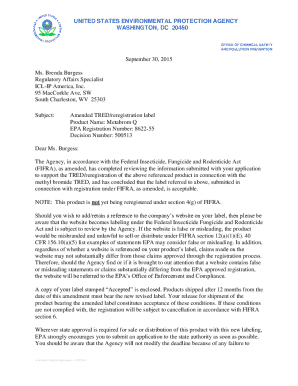

Managing changes and updates to your form

Life and business are dynamic, and changes may necessitate revisions to your Application Sales and Use Form. Understanding how to amend your application is critical for compliance.

Staying organized and informed about your changes can lead to smoother interactions with tax authorities.

Resources for further assistance

To enhance your understanding of the Application Sales and Use Form and related obligations, a variety of resources are available.

Investing time in understanding your tax responsibilities will ultimately lead to more efficient financial management in your operations.

Staying updated on sales and use tax changes

The landscape of sales and use tax is constantly evolving due to legislative changes. Understanding these modifications will keep you well-informed and compliant.

Taking proactive steps to stay updated not only aids in compliance but also positions your business favorably in the competitive landscape.

User testimonials and success stories

Real-world experiences highlight the advantages of utilizing the Application Sales and Use Form effectively. Case studies of businesses and individuals can offer insights into successful navigation of the sales and use tax process.

These success stories reinforce the idea that effective document management, especially with tools like pdfFiller, can significantly alleviate the stress associated with tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application sales and use in Gmail?

Can I sign the application sales and use electronically in Chrome?

How do I fill out the application sales and use form on my smartphone?

What is application sales and use?

Who is required to file application sales and use?

How to fill out application sales and use?

What is the purpose of application sales and use?

What information must be reported on application sales and use?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.