Get the free Rowekamp Tax Service LLC Tax Year 2023 Worksheet

Get, Create, Make and Sign rowekamp tax service llc

How to edit rowekamp tax service llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rowekamp tax service llc

How to fill out rowekamp tax service llc

Who needs rowekamp tax service llc?

Comprehensive Guide to the Rowekamp Tax Service Form

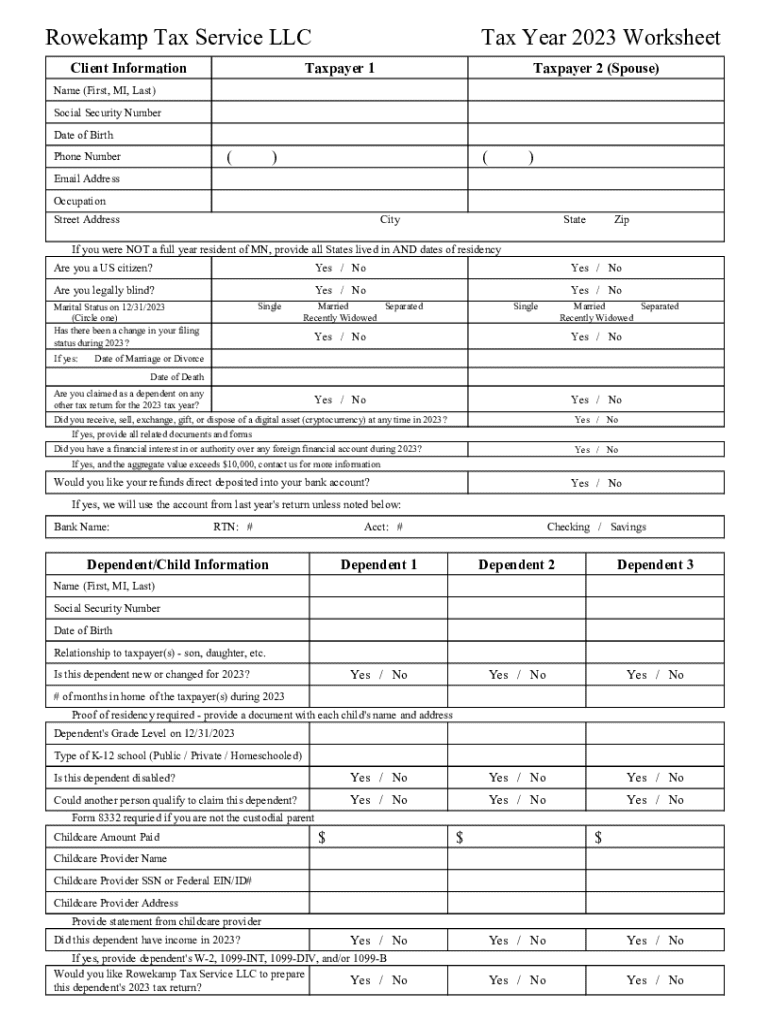

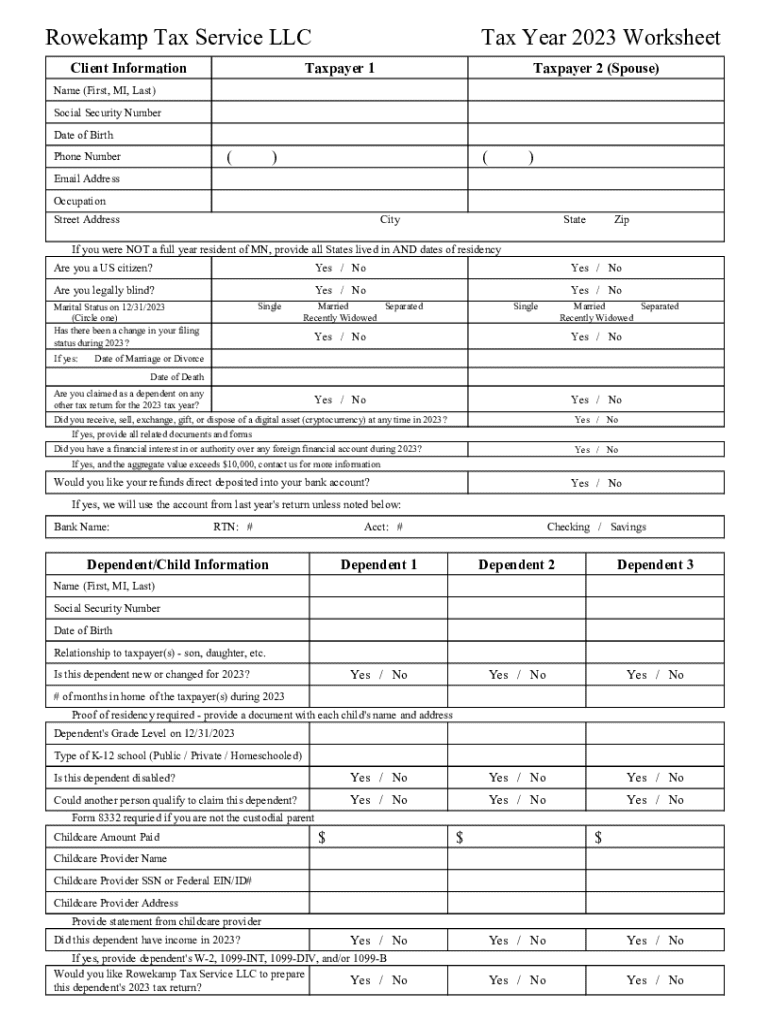

Overview of the Rowekamp Tax Service Form

The Rowekamp Tax Service LLC Form is an essential document designed specifically for limited liability companies (LLCs) to accurately report their business income and expenses. This form serves as a critical tool for not just complying with IRS regulations but also for optimizing tax deductions. Accurate tax filing with the Rowekamp form can significantly influence a company's financial health, enabling better cash flow management and planning.

The importance of accurately completing the Rowekamp Tax Service LLC Form cannot be overstated. Errors or omissions can lead to penalties or audits, so taking the time to fill it out correctly is vital. Furthermore, using the Rowekamp form correctly helps in maximizing eligible deductions which directly contributes to reduced taxable income.

Understanding the tax obligations for LLCs

Limited Liability Companies (LLCs) offer flexibility in taxation. An LLC can elect to be taxed as a sole proprietorship, partnership, or corporation. This versatility necessitates a profound understanding of the specific tax obligations that apply to the chosen structure. Each option influences the way the Rowekamp Tax Service LLC Form should be completed, depending on the financial activities of the LLC.

Common tax forms used by LLCs include Form 1065 for partnership taxation and Schedule C for single-member LLCs. It's crucial for a business owner to identify which forms are required based on the structure they select. The Rowekamp Tax Service LLC Form typically aligns with reporting income accurately and tabulating deductible expenses, thereby easing the tax burden on the business.

Key sections of the Rowekamp Tax Service Form

Understanding each section of the Rowekamp Tax Service LLC Form is critical for accurate and efficient completion. The form is divided into several key sections, each serving a distinct purpose that contributes to the overall financial picture of the LLC. This segmentation helps streamline the reporting process and avoids overwhelming the filer.

The main sections include Business Information, Income Reporting, Deductions and Credits, and Guidelines for Owner-Managed vs. Employee-Managed LLCs. Each section focuses on different aspects of the business and must be filled out carefully to avoid discrepancies.

Step-by-step instructions for completing the Rowekamp form

Completing the Rowekamp Tax Service LLC Form requires meticulous preparation and a structured approach. Start by gathering all necessary documentation, such as income statements, receipts for expenses, and any prior tax forms. Proper organization at this stage can greatly ease the subsequent filing process.

Next, enter your personal and business information in the designated sections of the form. In the Income Reporting section, be sure to itemize all revenues accurately. Using tools provided by pdfFiller can significantly reduce errors, especially when itemizing deductions where common deductions for LLCs may include office supplies, travel expenses, and professional services.

Using pdfFiller to manage your Rowekamp Tax Service Form

pdfFiller offers an intuitive platform for creating and managing the Rowekamp Tax Service LLC Form. To access the form, simply navigate to the pdfFiller website where you can find the document in their templates library. Utilizing pdfFiller's interactive features helps expedite document creation while also allowing for seamless collaboration with team members.

The eSigning options ensure compliance and convenience, enabling you to securely sign your form digitally. Once completed, you can easily save or download the finalized document in various formats. This level of flexibility is particularly valuable for businesses that require document management on the go.

Common pitfalls and FAQs

Filing the Rowekamp Tax Service LLC Form comes with its set of challenges. Common pitfalls include failing to report all income sources, overlooking eligible deductions, or submitting the form late. Awareness of these potential issues can promote a smoother filing experience.

FAQs relevant to the Rowekamp form often revolve around filing deadlines, the impact of business structure on tax obligations, and the best resources for deduction items. Providing clarity on these topics can empower users to approach their tax filings with confidence.

Additional support and resources

When navigating the Rowekamp Tax Service LLC Form, knowing where to find help is essential. Online forums can serve as valuable community resources where individuals share experiences and solutions to common issues. Websites such as Reddit and other financial discussion boards can provide insights from peers.

Additionally, pdfFiller offers comprehensive customer support options, including live help and a detailed knowledge base. Utilizing these resources can ensure that you're never left stranded when filing your taxes.

Staying updated: changes and updates in tax filing for 2024

As tax laws evolve, it’s crucial for LLCs to stay informed about changes that may impact the Rowekamp Tax Service LLC filings. Upcoming changes for 2024 include adjustments to deduction limits and updates in tax regulations. Being proactive about these shifts allows businesses to adapt and maintain compliance.

Utilizing pdfFiller’s resources ensures you're equipped with the latest information and compliance practices, making it easier to navigate such transitions in tax regulations.

Best practices for document management post-filing

Once the Rowekamp Tax Service LLC Form has been submitted, effective document management practices come into play. Organizing and securely storing tax documents aids in future reference and simplifies subsequent filings. Establish a system for categorizing documents, such as using folders for different years or types of expenses.

Consider setting reminders for future tax seasons to ensure you’re prepared ahead of time. Continuous access to your forms via pdfFiller means you can revisit past documents, helping you learn from previous filings and potentially streamline the process for the next tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit rowekamp tax service llc on an iOS device?

How can I fill out rowekamp tax service llc on an iOS device?

How do I complete rowekamp tax service llc on an Android device?

What is rowekamp tax service llc?

Who is required to file rowekamp tax service llc?

How to fill out rowekamp tax service llc?

What is the purpose of rowekamp tax service llc?

What information must be reported on rowekamp tax service llc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.