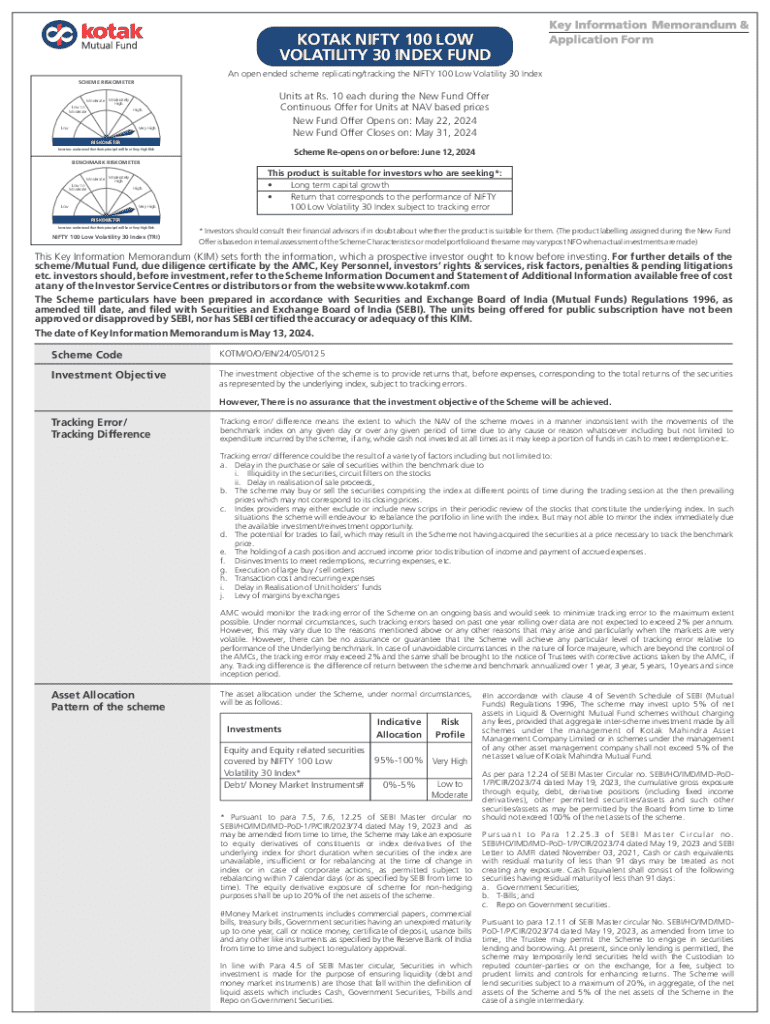

Get the free Invest in Kotak NIFTY 100 Low Volatility 30 Index Fund

Get, Create, Make and Sign invest in kotak nifty

Editing invest in kotak nifty online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invest in kotak nifty

How to fill out invest in kotak nifty

Who needs invest in kotak nifty?

Invest in Kotak Nifty Form: A Comprehensive Guide

Understanding the Kotak Nifty Investment

Nifty indices represent a collection of blue-chip stocks traded on the National Stock Exchange of India (NSE). It is one of the most tracked equity indices in the country, as it reflects the performance of the top 50 companies across various sectors. Investors closely monitor the Nifty index to gauge the overall health of the Indian stock market, making it a crucial benchmark for both institutional and retail investors.

Kotak Nifty stands out as an investment option within this landscape, primarily because of its association with Kotak Mahindra Asset Management Company, a well-regarded name in the Indian financial sector. The Kotak Nifty Index Fund allows investors to seamlessly replicate the Nifty index performance, potentially delivering similar returns while diversifying their portfolios.

What is the Kotak Nifty Form?

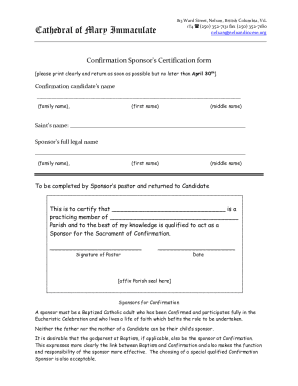

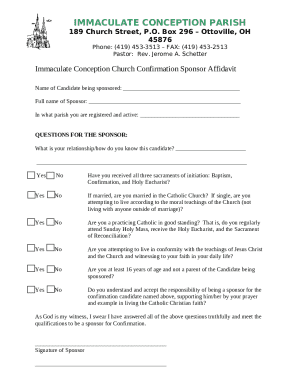

The Kotak Nifty Form is a structured document used to facilitate investments in the Kotak Nifty Index Fund. This form plays a crucial role in gathering essential information from investors, allowing them to express their intent to invest in this financial product. It includes fields for personal information, investment preferences, and consent declarations, ensuring compliance with regulatory requirements.

Investors can typically choose from various investment options through the Kotak Nifty Form, including Systematic Investment Plans (SIPs) and one-time lump sum investments, catering to different financial strategies and preferences.

Key features of the Kotak Nifty investment

Some salient attributes of the Kotak Nifty Fund include its impressive historical performance metrics. The fund has consistently tracked the Nifty index, providing returns that often mirror market performance. Historically, the Nifty index has witnessed growth, making this investment option attractive for many investors looking for long-term capital appreciation.

However, like all investment avenues, the Kotak Nifty Fund comes with its own set of risks, including market volatility and sector-specific downturns. The management strategies employed by Kotak Mahindra Asset Management Company are designed to mitigate these risks, utilizing a research-based approach to identify and manage potential hazards in market movements.

Investing in the Kotak Nifty provides several advantages, such as diversification across multiple top-performing stocks, which spreads financial risk. Additionally, professional management by experienced fund managers adds a layer of expertise, ensuring informed decision-making.

Who should consider investing in Kotak Nifty?

Individuals who are looking to invest in equity markets but prefer a managed approach will find the Kotak Nifty Fund appealing. Ideal investors typically include those seeking capital growth over the long term, individuals who may lack the time or expertise to actively manage their investments, and those who prefer a less risky, diversified portfolio.

Risk tolerance is another factor to consider. Investors must evaluate their risk profile before committing funds. For instance, conservative investors may be more drawn to the stability offered by indices like Nifty, while aggressive investors may look for higher returns through actively managed funds.

Long-term vs short-term investors

The Kotak Nifty Fund suits both long-term and short-term investment horizons. Long-term investors can benefit from the compounding effect of capital appreciation as they hold onto their investments through market fluctuations. In contrast, short-term investors may leverage market conditions for quick gains but should be aware of the associated risks.

How to fill out the Kotak Nifty Form

Filling out the Kotak Nifty Form is a straightforward process. Here’s a step-by-step guide to ensure accurate submission.

Managing your investment after form submission

After submitting the Kotak Nifty Form, ongoing management is key. Investors should continually monitor their investment performance, and tools available on pdfFiller can aid in tracking growth rates, performance metrics, and dividend distributions. Staying informed helps in making timely decisions based on market conditions.

Adjusting your investment strategy may be necessary depending on market shifts or personal financial goals. Regular reviews of your portfolio can help identify the right moments to rebalance or to stretch toward higher returns.

Ease of document management with pdfFiller

pdfFiller enhances the document management experience by allowing you to edit and manage your Kotak Nifty Form digitally. This means you can make changes to your investment information, update personal details, or correct errors without needing to resubmit physical forms. It brings agility and efficiency to your investment journey.

Additionally, pdfFiller’s eSigning tools simplify the signing process for agreements and transactions related to your investment. By utilizing these resources, you perform seamless transactions and maintain the integrity of your documentation.

Collaborative features

For teams making collective investment decisions, pdfFiller’s collaborative features are invaluable. Team members can access the document from anywhere, facilitate discussions online, sign off on decisions, and share insights, all within a cloud-based platform. This fluidity enhances teamwork and decision-making efficiency, which can positively impact overall investment strategies.

Pitfalls to avoid when investing in Kotak Nifty

New investors often stumble upon common mistakes when filing out the Kotak Nifty Form. These may include failing to provide complete information, neglecting to read terms and conditions, or overlooking the importance of selecting the right investment option. To avoid these pitfalls, it is crucial to take the time to thoroughly review all sections of the form and to understand the implications of your investment choices.

Effective risk management strategies are essential for minimizing losses. Understand market volatility and stay updated on market trends. Diversify your portfolio and assess your investment regularly to adjust your strategy as needed based on external conditions or personal financial goals.

Conclusion: Making informed investment decisions

Investing in the Kotak Nifty Fund presents unique opportunities for investors aiming to grow their wealth in the dynamic Indian market. With its robust structure, accessible investment options, and professional management, the Kotak Nifty taps into the performance potential of the market while offering necessary risk diversification.

Leveraging pdfFiller not only simplifies the process of filling out the Kotak Nifty Form, but it also streamlines document management, eSigning, and collaboration. By utilizing this digital platform, investors gain greater control and efficiency in managing their investment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit invest in kotak nifty from Google Drive?

How do I edit invest in kotak nifty in Chrome?

How do I complete invest in kotak nifty on an iOS device?

What is invest in kotak nifty?

Who is required to file invest in kotak nifty?

How to fill out invest in kotak nifty?

What is the purpose of invest in kotak nifty?

What information must be reported on invest in kotak nifty?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.