City Business and Occupation Form: A Comprehensive How-to Guide

Understanding City Business and Occupation Form

The City Business and Occupation Form is a crucial document that local businesses must complete to report their business activities and pay the appropriate city taxes. This form serves as a declaration of revenue generated by the business, helping municipalities assess and apply the business and occupation tax effectively. For local business operations, the significance of this form cannot be understated. It not only fulfills a legal requirement but also contributes to the funding of essential local services, such as public safety, infrastructure, and community programs.

Various industries utilize the City Business and Occupation Form. For instance, restaurants, retail stores, construction companies, and service providers all must submit this form to accurately report their income. While the basic structure of the form may remain consistent, specific requirements or classifications may differ depending on the industry, making familiarity with the form's components vital for successful compliance.

Key components of the City Business and Occupation Form

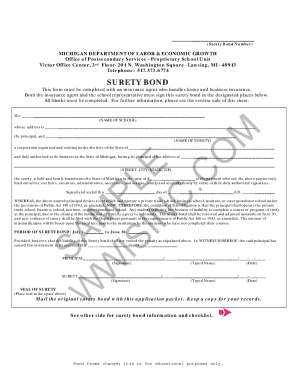

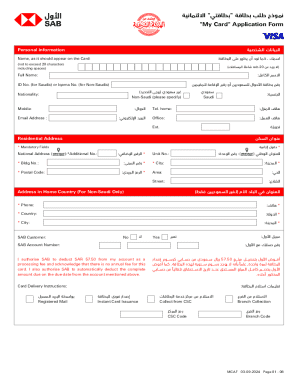

Understanding the City Business and Occupation Form involves recognizing its various components. The form is typically divided into several sections, each requiring specific information that contributes to the overall assessment of your business and its taxes.

Business Information: This includes the legal business name, the business structure—options might include Sole Proprietorship, LLC, or Corporation—and the business address.

Owner Information: Here, you will list the owner’s details, encompassing name, contact information, and possibly other relevant identifiers.

Business Activity Description: The form will request a clear description of the nature of your business activities, which helps in determining applicable classification codes.

Revenue Information: You must estimate your gross revenue and detail a breakdown of taxable and non-taxable revenue, which is essential for calculating your tax obligation.

Eligibility criteria for business and occupation tax

Not every individual or business is required to file the City Business and Occupation Form. Typically, businesses generating revenue within city limits must submit the form. However, some entities may qualify for exceptions based on specific criteria set by local regulations. Understanding these eligibility criteria is essential to avoid unnecessary penalties.

Certain relief programs may also be available. For example, small businesses or those affected by economic downturns may find provisions that allow them to delay payments or potentially reduce their tax base. Industry-specific guidelines can impact these considerations, so businesses should consult local regulations to determine their obligations.

Completing the City Business and Occupation Form

Filling out the City Business and Occupation Form correctly can streamline your tax compliance process and prevent issues down the line. Here’s a step-by-step guide to ensure you complete the form accurately.

Gather required documentation: Compile all necessary documents, such as business registration certificates, identification numbers, and financial records.

Fill out business and owner information accurately: Ensure that you provide complete and correct information, as errors can lead to complications.

Detail the nature of business activities concisely: Use specific terms that accurately describe what your business does, which will likely require choosing the correct classification codes.

Calculate gross and taxable revenues: This involves estimating your gross revenue and distinguishing between taxable and non-taxable income.

Review and revise before submission: Always double-check your form for any potential inaccuracies or missing information prior to submitting.

Avoiding common mistakes during completion is essential for maintaining compliance. These include miscalculating revenues, omitting necessary details, or using incorrect classification codes. Establishing a checklist prior to submission may assist in identifying potential pitfalls.

Submitting the City Business and Occupation Form

After completing your City Business and Occupation Form, the next step is to submit it correctly. Different submission methods are available, including online filing through the city's tax portal, mailing the form to the appropriate office, or delivering it in person.

Be mindful of submission deadlines, as failure to meet these can lead to penalties or delayed processing. Keeping track of your submission through confirmation receipts is equally important, as it provides proof of compliance and can assist in resolving any discrepancies in the future.

Managing City Business and Occupation Tax

Managing your City Business and Occupation Tax obligations doesn’t end with submission. It’s crucial to understand your responsibilities after filing the form. Businesses should maintain organized records of revenues, deductions, and correspondence related to their tax filings.

Payment options for the tax owed include online payments through the city’s portal, which is usually the fastest method, or mailing in a cheque.

Always keep a copy of receipts or proof of payment for your own records, which can be invaluable for future reference.

Utilize best practices for record-keeping by organizing financial documents chronologically and categorically to streamline audits.

Understanding related taxes and fees

Besides the City Business and Occupation Tax, local businesses may face various related municipal taxes and fees. These may include business licensing fees, real estate taxes on commercial property, and additional local taxes that impact business operations.

Understanding how these taxes interact with the City Business and Occupation Tax is critical. For instance, some localities allow certain tax deductions that can mitigate the overall tax burden. Awareness of these financial obligations helps business owners plan effectively and ensures full compliance with local regulations.

Resources for further assistance

Navigating through the complexities of the City Business and Occupation Form may require additional assistance. Local tax offices provide resources and support for businesses. Their staff is equipped to help answer questions regarding specific requirements or procedures.

Contact your city tax office for queries directly related to your filing.

Explore online resources and tools for business registration and tax management through pdfFiller, where various templates and guides are readily available.

Leverage interactive tools available for editing, signing, and managing forms online, streamlining your document handling process.

FAQs about the City Business and Occupation Form

Business owners frequently have questions about the City Business and Occupation Form. Addressing these common queries helps clarify processes and reduces frustration.

What to do if I miss the filing deadline? Contact your local tax office immediately to address potential penalties and explore options for late filings.

How can I amend a submitted form? Most municipalities allow businesses to file an amendment, which generally requires resubmitting the corrected information.

What are the penalties for late submission or inaccuracies? Penalties can vary by jurisdiction; however, they often result in fines based on the unpaid tax amount.

Utilizing pdfFiller for your business document needs

pdfFiller offers a seamless solution for managing the City Business and Occupation Form, along with other critical documents. Its cloud-based platform allows users to easily edit PDFs, sign documents electronically, and collaborate with team members in real-time.

The online editing feature of pdfFiller allows businesses to modify forms without needing complex software or printing.

eSignature capabilities facilitate quick approvals, making it easier to finalize tax documents promptly.

Document collaboration tools empower teams to work together, ensuring that all necessary inputs are captured before submission.

Success stories of businesses utilizing pdfFiller highlight its impact on document management efficiency, enabling them to focus more on business growth instead of dealing with paperwork hurdles.