Get the free Brokerage Firm Compensation Agreement

Get, Create, Make and Sign brokerage firm compensation agreement

Editing brokerage firm compensation agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brokerage firm compensation agreement

How to fill out brokerage firm compensation agreement

Who needs brokerage firm compensation agreement?

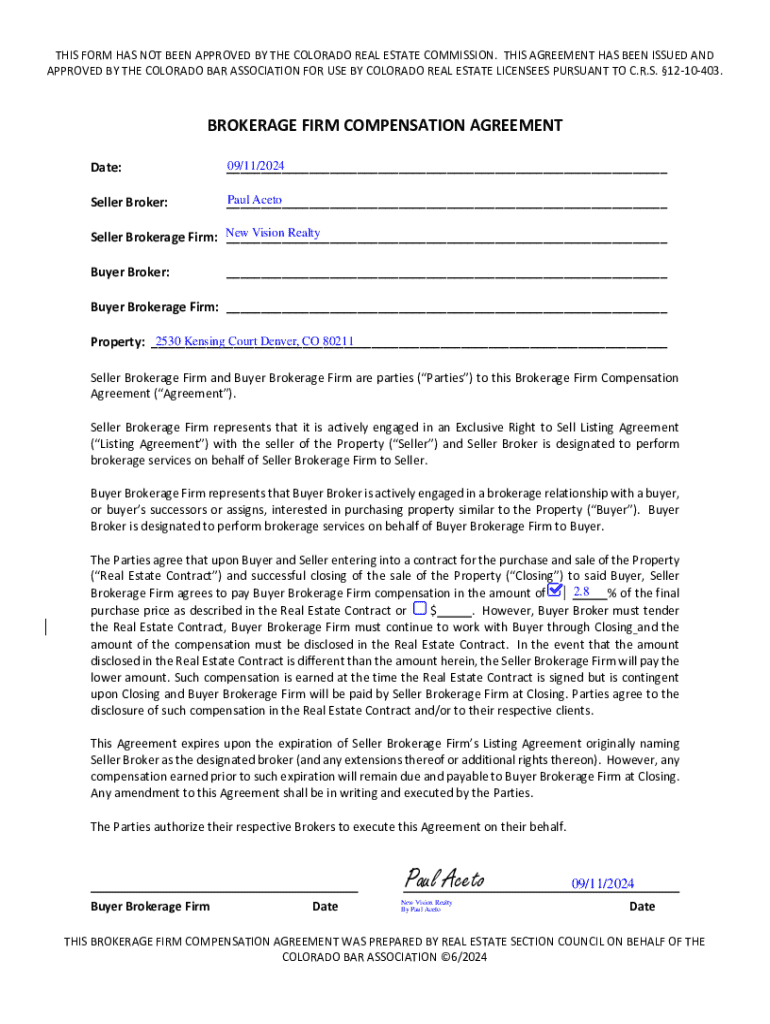

Understanding the Brokerage Firm Compensation Agreement Form

Understanding the brokerage firm compensation agreement

A brokerage firm compensation agreement is a crucial document that outlines the financial arrangement between a brokerage firm and its brokers. This agreement details how brokers will be compensated for their services, ensuring transparency and compliance within the firm. It serves not only as a contractual obligation but also as a guideline for financial expectations between parties.

The key components of the agreement include definitions of critical terms, the roles and responsibilities of brokers, and the specific compensation structure. Defined terms clarify language to avoid misunderstandings, while outlining brokers' responsibilities ensures accountability. This comprehensive understanding is essential for fostering trust and clarity in compensation practices.

Importance of the compensation agreement

The brokerage firm compensation agreement holds significant legal weight as it serves as evidence of the contractual relationship between the firm and its brokers. In a field as regulated as finance, adhering to these agreements can help prevent legal disputes and misunderstandings over compensation terms.

Moreover, this agreement provides financial clarity for all parties involved. It articulates the method by which brokers will earn commission or bonuses, allowing both brokers and management to align their objectives. Compliance with local regulations is another critical factor; the agreement often ensures that payment structures conform to industry standards and legal requirements.

Preparing to fill out the compensation agreement

To properly fill out the brokerage firm compensation agreement form, certain essential information is required. This includes broker details, client information, and specific transaction details necessary for accurately specifying compensation terms. Having all relevant data collated will make the process smoother and help ensure accuracy.

Key information to gather includes the broker's full name, license details, contact information, and any references to their previous compensation history. For clients, names, addresses, and transaction details must also be documented. Being thorough and meticulous during this preparation phase is vital for accurate data entry.

Step-by-step guide to completing the compensation agreement form

Filling out the brokerage firm compensation agreement form on pdfFiller involves a systematic approach. Start by accessing the form online, where you can fill in all required fields digitally. Each step in the process should be approached with care to ensure no detail is overlooked.

Step 1 involves filling in the broker's information precisely, ensuring that the spelling and details are accurate. Step 2 requires you to provide client details, mirroring the information from your gathered documentation. In Step 3, detail the transaction information, making sure it aligns with the service provided to the client.

Step 4 focuses on specifying the compensation structure, including commission rates and any bonus structures. In Step 5, review and edit your filled form for any discrepancies or omissions. Finally, in Step 6, eSign the document, making it legally binding, and share it securely with the appropriate parties.

Interactive tools for managing your form

pdfFiller offers a suite of interactive tools designed to make managing your brokerage firm compensation agreement easy. The platform includes editing features that allow users to add, remove, and modify text without hassle. This flexibility ensures that your document is always current and accurate.

In addition to editing, incorporating digital signatures simplifies the process of finalizing documents. Real-time collaboration tools enable teams to provide feedback instantly, ensuring that all parties are aligned and engaged in the process. The version history feature allows you to track changes and revert to previous editions if needed, adding an extra layer of security to your documentation efforts.

Best practices for managing your brokerage compensation agreement

To ensure your brokerage firm compensation agreement is effective, follow best practices for document management. Firstly, store and access documents securely, using cloud storage solutions like pdfFiller for convenience and safety. Ensure that only authorized personnel have access to sensitive information to protect client and broker data.

Setting reminders and follow-ups is another strategic approach. Periodic reviews of the compensation agreement are essential. This not only helps in maintaining compliance with any changing regulations but also allows firms to adjust compensation structures as necessary in response to market conditions or internal policy updates.

Common mistakes to avoid when creating an agreement

Creating a brokerage firm compensation agreement requires attention to detail, and common mistakes can lead to unnecessary complications. One such mistake is overlooking critical information. Each section of the agreement must be filled in comprehensively to prevent misunderstandings later.

Another common error is failing to comply with state regulations. Each state may have specific requirements for compensation structures, and ignorance of these can lead to compliance issues. Lastly, neglecting to secure necessary signatures renders the document ineffective, so ensuring all parties have signed before finalizing is vital.

Frequently asked questions (FAQs)

One question often posed is, 'What happens if the agreement is not signed?' If a brokerage firm compensation agreement goes unsigned, it effectively lacks legal standing, potentially leading to disputes regarding payment. It is essential to ensure all parties review and sign the agreement promptly.

Another common query is about making changes after the form is filled out. Changes can usually be made by editing the document on pdfFiller, but both parties must agree to any amendments, and updating signatures might be necessary to reflect these changes. For additional resources on brokerage agreements, it’s wise also to consult legal advisors or industry experts.

About the compensation agreement template available on pdfFiller

pdfFiller offers a robust compensation agreement template designed for ease of use and clarity. The template allows users to customize various sections to meet their specific needs, enhancing its utility across different organizations and sectors. This adaptability makes it an attractive tool for individuals and teams looking for a comprehensive documentation solution.

User testimonials reflect satisfaction with the straightforwardness and effectiveness of pdfFiller’s platform. Many users appreciate the cloud-based accessibility of their documents, which allows for seamless collaboration and management of agreements, positioning pdfFiller as a trusted partner for brokerage firms.

Additional insights and industry trends

The landscape of brokerage compensation is evolving, with emerging trends reflecting shifts toward greater transparency and flexibility. More firms are adopting hybrid compensation models that combine salary with performance-based bonuses, catering to the changing motivations of brokers. This trend highlights the importance of regular updates to compensation agreements to reflect these shifts.

As we move into the digital age, the future of compensation agreements is increasingly rooted in technology. Platforms like pdfFiller are leading the way in offering integrated solutions for document management, emphasizing the need for real-time updates and compliance monitoring. This shift promises to streamline the documentation process for brokerage firms and assure compliance with evolving regulations.

User engagement

To ensure continuous improvement in user experience, feedback on the effectiveness of this guide is invaluable. Thoughts on functionality and suggestions for enhancements are always welcome as they help us create more resources tailored to the needs of our users. Sharing experiences with the platform allows pdfFiller to grow and adapt in the ever-changing landscape of document management.

We encourage users to engage with us by sharing their insights on this guide’s helpfulness. Your feedback directly informs our efforts to optimize the platform and better serve individuals and teams navigating the complexities of brokerage firm compensation agreements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit brokerage firm compensation agreement straight from my smartphone?

How do I complete brokerage firm compensation agreement on an iOS device?

How do I fill out brokerage firm compensation agreement on an Android device?

What is brokerage firm compensation agreement?

Who is required to file brokerage firm compensation agreement?

How to fill out brokerage firm compensation agreement?

What is the purpose of brokerage firm compensation agreement?

What information must be reported on brokerage firm compensation agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.