Get the free Axis India Manufacturing Fund - NAV, Returns & Performance

Get, Create, Make and Sign axis india manufacturing fund

Editing axis india manufacturing fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out axis india manufacturing fund

How to fill out axis india manufacturing fund

Who needs axis india manufacturing fund?

Axis India Manufacturing Fund Form: A Comprehensive Guide

Understanding the Axis India Manufacturing Fund

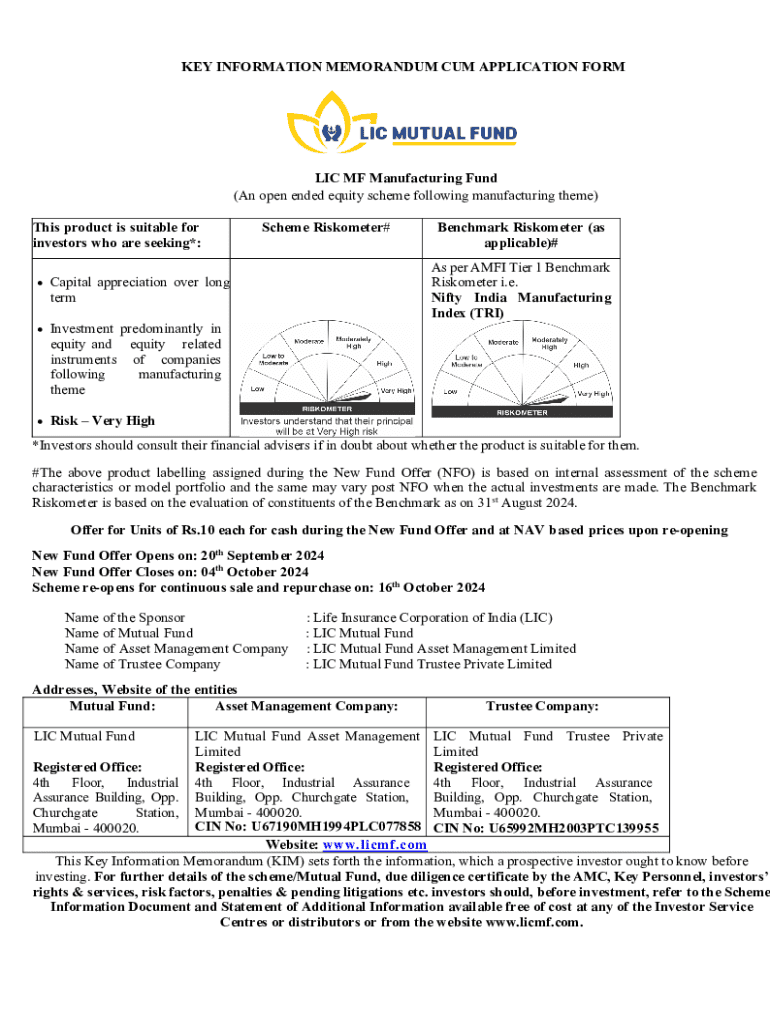

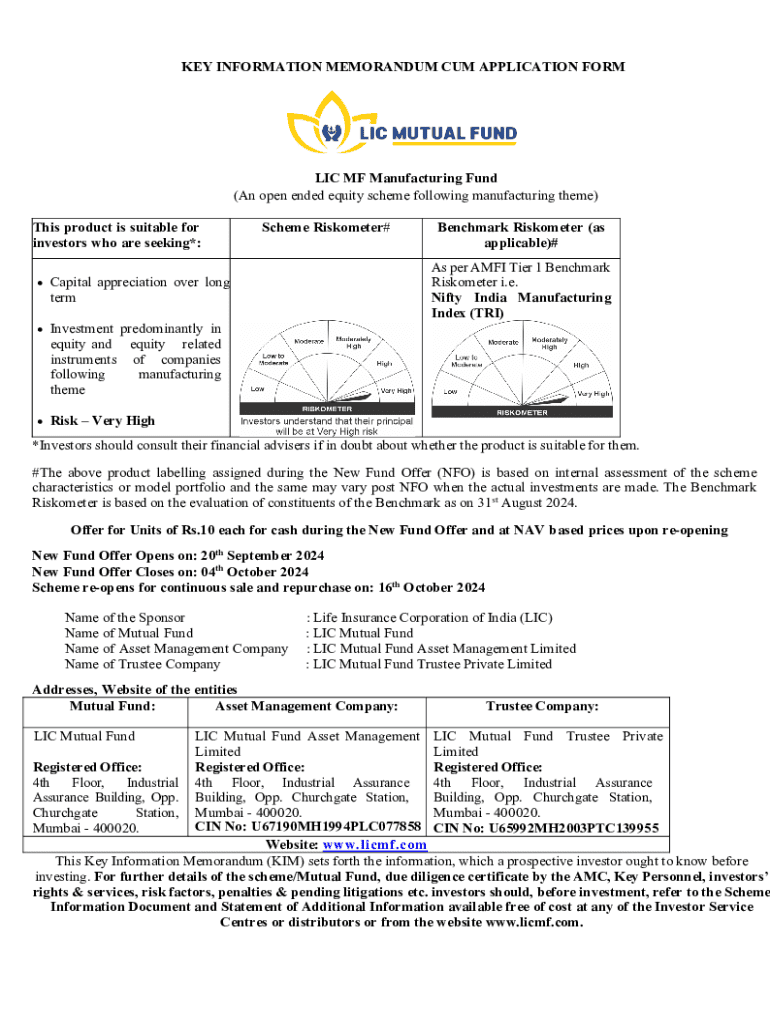

The Axis India Manufacturing Fund is a mutual fund designed specifically to capitalize on the growth of India's manufacturing sector. Launched in response to the increasing government focus on 'Make in India', this fund aims to channel investments into manufacturing companies that demonstrate strong growth potential. As the manufacturing sector is vital to India’s economic resurgence, this fund plays an important role in connecting investors with opportunities in sectors such as automobiles, textiles, and electronics.

Manufacturing is integral to India’s economy, contributing approximately 15% of the GDP. The government's initiatives to bolster infrastructure and ease regulations can drive significant growth. Investors looking to capitalize on these opportunities will find that the Axis India Manufacturing Fund aligns well with their investment objectives.

Key features of the Axis India Manufacturing Fund

What sets the Axis India Manufacturing Fund apart is its concentrated focus on the manufacturing sector. Unlike diversified mutual funds, this fund zeroes in on companies that will benefit significantly from the increasing demand for domestic manufacturing. Its diversification strategy entails spreading investments across various manufacturing sub-sectors to mitigate risk while maximizing growth potential.

The fund employs a stringent stock selection process to maintain quality in its portfolio. This process includes a multi-step analysis consisting of both quantitative metrics, such as earnings growth and return on equity, alongside qualitative assessments of management and competitive positioning.

Investment insights

With the fabric of India's economy rapidly changing, the manufacturing sector is projected to witness a significant uptrend. The government aims to increase the contribution of manufacturing to GDP from 15% to 25% by 2025, bolstered by initiatives like Production-Linked Incentives (PLI). Current trends indicate a shift towards advanced manufacturing technologies, including automation and sustainable practices. Recognizing these trends can guide strategic investments in the sector.

In terms of returns, the Axis India Manufacturing Fund has consistently outperformed many broader market indices. Historical performance metrics illustrate the fund's robust return on investment, positioning it as a solid choice for investors seeking to engage with the burgeoning manufacturing space.

How to invest in the Axis India Manufacturing Fund

Investing in the Axis India Manufacturing Fund involves a straightforward process. However, potential investors need to meet specific eligibility criteria, primarily concerning the minimum investment amount and identity verification standards. Generally, individuals and institutions can invest in this fund, provided they fill out the necessary forms and comply with the required documentation.

To start the investment process, one needs to complete the Axis India Manufacturing Fund form. This can be easily done using the online platform provided by the fund manager, or traditional paper forms can be utilized as well. After filling out the form, the submission process entails uploading or mailing the document, along with any supporting documentation to verify identity and income.

Understanding the form and related documentation

Filling out the Axis India Manufacturing Fund form requires attention to detail. Key information generally includes personal identification details, financial background, and information on the investment amount. Investors should be diligent in providing accurate information, as discrepancies can lead to processing delays.

Common mistakes to avoid include leaving sections blank and misreporting figures. By thoroughly reviewing the form before submission, individuals can ensure clarity and competence in their application.

Managing your investment

Once you have successfully invested in the fund, it is crucial to monitor performance regularly. Investors can utilize various tools, including return calculators and asset allocation insights, available through platforms like pdfFiller, to analyze performance and make informed decisions about their investments.

In the event of market fluctuations, it’s essential to have a strategy in place. Investors should regularly review their portfolios and respond accordingly. Whether that means rebalancing, adding to positions, or even redeeming shares, actively managing your investment can yield better long-term outcomes.

Taxation and regulatory information

Investors in the Axis India Manufacturing Fund need to be cognizant of the tax implications associated with their investments. As a mutual fund focusing on equity, any gains upon redemption are subject to capital gains tax. Long-term holds typically benefit from lower tax rates compared to short-term holdings.

Furthermore, there are various regulatory disclosures that investors must be aware of. These disclosures aim to ensure transparency and protect investor rights. Reading through these materials will help investors understand their rights and responsibilities after entering into the fund.

Frequently asked questions about Axis India Manufacturing Fund

Investors often have queries regarding the suitability of the Axis India Manufacturing Fund for their portfolio. Generally, this fund is appropriate for those seeking capital appreciation through exposure to the manufacturing sector. The ideal investment horizon for this fund should be long-term, allowing benefits from potential market uplifts.

Beginners may also find this fund appealing, given its structured approach and the potential for significant growth. For further education, investors can access several resources, including webinars, articles, and detailed FAQs provided by pdfFiller.

Literature and statutory disclosures

It is imperative for investors to review the fund factsheet and investor charter of the Axis India Manufacturing Fund. These documents encapsulate crucial information about fund objectives, structures, risk factors, and performance metrics. They can provide insights to optimize your investment strategy.

Investors should thoroughly familiarize themselves with all regulatory materials before investing. This understanding can bolster investor confidence and ensure all legal obligations are met.

Additional tools and support

For investors seeking further support, the knowledge center available on the pdfFiller website is an excellent resource. This center provides a plethora of information ranging from educational articles to in-depth analysis on how to fill out forms effectively. Building a comprehensive understanding by utilizing these resources ensures smarter investment decisions.

Should you require direct assistance, the investor support team is available to address any personal inquiries related to your investment or form filling queries, ensuring a smoother experience.

Related funds and peer schemes

Understanding the competitive landscape is essential for making informed investment choices. Several funds offer similar exposure to India's manufacturing sector, such as the HDFC Growth Fund and SBI Manufacturing Fund. Each of these funds has unique strategies and performance metrics.

While the Axis India Manufacturing Fund specializes in concentrated manufacturing investments, peers may offer broader or different approaches. Comparing performance metrics among these funds can assist investors in selecting the best vehicles for their financial goals.

Keeping up-to-date

Staying informed about the Axis India Manufacturing Fund and the broader manufacturing sector is vital for all investors. Following relevant corporate news and updates related to fund performance can empower investors to react adequately to changing market conditions.

Regularly referencing market analysis reports can also provide insights into sector trends and emerging opportunities. This proactive approach to information can ultimately shape smarter investment strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in axis india manufacturing fund?

How do I make edits in axis india manufacturing fund without leaving Chrome?

Can I edit axis india manufacturing fund on an Android device?

What is axis india manufacturing fund?

Who is required to file axis india manufacturing fund?

How to fill out axis india manufacturing fund?

What is the purpose of axis india manufacturing fund?

What information must be reported on axis india manufacturing fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.