Get the free LightNon-Banking Finance Company

Get, Create, Make and Sign lightnon-banking finance company

Editing lightnon-banking finance company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lightnon-banking finance company

How to fill out lightnon-banking finance company

Who needs lightnon-banking finance company?

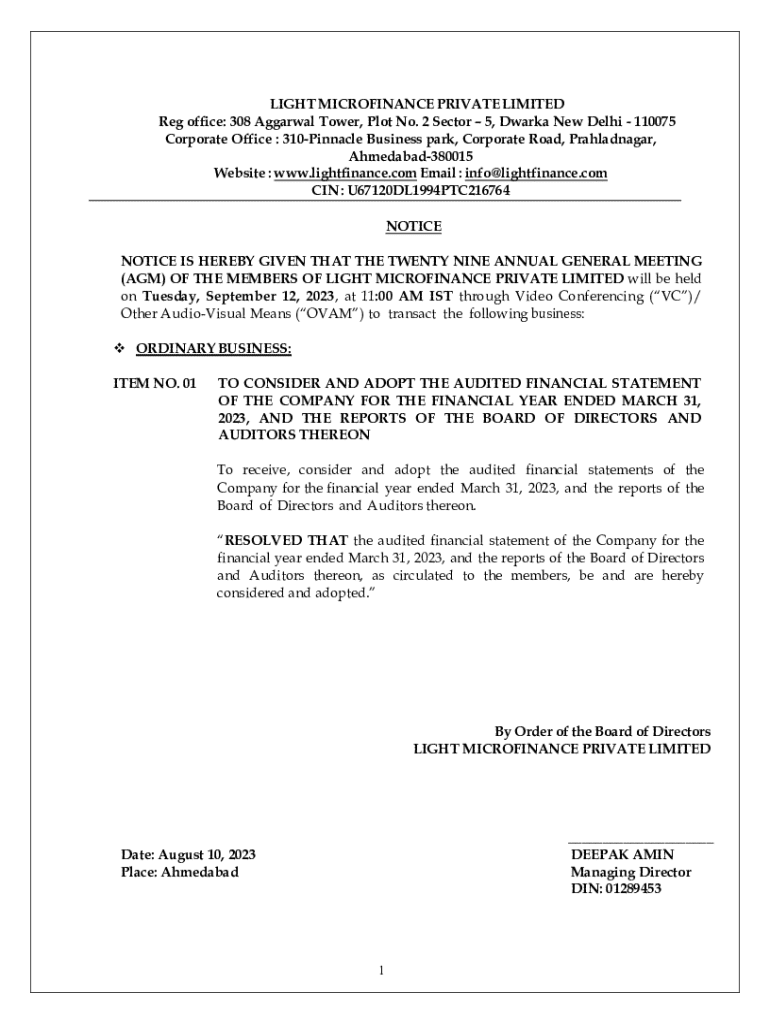

Understanding the Light Non-Banking Finance Company Form

Overview of light non-banking finance companies

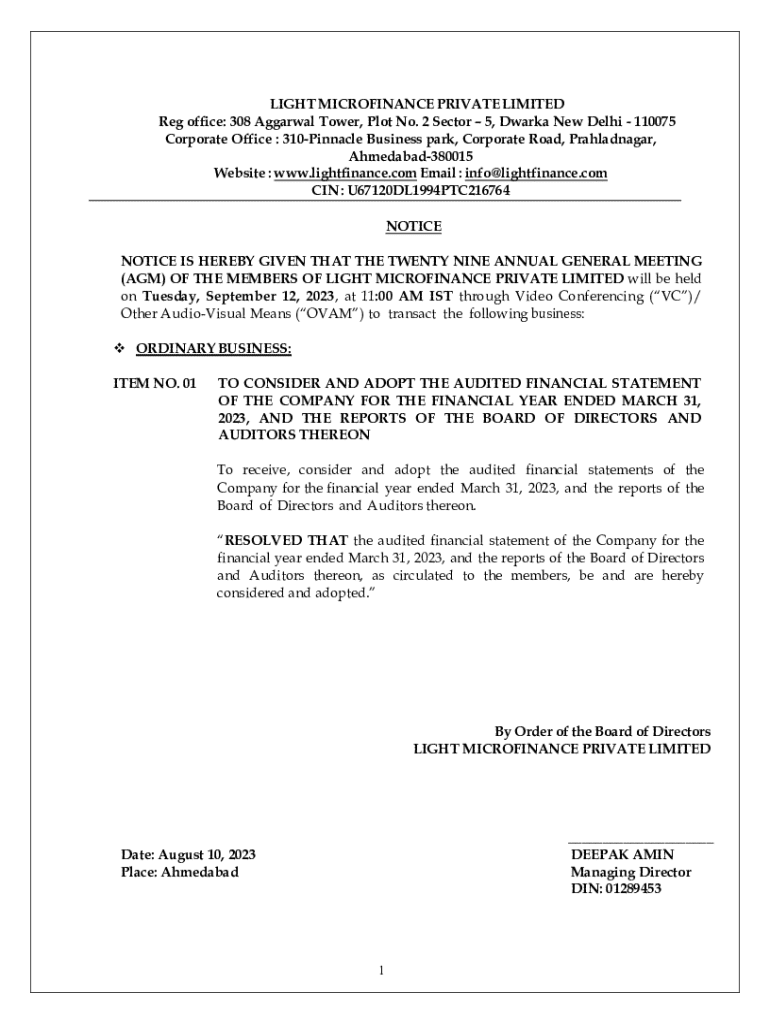

Light Non-Banking Finance Companies (LNBFCs) are financial institutions that provide a variety of services, including loans, credit facilities, and investment products. Unlike traditional banks, LNBFCs do not have a full banking license, which means their operations are limited in scope but often more flexible in terms of service offerings.

These companies play a critical role in the financial ecosystem by catering to specific financial needs that are often underserved by banks, such as providing small loans to individuals or financing small businesses. The reduced regulatory burden allows LNBFCs to offer quicker approvals and more personalized services.

Importance of proper documentation

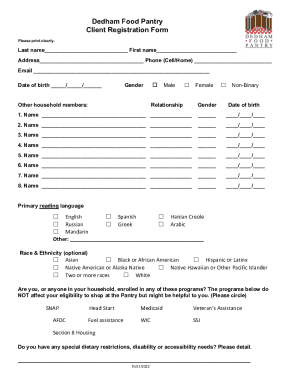

Accurate and well-structured documentation is fundamental when dealing with LNBFCs. The light non-banking finance company form serves as the primary means through which clients present their financial situation and obtain services. Errors or omissions in this form can lead to significant delays in processing applications or even outright rejections.

Common challenges that individuals encounter while filling out finance-related forms include confusion regarding required information, incomplete submissions, and misinterpretation of question prompts. By focusing on proper documentation, clients not only foster smoother transactions but also ensure compliance with LNBFC regulations.

Understanding the light non-banking finance company form

The light non-banking finance company form comprises several components essential for the client's financial profiling. Each section is designed to capture relevant aspects of the applicant’s financial status, ensuring that LNBFCs have a comprehensive overview of their potential clients.

Key components of the form include personal identification information, financial information about assets and liabilities, and compliance statements to ensure adherence to specific regulations. Each section plays a vital role in the evaluation process.

Step-by-step guide to filling out the form

Preparation before filling out the light non-banking finance company form is crucial. Gathering all necessary documentation, including identification and financial records, can streamline the process and minimize errors.

Below is a step-by-step guide for completing the form:

Utilizing pdfFiller for efficient completion

pdfFiller offers a seamless platform for accessing the light non-banking finance company form. It provides users with a user-friendly interface that simplifies filling out finance-related forms.

Key features of pdfFiller include:

Users can efficiently save and export completed forms, ensuring easy logistics for submissions.

Common mistakes to avoid

When filling out the light non-banking finance company form, several common mistakes can lead to serious issues, including processing delays. Frequently overlooked sections often include regulatory compliance statements or financial disclosures.

Errors such as incorrect personal information or missing signatures can impact the outcome of your application.

Interactive tools for managing your LNBFC forms

pdfFiller provides various interactive tools to facilitate the management of your light non-banking finance company forms. These tools enhance user experience by streamlining the documentation process.

By leveraging pdfFiller's features, users can efficiently track submissions and modifications, ensuring complete transparency in the process.

Regulatory compliance and best practices

LNBFCs are governed by a regulatory framework that outlines strict operational guidelines. Adhering to these regulations is essential for maintaining a good standing and ensuring access to necessary financial services.

Maintaining up-to-date documentation not only ensures compliance but also expedites any future financial transactions. Best practices involve regular review of documents and ensuring that all information submitted is accurate.

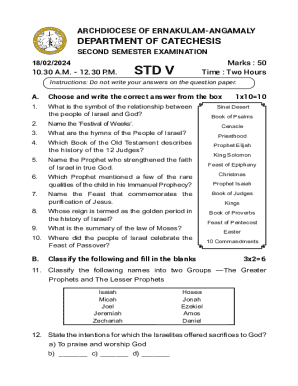

Frequently asked questions (FAQs)

Understanding common queries related to the light non-banking finance company form can ease the process for many users. Some frequently asked questions include:

Conclusion on leveraging pdfFiller for your finance needs

Using pdfFiller for managing your light non-banking finance company forms presents various benefits, from expedited processing to enhanced documentation management. Empowering users to streamline the financial form process can significantly alleviate the stress of document management.

By utilizing the features offered by pdfFiller, individuals and teams can explore and effectively leverage the services provided for a seamless financial experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find lightnon-banking finance company?

How do I edit lightnon-banking finance company in Chrome?

Can I edit lightnon-banking finance company on an Android device?

What is lightnon-banking finance company?

Who is required to file lightnon-banking finance company?

How to fill out lightnon-banking finance company?

What is the purpose of lightnon-banking finance company?

What information must be reported on lightnon-banking finance company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.