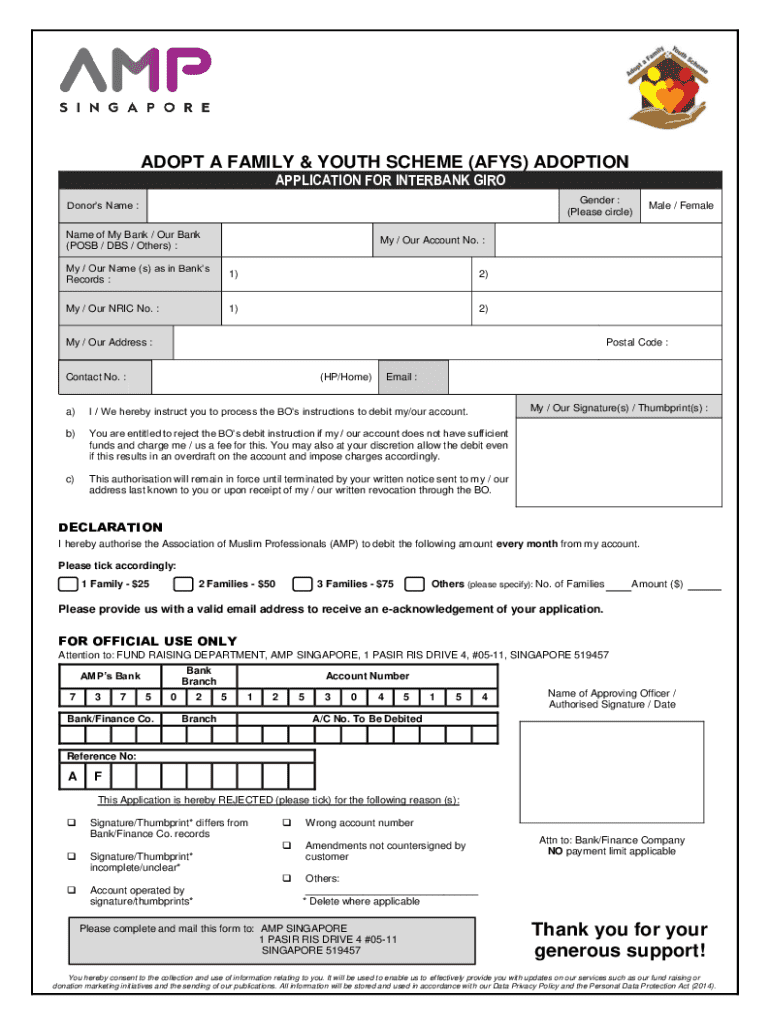

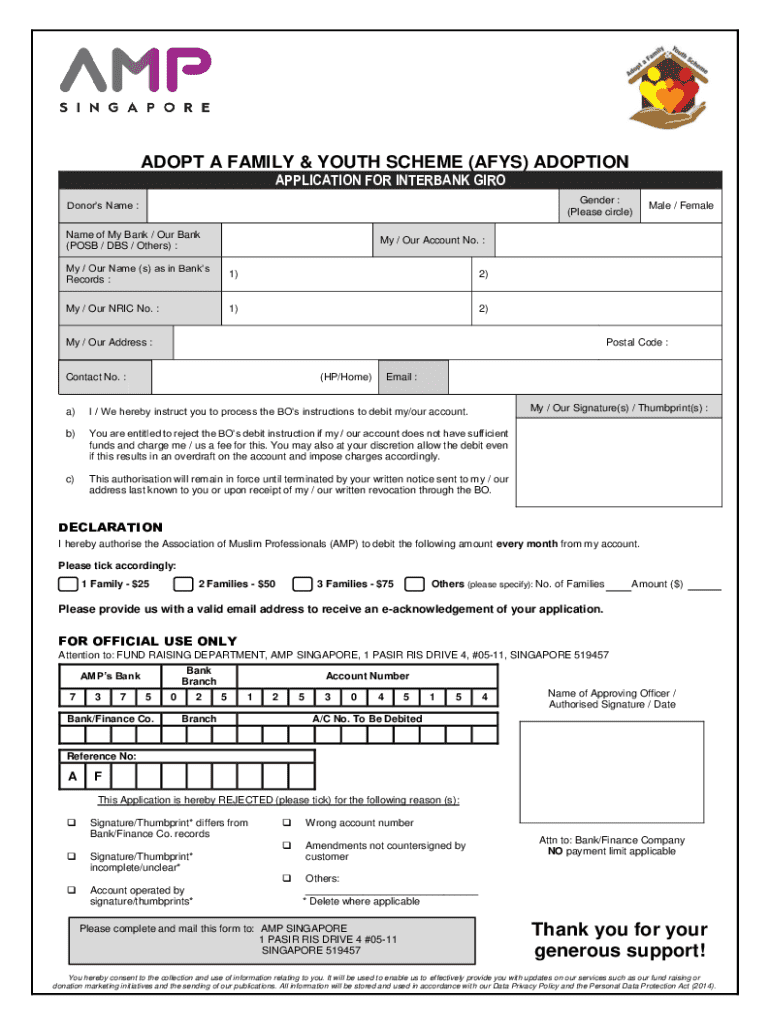

Get the free Application Form for Interbank Giro Donations

Get, Create, Make and Sign application form for interbank

Editing application form for interbank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for interbank

How to fill out application form for interbank

Who needs application form for interbank?

Application Form for Interbank Transactions: A Comprehensive How-To Guide

Understanding the interbank application form

An interbank application form is a vital document used for various banking transactions between different financial institutions. Its primary purpose is to facilitate transfers, loans, and other financial dealings that necessitate communication and agreement between banks. Ensuring that details filled in this form are accurate and complete is critical; any inaccuracies can result in delays or unintended rejections of requests.

Accurate information is paramount, as the interbank form serves as a record of transaction details, helping to protect both the sender and recipient from potential fraud. Common uses of the interbank application form include processing wire transfers, applying for loans, and executing currency exchanges. Miscommunication in any of these areas can lead to complications that are best avoided by meticulous attention to detail.

Who needs to fill out an interbank application form?

Both individuals and businesses may need to fill out an interbank application form, depending on their banking needs. For individuals, applying for a loan or transferring funds abroad often necessitates this type of application. Moreover, various transaction types will dictate when an individual needs to use this form. Promptly fulfilling these requirements can expedite transactions and improve user experience.

For businesses, the interbank application form is even more critical, as corporate transactions frequently involve significant sums or complex agreements. Whether a small startup needing operational funds or a large corporation conducting international transfers, understanding how to accurately complete this form can streamline operations and enhance financial management.

Preparing to fill out the interbank application form

Before filling out the interbank application form, preparing the necessary documentation is essential to ensure efficiency and accuracy. Collect personal identification documents such as government-issued IDs, social security numbers, or tax information. Financial statements, including recent bank statements and income verification documents, may also be required to substantiate your application.

In addition to personal IDs and financial statements, others may need further documentation depending on the transaction type. This may include letters of intent, business licenses for corporate applications, or tax clearance certificates. Organizing these documents in advance not only saves time but ensures that you are not caught off guard by potential requests from the bank.

Step-by-step: filling out the interbank application form

When you begin filling out the interbank application form, start with the personal details section. This is where you provide your name, address, and contact information. Ensure that all data is current and matches your identification documents. Next, move on to the financial information section, providing details about your income, assets, and liabilities to paint a complete picture of your financial situation.

Following that, specify the purpose of the transaction. Clearly articulate whether the request pertains to a loan, fund transfer, or business transaction. This section may require additional explanations or documentation, so clarity is essential. Be sure to double-check any fields that require numerical data, as these are often where mistakes occur most frequently.

Editing the interbank application form

Once you have filled out the interbank application form, you might find that some information needs editing or updating. Perhaps you realized a typo, or your financial circumstances have shifted slightly. Being able to efficiently edit the application is crucial to ensure its accuracy and completeness, which can be seamlessly handled using tools like pdfFiller.

pdfFiller offers user-friendly editing tools that allow you to modify text easily and add annotations. This flexibility lets you make necessary adjustments without starting the form from scratch, saving time and ensuring the final submission aligns perfectly with your intentions.

Signing the interbank application form

Before submitting your interbank application form, you will need to provide a signature to validate the document. You may choose between a traditional handwritten signature or an electronic signature. The latter has gained immense popularity due to its convenience and legality across most jurisdictions.

Using pdfFiller’s eSign features, signing digitally is straightforward. You can sign with your mouse or stylus, or even upload an image of your signature. Moreover, pdfFiller ensures that your signature is secured and protected, adding an extra layer of authenticity to your submitted form.

Submitting the interbank application form

Submitting your completed interbank application form can be done through various methods. Many banks offer online submission via their digital portals. This method often speeds up the processing time and provides immediate confirmation of receipt. Alternatively, you can opt for physical submission, in which case best practices include ensuring the submission is made during operational hours and retaining a copy for your records.

After submission, it's crucial to track your application status. Many banks provide tracking tools or references confirming submission, ensuring that you can follow up if necessary. Keeping abreast of your application’s progress can alleviate stress and help you plan next steps accordingly.

Managing your interbank application form

After submission, managing your interbank application form becomes essential. It’s wise to store digital copies securely in a format that you can easily access later. PdfFiller provides excellent tools for document management, allowing you to organize files systematically while ensuring that sensitive information remains protected.

Utilizing pdfFiller for your document management means you can share files with others securely, review changes, and collaborate on necessary edits, all within a single platform. This contributes to overall organizational efficiency and ensures everyone involved has access to the pertinent documents.

Frequently asked questions (FAQs)

Common issues may arise when filling out the interbank application form, such as lack of clarity in instructions or difficulty gathering required documentation. To alleviate these concerns, it's beneficial to have a list of FAQs that address typical questions. Understanding potential processing times for submission can also help calibrate expectations, as delays can sometimes occur based on bank volume or documentation needs.

If your application is rejected, don't panic. There are usually clear channels for understanding the reason behind the denial and procedures for reapplication or adjustment. Engaging with your bank's support services can often yield helpful insights and remedial steps.

Best practices for a successful application

Successfully filling out an interbank application form requires adherence to certain best practices. Start by ensuring all information is filled accurately and completely, checking back against your supporting documents where necessary. Double-checking your entries can save significant time and trouble later, especially if mistakes occur.

It’s essential to pay attention to the specific requirements outlined by your banking institution, as they may vary. Utilize resources and support services offered by banks or tools like pdfFiller to assist you in navigating the complexities of filling out the interbank application form. Relying on these can make the process smoother and increase the likelihood of successful submission.

Additional tools and features in pdfFiller

PdfFiller offers interactive features that significantly simplify document management. Users can edit, sign, and share documents, as well as track changes made by collaborators, enhancing overall workflow efficiency. The ability to collaborate on applications with teams in real-time ensures everyone remains in sync and can contribute where needed.

Moreover, the benefits of cloud-based document solutions mean your files can be accessed from anywhere, fitting seamlessly into busy lifestyles or enterprise structures needing flexibility. With pdfFiller, managing interbank application forms becomes a straightforward, efficient process that empowers users to focus on what truly matters.

Industry insights and trends in interbank applications

The standards in banking documentation are continually evolving, particularly where interbank processes are involved. As more institutions embrace digital transformation, the transition to online applications and submissions is becoming commonplace. This trend reflects broader movements within the financial services sector, emphasizing efficiency, speed, and enhanced security protocols.

Future developments may include increased automation and integration of artificial intelligence in processing applications. This shift will likely streamline the application process even further, making it easier for users to interact with banks and complete necessary forms. Keeping abreast of these trends can enhance how individuals and businesses approach their banking transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application form for interbank directly from Gmail?

How do I make edits in application form for interbank without leaving Chrome?

How do I fill out application form for interbank using my mobile device?

What is application form for interbank?

Who is required to file application form for interbank?

How to fill out application form for interbank?

What is the purpose of application form for interbank?

What information must be reported on application form for interbank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.