Get the free 1023-I Application for Recognition of Exemption Under ...

Get, Create, Make and Sign 1023-i application for recognition

Editing 1023-i application for recognition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1023-i application for recognition

How to fill out 1023-i application for recognition

Who needs 1023-i application for recognition?

1023- Application for Recognition Form: A Comprehensive Guide

Understanding the 1023- application for recognition

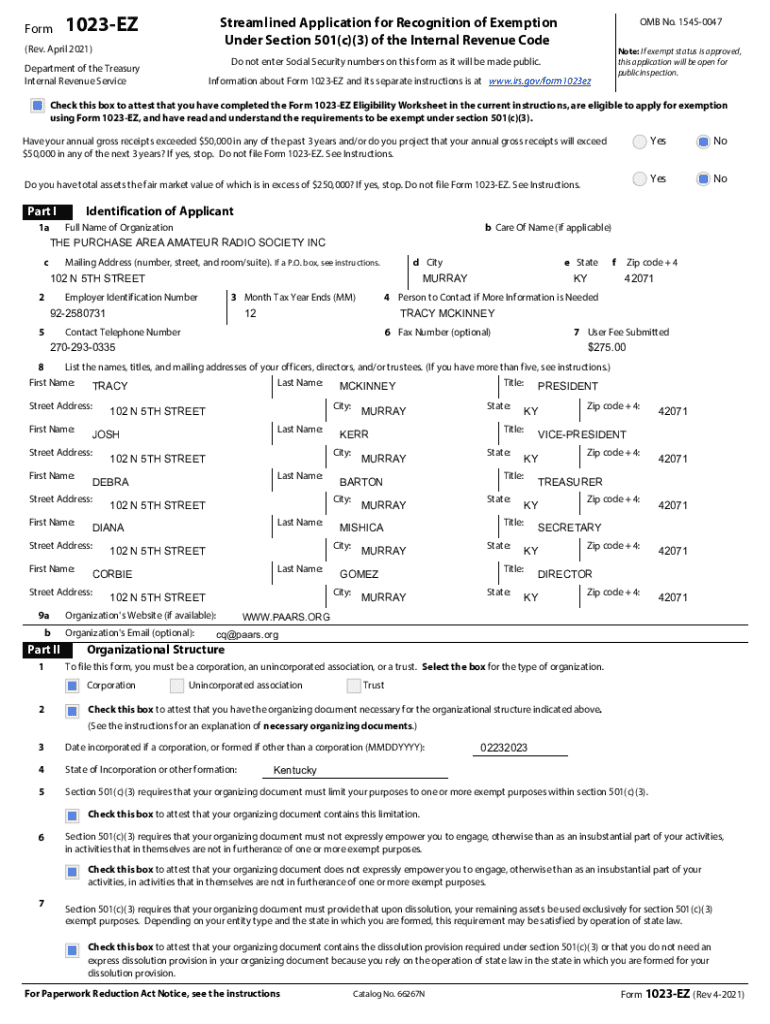

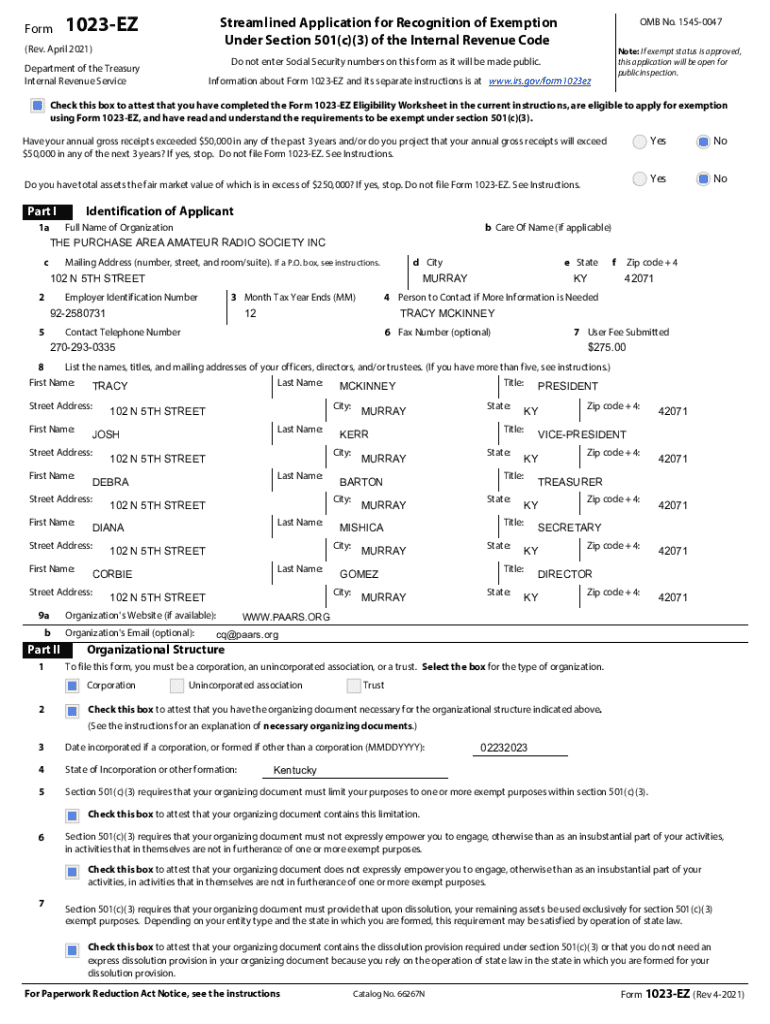

The Form 1023-i is a crucial document that organizations seeking 501(c)(3) status must complete. Designed specifically for smaller organizations with less than $250,000 in revenue and less than $1 million in assets, this streamlined application helps facilitate the recognition of tax-exempt status by the Internal Revenue Service (IRS). Securing 501(c)(3) status provides non-profit entities with significant advantages, including eligibility for grants, tax-deductible donations, and various state and local benefits.

Beyond operational advantages, recognition as a 501(c)(3) enhances credibility with donors, partners, and the public. It positions the organization as a legitimate entity, fostering trust and engagement in community initiatives. Awareness of these benefits is essential for nonprofits aiming to maximize their impact while navigating legal complexities.

Eligibility criteria for filing Form 1023-

Not every organization qualifies for 501(c)(3) status, and understanding eligibility criteria is vital. To apply using Form 1023-i, an organization must be a corporation, trust, or unincorporated association organized exclusively for charitable, scientific, educational, or religious purposes. Importantly, the organization must demonstrate its commitment to these purposes through its structure and activities.

Common ineligibility factors include focusing primarily on political lobbying rather than charitable purposes, having excessive private benefit, or being formed mainly for the support of a profit-oriented entity. Understanding these limitations can save organizations time and resources during the application process.

Key components of the 1023- application

Completing the Form 1023-i requires detailed information regarding various organizational aspects. Applicants need to present a clear organizational structure, which includes bylaws, articles of incorporation, and a list of board members. Financial information, such as projected budgets, must also be well-documented, showcasing revenue sources and expenditures.

Providing accurate and complete information is essential, as discrepancies may result in delayed processing or rejection of the application.

Step-by-step guide to completing Form 1023-

Before diving into the application, setting up a workspace equipped with the necessary resources can streamline the process. Utilize tools like pdfFiller to simplify document preparation and collaborative efforts. Gather essential documents, including by-laws, financial statements, and a narrative description of your organization's intended activities.

When filling out the application, follow these detailed instructions for each section:

Be vigilant about common mistakes, such as leaving out necessary documentation or misinterpreting IRS questions, which could lead to delays.

Submitting your 1023- application

Once the Form 1023-i is completed, the next step is submission. The review and approval process can vary in duration based on the volume of applications the IRS is handling. Electronic submission is highly recommended, and using tools like pdfFiller ensures a smooth process by minimizing errors.

After submission, you will receive confirmation of receipt from the IRS. It's essential to understand what to expect, which typically includes waiting for a few weeks for the IRS to review your application. Depending on their findings, you may be contacted for additional information or clarification of your submitted data.

Post-submission: next steps and compliance

Understanding the IRS's review timing for your 1023-i application can help alleviate stress during the waiting period. Generally, the IRS may take 3 to 6 months for review, and proactive communication is encouraged. If the IRS needs clarification on any aspect of your application, they will reach out directly.

Being prepared for potential follow-up requests ensures that your organization can respond promptly and accurately. Keeping all submitted documents organized and accessible is crucial for efficient communication with the IRS.

Managing your 501()(3) status

Once recognized as a 501(c)(3) organization, annual compliance becomes essential for maintaining your status. This typically involves filing Form 990, which details your organization’s revenue, expenses, and operations. Noncompliance may lead to a loss of tax-exempt status.

Adhering to best practices creates a solid foundation for your organization’s longevity and credibility.

Interactive tools for document preparation

Utilizing interactive forms through pdfFiller enhances the ease of document preparation. The platform offers templates specifically designed for the 1023-i application, making it user-friendly for first-time applicants.

Collaboration features allow for multiple team members to contribute simultaneously, streamlining the completion process. To make document management efficient, leverage features such as e-signing, which can facilitate signing by board members remotely.

Frequently asked questions (FAQs)

Several common queries arise around the 1023-i application process. Applicants often wonder about the timeline for IRS processing, the necessity of consulting legal experts, and the consequences of missteps during the application.

Addressing these queries pro-actively fosters a clearer understanding of the process, allowing smoother navigation.

Additional support and resources

Organizations seeking help in navigating the application process can find a wealth of resources. Legal assistance is advisable, especially for complex applications. Many local nonprofit support organizations provide workshops, resources, and guidance tailored specifically for emerging nonprofits.

Accessing reliable resources can significantly enhance an organization's understanding and efficiency in completing the Form 1023-i.

Engaging with the nonprofit community

Building connections within the nonprofit community is invaluable for resources and support. Participating in local nonprofit associations, attending conferences, and engaging in volunteer opportunities can expand your organization's network, fostering potential partnerships.

Furthermore, many organizations offer continuing education focused on nonprofit management, additional funds, and development, which enhances the ability to navigate the complexities of running a tax-exempt organization successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 1023-i application for recognition in Chrome?

How do I fill out the 1023-i application for recognition form on my smartphone?

How do I edit 1023-i application for recognition on an iOS device?

What is 1023-i application for recognition?

Who is required to file 1023-i application for recognition?

How to fill out 1023-i application for recognition?

What is the purpose of 1023-i application for recognition?

What information must be reported on 1023-i application for recognition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.