Get the free Collector of Revenue Town of Manchester

Get, Create, Make and Sign collector of revenue town

Editing collector of revenue town online

Uncompromising security for your PDF editing and eSignature needs

How to fill out collector of revenue town

How to fill out collector of revenue town

Who needs collector of revenue town?

Understanding the Collector of Revenue Town Form

Understanding the Collector of Revenue Town Form

The Collector of Revenue Town Form is a critical document for local governments, serving as a tool for recording property tax information and ensuring municipal services are funded properly. This form is essential in the collection of taxes that support various programs, maintenance, and infrastructure within the community. By providing accurate information, residents contribute to the financial health of their town, enabling local authorities to allocate resources effectively.

Accurate revenue collection not only affects the functioning of public services but also the broader economic stability of the area. It ensures that roads are maintained, schools are funded, and emergency services are operational. Without this critical input, local governments would struggle to meet the needs of their citizens.

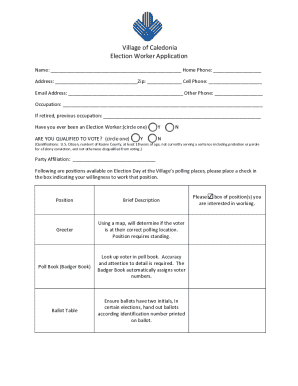

Key components of the Collector of Revenue Town Form

The Collector of Revenue Town Form includes several key sections and fields that need to be filled out accurately. Common sections include taxpayer identification information, property details, and a breakdown of assessed values. It's crucial that each part is filled out thoroughly to avoid delays or complications in processing the form.

Common mistakes to avoid include errors in the taxpayer's identification information and omissions of property assessments. Such mistakes can lead to penalties or delays in processing, so double-check all entries before submission.

How to access the form

There are multiple ways to access the Collector of Revenue Town Form. Many municipalities provide the option to download the form from their official website, typically in PDF format. For those who prefer physical copies, the form is usually available at the Collector of Revenue's office, local government offices, or public libraries.

When selecting the correct version of the form, ensure you are looking for the latest version, as municipalities may update their forms periodically to reflect new laws or changes in tax policy.

Step-by-step guide to filling out the form

Step 1: Gather Necessary Information

Begin by gathering all necessary information to facilitate a smooth filling process. You will need documents such as prior tax forms, property deeds, and identity verification materials. Having these ready will minimize the chances of errors and streamline the completion of the form.

Step 2: Filling Out Personal Information

Carefully complete the taxpayer information section. It's essential to input the correct full name, mailing address, and phone number. Failing to provide accurate personal details can lead to misdirected notices or issues with tax records.

Step 3: Documenting Property and Revenue Details

In this phase, you will elaborate on the property information, including lot number, property type, and detailed revenue assessments. Each line item should be reviewed to ensure accuracy, with special attention paid to the assessed values for any exemptions that may apply.

Step 4: Final Review

Before submission, perform a thorough review of the completed form. A checklist can be helpful to ensure all boxes are filled, all numbers are correct, and no required information is overlooked. This final step is critical in maintaining the integrity of your submission.

Editing and managing your form

Once you have filled out the Collector of Revenue Town Form, editing capabilities are essential. Platforms like pdfFiller provide advanced editing tools that allow users to modify text, add comments, and adjust layout easily. This makes it simple to revise entries without starting from scratch.

When making changes, it’s beneficial to save different versions of your document. This allows you to keep track of modifications and provides transparency in case of disputes or audits. Version control will help maintain an organized filing system.

Signing the Collector of Revenue Town Form

Legal validity of the Collector of Revenue Town Form is determined in part by the signatures it contains. It's important to sign the document before submitting it, as unsigned forms may be deemed incomplete. Depending on your municipality, you may also have the option to use electronic signatures through services like pdfFiller.

To ensure proper signing, follow specific guidelines set forth by the local government. Typically, you will need to ensure that the signature matches the name printed on the form, and the date of signing is also accurate.

Submission process

Submitting the Collector of Revenue Town Form can usually be completed online or in person. Online submissions often require you to upload the completed form to the local government's portal, while offline submissions necessitate delivering it to the Collector of Revenue's office directly.

Be mindful of submission deadlines, which can vary by municipality and specific circumstances. Setting reminders well ahead of the due date can help ensure timely submissions and avoid penalties.

Frequently asked questions (FAQs)

When dealing with the Collector of Revenue Town Form, taxpayers often have common concerns. Many questions relate to who to contact for assistance or how to follow up on the submission status of their form. Local government websites frequently have comprehensive FAQs sections or designated contact points for inquiries.

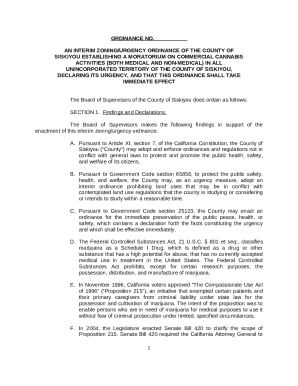

Legal and policy considerations

It's crucial to be familiar with local government policies regarding revenue collection. Each municipality has unique regulations that influence how the Collector of Revenue Town Form is constructed as well as its associated deadlines. Compliance with these regulations ensures that taxpayers fulfill their obligations without incurring penalties.

Failing to submit the form correctly can lead to significant consequences, such as fines or legal issues. In extreme cases, repeated failures could result in property tax liens or lawsuits, which can have lasting adverse effects on property ownership.

Contact information

For those needing support with the Collector of Revenue Town Form, reaching out to the appropriate local authority is essential. Typically, contact information is listed on the town or county’s official website. You can connect via phone or email during business hours or visit in person for more personalized assistance.

Additional tools and resources

Utilizing pdfFiller's interactive tools can significantly ease the process of completing the Collector of Revenue Town Form. These tools allow for easy editing, commenting, and collaboration among team members or family members who may also have input on the form.

Additionally, links to related documents, such as properties or exemptions listed, can provide taxpayers with a comprehensive understanding of their obligations, making the tax filing process smoother.

Understanding your tax contribution

Your tax contributions via the Collector of Revenue Town Form play a significant role in determining the level and quality of services provided in your community. From funding education to maintaining public parks, these contributions shape the lived experiences of every resident.

Many municipalities use tax contributions transparently, often providing breakdowns or reports that outline how funds are utilized. Understanding where your tax dollars go can foster a sense of community accountability and encourage proactive engagement in local governance.

Staying informed

Staying updated on local government changes, including tax sales or policy adjustments, is crucial for taxpayers. Many municipalities distribute newsletters or bulletins that provide valuable information regarding any changes in the tax code or upcoming deadlines.

Subscribing to these updates or signing up for alerts can ensure you remain informed and prepared for any changes that might affect your tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit collector of revenue town from Google Drive?

Where do I find collector of revenue town?

Can I create an electronic signature for the collector of revenue town in Chrome?

What is collector of revenue town?

Who is required to file collector of revenue town?

How to fill out collector of revenue town?

What is the purpose of collector of revenue town?

What information must be reported on collector of revenue town?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.