Get the free State Of Maine Independent Contractor Application - Fill ...

Get, Create, Make and Sign state of maine independent

How to edit state of maine independent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of maine independent

How to fill out state of maine independent

Who needs state of maine independent?

State of Maine Independent Form: A Comprehensive Guide

Overview of the Independent Form in Maine

The State of Maine Independent Form is a vital document designed for independent contractors and freelancers operating within the state. It serves to clarify the relationship between the contractor and the hiring entity, ensuring that all parties understand their obligations regarding taxes and liabilities. The form is essential for maintaining compliance with state regulations and avoiding potential misunderstandings or disputes. Properly completing and filing this form is crucial not only for legal clarity but also for securing benefits that may be associated with independent work.

Filing the correct independent form streamlines the tax process for individuals and allows for accurate reporting of income. As the gig economy flourishes, understanding this form becomes even more critical. The process typically involves gathering financial information, entering personal data, and understanding the implications of independent work in Maine.

Eligibility criteria

The State of Maine Independent Form is specifically tailored for individuals who operate as independent contractors or freelancers. These roles include, but are not limited to, graphic designers, consultants, writers, and various tradespeople. If you fall into any of these categories, it is essential to fill out this form to properly categorize your work status and align with state guidelines.

Key requirements and considerations for filling out the independent form include having realistic income expectations based on your contracts. You must also understand the tax implications associated with your earnings. Independent contractors often face different withholding arrangements compared to traditional employees, making proactive management of your finances and taxes crucial.

Key components of the State of Maine Independent Form

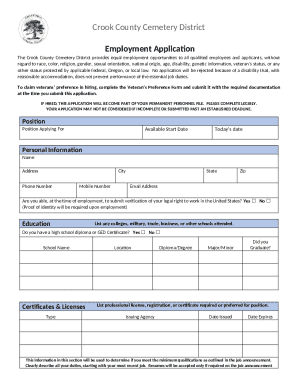

Understanding the main components of the State of Maine Independent Form is essential for accurate completion. This form consists of several sections that gather vital information about your business practices and personal details. Each section serves a specific purpose, making it important to fill them out carefully.

The primary components include personal identification information, which covers your name, address, and Social Security number. Next, the business details section captures information about your services and clientele, while financial information outlines your expected income and expenses. Lastly, signatures and dates are needed to validate your submission, confirming that all provided information is correct.

Step-by-step instructions for completing the form

Completing the State of Maine Independent Form can seem daunting, but by breaking it down into manageable steps, you can ensure accuracy and compliance. The first step involves gathering all necessary documents, including past tax returns, contracts with clients, and any financial statements that could help clarify your income and expenses.

Next, work through each section of the form meticulously. Pay special attention to details, as errors can lead to complications later. Once you have completed the form, take the time to review and edit your entries—double-checking for accuracy reduces the likelihood of mistakes. Finally, you can choose to submit your form electronically or via traditional paper methods.

Filing and submission process

Once the State of Maine Independent Form is completed, the next step is to file it accordingly. You have several options when it comes to submission. For a more streamlined process, the state portal allows for online submission; this method is secure and often faster.

If you prefer traditional methods, mailing the completed form is also an option. Be sure to follow the guidelines provided in the filing instructions to ensure your form reaches the correct department. Additionally, it's crucial to be aware of specific deadlines to avoid any penalties or issues, especially around tax season.

Common mistakes to avoid

Filing the State of Maine Independent Form can be straightforward, but several common pitfalls can lead to complications. One major mistake is neglecting to review the form thoroughly after completion, which can result in false submissions or missing information. Additionally, failing to report income accurately can lead to tax issues later on.

Another frequent error is misunderstanding the nature of your work classification, which can affect your tax obligations. Much can hinge on the details provided in the independent form, making it all the more important to invest time in ensuring compliance with state regulations and requirements.

Tracking your submission

To maintain peace of mind, learning how to track your submission of the State of Maine Independent Form is important. Many applicants find it helpful to keep records and confirmation of their submissions, especially when using online platforms to file. If you have submitted your form digitally, logging into the state portal often allows you to check the status of your application.

For those who opted for mailing their forms, retain a copy of any tracking information provided by the postal service. In case you have questions or need assistance, having the correct contact information for state departments can expedite the process.

Updating or amending your independent form

Circumstances may arise that require you to update or amend your State of Maine Independent Form. Examples include changes in your business conditions, alterations in income, or shifts in the nature of your work. It is advisable to keep your information current, as discrepancies can lead to legal complications or tax inconsistencies.

To make changes, you generally need to fill out a new form or follow the specified amendment procedures provided by the state. Always double-check the updated information for accuracy as even minor mistakes can have significant repercussions.

Frequently asked questions (FAQs)

Filling out the State of Maine Independent Form can raise several questions. Many individuals wonder about the resources available when they face challenges while completing the form. Assistance from professionals or online platforms exists, providing guidance throughout the self-filing process.

Another common question pertains to the tax implications following form submission. Understanding your responsibilities as an independent contractor is crucial for maintaining compliance. There are numerous resources for independent contractors in Maine, including websites, local organizations, and workshops designed to empower professionals in the gig economy.

Interactive tools for document management

pdfFiller offers a plethora of interactive tools designed to enhance your document management experience when handling the State of Maine Independent Form. With features that allow for easy editing of PDFs, adding electronic signatures, and facilitating collaborative reviews, pdfFiller helps streamline the form completion process.

Users can benefit from a user-friendly interface that guides them through each step, ensuring they efficiently manage their important documents. Whether working remotely or needing to coordinate with others, pdfFiller's tools empower independent contractors to focus on their work without worrying about document-related complications.

Related forms and resources

Independent contractors may find it useful to explore related forms that complement the State of Maine Independent Form. Various tax documents or compliance-related forms exist that can aid in the overall management of your independent work. Knowing which forms to use will streamline the process and keep your records organized.

Additionally, numerous state resources are available online, such as guides and FAQs specific to independent contractors in Maine. Websites dedicated to self-employment resources provide valuable information concerning legal obligations and rights.

Contact support and assistance

When navigating the State of Maine Independent Form and its related processes, having access to customer support can significantly ease the experience. pdfFiller provides robust support features, including live chat, email assistance, and phone support. These services guide users through any questions they may have concerning form completion or legality.

Whether you're facing issues with editing your document or need clarification on submission requirements, the support staff is well-equipped to assist. Utilizing these resources can save users time and ensure compliance with state regulations, protecting their interests as independent contractors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in state of maine independent?

How do I fill out the state of maine independent form on my smartphone?

How do I edit state of maine independent on an iOS device?

What is state of maine independent?

Who is required to file state of maine independent?

How to fill out state of maine independent?

What is the purpose of state of maine independent?

What information must be reported on state of maine independent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.