Get the free Simplified Underwriting: Group Multiple Benefits Insurance ...

Get, Create, Make and Sign simplified underwriting group multiple

How to edit simplified underwriting group multiple online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simplified underwriting group multiple

How to fill out simplified underwriting group multiple

Who needs simplified underwriting group multiple?

Simplified Underwriting Group Multiple Form: A Comprehensive Guide

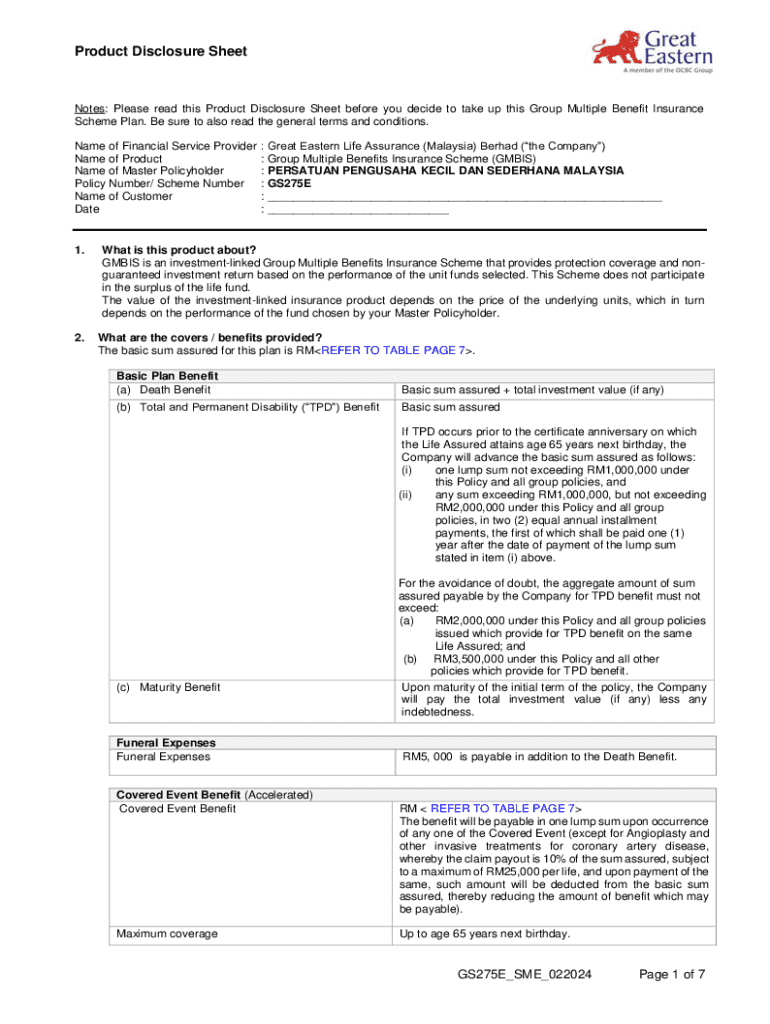

Understanding simplified underwriting

Simplified underwriting is a streamlined approach in the insurance process that allows for faster and less complex evaluations of applicants. This type of underwriting uses fewer medical questions and may not require formal medical examinations for certain prospects. This method significantly reduces the time and effort involved in gaining insurance coverage.

The importance of simplified underwriting in insurance cannot be overstated. It's particularly advantageous for individuals and groups who may find traditional underwriting burdensome or time-consuming. Simplified underwriting fosters inclusivity, enabling more people to access insurance products while minimizing delays in coverage.

Exploring the group multiple form

The group multiple form is a specific type of application used under simplified underwriting. This form allows multiple individuals to be covered under a single insurance policy, boasting the advantage of collective participation. It's commonly utilized by employers, associations, or groups seeking to provide insurance coverage to their members or employees.

The purpose of the group multiple form in simplified underwriting is to streamline the application process for groups. It consolidates the necessary information for all members into one document, promoting efficiency and facilitating quicker insurance underwriting. By using this form, organizations benefit from simplified administration and reduced costs associated with insuring multiple individuals.

The process of completing the group multiple form

Completing the group multiple form might seem daunting, but with a clear understanding of the process, it can be straightforward. Here’s a step-by-step breakdown of how to fill out this form effectively.

Common errors to avoid include providing incorrect personal information, missing signatures, and failing to include essential documents. Triple-checking all entries and consulting with team members can significantly enhance the accuracy of your submission.

To ensure your submission's accuracy, maintain a checklist of required documents and scrutinize the form before sending it off. Implementing a thorough review process can save time and unintended complications downstream.

Editing and managing your group multiple form using pdfFiller

pdfFiller offers intuitive editing tools that enhance the experience of managing your group multiple form. Its features are tailored to streamline the process from filling out to editing and collaborating.

Signing the group multiple form

Understanding eSignatures and their legal validity is crucial in today's digital age. An electronic signature is widely accepted in most jurisdictions as a valid form of signing documents, including insurance forms.

The step-by-step process for signing the group multiple form via pdfFiller is straightforward. Simply follow these steps:

Collaborating on the group multiple form

Collaboration is essential when filling out the group multiple form, especially if you are working as part of a team. pdfFiller facilitates this by allowing you to invite team members to review and edit.

Frequently asked questions about the group multiple form

As with any process, questions often arise regarding the group multiple form. Here are some common inquiries addressed:

Final submission and next steps

After completing your group multiple form, several submission methods are available to ensure that your documentation reaches the insurance provider.

After submission, keep track of your application status through the insurance provider's online portal or by contacting their customer service. This proactivity ensures that you remain informed about the progression and any potential follow-ups required.

Additional considerations in simplified underwriting

Common misconceptions about simplified underwriting include the belief that it provides less comprehensive coverage compared to traditional methods. In reality, many simplified underwriting policies offer robust features and benefits suitable for a variety of needs.

Addressing clients' concerns effectively involves educating them about the advantages and limitations of simplified underwriting. Transparency is key to building trust.

Looking forward, the future of underwriting in insurance may lean toward more advanced technologies such as AI and machine learning, resulting in even more refined processes that further simplify the application journey.

Empowering your document management

An efficient document creation solution is crucial for modern businesses. pdfFiller not only offers simple forms but also robust features tailored for comprehensive document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit simplified underwriting group multiple straight from my smartphone?

How do I fill out simplified underwriting group multiple using my mobile device?

How do I edit simplified underwriting group multiple on an iOS device?

What is simplified underwriting group multiple?

Who is required to file simplified underwriting group multiple?

How to fill out simplified underwriting group multiple?

What is the purpose of simplified underwriting group multiple?

What information must be reported on simplified underwriting group multiple?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.