Get the free Loan-Out-Personal-Service-Shell-Corporation-Application. ...

Get, Create, Make and Sign loan-out-personal-service-shell-corporation-application

Editing loan-out-personal-service-shell-corporation-application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan-out-personal-service-shell-corporation-application

How to fill out loan-out-personal-service-shell-corporation-application

Who needs loan-out-personal-service-shell-corporation-application?

Comprehensive guide to loan-out personal service shell corporation application form

Understanding loan out personal service corporations

A loan-out personal service corporation (PSC) is a specialized legal entity designed primarily for individuals who provide professional services and want to optimize their tax liabilities while protecting their personal assets. Unlike traditional corporations, which can engage in a variety of business activities, loan-out PSCs focus their operations on providing services, thus falling under unique regulatory and tax treatment.

One key reason professionals may choose to operate through a loan-out corporation is to manage their income and expenses effectively. This allows for potential tax savings, as corporations can often deduct business-related expenses that personal income cannot. It also enables individuals to limit their personal liability, providing a layer of protection that simple contracts may not offer.

The importance of the application form

The application form for a loan-out personal service corporation serves as a critical entry point for anyone looking to establish this type of entity. A well-completed application is essential, as it not only dictates the legal status of the corporation but also influences tax implications, operational capacity, and liability protections. Moreover, inaccuracies or omissions can delay approval and complicate your business dealings.

An efficiently prepared application underscores the applicant’s professionalism and attention to detail, which can further instill confidence in potential clients and partners. By ensuring clarity and accuracy, the applicant presents themselves positively to regulatory authorities, paving the path for smoother operations in the future.

Eligibility criteria and considerations

Before proceeding with the loan-out personal service corporation application, it's essential to evaluate eligibility requirements. Generally, individual contractors, freelancers, and small teams offering professional services, like consultants, artists, or writers, are well-suited for forming a loan-out corporation.

Candidates must demonstrate that they are earning income through contracted services, which is the cornerstone for qualifying for a loan-out structure. Teams considering this path should ensure that each member can contribute substantial personal services, as shared corporations may attract additional scrutiny from tax authorities.

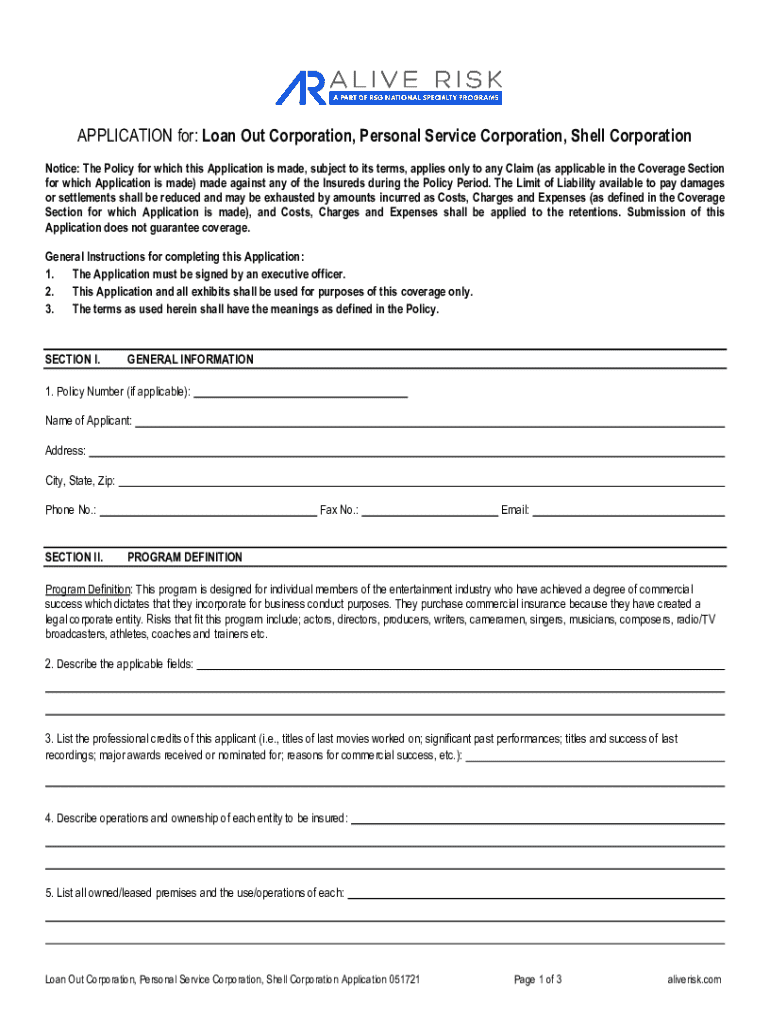

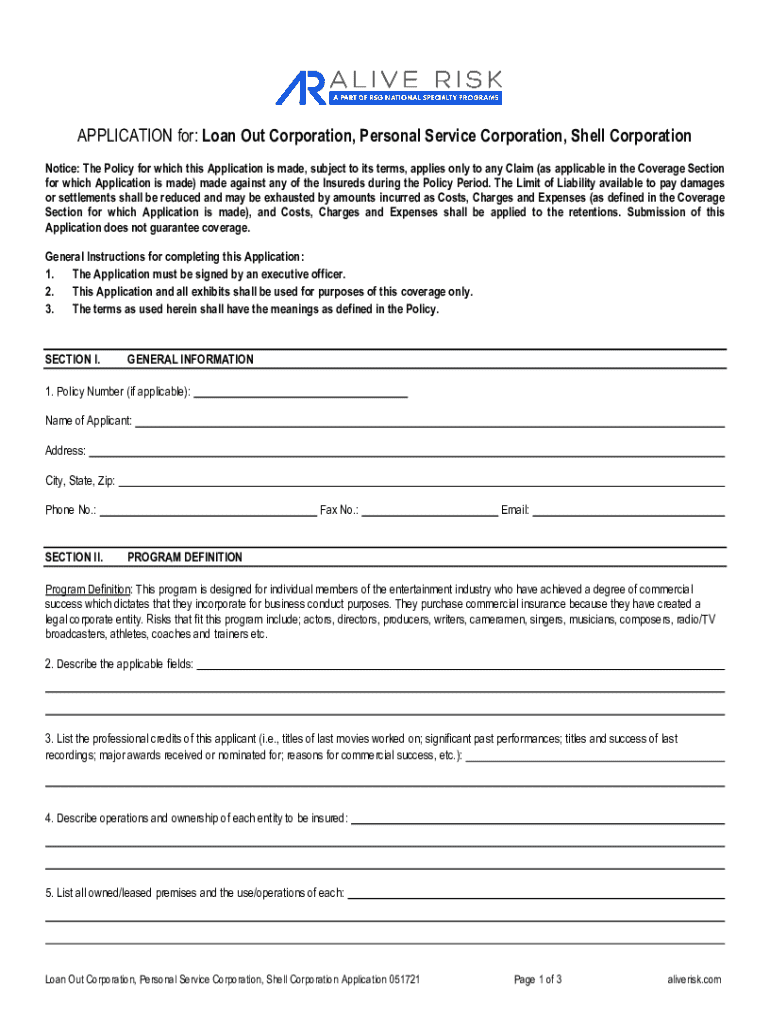

Components of the application form

The application form for a loan-out personal service corporation consists of several critical sections, each of which requires careful attention. Key components include the applicant's information, detailing the nature of services to be provided, financial information regarding service fees, and compliance with relevant documentation requirements.

Navigating these components can be daunting, but focusing on precision is vital. Common pitfalls often include misreporting service fees, failing to substantiate provided services, or neglecting to include necessary compliance documents. Minimizing these errors will increase the likelihood of a smooth approval process.

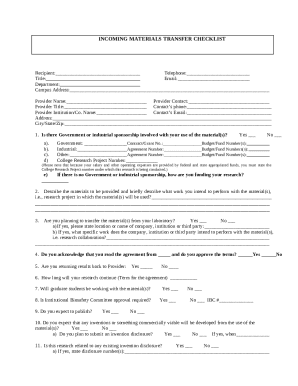

Preparing supporting documentation

Compiling supporting documentation is a critical step in the loan-out personal service corporation application process. Required documents typically include proof of income, contracts for services rendered, tax identification numbers, and any necessary licenses or certifications depending on the industry. Failing to provide these can lead to delays or a rejected application.

Best practices for gathering these documents involve organizing materials systematically and ensuring everything is up-to-date. For instance, maintain clear and concise invoices and contracts, as they validate your income and service provision. Additionally, consider utilizing document management tools to keep everything accessible and easily retrievable.

Step-by-step guide to completing the application form

Completing the loan-out personal service corporation application form requires attention to detail and a methodical approach. Begin by gathering all necessary information, including personal details, business plans, and financial documentation. Each section of the form is crucial and must be completed accurately.

Follow this step-by-step process for effective completion: gather your information, fill out each section diligently, check for any errors, and finalize your submission. Utilizing tools like pdfFiller can significantly streamline this process, providing functionalities for easy editing and completion.

Submission process

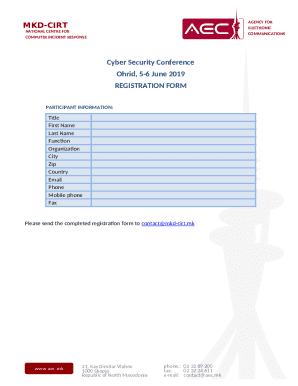

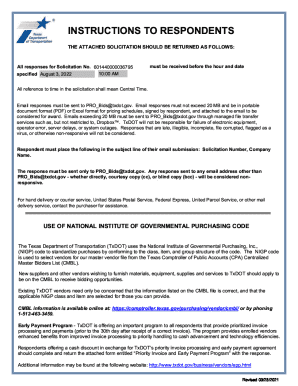

Once the application form is meticulously completed, the next step is submitting it. Applications can often be submitted online or offline, depending on the requirements of your jurisdiction. It's crucial to follow the specified guidelines to ensure that your application is accepted without delays.

After submission, keep a close eye on your application's status. Depending on the processing time indicated, you may need to follow up for updates. Online submissions sometimes provide tracking options, yielding peace of mind during the application process.

Common issues and how to resolve them

As with any application process, applicants may encounter various issues. Frequently asked questions often stem from confusion over documentation requirements, processing times, and response times. Knowing how to address these common issues in advance can save applicants from unnecessary stress.

If issues arise during submission, complications often relate to form accuracy or missing information. In most cases, promptly contacting support through provided channels will facilitate quick resolutions and clear guidance.

Post-application steps

Upon submitting the application, candidates should be prepared for various outcomes. Understanding the approval and rejection processes is fundamental. Generally, applicants can expect to receive notification of their status within a specified timeframe, which may vary depending on the approval authority.

In the case of approval, you may need to complete additional forms or finalize local registrations. Conversely, if rejected, it's crucial to scrutinize the feedback for reasons, allowing for effective corrections before reapplying.

Best practices for managing your loan out corporation

Successfully managing a loan-out personal service corporation extends beyond the initial application process. Ongoing compliance and record-keeping are critical to avoid legal complications. This involves timely tax filings, transparent financial reporting, and meticulous management of all business-related documents.

Utilizing tools like pdfFiller can significantly aid in the organization and consistency of document management. Secure storage options ensure documents are accessible yet protected, while collaboration features allow for smooth team interactions across various locations.

Real-world examples and case studies

Exploring real-world examples of loan-out personal service corporations can provide valuable insights and inspiration. Many successful professionals, from artists to consultants, have transformed their businesses using this corporate structure. These success stories often highlight how effective organization, thorough compliance, and strategic planning contribute to their operational success.

Learning from their experiences can guide new applicants in understanding not just the application process, but also best practices for growth and management of their loan-out corporations, ensuring sustainable success.

Regulatory landscape and compliance guidelines

Remaining informed about the regulatory landscape governing loan-out personal service corporations is crucial. Various laws and regulations dictate operational conduct, tax obligations, and compliance standards. Regularly accessing resources, such as industry specific publications and government guidelines, will ensure you remain compliant while navigating your corporate landscape.

Utilizing advisory services or legal consultations can further bolster your understanding of compliance implications. Investing time in education regarding the relevant laws protects not only your interests but facilitates smoother operational practices.

Exploring the benefits of pdfFiller for your application process

During the loan-out personal service corporation application process, utilizing a tool like pdfFiller can enhance efficiency significantly. Its comprehensive document management solutions allow users to create, edit, and manage documents from anywhere, making it particularly suited for professionals and teams. The cloud-based platform offers seamless editing and eSigning, which is essential for meeting submission deadlines.

Additionally, the collaboration features within pdfFiller enable teams to work together effortlessly, even across different locations. This integration enhances productivity while ensuring that all documentation is accurate and compliant, ultimately streamlining the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan-out-personal-service-shell-corporation-application directly from Gmail?

How do I make edits in loan-out-personal-service-shell-corporation-application without leaving Chrome?

Can I create an eSignature for the loan-out-personal-service-shell-corporation-application in Gmail?

What is loan-out-personal-service-shell-corporation-application?

Who is required to file loan-out-personal-service-shell-corporation-application?

How to fill out loan-out-personal-service-shell-corporation-application?

What is the purpose of loan-out-personal-service-shell-corporation-application?

What information must be reported on loan-out-personal-service-shell-corporation-application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.