Get the free Ecommerce in Maryland City, MD (Report by Nitin Sharma)

Get, Create, Make and Sign ecommerce in maryland city

How to edit ecommerce in maryland city online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ecommerce in maryland city

How to fill out ecommerce in maryland city

Who needs ecommerce in maryland city?

Ecommerce in Maryland City Form: A Comprehensive Guide to Starting Your Online Business

Understanding ecommerce in Maryland

Ecommerce has experienced remarkable growth in Maryland, with the state’s strong technological infrastructure, diverse economy, and access to major markets facilitating this trend. The rise of online shopping is not just a passing phase; it’s a fundamental shift in how consumers interact with businesses. From local artisans selling handmade goods to large retailers expanding their reach, Maryland's ecommerce landscape is vibrant and competitive.

Choosing the right business structure is crucial for any ecommerce enterprise. This decision influences not only your legal liability but also your tax obligations and management strategies. Understanding the implications of different structures available in Maryland, such as LLCs and corporations, can greatly affect your business' future.

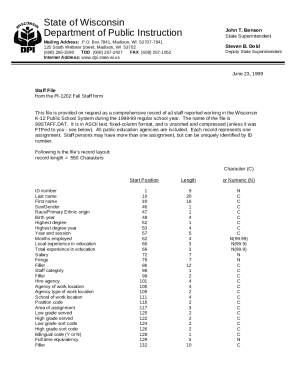

Steps to register your ecommerce business in Maryland

Starting an ecommerce business involves several key steps, beginning with the choice of business structure.

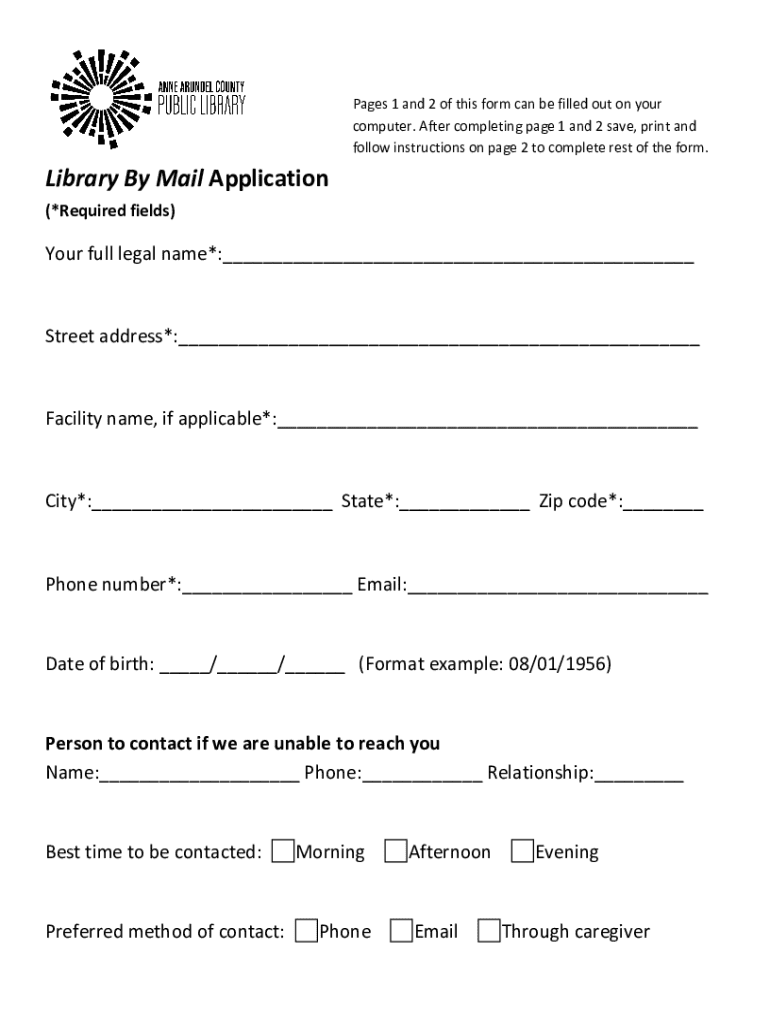

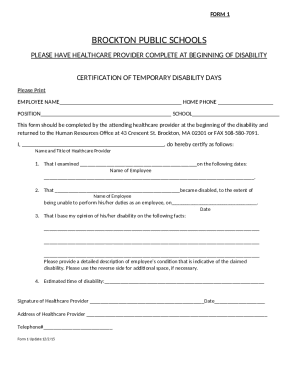

Licensing requirements for ecommerce in Maryland

A crucial aspect of operating an ecommerce business in Maryland is acquiring the necessary licenses. An Ecommerce Business License is fundamental for legal operation, enabling you to engage in commerce within the state.

It’s vital to understand the differences between a standard business license and a seller's permit. A seller's permit may be required if you intend to collect sales tax. To avoid pitfalls, follow these steps when applying for your business license.

Understanding sales tax in Maryland

Maryland has specific sales tax regulations that apply to ecommerce businesses. Understanding these can prevent unintentional compliance issues. Maryland requires ecommerce businesses to collect sales tax if they meet certain sales thresholds, specifically if the sales exceed $100,000 or 200 transactions in the previous calendar year.

Once you determine your requirement to collect sales tax, you need to register for a Maryland Sales Tax Permit, which is a straightforward process. Following the necessary steps to apply will save you time and ensure compliance.

Setting up your ecommerce website

An effective ecommerce website is foundational to your business success. Choosing the right ecommerce platform is critical. Platforms like Shopify, WooCommerce, and BigCommerce cater to different business needs, each offering unique advantages and considerations.

Your website's design and functionality must enhance the user experience. Incorporating best practices helps ensure that your site is not only visually appealing but also easy to navigate and secure.

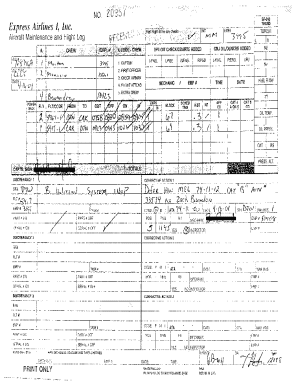

Operational considerations for ecommerce businesses

Operational efficiency is vital for ecommerce success. A well-defined shipping and fulfillment strategy not only enhances customer satisfaction but can also minimize operational costs.

Additionally, understanding consumer protection laws in Maryland is essential. Compliance with regulations ensures that you build trust with your customers while also protecting your interests.

Marketing your ecommerce business

Digital marketing plays a pivotal role in driving traffic to your ecommerce site. Implementing effective SEO strategies helps increase your visibility in search engines, a crucial factor for attracting new customers.

Utilizing social media platforms for promotion is equally important. Building a recognizable brand presence assists you in cementing a connection with your target audience.

Managing finances and taxes for ecommerce

Effective financial management is crucial for sustainability in ecommerce. Implementing robust accounting practices helps in navigating the complexities of tracking income and expenses.

Understanding your tax obligations is equally vital. Navigating both federal and state tax requirements is essential to avoid rising fines or audits and ensure smooth operations.

Tools and resources for successful ecommerce management

Utilizing interactive tools can significantly improve efficiency in managing your ecommerce operations. pdfFiller offers solutions for document management, allowing you to edit and collaborate directly within the platform.

Additionally, engaging with local support organizations and networking groups can provide invaluable resources and assistance as you navigate the complexities of setting up and running your ecommerce business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ecommerce in maryland city directly from Gmail?

How do I edit ecommerce in maryland city online?

How do I make edits in ecommerce in maryland city without leaving Chrome?

What is ecommerce in maryland city?

Who is required to file ecommerce in maryland city?

How to fill out ecommerce in maryland city?

What is the purpose of ecommerce in maryland city?

What information must be reported on ecommerce in maryland city?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.