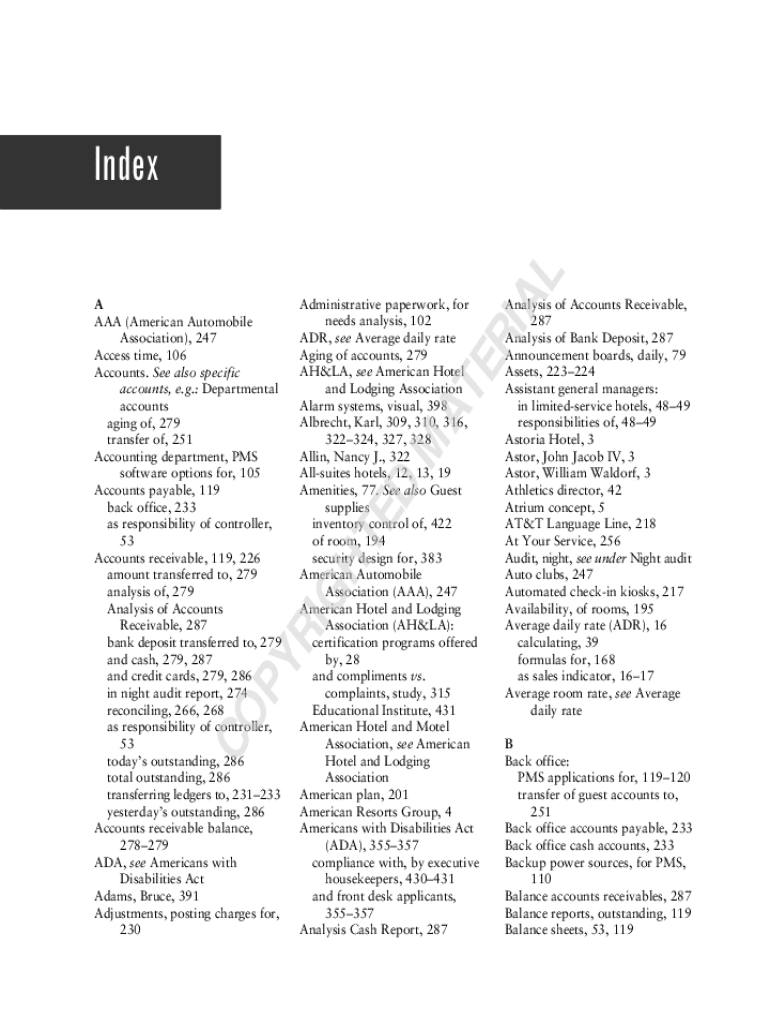

Get the free Analysis of Accounts Receivable,

Get, Create, Make and Sign analysis of accounts receivable

How to edit analysis of accounts receivable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out analysis of accounts receivable

How to fill out analysis of accounts receivable

Who needs analysis of accounts receivable?

Analysis of Accounts Receivable Form: A Comprehensive Guide

Understanding accounts receivable

Accounts receivable (AR) represents funds owed to a company by its customers for goods or services delivered but not yet paid for. This forms a crucial part of a business's balance sheet and cash flow management. Essentially, it is credit extended to customers, and often reflects a company's sales success and revenue generation capabilities.

The role of accounts receivable in business finance cannot be overstated; it directly affects liquidity and operational efficiency. For companies, an efficient AR process leads to improved cash flow and allows for reinvestment in business operations. Therefore, managing it accurately is vital for sustaining financial health and achieving long-term growth.

The accounts receivable analysis form: An overview

The accounts receivable analysis form serves the important purpose of systematically recording and analyzing outstanding invoices. By standardizing data collection, this form helps businesses track which invoices remain unpaid, monitor payment terms, and evaluate customer payment behaviors.

Key elements included in this form typically involve customer identification details, invoice specifics such as date and amount, and specified payment terms. These components not only facilitate tracking overdue payments but also assist in prioritizing collection efforts efficiently.

How to access and utilize the accounts receivable analysis form

Accessing the accounts receivable analysis form can be done seamlessly via pdfFiller, a cloud-based platform that allows users to fill out and manage forms conveniently from anywhere. Here’s a step-by-step guide on how to access and utilize the form effectively.

Interactive tools enhance the analysis process by allowing users to input data directly and make changes easily. Features such as digital signatures and eSign capabilities enable secure transactions, while collaboration features allow teams to work together seamlessly.

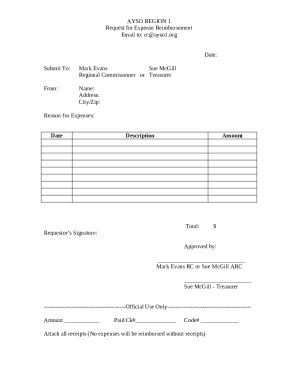

Filling out the accounts receivable analysis form

Filling out the accounts receivable analysis form accurately is crucial for effective analysis. Each section requires careful attention to detail, starting with customer information, where users must input client names, contact details, and account numbers.

Next, entering invoice details is essential for tracking what is owed. This includes listing invoice numbers, amounts due, and due dates. Finally, specifying payment terms such as net 30 or net 60 days helps clarify expectations with customers regarding payment timelines.

To avoid common errors, double-check data entered for typos and inconsistencies. Utilize built-in validation features in pdfFiller to minimize mistakes.

Analyzing accounts receivable data

Once the accounts receivable analysis form is filled out, it is essential to analyze the data effectively. Key metrics to focus on include Days Sales Outstanding (DSO), which indicates how long it takes to collect cash from credit sales. Additionally, an aging schedule provides insights into how long invoices remain unpaid, while the accounts receivable turnover ratio measures how efficiently a company collects receivables.

These metrics are not just numbers; they significantly influence business decisions. For example, a high DSO may indicate collection issues, prompting a company to investigate customer payment patterns and adjust credit policies.

Automating accounts receivable analysis

Automation is revolutionizing how businesses manage accounts receivable. pdfFiller facilitates this by streamlining data entry and reporting, which minimizes human error and saves valuable time. Automating routine tasks allows teams to focus on more strategic activities, such as cash flow forecasting and collection strategies.

Cloud document management also enhances collaboration, ensuring that all team members have access to the latest information from any device. This not only increases productivity but also provides a centralized repository for all accounts receivable documentation.

Best practices for effective accounts receivable analysis

Implementing best practices is key to maintaining effective accounts receivable analysis. Regularly reviewing AR status helps businesses identify trends and address issues proactively. Using technology, such as pdfFiller, for accurate forecasting and budgeting enhances decision-making capabilities.

To improve collection rates, businesses could set up systematic follow-up processes for overdue payments, ensuring consistent communication with customers. Offering incentives for early payments can also encourage prompt settlement of invoices.

Case studies and practical applications

Many businesses have reaped significant benefits from effective accounts receivable analysis. For instance, a small manufacturing firm that employed rigorous AR practices improved its cash flow by 25% within six months. By utilizing the accounts receivable analysis form, they pinpointed delinquent accounts and streamlined their collection processes.

Another case involves a service-based company that managed to reduce its DSO from 60 days to 30 days after embedding technology solutions for AR analysis. This shift not only enhanced cash flow but also allowed them to invest in growth opportunities.

Frequently asked questions about account receivable analysis forms

Common queries related to accounts receivable include what to do if payments are delayed and how to handle disputes over invoices. In the case of delayed payments, having a structured follow-up process based on insights from the AR analysis form is critical. It provides a pathway to contact clients professionally and resolve outstanding issues.

Handling invoice disputes effectively involves clear communication and providing documentation to substantiate claims. By utilizing the accounts receivable analysis form, businesses can present accurate records that facilitate resolution.

Integrating accounts receivable analysis with broader financial strategies

Integrating accounts receivable analysis with a company's broader financial strategies is essential for comprehensive cash management. By linking AR metrics with overall financial performance, businesses can gain deeper insights into cash flows and financial health.

Collaboration across departments is paramount. Involving sales, accounting, and customer service teams ensures a unified approach to managing receivables, reducing risks, and enhancing cash collection processes while also supporting strategic business goals.

Resources for further learning

For those looking to deepen their understanding of accounts receivable, various resources are available. Articles, industry studies, and online courses can provide insights into best practices and emerging trends in accounts receivable management.

Furthermore, pdfFiller offers additional tools and calculators tailored to assist businesses in analyzing accounts receivable data effectively. Utilizing these resources can enhance knowledge and drive improvements in financial operations.

Engage with the community

Connecting with other professionals in the world of accounts receivable can offer invaluable perspectives and insights. Join forums, attend workshops, or participate in webinars focusing on AR practices to share best practices and learn from industry experts.

Networking opportunities not only provide knowledge but also foster collaborative efforts that can lead to innovative solutions for common challenges in accounts receivable management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send analysis of accounts receivable to be eSigned by others?

How do I edit analysis of accounts receivable online?

How do I fill out analysis of accounts receivable using my mobile device?

What is analysis of accounts receivable?

Who is required to file analysis of accounts receivable?

How to fill out analysis of accounts receivable?

What is the purpose of analysis of accounts receivable?

What information must be reported on analysis of accounts receivable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.