Get the free Consumer Credit Application Form for Dealerships

Get, Create, Make and Sign consumer credit application form

How to edit consumer credit application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit application form

How to fill out consumer credit application form

Who needs consumer credit application form?

A Comprehensive Guide to the Consumer Credit Application Form

Understanding the consumer credit application form

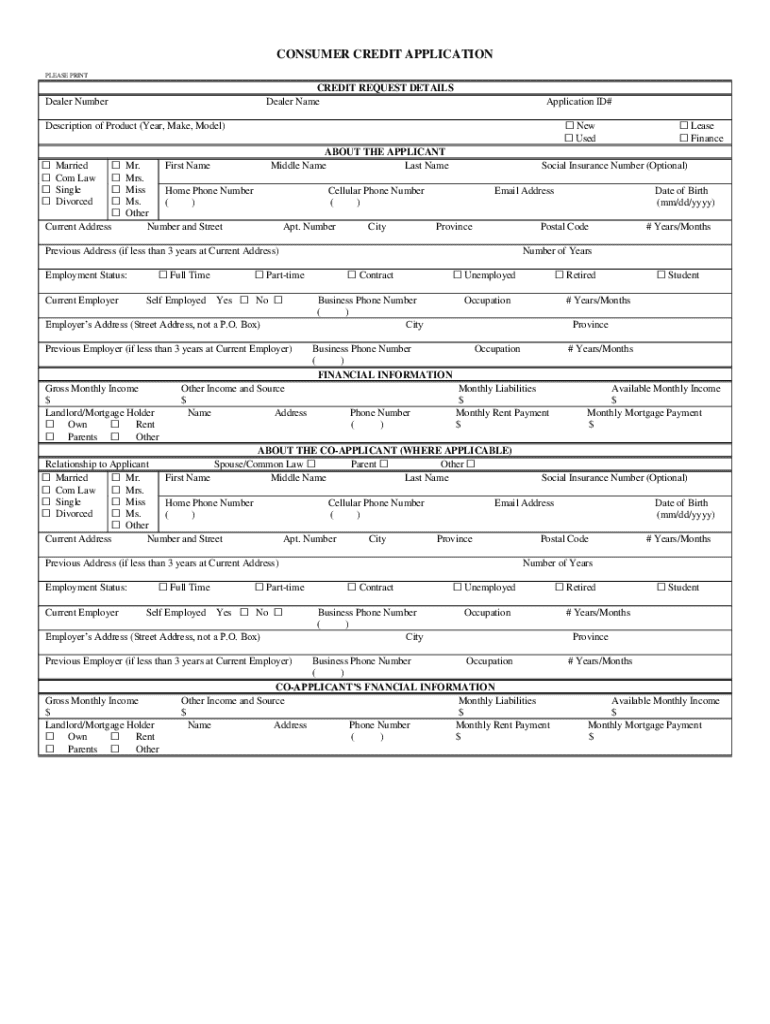

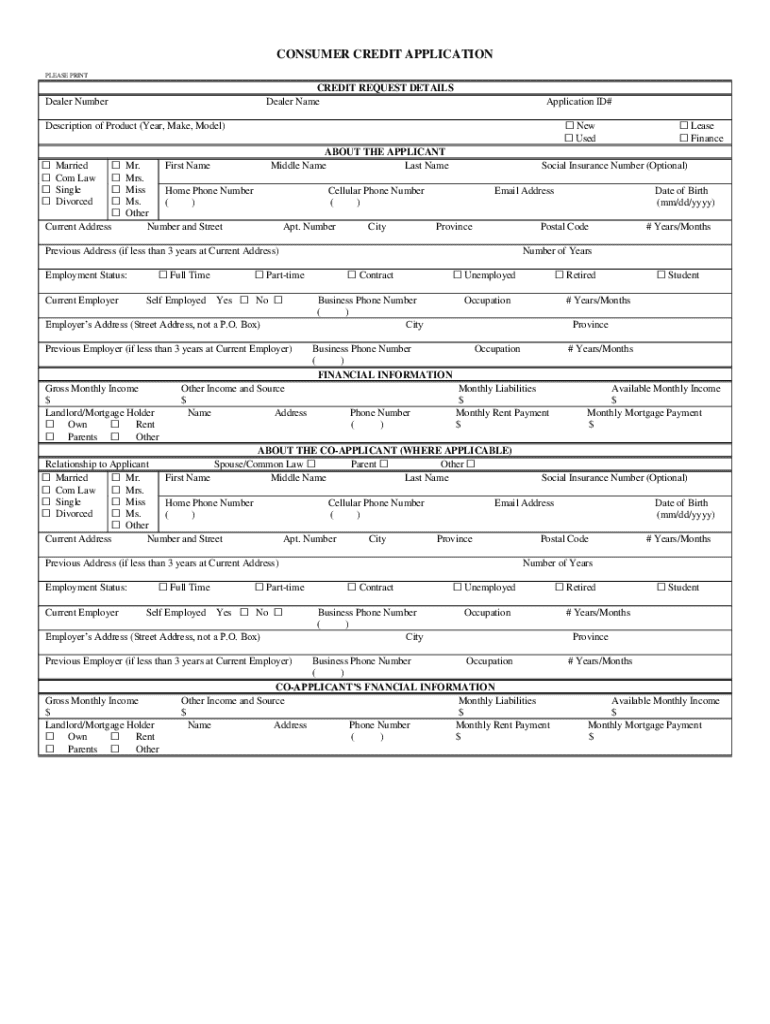

A consumer credit application form serves as a formal request submitted to financial institutions for credit approval. This essential document collects critical information from applicants, enabling lenders to assess their creditworthiness and financial stability. Whether you're seeking a personal loan, a credit card, or an auto loan, providing accurate information on your consumer credit application form can significantly impact your approval odds. Many individuals encounter situations necessitating this application, such as purchasing a new vehicle, consolidating existing debt, or making large purchases. With the increasing dependency on credit, comprehending how to fill out this form correctly is paramount.

The significance of accuracy in the application process cannot be overstated. Any discrepancies or omissions may raise red flags during the assessment, potentially leading to delays or even denial. It’s crucial to verify your information, ensuring that all details reflect your financial situation truthfully. Knowing when to submit a consumer credit application form can also save you from potential inconveniences, allowing you to prepare your finances beforehand.

Key components of the consumer credit application form

Understanding the key components of a consumer credit application form is essential for anyone looking to obtain credit. The form typically includes several core sections designed to capture detailed information about the applicant. These sections generally fall into three main categories: personal information, financial information, and consent/authorization.

The consumer credit application process

Completing a consumer credit application form doesn’t have to be daunting. With a step-by-step approach, you can navigate this process confidently. Begin by gathering all necessary documents that provide evidence of your income, such as pay stubs, tax returns, and bank statements. These documents will help fill out your financial information accurately.

When filling out each section, it is imperative to provide thorough and precise details. Take your time to ensure the data corresponds with the supporting documents you’ve gathered. If the application offers space for additional comments, don’t hesitate to clarify any points that may help the lender in understanding your financial situation.

Before submitting your application, review it meticulously for common mistakes like typos, incorrect amounts, or missed signatures. Such errors can lead to unnecessary processing delays or application denials.

Interactive tools for completing your form

Using tools designed for form completion can enhance your experience when filling out a consumer credit application form. One such tool is pdfFiller, which lets users seamlessly fill out PDF forms. With pdfFiller, you can upload your application form, fill it in with ease, and make edits as necessary.

Once your form is filled, pdfFiller provides options to sign digitally and save your application securely in the cloud. Utilizing the collaboration features allows teams to work together on submissions, ensuring all necessary sets of eyes are on the application before it is submitted, thus reducing the chance of errors and omissions.

Types of consumer credit applications

Consumer credit applications can vary significantly based on the applicant’s situation and needs. There are typically two main types of applications: individual applications and joint applications. An individual application is submitted by one person, whereas a joint application is submitted by two or more individuals, often couples seeking shared credit, such as for a mortgage or an auto loan.

Moreover, specific applications cater to different credit types, such as auto loans, personal loans, or credit cards. Each application may have unique requirements or sections, depending on the lender’s specifications. Familiarizing yourself with these differences is crucial for ensuring that you complete the correct forms in accordance with the lender's guidelines, which can differ by institution.

Additional resources and assistance

Navigating the consumer credit application process can be complex, but various resources are available to assist you. For individuals unsure about the process, accessing sample consumer credit application forms can help demystify the requirements. These samples illustrate how to structure and complete your application correctly.

Additionally, state-specific requirements may vary, and understanding these can prevent potential issues when submitting your application. It’s advisable to research your state’s specific forms and the information they require. Many lenders also offer assistance and guidance throughout the application process, and leveraging these sources can be beneficial.

FAQs about consumer credit applications

After submitting your consumer credit application form, you may have questions about the subsequent steps. One common inquiry revolves around approval timelines; the process can vary significantly from lender to lender. Typically, some lenders provide initial feedback within days, while others may take weeks, especially if additional documentation is required.

What happens if your application is rejected is another vital concern. It’s important to remember that a rejection does not mark the end of the road; you can request a reason for the denial, which can help you understand how to improve your situation for next time. In some cases, addressing the highlighted concerns and resubmitting your application might make you more favorable to the lender.

Managing your consumer credit application

Once your consumer credit application is submitted, it’s crucial to actively manage its status. Keep track of its progress, and don’t hesitate to contact the lender for inquiries if you haven’t received feedback within the expected timeframe. Being proactive can display your eagerness and responsibility, making a positive impression on the lender.

If your application is denied, it’s beneficial to consider appealing the decision. Some lenders might allow introductions of new evidence or clarification of your financial situation. Alternatively, you can revisit your application after addressing any concerns that may have contributed to the initial rejection. Improving your credit score and demonstrating sound financial practices may bolster your chances.

Best practices for ensuring application success

To enhance your chances of successfully obtaining credit, consider the following best practices prior to applying: First, improve your credit score as much as possible by paying off existing debts, making payments on time, and maintaining low credit utilization ratios. Each of these factors contributes to lenders' perceptions of your creditworthiness.

Moreover, prepare for potential interviews or follow-up queries. Lenders may want to clarify aspects of your application or solicit further documentation. Being ready for such interactions will demonstrate your preparedness and reliability. Finally, ensure you are working with reputable lenders who have transparent terms and positive consumer feedback, ensuring that your application is handled professionally.

Navigating legal considerations

When completing a consumer credit application form, it’s vital to understand your rights as a consumer. Regulations governing consumer credit applications vary by jurisdiction, but generally, they ensure that you have access to clear terms, fair practices, and the opportunity to understand your credit history. Being informed about these rights helps you advocate for yourself if you encounter any discrepancies.

If you suspect unfair practices during the application process, resources are available for reporting these incidents. Authorities such as the Consumer Financial Protection Bureau (CFPB) provide mechanisms for addressing grievances, which can protect you and others from predatory lending practices.

Testimonials and case studies

Real-life success stories can be powerful motivators for understanding the consumer credit application process. Many individuals have positively transformed their financial situations through well-completed applications, leading to approvals for favorable loans and credit cards. Analyzing trends from various lenders can also offer insights into what criteria are most valued, helping future applicants tailor their submissions effectively.

Feedback from lenders about common mistakes or areas where applicants excel can provide added guidance. Employing these insights allows prospective borrowers to increase their chances of success significantly.

Keeping your information secure

Data security is paramount when submitting a consumer credit application form. Personal and financial information must be safeguarded to prevent identity theft and fraud. Best practices for maintaining security include using secure internet connections and trusted platforms for online submissions.

Tools like pdfFiller further enhance your ability to keep sensitive information secure. With its built-in security features such as encryption and secure cloud storage options, users have peace of mind knowing that their data is protected while filling out, editing, and submitting their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get consumer credit application form?

Can I create an electronic signature for signing my consumer credit application form in Gmail?

How can I edit consumer credit application form on a smartphone?

What is consumer credit application form?

Who is required to file consumer credit application form?

How to fill out consumer credit application form?

What is the purpose of consumer credit application form?

What information must be reported on consumer credit application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.