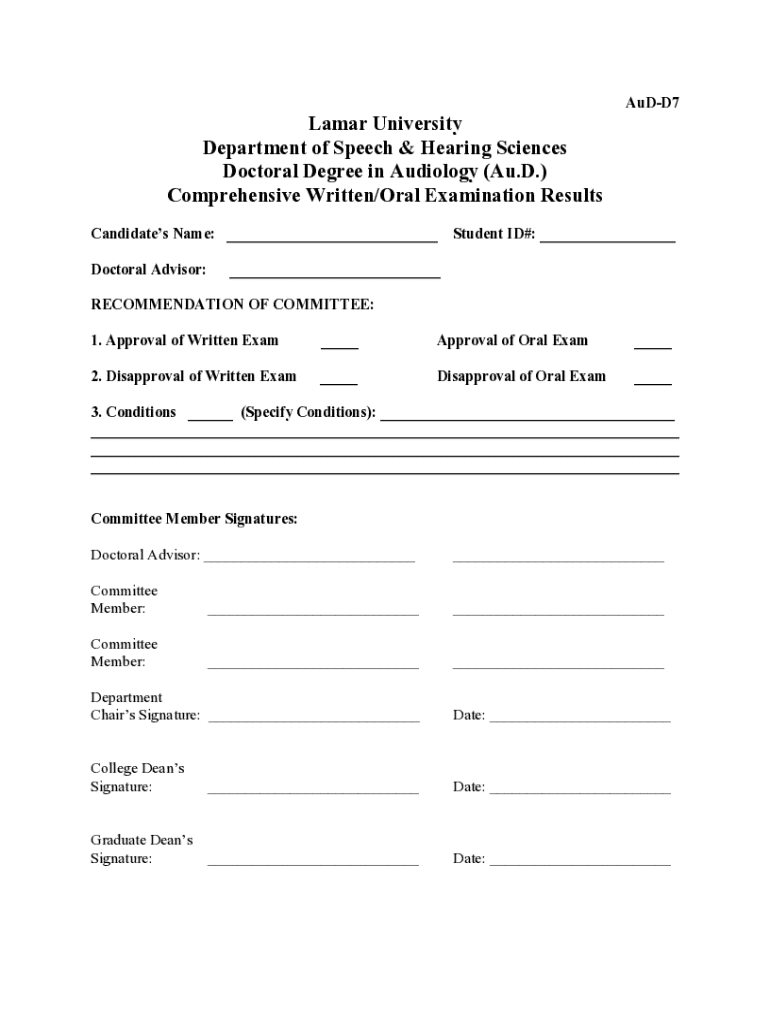

Get the free AuD-D7

Get, Create, Make and Sign aud-d7

Editing aud-d7 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aud-d7

How to fill out aud-d7

Who needs aud-d7?

aud-d7 Form How-to Guide

Understanding the aud-d7 Form

The aud-d7 form serves a critical function in specific administrative and financial processes, particularly within organizational contexts. Primarily, it is utilized for gathering information regarding financial and employment details required by various institutions or regulatory bodies. Understanding its importance is vital for organizations and individuals alike, ensuring compliance and efficient processing.

This form is particularly relevant for those applying for loans, grants, or any financial assistance, as it provides necessary insights into an applicant's financial situation. Completing the aud-d7 form accurately can make a significant difference in the approval process, highlighting the necessary data that decision-makers rely upon.

Preparing to Fill Out the aud-d7 Form

Preparation is critical for successfully filling out the aud-d7 form. Before you begin, gather all necessary documentation to provide accurate and complete information. This may include identification documents, bank statements, pay slips, and any previous tax returns that can substantiate the data you are reporting.

Many applicants fall into the trap of neglecting to double-check their entries, which can lead to submission errors. By being aware of common mistakes, you can enhance your accuracy and efficiency while completing the form. Incorrect information can lead to processing delays or outright rejections of applications.

Step-by-step instructions for filling out the aud-d7 Form

Filling out the aud-d7 form involves several key sections, each designed to capture crucial information. Below is a detailed step-by-step guide to navigate through each segment, ensuring you complete the form accurately and efficiently.

Section 1: Personal Information

Section 2: Employment Details

Section 3: Financial Information

Section 4: Review & Confirm

Editing and customizing the aud-d7 Form

Once the aud-d7 form has been filled out, you may find it necessary to make edits or customize it to suit your needs. pdfFiller offers various interactive tools to simplify this process, enabling users to adjust content effortlessly.

Editing with pdfFiller not only allows you to correct errors but also enables the addition of new sections or the removal of unnecessary content. These features enhance the usability of the form and facilitate future customizations.

Signing the aud-d7 Form

Signing the aud-d7 form is crucial for validating and finalizing your submission. Depending on your setup, you can sign the document electronically via pdfFiller, which streamlines the process, ensuring swift completion.

Creating and using an eSignature through pdfFiller is straightforward. You can also reuse your signature across different documents, enhancing efficiency and reducing the time spent on repetitive tasks.

Managing the aud-d7 Form after completion

After completing the aud-d7 form, managing it effectively is crucial for future reference and accessibility. pdfFiller provides numerous options for saving and exporting your completed forms.

Additionally, sharing your completed form securely is vital. You can utilize pdfFiller’s cloud features to store completed forms and retrieve them anytime from anywhere, ensuring you have access to your important documents whenever needed.

Troubleshooting common issues with the aud-d7 Form

Despite careful preparation and completion, users may encounter challenges with the aud-d7 form. Being acquainted with common issues and their solutions will facilitate a smoother experience.

For example, incomplete submissions or error messages can create roadblocks. Familiarizing yourself with these scenarios will empower you to address them quickly and contact customer support when necessary.

Best practices for using the aud-d7 Form

Following best practices enhances the overall experience of filling out and using the aud-d7 form. Maintaining data integrity is paramount and ensures that your submissions meet all requirements without errors.

It's also wise to keep meticulous records of any amendments made to forms, along with verification of compliance with relevant regulations. This will not only support your current submissions but will also be pivotal for any future processes.

Advanced features related to the aud-d7 Form in pdfFiller

pdfFiller goes beyond basic functionality, allowing users to take advantage of advanced features tailored to elevate the user experience when handling the aud-d7 form. Automation tools can streamline the gathering and processing of information, making life much easier.

Furthermore, integrations with eSignature solutions enable a seamless signing process, while custom workflow solutions allow teams to adjust the document handling process according to their unique organizational needs.

User stories: Successful usage of the aud-d7 Form

Real-world examples bring insight into how users have leveraged the aud-d7 form to meet their needs effectively. For individuals, the clear structure provided by pdfFiller has simplified the process of applying for loans, allowing them to focus on crucial personal information and employment records.

Teams have also benefited from collaborative capabilities, wherein multiple users have efficiently worked on the same aud-d7 form. This synergy has led to quicker modifications and reviews, resulting in successful submissions.

FAQs about the aud-d7 Form and pdfFiller

Having clarified essential aspects of the aud-d7 form, it is also vital to address frequently asked questions. These queries often focus on users’ experiences and how they can maximize the functionalities of pdfFiller.

Common concerns include the ability to edit the form post-submission, security of personal information, and troubleshooting steps if access is lost due to forgotten passwords.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the aud-d7 in Chrome?

Can I edit aud-d7 on an Android device?

How do I fill out aud-d7 on an Android device?

What is aud-d7?

Who is required to file aud-d7?

How to fill out aud-d7?

What is the purpose of aud-d7?

What information must be reported on aud-d7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.