Get the free MI-W4, Emploee's Michigan Withholding Exemption ...

Get, Create, Make and Sign mi-w4 emploees michigan withholding

Editing mi-w4 emploees michigan withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mi-w4 emploees michigan withholding

How to fill out mi-w4 emploees michigan withholding

Who needs mi-w4 emploees michigan withholding?

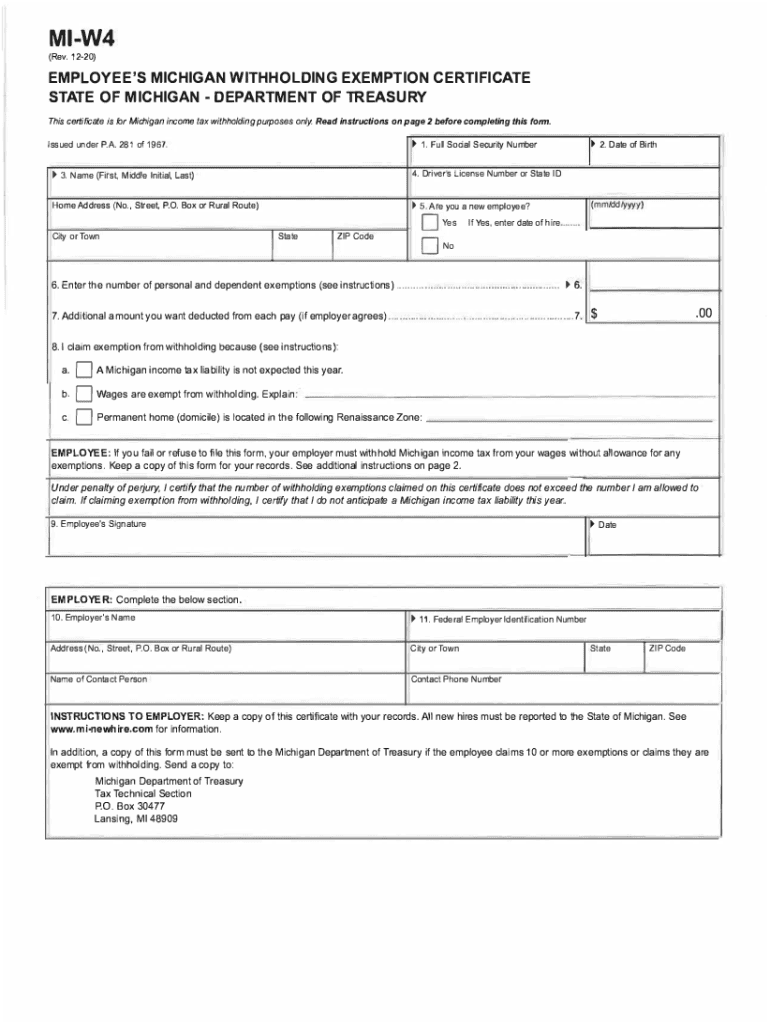

-W4 Employees Michigan Withholding Form: A Comprehensive Guide

Understanding the -W4 form

The MI-W4 form is a crucial document for employees working in Michigan. It serves the purpose of letting employers know how much state income tax to withhold from an employee's paycheck. The correct withholding helps ensure that employees do not owe a significant amount during tax season or face any penalties for under-withholding.

Withholding tax is critical in managing state revenue, contributing to public services and infrastructure. By accurately filling out the MI-W4 form, employees can play an active role in their tax responsibilities. Key terminology associated with this form includes 'withholding allowances,' 'exemptions,' and 'filing status,' all of which impact the amount withheld from each paycheck.

Who needs to fill out the -W4 form?

Generally, all employees earning taxable income in Michigan are required to complete an MI-W4 form. This includes part-time, full-time, and seasonal workers. Any employee who prefers their withholding to be adjusted, or whose current personal circumstances have changed, should update their MI-W4.

There are specific situations where a new MI-W4 submission is prompted. These include changes in employment status, such as starting a new job, a promotion, or changing from part-time to full-time status. Life events can also necessitate an update, including marriage, divorce, or becoming a parent. Whenever personal or financial situations shift, it is advisable to reassess withholding needs.

Step-by-step instructions for completing the -W4

Completing the MI-W4 form doesn't have to be complicated. Follow these steps for a seamless process.

Submitting the -W4 form

Once completed, the MI-W4 form must be submitted to your employer. This can often be done either online through your company's HR portal or through paper submission, depending on employer preference.

Employers are responsible for processing the MI-W4 form and ensuring the correct withholding tax is applied to employee paychecks. If forms are submitted late, it can lead to improper withholding which will need correction. Therefore, it’s important to ensure your employer receives the MI-W4 promptly.

Managing your withholding information

Life changes can impact your withholding needs significantly. It’s important to know when and how to update your MI-W4 to reflect your current situation accurately. While it is advisable to check your withholding at least annually, significant changes such as a marriage, divorce, birth of a child, or a new job may prompt immediate updates.

In most cases, you can submit a new MI-W4 any time to address these changes. Staying proactive about your withholding status ensures that you are paying the correct amount of state income tax and helps to avoid any surprises during tax time.

Understanding your pay stub in relation to the -W4

Your pay stub is a document that provides detailed information about your paycheck and illustrates how much tax has been withheld as per your MI-W4 form. Knowing how to read your pay stub is crucial for understanding your finances.

Pay stubs typically show gross earnings, deductions including federal and state withholding, and net pay. Understanding the withholding amounts and how they correlate to the allowances you claimed on your MI-W4 helps you assess whether you are on the right track regarding your tax obligations.

Additional resources

To simplify the process of filling out the MI-W4 form, tools such as pdfFiller can be tremendously beneficial. By providing interactive platforms for form completion and e-signing, pdfFiller allows employees to manage their MI-W4 forms effectively.

Why use pdfFiller for your -W4 needs?

Using a cloud-based document management system like pdfFiller enhances your experience with the MI-W4 form. Benefits include the ability to edit, e-sign, and collaborate on documents from any device, ensuring that you have access to critical forms whenever you need them.

Troubleshooting common issues with -W4 forms

It's not uncommon to face issues with MI-W4 forms. For instance, if you notice incorrect allowances reported, it's essential to rectify the situation quickly by submitting a new form with the correct information.

Similarly, if your MI-W4 submission is lost, inform your employer immediately and send another copy to ensure your withholding is accurate. Addressing these issues early can save you from potential under-withholding penalties or overpayment situations.

Final thoughts on the -W4 form

The MI-W4 form plays a vital role in managing state tax withholding responsibilities for employees in Michigan. Staying informed about changes in tax regulations ensures that your withholding aligns with your financial situation and avoids unnecessary penalties.

Utilizing resources like pdfFiller can streamline the process of completing and managing your MI-W4 form. Remember, accurate withholding is beneficial not just for fulfilling legal requirements, but also for better financial planning throughout the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mi-w4 emploees michigan withholding to be eSigned by others?

Can I create an electronic signature for signing my mi-w4 emploees michigan withholding in Gmail?

How do I edit mi-w4 emploees michigan withholding on an Android device?

What is mi-w4 emploees michigan withholding?

Who is required to file mi-w4 emploees michigan withholding?

How to fill out mi-w4 emploees michigan withholding?

What is the purpose of mi-w4 emploees michigan withholding?

What information must be reported on mi-w4 emploees michigan withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.