Get the free Wells Fargo Financial Leasing

Get, Create, Make and Sign wells fargo financial leasing

How to edit wells fargo financial leasing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wells fargo financial leasing

How to fill out wells fargo financial leasing

Who needs wells fargo financial leasing?

A Comprehensive Guide to the Wells Fargo Financial Leasing Form

Understanding financial leasing with Wells Fargo

Financial leasing is a method of acquiring the use of equipment without the burden of outright purchasing it. Businesses can access high-quality assets while preserving cash flow and improving their financial flexibility. Wells Fargo, a leading financial services provider, offers various leasing options tailored to meet the needs of diverse businesses.

Choosing Wells Fargo for financial leasing comes with several advantages. The bank brings decades of experience in the leasing industry, a user-friendly application process, and a range of leasing products. Furthermore, partnering with a reputable institution enhances trust and ensures a smooth leasing experience.

It's crucial to understand the key differences between leasing and buying equipment. With leasing, businesses can easily upgrade to newer models as technology advances, while purchasing ties them to a specific asset for a longer period, often requiring additional maintenance costs.

Types of financial leasing offered by Wells Fargo

Wells Fargo provides a range of financial leasing options, each catering to different business requirements. The two primary types are operating leases and capital leases.

Operating leases

Operating leases allow businesses to use equipment without the burdens associated with ownership. They typically have lower monthly payments compared to capital leases, making them an attractive option for businesses looking to manage cash flow effectively. The asset returns to the lender at the end of the lease term, which means the lessee does not have to worry about its residual value.

Capital leases

In contrast, capital leases resemble installment purchases. Businesses get the benefits of ownership, including depreciation tax benefits, but with a commitment to buy the equipment at the end of the lease term. Capital leases usually lead to higher monthly payments but ultimately allow for asset ownership.

Customized leasing solutions

Wells Fargo recognizes that no two businesses are alike; thus, it also offers customized leasing solutions tailored to specific industry needs. This flexibility ensures that businesses can choose terms and conditions that align with their operational requirements.

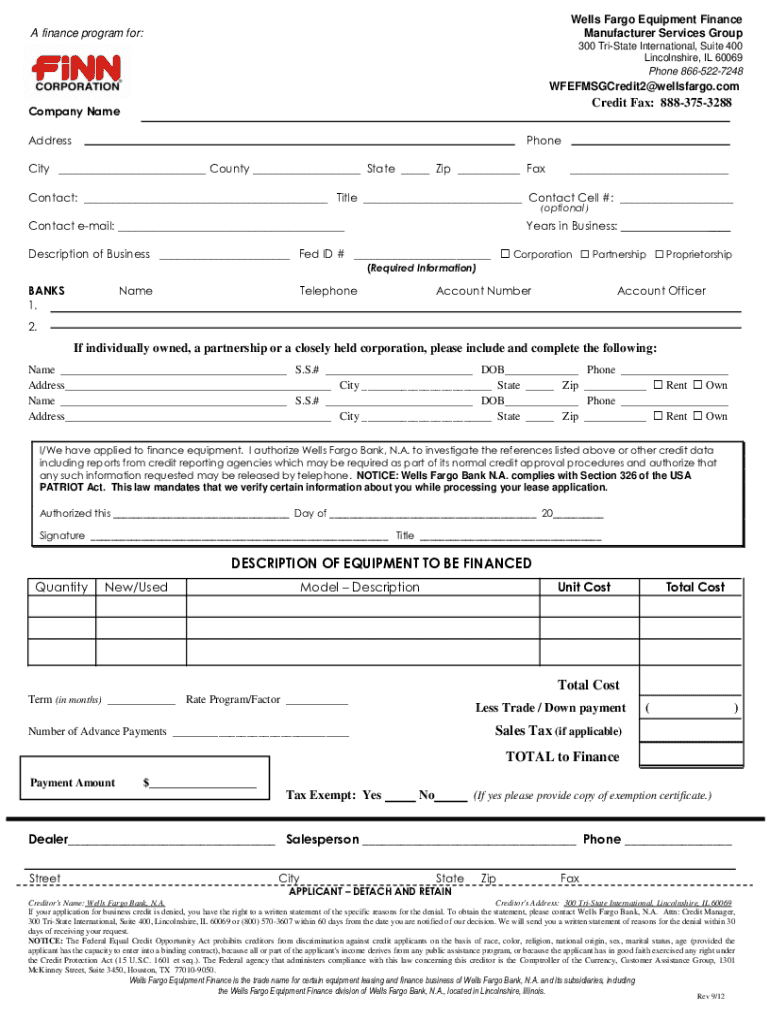

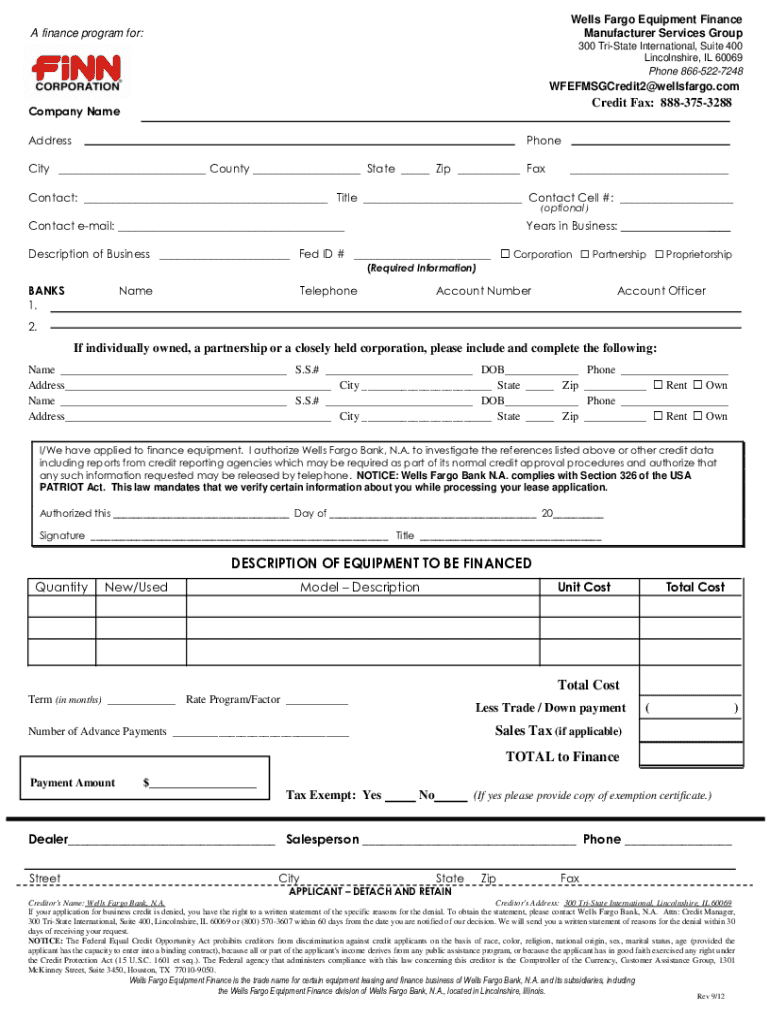

Step-by-step guide to completing the Wells Fargo financial leasing form

Completing the Wells Fargo financial leasing form can seem daunting. However, by following a structured approach, you can ensure a smooth application process.

Finding the right form

Start by locating the financial leasing form on the Wells Fargo website. It’s typically found under the 'Business' or 'Leasing' sections. Make sure you’re using the most current version of the form to avoid processing delays.

Gathering necessary information

Before filling out the form, gather all the required information. This includes personal details, business information, and any relevant financial data. Supporting documentation may also be necessary for verification purposes, such as tax returns, business licenses, and financial statements.

Filling out the form

When you begin filling out the Wells Fargo financial leasing form, ensure that you provide accurate and up-to-date information. Pay special attention to details such as business structure and financing amount. Avoid common mistakes like leaving sections blank or misrepresenting financial data, as this can lead to delays.

Editing and customizing your financial leasing form

Once you have completed your form, you may need to make adjustments. Using a platform like pdfFiller simplifies this process, allowing you to edit your document with ease.

Using pdfFiller to edit your document

With pdfFiller, uploading the Wells Fargo financial leasing form is straightforward. You can add text, digital signatures, and notes directly onto the PDF, making your document more professional and easier to understand.

Tips for clarity and professional appearance

When customizing the form, prioritize clarity. Use clear fonts, appropriate colors, and a straightforward layout. Ensure all sections are filled accurately and concisely for a polished appearance.

Signing your financial leasing form

Before submission, you’ll need to sign the completed form. The eSignature process with pdfFiller is quick and secure.

eSignature process with pdfFiller

eSignatures are legally valid and can be used in place of traditional handwritten signatures. Thus, using pdfFiller's eSignature functionality allows for a seamless transaction process.

Securely storing your signed document

Once signed, it’s essential to store your document securely. pdfFiller offers cloud storage options, allowing you to access your signed Wells Fargo financial leasing form anytime, from anywhere.

Submitting your financial leasing form to Wells Fargo

With the form completed and signed, it’s time to submit it. Wells Fargo provides various methods for submission.

Tracking the status of your application is crucial. Wells Fargo typically provides confirmation notices when your application is received and updates throughout the approval process.

After submission: What to expect

Once you have submitted your form, it’s important to understand the next steps in the process. Typically, you can expect an approval timeline communicated to you via email or phone.

Be prepared for potential follow-up questions from Wells Fargo as they may require additional clarification regarding your financial information or business operations.

Effective management of communication during this stage can significantly impact the speed of your approval process. Stay responsive and provide requested information promptly.

Additional considerations when leasing equipment

While the logistics of leasing may seem straightforward, consider the long-term impact of your lease terms on your business. Evaluate the length of the lease, monthly payments, and total cost of ownership over time.

Interest rates also play a significant role in leasing agreements. As these rates fluctuate, they can affect your total cost, so it's wise to negotiate terms accordingly.

Interactive tools and resources

Utilizing interactive tools can significantly simplify your document management processes. pdfFiller offers an array of tools that enhance the efficiency of filling out, editing, and managing your forms.

Financial calculators available on pdfFiller can assist in making informed decisions. For example, they can help you evaluate whether to lease or buy equipment based on your financial circumstances.

FAQs about Wells Fargo financial leasing

Understanding the financial leasing process can prompt numerous questions. Here are some common inquiries related to the Wells Fargo financial leasing form.

Addressing these questions upfront can alleviate concerns and improve the overall experience of the leasing process.

Testimonials and success stories

Many businesses have benefited from the Wells Fargo financial leasing options, finding solutions that fit their unique needs. For instance, a local construction firm was able to upgrade its machinery without straining its capital. According to the firm's owner, 'Leasing with Wells Fargo has kept our operations fluid and allowed us to invest in projects without delay.'

Additionally, pdfFiller has played a vital role in facilitating a smoother leasing experience. Users have noted how easy it is to fill out and submit forms using the platform, leading to faster approvals and better document management overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wells fargo financial leasing straight from my smartphone?

How can I fill out wells fargo financial leasing on an iOS device?

How do I edit wells fargo financial leasing on an Android device?

What is wells fargo financial leasing?

Who is required to file wells fargo financial leasing?

How to fill out wells fargo financial leasing?

What is the purpose of wells fargo financial leasing?

What information must be reported on wells fargo financial leasing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.