Get the free Budget Appeals Form 2022-2023

Get, Create, Make and Sign budget appeals form 2022-2023

Editing budget appeals form 2022-2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget appeals form 2022-2023

How to fill out budget appeals form 2022-2023

Who needs budget appeals form 2022-2023?

A Comprehensive Guide to the Budget Appeals Form 2

Understanding the budget appeals process

The budget appeals process is a vital mechanism for individuals and teams to contest budgetary decisions that impact their operations. It allows stakeholders to formally request reconsideration of allocation decisions, helping to ensure that necessary resources are available to meet specific objectives. Understanding this process is crucial for effective budget management within organizations.

In a dynamic financial environment, the importance of the budget appeals process cannot be overstated. It provides an avenue for feedback and improvement, ensuring that resource allocation aligns with the evolving needs of teams, projects, or departments. For those navigating financial constraints, leveraging the budget appeals process could be a turning point in securing essential funding.

Preparing for your budget appeal

Preparation for submitting a budget appeals form begins with identifying valid grounds for your appeal. Common reasons for appeals include unexpected project expenses, changes in project scope, or critical needs overlooked during initial budget discussions. Evaluating your eligibility to appeal is just as critical, as not all decisions are subject to challenge.

Gathering necessary documentation is a pivotal step in this process. Compile relevant forms, previous budget reports, financial statements, and any correspondence related to your budget decision. Adherence to deadlines is also vital; ensure that all materials are submitted in accordance with timelines specified by your organization’s budgeting authority.

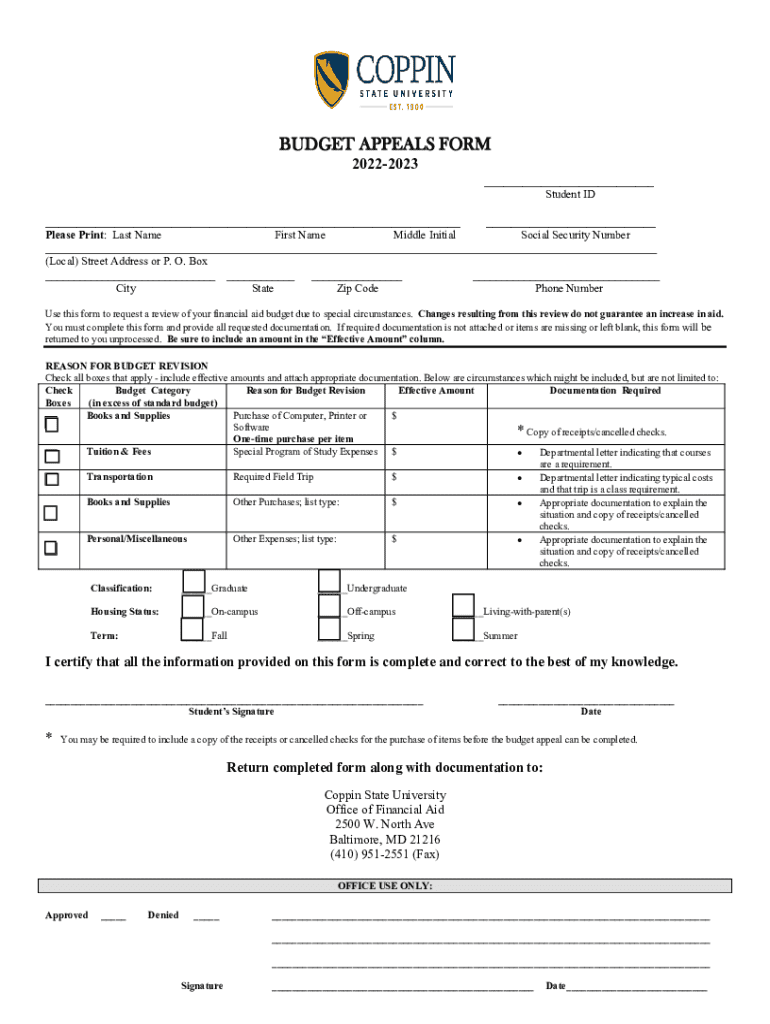

Navigating the budget appeals form

Completing the budget appeals form requires attention to detail. Each section of the form is designed to capture essential information that will aid in the evaluation of your appeal. Begin with the basic information, such as contact details and departmental identifiers, and move through the form methodically to ensure completeness.

Be mindful of common misinterpretations that can lead to delays in your appeal review. For instance, vague language or insufficient justification for your requested budget can hinder your case. Instead, focus on articulating your needs clearly and provide supporting evidence, such as data charts or previous project outcomes that demonstrate the necessity for additional funds.

Submission and review process

Submitting your budget appeals form can typically be done through both online and offline channels. Online submissions often provide instant confirmation, ensuring you have a record of your appeal. If opting for offline submission, ensure that you retain copies for your records and verify receipt with the appropriate department.

After submitting your budget appeals form, expect a review period during which the appeals board will assess your request. Communication is key; stay informed through the channels established by your organization. Regular follow-ups can provide insights into the status of your appeal.

Potential outcomes of your appeal

Understanding the potential outcomes of your budget appeal helps in strategic planning. If your appeal is approved, you will likely receive guidelines on how to access those additional funds and any implications they may have on future budgets. Conversely, a denied appeal requires a reevaluation of your proposal or consideration of alternative funding avenues.

Should your appeal be denied, exploring additional steps is crucial. This may include gathering further data to bolster your case for a reapplication. It's essential to remain proactive and align your requests with budget priorities established by your organization to enhance the likelihood of success in future endeavors.

Frequently asked questions (FAQs)

Navigating the budget appeals process can be daunting, leading to common questions. One prevalent concern is what to do if an appeal is denied. In such cases, it’s a good practice to analyze the feedback received and use it to bolster future appeals. Additionally, can you amend your budget appeals form after submission? Typically, once an appeal is in review, changes are not permitted, so be meticulous in your initial submission.

For those seeking assistance, many resources are available, from financial advisors within your organization to external support groups that specialize in budget management. Familiarizing yourself with these resources and knowing where to seek help is beneficial as you navigate the appeals process.

Interactive tools and resources

During the appeals process, accessing interactive tools can streamline your submission. On pdfFiller, you can use templates for the budget appeals form 2, which allow you to fill, edit, and eSign documents with ease. Leveraging these interactive features will enhance your submission efficiency and documentation management.

In addition to the budget appeals template, pdfFiller offers various resources like eSigning capabilities and collaboration tools, ensuring that you manage all your documents effectively in one place. Features like these are especially valuable for teams or individuals managing multiple budget appeals.

Ensuring compliance and documentation management

Keeping track of your appeal documentation is essential to ensure compliance with organizational standards. Create a centralized filing system for all materials related to your budget appeals. This not only aids in managing deadlines but also facilitates easy access to necessary information for future appeals.

Considering best practices for future appeals involves reflecting on feedback from previous submissions. By continuously adapting your approach based on experiences and outcomes, you can sharpen your skills in budget management. Utilizing platforms like pdfFiller helps in effectively managing these documents by providing a structured environment.

Updates and changes for the 2 period

Keeping abreast of key policy changes that affect the budget appeals process for the 2 period is crucial. Many organizations have adjusted their criteria for appeals to reflect current economic challenges and emerging needs within their departments. Regularly review updates from your organization’s finance department or budget office to stay informed.

Additionally, be aware of important dates and deadlines specific to the current budget cycle. These details are often published in organizational communications and are critical for ensuring that your appeal is submitted in a timely manner.

How to get support

If you need assistance with the budget appeals form, know that support is available. Many organizations offer dedicated support teams to help answer questions about the appeals process. You can reach out to these resources via email or direct communication for personalized guidance.

Additionally, engaging with community support and resource links can provide further insights. Networking with peers who have undergone similar processes can yield valuable tactics and lessons learned, equipping you with best practices to enhance your appeal submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send budget appeals form 2022-2023 for eSignature?

How do I make edits in budget appeals form 2022-2023 without leaving Chrome?

How do I fill out budget appeals form 2022-2023 on an Android device?

What is budget appeals form 2022-2023?

Who is required to file budget appeals form 2022-2023?

How to fill out budget appeals form 2022-2023?

What is the purpose of budget appeals form 2022-2023?

What information must be reported on budget appeals form 2022-2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.