Client Authorisation - Tasmania Form: A Comprehensive Guide

Understanding client authorisation

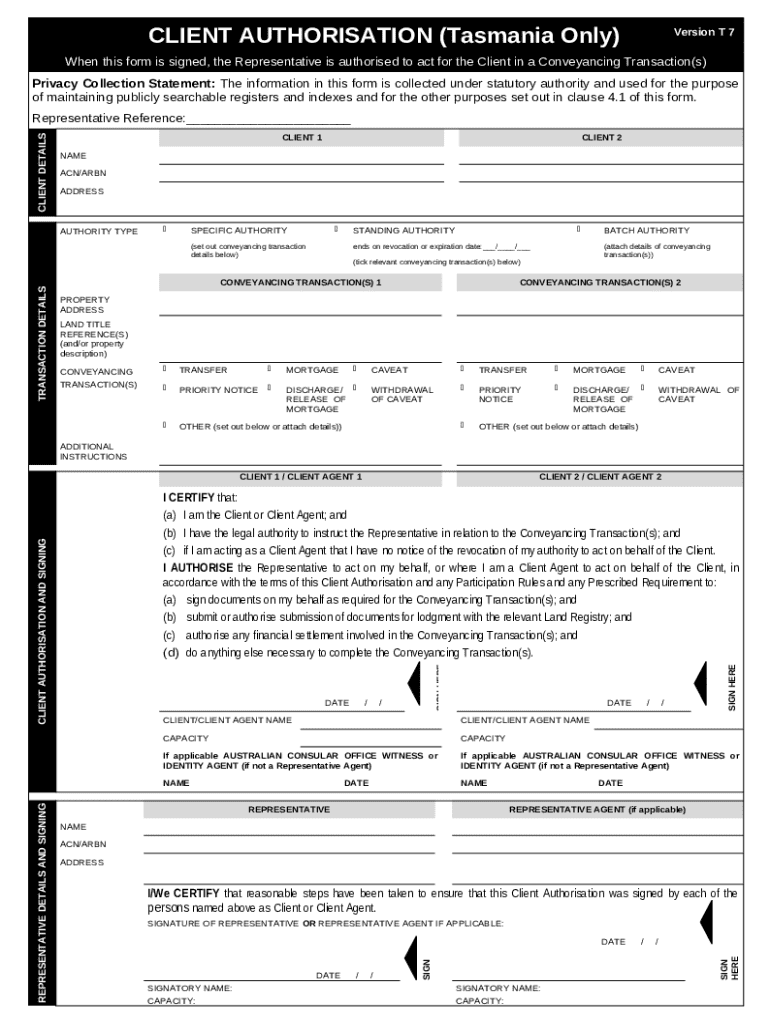

Client authorisation in Tasmania is a formal process wherein an individual grants permission to another party to act on their behalf regarding specific matters. This is crucial in various fields, such as legal, financial, and health services, ensuring that all actions taken by the appointed party are in line with the client's wishes and legal frameworks.

The primary purpose of client authorisation is to facilitate clear communication and effective management of client interactions. It establishes a trusted relationship between all parties involved, minimizes misunderstandings, and provides a safeguard against unauthorized decisions.

Forms a legal contract commonly recognized in Tasmania.

Ensures that clients can maintain control over their information and decision-making processes.

Serves as proof of consent and agreement, which can be referred to in case of disputes.

When is client authorisation required?

Client authorisation forms are necessary in numerous scenarios, particularly when sensitive information or substantial financial transactions are involved. Common situations include engaging legal representation, authorising financial advisers, or designating agents for property sales or purchases.

Failure to complete a client authorisation can lead to significant regulatory consequences. For instance, in the financial sector, banks and institutions must adhere to strict guidelines about who is authorized to act on behalf of a client to ensure compliance with anti-money laundering laws and customer privacy regulations.

Transferring property ownership.

Lodging or discharging mortgages.

Even simple inquiries into a client’s account status can require authorisation.

How to complete the client authorisation form

Completing the client authorisation form requires careful attention to detail. First, gather all necessary information, including identification documents, proof of address, and any relevant account or case numbers. This will ensure that you have all the details required to fill out the form accurately.

The client authorisation form can typically be found on the websites of relevant institutions or service providers. Navigate to the appropriate section that deals with client forms; often, they’ll be listed under customer service or legal documents.

Fill in personal details: This includes the client's full name, address, and contact information.

Specify the type of authority being granted: Financial transactions, health decisions, or property dealings.

Review the completed form for accuracy: Misentries can lead to legal complications.

Common mistakes to avoid during this process include leaving sections unfilled, using incorrect personal details, or failing to sign the document. Always double-check each section before submission.

Submitting the form

After completing the client authorisation form, it must be submitted correctly to be effective. There are generally two methods for submitting the form: electronically or in person. Electronic submissions typically require scanning the completed form and sending it via email or through an online portal.

For in-person submission, clients can take the form directly to the office of the institution requiring authorisation. This method can be beneficial as it allows for immediate confirmation of receipt.

For electronic submissions, ensure to receive a confirmation email as proof of submission.

In-person submissions should include asking for a stamped copy of the form as proof.

To confirm that the form has been processed, clients may follow up with the institution via phone or email, providing their submission details for verification.

Types of client authorisation

There are various client authorisation forms tailored to specific needs and industries, such as real estate, legal matters, and financial services. Each form is tailored to the particular requirements of the transaction at hand. Understanding these distinctions is vital to ensure that clients are using the correct form for their needs.

For instance, a financial services authorisation may have sections dedicated to investment decisions and banking transactions, whereas a property-related authorisation may focus more on permissions concerning property sales or leasing.

Real estate: Often requires more detailed information regarding property specifics.

Legal: May include clauses regarding the extent of authority granted.

Financial: Typically focuses on account-related permissions and financial management powers.

Each type of authorisation requests different levels of detail. For example, a financial transaction might require proof of identity and account information, while other types might ask for legal representation details.

Additional details on client authorisation processes

Client authorisation forms can usually accommodate multiple clients in one instance, particularly when parties are involved in a joint initiative or transaction. For example, in property sales, multiple owners can authorise a single agent to manage the sale process, thus streamlining communications and reducing individual paperwork.

A representative agent often acts on behalf of clients to manage the entire authorisation process. This agent carries the responsibility of ensuring that all actions taken are in alignment with the clients’ interests and respect the authority granted.

A representative agent must clearly define the scope of their authority in the form.

Their involvement can simplify the process, especially in intricate transactions.

Customizing a client authorisation form may be possible; however, it is important to ensure compliance with local regulations and industry standards. Tailored forms should still encompass all necessary information and clauses to avoid any potential legal issues.

Common client authorisation questions

One common question is whether a client authorisation form can be electronically signed. Yes, electronic signatures are generally accepted, providing that they comply with the Electronic Transactions Act in Tasmania. This flexibility can enhance the convenience for clients, allowing them to perform tasks remotely, especially in today's fast-paced environment.

Another inquiry often relates to the need for client authorisation in transactions involving mortgages. Financial institutions typically mandate client authorisation for lodging or discharging mortgages to ensure that adequate permissions have been granted and to uphold the integrity of financial processes.

Frequently asked questions

Financial institutions acting on their behalf must understand the nuances of client authorisation. While they might perceive they don’t require explicit client authorisation for standard transactions, there are instances, particularly around sensitive account actions, where having proper documentation is vital to safeguard against disputes.

It is essential to note that a client authorisation form does not replace the usual retainer agreement. While both documents serve different purposes — the retainer agreement often detailing the terms of service, and the client authorisation form focusing on permitting actions — having both can provide a comprehensive approach to client management.

Conclusion: Empowering document management with pdfFiller

pdfFiller streamlines the development and management of client authorisation documents, allowing users to easily edit, sign, and collaborate on necessary forms. With its cloud-based platform, users can access their documents from anywhere, ensuring they can manage authorisations efficiently and effectively.

Using pdfFiller, individuals and teams can create customized client authorisation forms that are compliant and ready for any transaction. This enhances not only the client's experience but also improves overall compliance and document management. Empower yourself and your team with pdfFiller for seamless documentation processes.