Get the free CRT-61 Certificate of Resale - Step 1: Identify the seller

Get, Create, Make and Sign crt-61 certificate of resale

How to edit crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

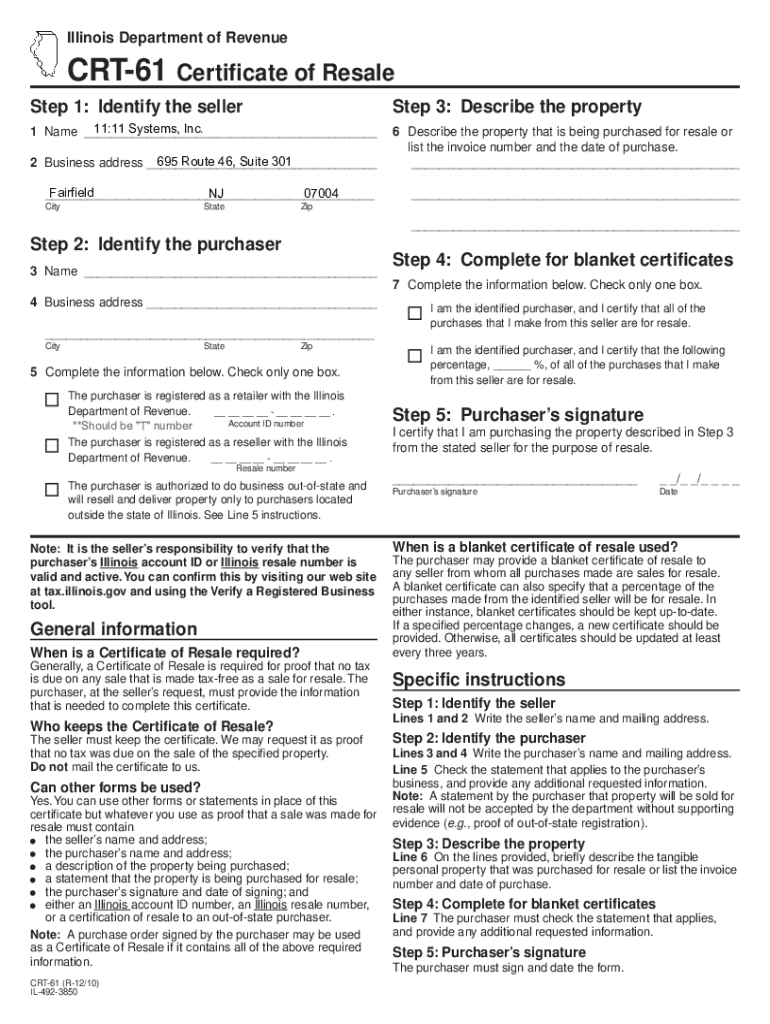

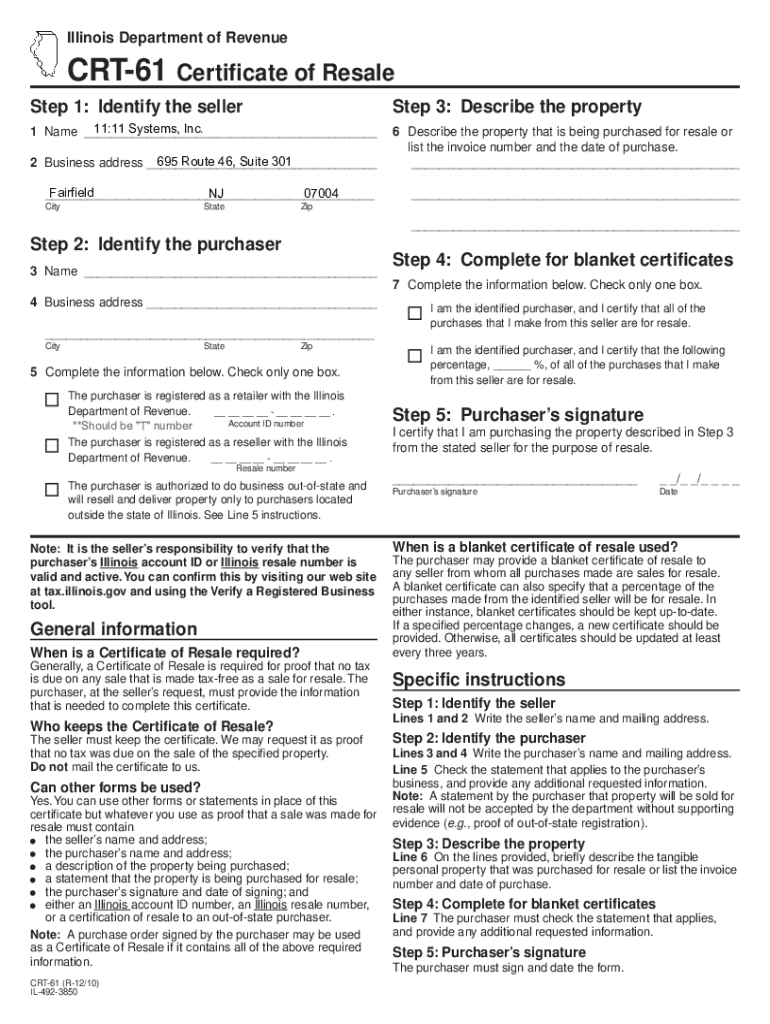

Understanding the CRT-61 Certificate of Resale Form

Understanding the CRT-61 certificate of resale form

The CRT-61 certificate of resale form is a vital document for businesses engaged in reselling goods in Illinois. This form allows sellers to purchase products tax-free, provided that they plan to resell them in the regular course of business. The primary purpose of the CRT-61 form is to ensure that sales tax is only applied once—at the final sale to the consumer—thereby facilitating a smoother transaction process for wholesalers and retailers.

The importance of the CRT-61 certificate extends beyond mere tax exemption; it plays a significant role in managing cash flow and pricing strategies for businesses. Without this certificate, retailers and wholesalers would incur additional upfront costs that could adversely affect their pricing structures, potentially leading to reduced competitiveness in the marketplace. Understanding how to use the CRT-61 form effectively can result in significant savings and more efficient operations.

Illinois regulations specify that individuals or businesses engaging in the sale of tangible personal property may apply for this resale certificate, making it an essential tool for compliance with state sales tax law. Being familiar with these regulations will aid in effective and lawful operation within Illinois's commercial landscape.

Who needs the CRT-61 certificate of resale form?

Not all businesses require the CRT-61 certificate, but various types of businesses can greatly benefit from acquiring it. Retailers, wholesalers, and online sellers who purchase items solely for resale can all utilize this certificate to exempt themselves from sales tax at the point of purchase. Each of these business types engages with suppliers and buyers differently, but all need a streamlined process for managing sales tax compliance.

Criteria for obtaining a CRT-61 certificate include establishing a legitimate business presence and having a valid Illinois sales tax ID, which reassures suppliers that the transaction is business-related and intended for resale. By meeting these requirements, businesses can start benefiting from this important tax exemption resource.

Step-by-step guide to completing the CRT-61 certificate of resale form

Filling out the CRT-61 certificate can seem daunting at first, but with the right resources, it becomes an easier task. The first step is accessing the form, which is available for download from various sites, including pdfFiller, where users can find the CRT-61 form in a PDF format that allows for online editing.

Once the form is filled out, review all entries for accuracy. pdfFiller's editing tools allow for easy corrections, ensuring the document is professional and error-free before submission. Finally, sign the form electronically using pdfFiller’s eSigning options to finalize the document effortlessly.

Best practices for using the CRT-61 certificate of resale form

Understanding when and how to present the CRT-61 resale certificate is key to safeguarding your business from unnecessary tax liabilities. Ideally, present the certificate at the point of sale when engaging with suppliers. Not only does this practice streamline the purchasing process, but it also limits the risk of encountering tax collection after the fact.

Maintaining clear and organized records is vital. It helps during tax audits and provides proof of resale transactions, fostering trust and transparency between your business and suppliers.

Managing your resale certificates

Proper management of resale certificates, including the CRT-61, is imperative for efficient business operations. Start by ensuring that all resale certificates are stored in an easily accessible format. Digital copies are advantageous for quick retrieval and can be backed up for security. Using pdfFiller, you can store your resale certificates in the cloud, ensuring they are accessible whenever needed.

Regularly updating your certificates will help you avoid unwarranted tax consequences, providing peace of mind as you do business.

Insights on sales tax compliance and the CRT-61 resale certificate

Familiarity with sales tax laws surrounding the CRT-61 resale certificate is crucial for maintaining compliance and protecting your business from audits and liabilities. For instance, Illinois law requires that the reseller genuinely intends to resell products. Therefore, failure to use the certificate appropriately can lead to penalties or sales tax being imposed unjustly.

By embracing these insights, you can become more adept at navigating the complexities of sales tax compliance while maximizing the advantages of the CRT-61 certificate.

Creative tools and features on pdfFiller for managing your resale certificate

pdfFiller offers a suite of creative tools tailored to enhance the management of your CRT-61 resale certificate and beyond. Users benefit from interactive editing tools that simplify the process of customizing forms and ensuring all necessary details are filled out properly. These features save time and reduce errors, allowing businesses to focus on their core operations.

By leveraging pdfFiller's features, you ensure that your CRT-61 resale certificate is up-to-date, compliant, and easy to access, providing efficiencies in your day-to-day operations.

Frequently asked questions (FAQs) about CRT-61 certificate of resale

A few common questions frequently arise concerning the CRT-61 certificate of resale. Understanding these questions can help businesses navigate its use confidently:

Being informed about these common queries can empower businesses to use the CRT-61 certificate effectively, ensuring compliance and optimal use.

Related forms and resources on pdfFiller

Beyond the CRT-61, several related forms can help with compliance and tax management. For instance, forms such as CRT-1 and CRT-2 serve different purposes but are also key documents in the realm of sales tax compliance. pdfFiller provides users with easy access to these forms along with tools for comparison and analysis.

Engaging with these forms and resources through pdfFiller grants users comprehensive support for all aspects of sales tax documentation.

Real-life scenarios and case studies

Examining real-life scenarios where businesses effectively implemented the CRT-61 certificate reveals practical insights. For example, many online retailers have adeptly used the CRT-61 form to save significantly on inventory costs, allowing for competitive pricing that drives sales. On the other hand, businesses that neglected proper management of their resale certificates faced significant penalties during audits.

Learning from these examples can provide businesses with valuable strategies for maximizing the benefits of the CRT-61 certificate while avoiding common missteps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find crt-61 certificate of resale?

How do I edit crt-61 certificate of resale in Chrome?

How do I fill out crt-61 certificate of resale using my mobile device?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.