Get the free Maryland worksheet is available online at https://marylandtaxes

Get, Create, Make and Sign maryland worksheet is available

How to edit maryland worksheet is available online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland worksheet is available

How to fill out maryland worksheet is available

Who needs maryland worksheet is available?

Maryland Worksheet is Available Form: A Comprehensive Guide

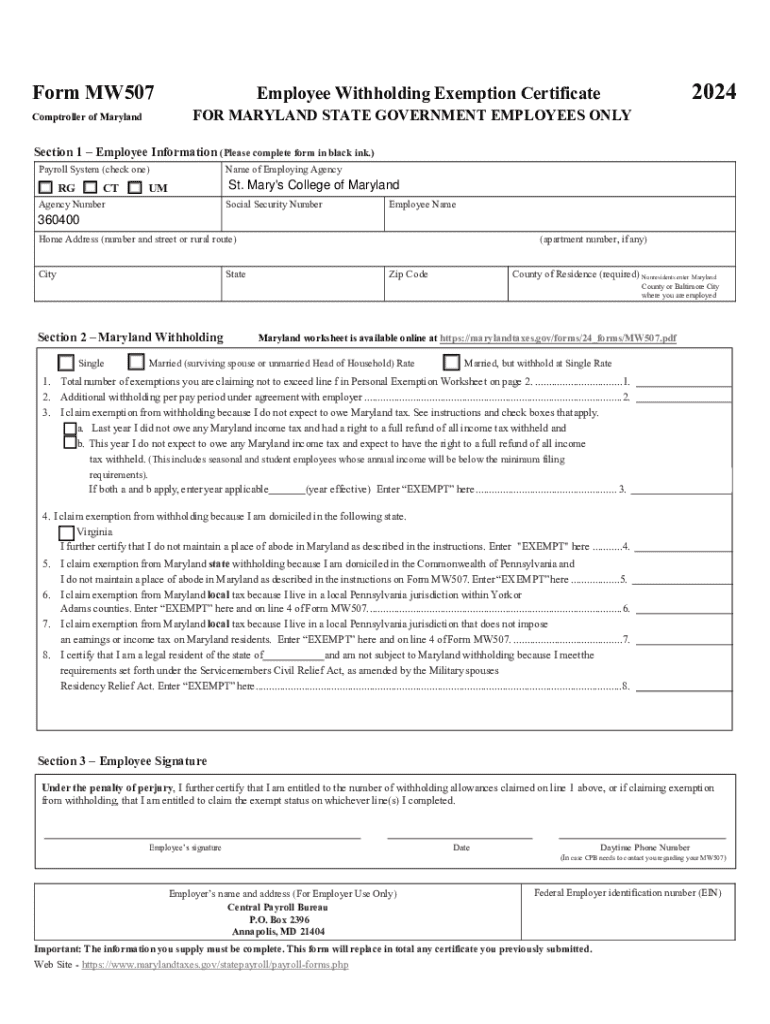

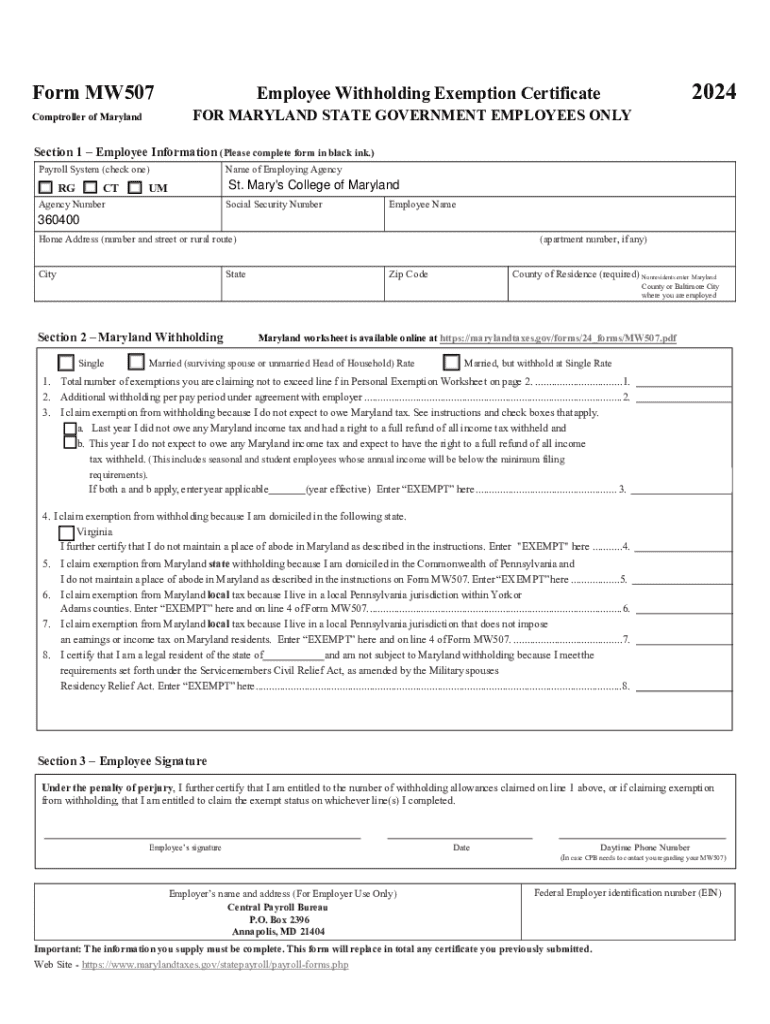

Overview of the Maryland Worksheet

The Maryland Worksheet is a critical document utilized in various applications within the state of Maryland. It serves as a standardized form that helps streamline processes such as tax submissions, business assessments, and personal development evaluations. The importance of the Maryland Worksheet lies in its ability to ensure compliance with state regulations while providing a structured format for users to input vital information.

Key features of the Maryland Worksheet include its user-friendly layout, specific sections tailored for different needs, and the ability to fill it out digitally. This form assists both individuals and business entities in managing their submissions efficiently.

Types of Maryland Worksheets

Maryland provides several categories of worksheets tailored for specific uses. These include personal development worksheets aimed at individuals seeking to track their progress in various life areas, business worksheets designed for new and existing businesses attempting to navigate state regulations, and tax and assessment worksheets necessary for tax compliance.

Accessing the Maryland Worksheet

To access the Maryland Worksheet, you need to follow a straightforward process. Start by navigating to the Maryland Department of Assessments and Taxation website. The site serves as a central hub for all related forms and worksheets you may require. Using the search functionality can enhance your chances of locating the exact worksheet needed without sifting through irrelevant information.

After reaching the homepage, look for a section dedicated to Forms or Worksheets. This area will list the types of worksheets available, allowing you to pinpoint the one you require quickly. Here are some direct links for essential worksheets for quick access: [insert direct links here].

Filling Out the Maryland Worksheet

Completing the Maryland Worksheet accurately is critical. Begin by gathering all necessary information, which may include personal details such as name, address, and other identification numbers relevant to the specific worksheet type. Ensure that you cross-check requirements for the sheet you are filling out, as these can vary significantly.

Common mistakes often occur during the data entry process; thus, double-checking your entries is crucial. For instance, ensure that numerical entries are correct and that all required fields are filled out. To streamline your process, consider using digital tools such as pdfFiller, which offers easy filling and error-check options to enhance the overall experience.

Editing and Updating the Maryland Worksheet

If changes are necessary after submitting the Maryland Worksheet, it’s crucial to know how to amend it. Identify what changes are required and determine whether these can be made directly online or if a new submission is needed. If the worksheet is editable online, you can utilize pdfFiller for seamless modifications.

Best practices for ensuring updates remain consistent include maintaining copies of all versions of the worksheet, establishing a clear version control system, and regularly checking for any compliance updates from the Maryland Department of Assessments and Taxation to ensure that your worksheets meet current regulations.

Signing the Maryland Worksheet

Signing the Maryland Worksheet is an essential step that may require a handwritten signature or an electronic one. Understanding the signing requirements can save you time and avoid rejection. Many users are migrating to electronic signatures due to their convenience and speed. Using services like pdfFiller, you can easily incorporate an eSignature into your documents.

The benefits of electronic signatures include enhanced security, reduced need for physical storage, and the ability to sign from virtually anywhere. To eSign on pdfFiller, follow these steps: [insert step-by-step guide here].

Submitting the Maryland Worksheet

After completing and signing the Maryland Worksheet, the next step is submission. There are various submission methods available. Online submissions can often be completed through state portals, providing a quick and efficient method. For those opting for traditional methods, physical mailing instructions should be followed carefully to ensure timely delivery.

Consider confirming receipt of your submission. This can typically be done by contacting the receiving office or checking online if a tracking option is available. Following up ensures that your worksheet has been processed and can prevent unnecessary delays.

Collaboration on the Maryland Worksheet

One of the powerful features of using pdfFiller is the ability to collaborate effectively on the Maryland Worksheet. Teams can work together in real-time, allowing multiple contributors to input their data and insights directly. This collaborative functionality streamlines the process significantly.

Sharing the worksheet for review is effortless with pdfFiller. Users can share links or email the worksheet directly from the platform. Additionally, managing feedback and revisions collaboratively helps keep all inputs organized, ensuring that everyone’s contributions are acknowledged and incorporated.

Frequently Asked Questions (FAQs)

Several common inquiries arise when dealing with the Maryland Worksheet. For instance, users often ask what to do if they lose the original worksheet or file. In such cases, it's advisable to download it anew from the Maryland Department of Assessments and Taxation website. Alternatively, clarifications on filing deadlines and timelines can also be sought directly from the site.

Additional tools and resources

Utilize interactive tools available on pdfFiller to enhance your experience with the Maryland Worksheet. These tools can guide you through each step, ensuring you don’t miss critical areas of data entry. There are also various resources for assistance including guides, video tutorials, and direct links to official Maryland documents.

For further support, accessing the official Maryland resources can be invaluable. They offer up-to-date information regarding all forms, including any legal changes or updates to the requirements for the Maryland Worksheet.

Ensuring compliance and best practices

Compliance is paramount when filling out any worksheet, and the Maryland Worksheet is no exception. Ensure accuracy and adherence to regulations in your submissions. Regularly updating your knowledge on the latest changes to worksheets or associated laws can also help prevent issues and enhance your filing experience.

It’s beneficial to approach the management of personal and business forms proactively. By leveraging tools like pdfFiller, you can manage, edit, and store your documents efficiently, thereby easing the burden of documentation when it comes to compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland worksheet is available to be eSigned by others?

How can I get maryland worksheet is available?

How do I fill out maryland worksheet is available on an Android device?

What is Maryland worksheet available?

Who is required to file Maryland worksheet available?

How to fill out Maryland worksheet available?

What is the purpose of Maryland worksheet available?

What information must be reported on Maryland worksheet available?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.