Get the free Completing the Non-Tax Filer Form

Get, Create, Make and Sign completing form non-tax filer

Editing completing form non-tax filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out completing form non-tax filer

How to fill out completing form non-tax filer

Who needs completing form non-tax filer?

Completing Form Non-Tax Filer Form: A Comprehensive How-to Guide

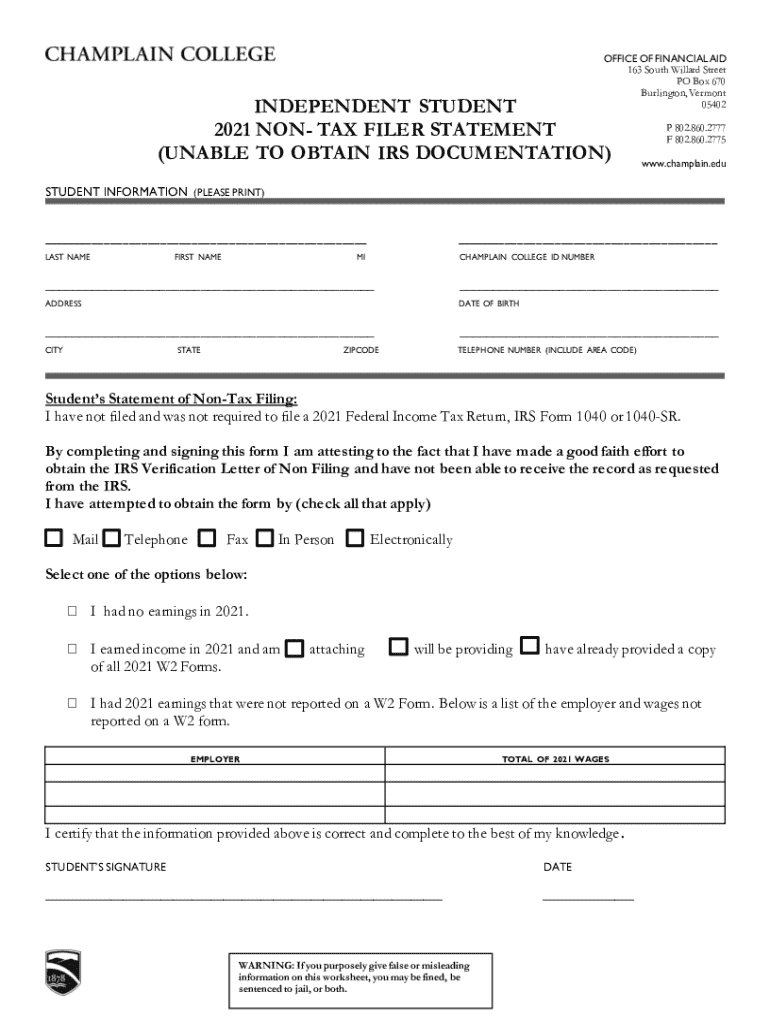

Understanding the Non-Tax Filer Form

The Non-Tax Filer Form is a crucial document for individuals who did not earn enough income to require filing a federal tax return. This form is specifically designed to assist people in various scenarios, such as applying for federal student aid or other government programs that require documentation of income. Understanding the significance of the Non-Tax Filer Form is essential for ensuring compliance and access to resources.

Getting Started with the Non-Tax Filer Form

Before diving into the completion of the Non-Tax Filer Form, it is crucial to determine whether you are indeed eligible to file as a non-tax filer. Criteria may include your income level, employment status, and whether you are claimed as a dependent on someone’s tax return. Utilize eligibility calculators available from various tax assistance providers or the IRS to confirm your status.

Once confirmed, gathering the right documentation is the next step. Essential documents typically include W-2 forms from your employer, bank statements, and identification documents. Organizing these documents efficiently can save a significant amount of time when you start filling out the form. Consider using folders or digital storage solutions to keep everything in one place.

Step-by-step instructions for completing the form

The first step in the process of submitting your Non-Tax Filer Form is to access it. The IRS provides the Non-Tax Filer Form on their official website. This can be conveniently downloaded as a PDF or filled out online in certain states which allow electronic submissions.

Once you have acquired the form, creating an IRS online account facilitates easier submissions. To set up this account, navigate to the IRS website and follow the prompts. Benefits of online submission include faster processing times and the ability to track your form efficiently.

Next, accurately fill out your personal identification information, including your name, address, and Social Security number. Double-checking this information is vital, as any errors could lead to processing delays. When prompted to specify your filing status—whether single, married, or head of household—make sure that you report any dependents correctly, providing their relevant information.

For those with minimal income, reporting it accurately is a significant part of your submission. If you earned income at all, such as through freelance work or odd jobs, include that data on the form. Familiarize yourself with common exceptions regarding income reporting to ensure compliance while filling out the form. After detailing your information, take the time to review and verify every section. Utilizing tools like pdfFiller helps in editing and verifying your document for accuracy.

Submitting Your Non-Tax Filer Form

After completing the form, the next step is to submit it. If submitting electronically, follow the instructions through your IRS online account to finalize your submission. For those opting for the traditional mail route, ensure that you send it to the correct address as specified by the IRS based on your location. Confirming your submission has been successful is critical, and you can check your status through your IRS account or even by calling their help center.

FAQs related to completing the Non-Tax Filer Form

While filling out the Non-Tax Filer Form, you may encounter certain questions. One common concern is what to do if you have not received confirmation post-submission. It's essential to check your email, including your spam folder, as confirmations often get filtered. If you still see no confirmation, consider reaching out to the IRS for assistance.

Additionally, if you need to amend submitted information, familiarize yourself with the IRS process for making corrections. If someone else submits the form on your behalf, ensure that they have your permission and follow proper granting of authority procedures. All these steps can help streamline your experience.

Additional support and resources

For those who find themselves needing more assistance, the IRS provides multiple avenues for help. They offer various contact methods, including phone support, where you can discuss specific queries regarding the Non-Tax Filer Form. Their website also features an extensive FAQ section, which could provide quick answers to common issues.

Other relevant forms, like IRS Form 4506-T, may also be beneficial depending on your situation. Furthermore, using platforms like pdfFiller can aid in managing all your documents efficiently, enabling features that simplify the form filling and editing process.

Final thoughts on completing your Non-Tax Filer Form

Successfully completing the Non-Tax Filer Form requires careful attention to detail, a clear understanding of your eligibility, and the right tools at your disposal. Best practices suggest keeping all records of your filing organized, perhaps even digitally using a document management platform like pdfFiller, to ensure easy retrieval if needed in the future.

Tracking your filing progress is also a wise move. Employ the features of pdfFiller’s tools for efficiency and ease throughout the entire process. Completing form non-tax filer form might seem daunting, but with the right guidance, you can navigate it with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit completing form non-tax filer online?

Can I create an electronic signature for signing my completing form non-tax filer in Gmail?

How do I complete completing form non-tax filer on an Android device?

What is completing form non-tax filer?

Who is required to file completing form non-tax filer?

How to fill out completing form non-tax filer?

What is the purpose of completing form non-tax filer?

What information must be reported on completing form non-tax filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.