Get the free LANDLORD INSURANCE APPLICATION

Get, Create, Make and Sign landlord insurance application

Editing landlord insurance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out landlord insurance application

How to fill out landlord insurance application

Who needs landlord insurance application?

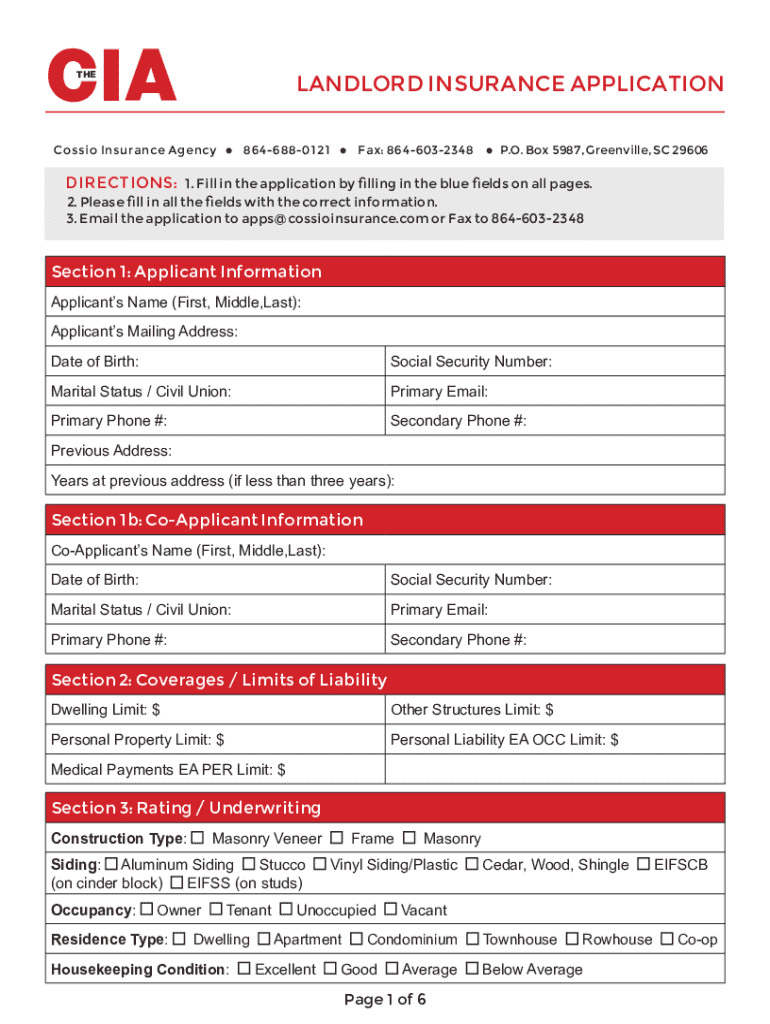

Comprehensive Guide to Landlord Insurance Application Form

Understanding landlord insurance

Landlord insurance is a specialized insurance policy designed to protect property owners renting out residential or commercial properties. This insurance is essential for landlords as it covers various risks associated with rental properties, offering peace of mind. Unlike homeowner's insurance, which provides coverage limited to primary residences, landlord insurance accounts for potential tenant-related risks and rental income protection.

For landlords, having adequate insurance is not just a recommended practice but often a necessity, especially in today’s litigious society. Additionally, understanding the distinctions between homeowner’s and landlord insurance is crucial. The former typically covers personal property and associated liabilities, while the latter focuses on the rental aspects, including property damage, loss of rental income, and tenant-related incidents.

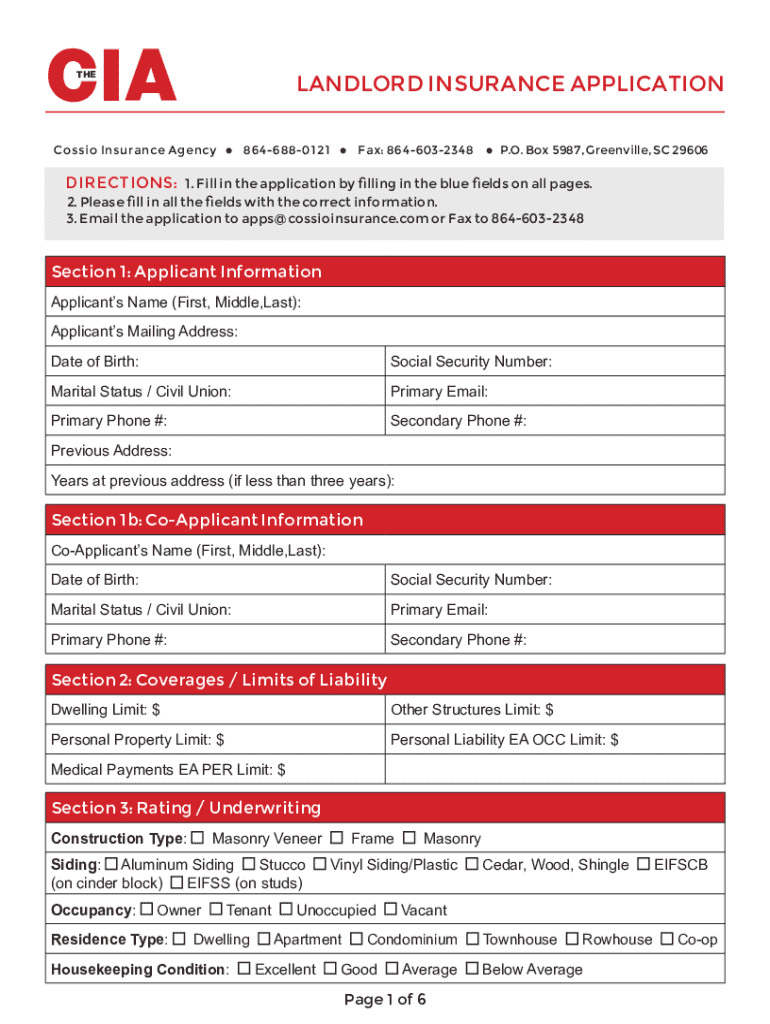

Key components of a landlord insurance application form

When filling out a landlord insurance application form, providing complete and accurate personal information is paramount. This ensures the underwriting process goes smoothly and avoids any delays. Key personal details typically include your full name, contact information, and any relevant identification numbers. Accuracy in this section helps form the foundation of your insurance coverage.

Equally important is the section dedicated to property information. You will need to specify the address and the type of rental property—whether it's a single-family home, multi-unit building, or commercial property. Further details such as the number of units and the current occupancy status provide the insurer with a comprehensive overview of the property’s rental situation.

Coverage options explained

Landlord insurance often comprises several coverage types, including building and contents coverage. This provides a safety net for the physical structure of the property, protecting against damages caused by perils such as fire, theft, or natural disasters. It also covers personal items and appliances provided for tenant use, which landlords might keep within the rental unit.

Liability coverage is another critical component, protecting landlords from legal expenses and claims arising from tenant injuries on the property. This can include medical payments for injuries or damages that a tenant may incur while renting your property, thus safeguarding your financial interests against various liability claims. Additionally, loss of income protection ensures that if your property becomes uninhabitable due to covered damages, you may still receive compensation for lost rental income.

The application process step-by-step

The journey to obtaining landlord insurance begins with gathering all necessary information. This includes compiling personal details, property specifics, and coverage preferences. For a smoother experience, using a checklist can help ensure you gather everything required before starting your application. Familiarity with your property’s details, including occupancy rates and previous claims, will also facilitate this step.

Once you have all required information at hand, it's time to fill out the application form. Pay careful attention to each section, ensuring that all questions are answered accurately. Common mistakes include incorrect property details, missing personal information, or failing to disclose prior claims history. After completing the form, submitting it promptly, whether online or through traditional mail, is essential. Be aware of varying timelines for approval, as these can influence when you receive coverage.

Insights on claims history

Your claims history is a critical factor when applying for landlord insurance. It reflects your history of filing claims, which influences the premiums you are offered. Be upfront about any previous claims, whether related to property damage, liability, or other incidents. A transparent claims history helps establish trust with the insurance provider and prevents any issues down the line.

To report your claims history accurately, compile a clear report detailing each event, the nature of the claims, and how they were resolved. Including specific dates and outcomes will give insurers a better understanding of your risk profile. Honesty in this section not only promotes a smoother application process but can also benefit you by helping to negotiate better terms and lower rates as a responsible landlord.

Duty of disclosure

As a landlord, understanding your duty of disclosure is vital. Insurance providers enforce strict requirements regarding the information you must share. This includes not only previous claims but also any factors that could influence the risk associated with insuring your property. Failing to disclose such information can result in denied claims or cancellation of your policy, leaving your investment and livelihood at risk.

To ensure compliance with your duty of disclosure, keep meticulous records of property changes, tenant interactions, and any incidents that may arise. Regularly review your property against your insurance policy requirements, adjusting your disclosures as necessary. This proactive approach helps maintain your coverage and provides clarity to your insurer about your rental situation.

Tailoring your coverage to specific needs

Every rental property comes with unique risks, necessitating a tailored insurance policy. Assessing potential risks specific to your rental market can inform decisions on the necessary coverage. Factors to consider include local crime rates, weather patterns, and tenant demographics, which can indicate the type of insurance best suited to your situation.

Customizing your policy might involve adding renters’ liability insurance or considering umbrella policies for greater coverage. It’s essential to evaluate what specific circumstances could pose greater risks to your property, ensuring your insurance adapts to the distinct needs present in your rental agreement. Strongly consider consulting an insurance professional to discuss your options.

Managing your policy over time

Once you obtain a landlord insurance policy, it’s vital to stay engaged with its terms and requirements. The renewal process typically requires a review of your current policy coverage, ensuring it aligns with any changes in your property or rental situation. Staying informed about policy changes or updates from your insurer is equally important to maintain adequate protection.

Adjusting your coverage levels may become necessary anytime there’s a change in property value, an addition of new units, or higher tenant turnover. Regularly assessing your policy ensures that you are not under-insured or overpaying for unnecessary coverage, thereby optimizing your rental insurance strategy. Keeping an open dialogue with your insurance provider will facilitate timely changes to tailor your policy to your current needs.

Resources for landlords

Navigating the world of landlord insurance doesn’t have to be overwhelming, especially with tools available through pdfFiller. The pdfFiller platform offers interactive solutions, allowing landlords to edit and manage their insurance documents easily. Whether you're filling out application forms or updating your coverage details, pdfFiller streamlines document management, saving you time and effort.

Additionally, understanding legal considerations is crucial as a landlord. Zoning laws, tenant rights, and other regulations affect both your responsibilities and liabilities as a property owner. Consulting legal experts can provide valuable insights into these areas, ensuring you stay compliant and protected in your landlord journey.

Protecting your rental investment

To maintain your rental investment, risk management strategies are essential. Best practices include engaging in regular property maintenance, inspections, and updates that reduce risks of damage or loss. This proactive approach goes a long way in securing your property and can also result in lower insurance premiums.

Additionally, preparing for unforeseen issues is crucial. Establishing a contingency plan for emergencies helps mitigate risks associated with sudden repair needs or tenant liabilities. Make sure you have essential contacts readily available for emergencies, ensuring you’re never left scrambling during a crisis.

Success stories and testimonials

Real-life examples abound of landlords who have successfully navigated the nuances of landlord insurance to protect their investments. Many have benefited from a well-structured insurance policy, allowing them to recover quickly after unpredictable events such as fire damage or tenant injuries. These success stories not only highlight the importance of thorough preparation but also demonstrate how proper coverage leads to peace of mind.

Testimonials from satisfied landlords underscore the value of a tailored insurance policy. They share experiences about how their proactive risk management, coupled with appropriate insurance coverage, significantly cushioned their financial exposure to various risks, offering a testament to the importance of proper preparation and good communication with insurers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send landlord insurance application for eSignature?

How do I edit landlord insurance application straight from my smartphone?

How do I fill out landlord insurance application using my mobile device?

What is landlord insurance application?

Who is required to file landlord insurance application?

How to fill out landlord insurance application?

What is the purpose of landlord insurance application?

What information must be reported on landlord insurance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.