Get the free Form 4506-T must be completed

Get, Create, Make and Sign form 4506-t must be

How to edit form 4506-t must be online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4506-t must be

How to fill out form 4506-t must be

Who needs form 4506-t must be?

Form 4506-T Must Be Form

Understanding IRS Form 4506-T: A Comprehensive Overview

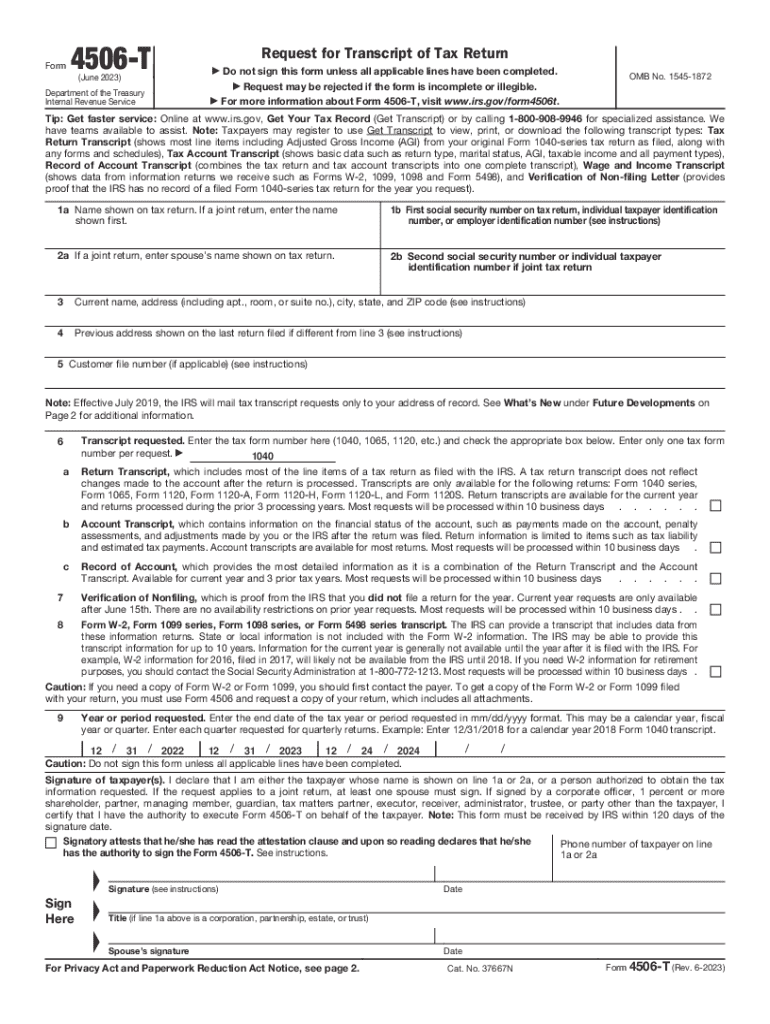

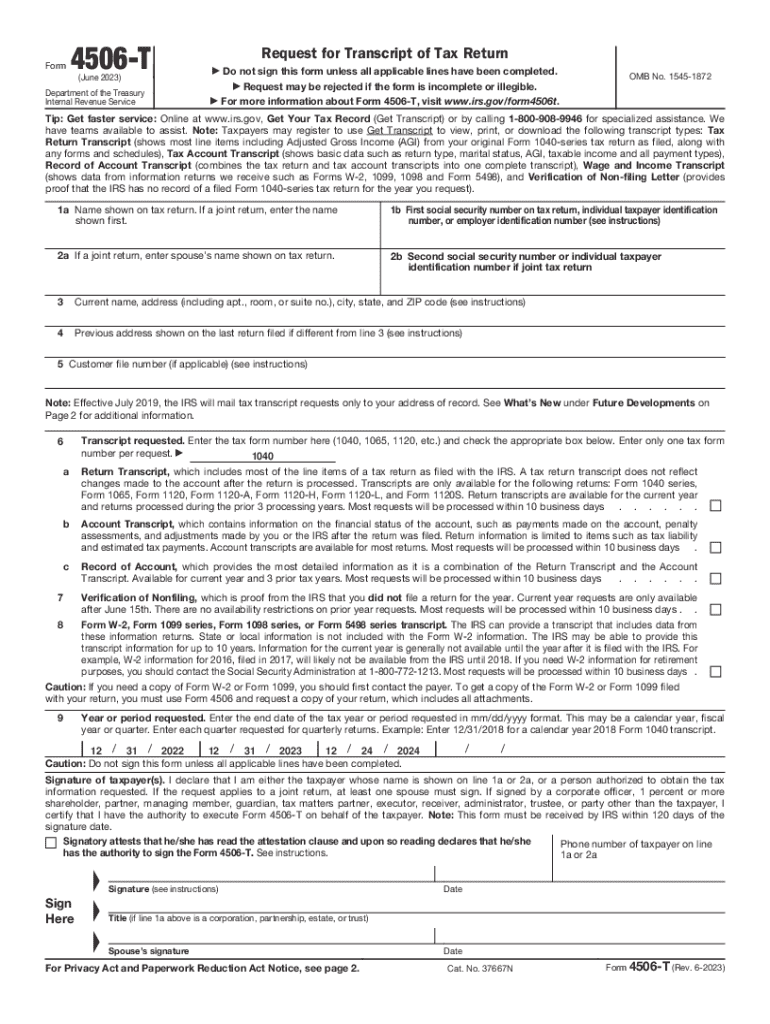

IRS Form 4506-T is a crucial document that allows taxpayers to request a transcript of their tax returns from the IRS. This form is essential for individuals and businesses seeking to verify past income for various financial purposes, such as loan applications or mortgage approvals. A tax transcript is a summary of one's tax return information, typically needed after a taxpayer has filed their return.

The importance of Form 4506-T stems from its ability to provide an official record of a taxpayer's financial history. Financial institutions often require this documentation when assessing the creditworthiness of loan applicants. Beyond loans, recipients may utilize the transcripts for tax audits or to satisfy requests from state agencies or other governmental bodies.

This form becomes necessary in various situations, particularly when traditional tax returns cannot be provided or when financial institutions specify the need for official documentation. For instance, if you are applying for a federal student loan, or if there are discrepancies in your tax files, this form is a valuable tool to obtain accurate financial records.

Key features of Form 4506-T

Form 4506-T has several key features that enhance its utility. One significant aspect is that it allows users to request various types of tax transcripts. Taxpayers can request the IRS to provide different forms of transcripts, including the Return Transcript, Account Transcript, and Record of Account, depending on their specific needs.

The benefits of using Form 4506-T are manifold. First, it streamlines the process of obtaining necessary tax documents, making it faster and easier to fulfill financial requirements. Additionally, the form's simplicity reduces the likelihood of errors during submission, allowing taxpayers and institutions to access accurate information efficiently. This is particularly advantageous for lenders who need immediate and trustworthy documentation to expedite loan processing.

How to obtain IRS Form 4506-T

Obtaining IRS Form 4506-T is straightforward. The form is readily available on the IRS website, IRS.gov, where users can easily download it in PDF format. Additionally, pdfFiller provides convenient access to the form, enabling users to complete and manage their documents efficiently.

In terms of fees and processing times, it’s important to note that requesting a transcript using Form 4506-T is generally free of charge. However, if you require a paper copy of prior tax returns, the IRS may charge a nominal fee. Processing times can vary based on the volume of requests, with most transcripts taking about 5 to 10 business days to be delivered.

Step-by-step guide on how to complete Form 4506-T

Filling out Form 4506-T can be easily accomplished with a step-by-step approach. First, it's critical to understand each section of the form. The top of the form asks for basic taxpayer identification information, including name, Social Security Number, and address. Each question must be answered accurately to ensure the request is processed without delay.

Common mistakes often occur when parties overlook required details or mix up the tax years for which transcripts are being requested. It's crucial to review the completed form thoroughly to avoid these errors. Additionally, ensure that all signatures are included where necessary, as the IRS requires a signed form for processing.

Alternatives to Form 4506-T

While Form 4506-T is a popular option for obtaining tax transcripts, there are alternatives available. One alternative is accessing the IRS’s online service, where taxpayers can create an account and request transcripts instantly. This option is ideal for those with immediate needs, as users can often get results without having to wait for postal delivery.

Moreover, some may wonder about the differences between Form 4506 and Form 4506-T. While both forms are used to request tax information, Form 4506 is specifically for obtaining complete copies of tax returns for a fee, while Form 4506-T provides a free summary of the data in transcript form. Understanding these distinctions helps taxpayers choose the appropriate form for their specific needs.

Privacy considerations and protecting personal information

Security is paramount when submitting sensitive documents like Form 4506-T. It's essential to employ secure submission practices, especially when sending personal information through the mail or online. For instance, using encrypted email or secure fax services shields your data from unauthorized access. Always ensure that the recipient's security practices meet your standards.

It's also vital to understand the data privacy risks involved when providing personal information on this form. Tax records contain sensitive data that can lead to identity theft if mishandled. Thus, always limit the amount of personal information shared, and when possible, utilize services from trusted providers like pdfFiller, which employs robust security measures to safeguard user data.

FAQs related to Form 4506-T

One of the common questions is: How long does it take for Form 4506-T to process? Typically, processing lasts between 5 to 10 business days, but factors such as the current volume of requests can affect this timeline.

Another frequent inquiry revolves around the purpose of Form 4506-T. Users often seek this form for verifying income when applying for loans or when facing audits. Lenders indeed request this form to ensure the income details provided by applicants align with IRS records.

Information required on Form 4506-T includes taxpayer identification details as well as specific information about the type of transcript and the tax years requested.

Supporting resources for users of Form 4506-T

For taxpayers seeking more assistance in managing Form 4506-T, additional resources are available through pdfFiller. The platform not only facilitates the filling and editing of the form but also offers various tools to streamline document management. Users can benefit from built-in eSignature features and collaborative support, providing a comprehensive solution for all their document needs.

Furthermore, pdfFiller's customer support service offers consultation services to guide users through completing and submitting the form correctly. With dedicated support, users can have peace of mind that they are navigating the process effectively and securely.

Real-world applications of Form 4506-T

Form 4506-T has played a pivotal role in various successful financial transactions. For example, homebuyers often utilize this form to validate their income during mortgage applications, ensuring that lenders can move forward with confidence in the borrower’s declared financial history. Similarly, businesses have leveraged the form when undergoing loan application processes to establish creditworthiness, ultimately helping them secure necessary funding.

Testimonials abound illustrating how Form 4506-T facilitates financial processes across diverse scenarios. Whether it's someone refinancing their mortgage for better rates or a small business securing capital for expansion, the transcript obtained via Form 4506-T is instrumental in expressing financial reliability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 4506-t must be without leaving Google Drive?

How do I make changes in form 4506-t must be?

How do I edit form 4506-t must be on an iOS device?

What is form 4506-T?

Who is required to file form 4506-T?

How to fill out form 4506-T?

What is the purpose of form 4506-T?

What information must be reported on form 4506-T?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.