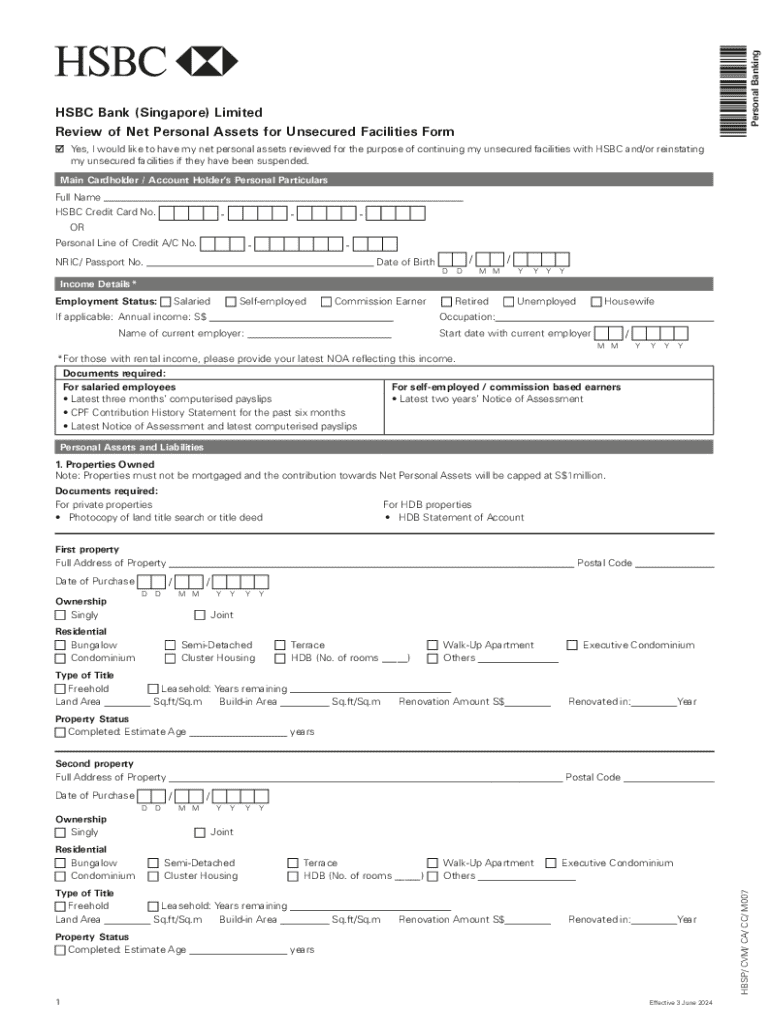

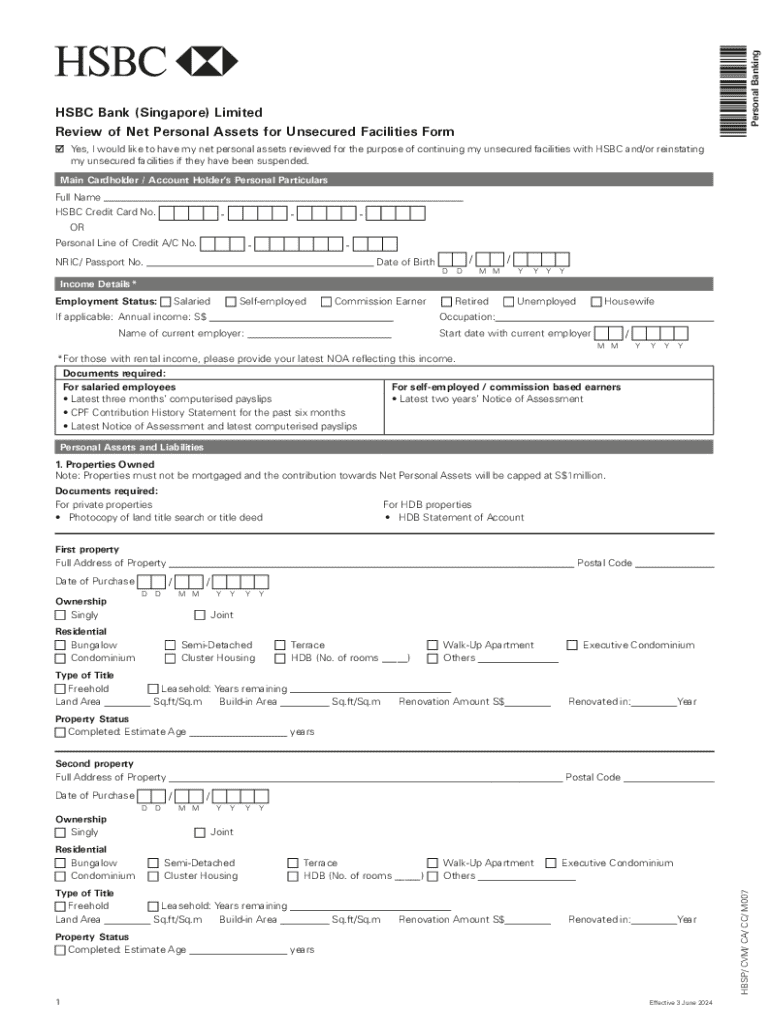

Get the free financial assetsLatest bank statement (or last 3 months ...

Get, Create, Make and Sign financial assetslatest bank statement

Editing financial assetslatest bank statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assetslatest bank statement

How to fill out financial assetslatest bank statement

Who needs financial assetslatest bank statement?

Financial Assets Latest Bank Statement Form: A Comprehensive Guide

Understanding financial assets and their importance

Financial assets encompass various resources that provide economic benefits. They serve as a crucial foundation for personal and business wealth management. Such assets can be easily converted into cash or held for potential future value appreciation.

Common types of financial assets include cash and cash equivalents, stocks and bonds, and real estate assets. Cash and cash equivalents, such as savings accounts, provide immediate liquidity. Stocks and bonds represent equity and debt investments, respectively, which can yield dividends and interest over time. Real estate assets not only appreciate in value but can also generate rental income.

Bank statements play a pivotal role in managing these financial assets. They provide a detailed overview of an individual’s or organization’s financial standing, showcasing how assets have been utilized over time. Monitoring bank statements can help prevent unauthorized transactions and identify spending trends.

Overview of bank statement forms

A bank statement form is a document issued by banks that provides a summary of an account holder’s transactions over a specified period, usually monthly. It includes details like deposits, withdrawals, and account balances, giving a clear picture of financial activity.

These forms are essential for several purposes, including personal finance management, supporting loan applications, and assisting in tax preparation. Individuals use them to assess their spending habits and savings. During loan applications, lenders often request them to verify an applicant's financial status.

The latest bank statement form incorporates advanced features that enhance clarity and usability, such as graphical representations of transactions and alerts for unusual activities, making it easier for holders to manage their finances.

The latest bank statement form explained

The latest bank statement form typically consists of several key sections. These include account holder information, a summary of transactions, and the ending balance along with interest earned. Each section is designed to provide clarity on the account’s financial performance over the specified period.

The account holder information section identifies the account’s owner and relevant details like account number and contact information. The transaction summary highlights deposits, withdrawals, and any fees incurred, allowing users to understand their cash flow. Finally, the ending balance and interest earned give an overview of the account’s cumulative performance.

Interpreting a bank statement involves analyzing transaction details and understanding associated fees and charges. Identifying patterns in spending can help users budget more effectively.

Step-by-step guide to filling out the latest bank statement form

Preparing your documents is the first step toward filling out the latest bank statement form. Gather necessary information, including your identification, financial account numbers, and any transactions that occurred during the statement period.

When filling out the form, begin by accurately entering your account holder information; ensure names and numbers are correct. Next, move to the summary section, documenting each transaction type clearly. Pay attention to common mistakes such as misentering numbers or skipping details.

After completing the form, editing and reviewing are crucial. Minor mistakes can lead to financial discrepancies. An accurate bank statement form is vital for proper financial documentation.

Tools and resources for managing your bank statements

Using pdfFiller for handling bank statement forms offers numerous benefits. This cloud-based platform allows users to edit PDFs seamlessly, eSign documents, and collaborate on forms in real-time. It provides users with the convenience of accessing their financial documentation from anywhere.

Interactive features facilitate document management by enabling collaborative tools for teams. Users can securely store their forms and access them remotely, which enhances productivity and reduces the risk of lost documents.

Best practices for maintaining financial records

Organizing your financial documents is essential for effective financial management. Maintain a systematic filing system either digitally or physically. Regularly review bank statements to ensure accuracy and discover any discrepancies, thereby allowing timely corrections.

Technology plays a vital role in managing financial records. Numerous software options and mobile apps exist that help track expenses and income, providing insights into spending habits and helping with budgeting.

Case studies: success stories with bank statement management

Consider an individual case where a person improved their financial health by closely monitoring their bank statements. By analyzing variable expenses, they identified unnecessary subscriptions resulting in significant savings. Through diligent record-keeping and strategic financial planning, they enhanced their credit score.

In a team scenario, a financial institution streamlined its loan application process by utilizing accurate, timely bank statements. This not only expedited approvals but also minimized errors that typically delayed applications, improving client satisfaction.

In both cases, proper documentation and management of bank statements prevented financial pitfalls and facilitated informed decision-making.

Frequently asked questions about the latest bank statement form

Many users often ask how to request a copy of their bank statement. Typically, this can be done through online banking access, via customer support, or by visiting a local bank branch.

Another common concern is what to do if there are errors on a statement. Immediate communication with the bank is crucial, as they can assist in rectifying inaccuracies swiftly. Furthermore, most experts recommend keeping financial records for at least three to seven years, especially for tax-related documentation.

Conclusion: the value of accurate financial documentation

In summary, bank statements are vital documents that provide insight into financial health. Accurate record-keeping ensures that you make informed financial decisions. Embracing digital tools such as pdfFiller empowers users to enhance their document management efficiency, offering a streamlined approach to financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the financial assetslatest bank statement electronically in Chrome?

How can I edit financial assetslatest bank statement on a smartphone?

How do I fill out financial assetslatest bank statement on an Android device?

What is financial assetslatest bank statement?

Who is required to file financial assetslatest bank statement?

How to fill out financial assetslatest bank statement?

What is the purpose of financial assetslatest bank statement?

What information must be reported on financial assetslatest bank statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.