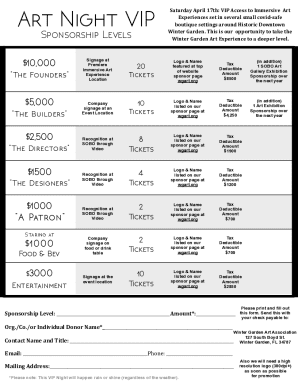

Get the free Account aggregator Process note. Fetching customer bank statement from FIPs using AA...

Get, Create, Make and Sign account aggregator process note

Editing account aggregator process note online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account aggregator process note

How to fill out account aggregator process note

Who needs account aggregator process note?

Account Aggregator Process Note Form - How-to Guide

Understanding account aggregators

Account aggregators serve as indispensable tools in the realm of personal finance, enabling users to view and manage their financial data across multiple platforms in one place. These services allow individuals to connect various financial accounts, like bank accounts, investment portfolios, and credit cards, providing a consolidated view of their financial landscape.

The importance of account aggregation lies in its ability to simplify financial management. Instead of logging into each separate account, users can monitor all their financial data through a single interface, saving both time and effort. By offering enhanced data accessibility and sharing, account aggregators empower users to make informed financial decisions based on comprehensive insights.

The importance of the account aggregator process note form

The account aggregator process note form holds significant importance in anchoring the entire account linking process. It acts as a documented record of the methods involved in sharing financial data among various parties. This documentation is crucial for both transparency and accountability, ensuring that all participants are aware of their roles and responsibilities.

One of the primary purposes of the process note form is to ensure compliance with regulatory mandates. With various privacy laws such as the GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), documenting consent mechanisms and data permissions is vital. This not only safeguards user data but also enhances trust between the stakeholders involved.

How to create an account aggregator process note form

Creating an account aggregator process note form is a straightforward task with pdfFiller. The platform offers user-friendly tools that simplify the documentation process across each step. Here’s how to get started.

First, access the process note form via pdfFiller. This versatile tool offers various templates tailored to meet the specific needs of account aggregation. Once you find your desired template, fill out the required information, ensuring accurate input of participant details and consent options.

Managing consent and data sharing

Consent management is a critical aspect of the account aggregation process. Users must provide explicit consent before their financial data is shared or accessed, ensuring they maintain control over their personal information. This becomes even more significant when considering the regulatory frameworks governing such consent, like the GDPR and CCPA.

To effectively manage consent within the account aggregator framework, it's vital to provide clear instructions on how users can grant or revoke their consent at any time. Ensuring users understand the scope of the data being shared, along with their rights under the law, can significantly enhance compliance and trust in the process.

Stakeholders in the account aggregation process

The account aggregation process involves multiple stakeholders, each playing a unique role. Banks and financial institutions are vital participants, providing the data that aggregators will display in one consolidated view. Meanwhile, account aggregators act as intermediaries, facilitating the flow of data while ensuring security and compliance.

Understanding the responsibilities of each stakeholder is essential. Financial institutions must ensure they securely share user data, while aggregators must have robust systems in place to protect that data. Clear communication between all parties can enhance the efficacy of the account aggregation process.

Advanced features of pdfFiller for account aggregators

PdfFiller offers advanced features that enhance the experience of managing the account aggregator process note form. Collaborative tools enable team members to work together in real-time, editing documents and providing feedback instantly, making the process more efficient.

Additionally, pdfFiller’s eSigning capabilities allow users to sign documents electronically, streamlining the consent process. This not only saves time but also enhances the user experience by minimizing the need for physical documents.

Case studies and success stories

Real-world applications of account aggregators demonstrate profound efficiency improvements in the documentation and data-sharing process. Companies leveraging the aggregated approach have reported increased data accuracy and better compliance with regulations due to extensive documentation practices.

User testimonials reflect a high satisfaction rate among pdfFiller users. Many have found that the platform not only simplifies the documentation process but also enhances collaboration, making it a preferred choice for both individuals and teams engaged in financial management.

Frequently asked questions (FAQs)

Filling out the account aggregator process note form can often lead to questions about specific common issues. Users frequently seek troubleshooting tips on how to address errors or confusion that may arise during the form-filling process.

Additionally, concerns regarding regulatory compliance have been at the forefront of user queries. As data sharing regulations evolve, users require updated guidance to remain compliant while using account aggregation services.

Interactivity and user engagement

PdfFiller enhances user engagement through a variety of interactive tools and resources. Accessing tutorials, videos, and webinars can significantly improve user understanding and proficiency of the account aggregator process note form.

In addition, the pdfFiller community provides a platform where users can share their experiences and seek assistance. Building a network not only enhances personal insights but also fosters a supportive environment for learning about effective document management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the account aggregator process note electronically in Chrome?

How do I fill out account aggregator process note using my mobile device?

How can I fill out account aggregator process note on an iOS device?

What is account aggregator process note?

Who is required to file account aggregator process note?

How to fill out account aggregator process note?

What is the purpose of account aggregator process note?

What information must be reported on account aggregator process note?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.