Get the free Unit Trust Funds Corporate Application Form

Get, Create, Make and Sign unit trust funds corporate

How to edit unit trust funds corporate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unit trust funds corporate

How to fill out unit trust funds corporate

Who needs unit trust funds corporate?

Unit Trust Funds Corporate Form - A Comprehensive How-to Guide

Understanding unit trust funds

Unit trust funds represent a collective investment scheme where multiple investors pool their money to purchase assets managed by professionals. The funds are structured to allow investors to gain exposure to a diversified portfolio, which may include equities, fixed income securities, and other investment types.

Unit trust funds typically operate under a trust structure, wherein the investors hold units in the trust rather than direct ownership of the underlying assets. This facilitates easier transactions and pricing based on the net asset value (NAV) of the units, making it a suitable choice for varying investor profiles.

The regulatory framework ensures these unit trusts operate transparently and adhere to investor protections, thus instilling confidence among participants.

Investors are attracted to unit trusts for their potential benefits, including diversification, which minimizes risk across a variety of assets, professional management from experienced fund managers, and enhanced accessibility for retail investors who might lack the expertise or funds for direct investment.

Exploring the corporate form of unit trust funds

The corporate form of unit trust funds is a legal structure where the fund operates as a corporation, providing a distinct set of rights and obligations for investors. Unlike traditional unit trust schemes, a corporate form grants shareholders ownership through shares rather than units, making it essential for investors to understand the implications.

This structural change introduces differences in management, voting rights, and tax implications. Corporate unit trusts may also evade certain regulatory constraints applicable to conventional trusts, thus allowing for more flexibility in operation and marketing.

Investors in a corporate form unit trust enjoy a more defined scope of rights and structural clarity that can appeal to those seeking a certain degree of stability and security in their investment.

Key components of unit trust funds corporate form

A fundamental element shaping unit trust funds in a corporate structure is their memorandum and articles of association. These documents outline the objectives, rights, and regulations guiding the operation of the fund, including the relationship between directors and shareholders.

Shareholder rights typically entail voting on important issues, receiving dividends, and access to financial reports. This contrasts with unit holders in regular trusts who may have limited rights beyond their investment interests.

Understanding these key components is crucial for potential investors as they determine the framework within which unit trust funds operate, enhancing both accountability and investment assurance.

How to fill out unit trust forms

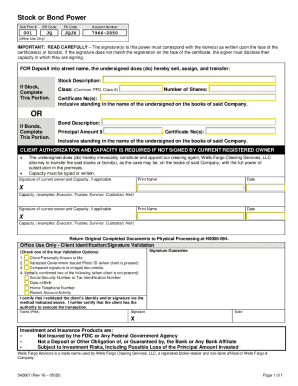

Filling out the necessary forms for unit trust investment is a critical step in the investment journey. There are essential forms to consider, beginning with the registration form, which establishes your identity as a prospective investor, and the investment application form, detailing your intended investment amounts.

Gathering the necessary information, such as personal identification details and financial information related to your investment, is paramount before embarking on the form completion process.

To ensure a smooth application process, focus on common errors to avoid, such as inaccurate information or missing documentation that could delay your application. Verify your forms against provided guidelines before submission.

Managing your unit trust fund investments

Once your unit trust fund investment is established, managing your portfolio becomes crucial for achieving your financial objectives. Monitoring performance through regular access to fund performance reports allows investors to remain informed about their investment's health.

Various tools and resources facilitate investment tracking, providing insights to make informed decisions about potential changes in investment allocations or new opportunities.

Successful management requires diligence in understanding the fee structures linked to your fund and the potential impact of these costs on your overall returns. A proactive approach will enable you to make timely alterations to your investment strategy.

Interactive tools for unit trust funds

Utilizing interactive tools can significantly enhance your investment management efforts. Online calculators for investment growth allow you to project potential returns based on varying assumptions, helping to guide your investment decisions.

pdfFiller provides customizable document templates that make completing necessary forms effortless. From registration to investment applications, these templates simplify the process, allowing you to maintain focus on your financial strategy.

Leveraging these tools can not only simplify the administrative aspects of unit trust investments but also foster better teamwork and efficiency among investment teams.

Insights into the unit trust investment landscape

Keeping informed about trends in unit trust fund performance is vital for making astute investment choices. Factors such as economic indicators, changes in interest rates, and global market fluctuations can considerably influence performance dynamics and investor attitudes.

Investors should also remain vigilant for common mistakes that new investors often make, such as allowing emotions to dictate investment decisions or neglecting fundamental research before investing.

Thus, staying informed and being proactive about your investment can make a considerable difference in long-term success in the unit trust investment landscape.

Support and advisory services

Accessing advisory services can provide invaluable insights when investing in unit trusts. Given the complexity of the investment landscape, professional guidance can assist in navigating intricate market conditions and optimizing your portfolio.

Many investment firms also offer dedicated customer support to answer queries and facilitate smoother interactions between investors and fund management teams.

Reaching out for support ensures that investors leverage all the resources available to enhance their experience in the unit trust ecosystem.

Additional financial planning considerations

Incorporating unit trusts into your broader financial portfolio is a crucial aspect of effective investment planning. Understanding how these funds fit into retirement strategies or long-term financial goals enables individuals to make informed choices that align with their future needs.

Regularly reviewing your investment strategy is equally important. Market conditions and personal circumstances can change, necessitating adjustments in investment allocations to maintain alignment with your overarching financial objectives.

Thus, unit trust funds corporate form not only enhances investor engagement but also integrates seamlessly into sophisticated financial planning frameworks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in unit trust funds corporate without leaving Chrome?

Can I sign the unit trust funds corporate electronically in Chrome?

How do I edit unit trust funds corporate straight from my smartphone?

What is unit trust funds corporate?

Who is required to file unit trust funds corporate?

How to fill out unit trust funds corporate?

What is the purpose of unit trust funds corporate?

What information must be reported on unit trust funds corporate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.