Get the free 2/ L

Get, Create, Make and Sign 2 l

How to edit 2 l online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2 l

How to fill out 2 l

Who needs 2 l?

2 Form: A Comprehensive Guide

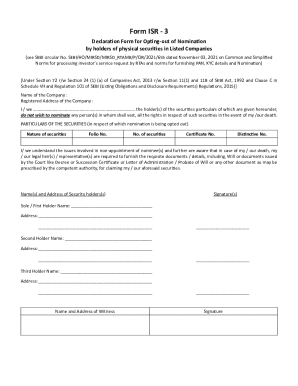

Overview of the 2 Form

The 2 L Form is a crucial document utilized primarily for tax-related purposes in various sectors, including finance and real estate. It serves as a declaration of income, expenditures, and other financial obligations, enabling individuals and organizations to report their financial status accurately to authorities. Understanding its application not only streamlines tax filing but also provides insights into personal and corporate financial health.

In the context of tax preparation, the 2 L Form consolidates essential data that helps in calculating tax liabilities and potential refunds. Its importance extends beyond mere compliance; it acts as a foundational document that informs financial planning, eligibility for loans, and even company insurance assessments.

Accessibility and editing options

Accessing the 2 L Form has never been easier thanks to digital solutions like pdfFiller. With just a few clicks, users can navigate to pdfFiller’s website, find the 2 L Form, and download it in a PDF format. This ease of access is crucial for timely submission, especially as tax deadlines approach.

Once downloaded, pdfFiller offers robust editing features that allow for smooth form completion. Users can fill in the required fields, add relevant images, and even include electronic signatures directly on the form. Such features simplify the process and ensure that all necessary information is captured before submission.

Detailed instructions for filling out the 2 Form

Completing the 2 L Form accurately is essential for ensuring compliance and avoiding delays. Here’s a step-by-step guide to help you through the process.

Step 1: Gather Necessary Information. Prior to filling out the form, collect all required data, including income statements, previous tax returns, and any relevant supporting documents. Refer to financial records and employer statements for precise figures.

Step 2: Start Filling the Form. Break down the sections methodically. Each part of the form should be addressed carefully. For instance, ensure that numerical entries are accurate and match your financial records to prevent discrepancies.

Step 3: Review Your Filling. This stage is crucial; proofreading your answers can significantly reduce the chance of errors. Take the time to compare your filled-out form with your gathered information.

Step 4: Save and Share. Once completed, pdfFiller allows you to easily save your progress. Utilize the sharing methods offered by the platform to send the form to accountants or tax professionals without hassles.

Managing and storing the 2 Form

Effective document management is vital for both personal and professional organization. When it comes to the 2 L Form, consider whether you want to maintain physical copies or rely on electronic storage. The latter offers greater convenience and security.

Utilizing pdfFiller’s Document Management System enhances your ability to track and retrieve the 2 L Form easily. With a user-friendly dashboard, you can categorize forms, implement tagging systems, and search for documents rapidly, significantly improving your organizational workflow.

Common challenges and solutions

Every user encountering the 2 L Form may face challenges, particularly with completing it accurately. Frequent mistakes include misinterpreted financial data and omitted sections. Being aware of these common pitfalls can greatly enhance the accuracy of your submission.

When technical issues arise, users may encounter problems filling out fields or saving progress. pdfFiller provides assistance and customer support, making troubleshooting straightforward. Reach out for guidance to resolve any technical questions.

Related forms and templates

The 2 L Form is often linked with a variety of other forms that facilitate comprehensive financial reporting. Commonly associated forms can include the Itemized Deduction Schedule and Self-Employment Tax Calculator.

Each of these forms plays a vital role in filling out the 2 L Form correctly. They add layers of detail to your overall financial reporting and can provide supplementary information required for specific scenarios such as deductions or tax credits.

User guides and tutorials

Visual learners might find video tutorials useful when trying to navigate the 2 L Form. Various online resources can guide you through the completion process with step-by-step instructions. Always check for the latest tutorials to ensure you’re up-to-date with any changes.

If you prefer written guides, pdfFiller offers extensive documentation on advanced editing features. Users can learn how to apply tools for complex needs including collaborative features and document sharing.

Future updates and changes to the 2 Form

The financial landscape is ever-evolving, and staying informed about potential updates to the 2 L Form is crucial. Regulatory changes can occur due to shifts in tax laws, which may require you to adapt your filing practices to ensure compliance.

To keep abreast of new requirements, regularly check updates from authoritative financial agencies. Adapting quickly to revisions ensures that you maintain accuracy and compliance with existing tax regulations.

Connecting with pdfFiller

Engaging with the pdfFiller community gives users a platform to exchange knowledge and solutions. Providing feedback on your experiences can help enhance the platform for future users. Sharing insights about the 2 L Form can cultivate a supportive environment that values user experience.

To stay updated on new features, consider subscribing to newsletters from pdfFiller. These newsletters often include information on updates, special features, and tips for maximizing the benefits of their document management system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2 l for eSignature?

Can I create an electronic signature for signing my 2 l in Gmail?

How do I fill out 2 l on an Android device?

What is 2 l?

Who is required to file 2 l?

How to fill out 2 l?

What is the purpose of 2 l?

What information must be reported on 2 l?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.