Get the free BUSINESS CONTRIBUTION FORM - GO For Catholic Schools

Get, Create, Make and Sign business contribution form

Editing business contribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business contribution form

How to fill out business contribution form

Who needs business contribution form?

Business Contribution Form - How-to Guide

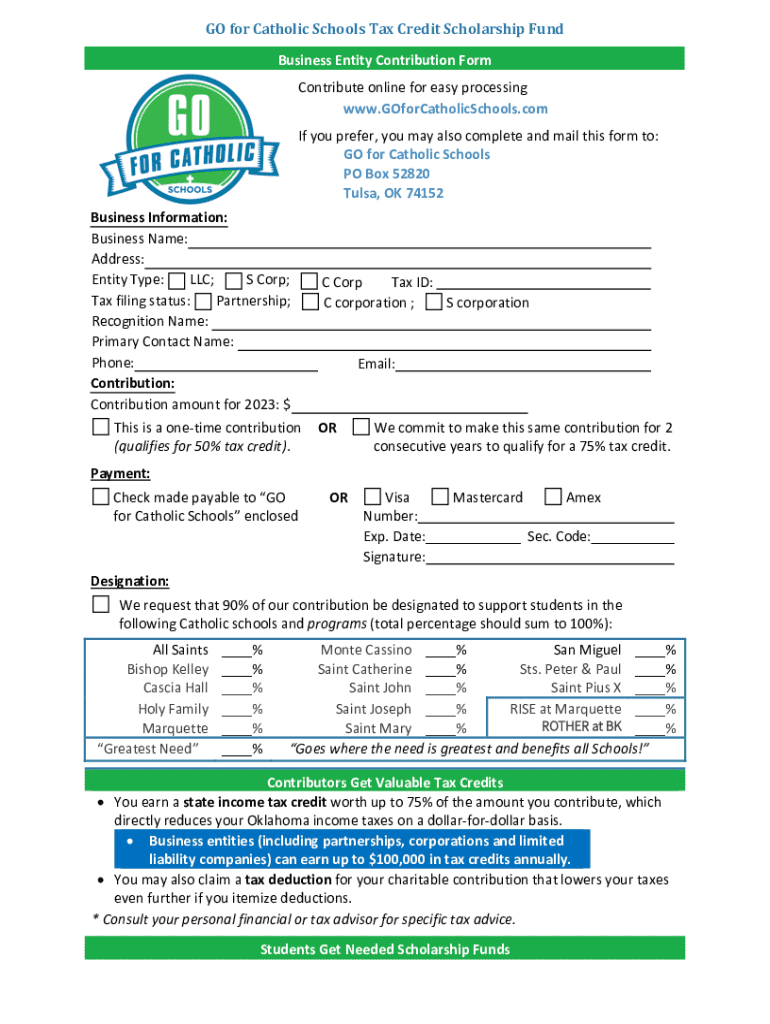

Understanding the Business Contribution Form

A Business Contribution Form is a crucial document used by businesses to record contributions made by various stakeholders, including investors, partners, and employees. This form captures essential details regarding the nature and scope of contributions, which can vary widely from financial investments to assets or services rendered.

The importance of utilizing a Business Contribution Form cannot be understated. It serves as a formal record that helps in maintaining transparency and accountability in business operations. Moreover, it ensures that all contributions are documented accurately, which can be vital for financial reporting, tax purposes, and even compliance with legal requirements.

Common situations requiring a Business Contribution Form include initial funding rounds, partnership agreements, and the acquisition of new assets. Understanding when and how to use this form can significantly streamline business processes and enhance organizational efficiency.

Key components of the Business Contribution Form

The Business Contribution Form consists of several essential fields that capture necessary information about both the contributor and the contribution itself. These components ensure clarity and facilitate smoother processing.

Additionally, it may be beneficial to include further information like the purpose of the contribution, the date of the contribution, and signatures from both the contributor and an authorized representative of the business. These extra details help emphasize the intention behind the contribution.

Step-by-step guide to completing the Business Contribution Form

Completing the Business Contribution Form requires a systematic approach to ensure accuracy and completeness. Follow these steps for a smooth process.

Editing and customizing your Business Contribution Form

pdfFiller offers powerful editing tools that enable users to customize their Business Contribution Form as needed. This functionality can be crucial for businesses with specific formatting or informational requirements.

Formatting tips include using clear fonts, consistent colors, and ensuring adequate spacing, which contribute to professionalism and clarity.

Signing and submitting the Business Contribution Form

Once completed, the Business Contribution Form must be signed by all relevant contributors. Electronic signatures have become a legally accepted method of signing documents, making this process efficient and secure.

Managing your Business Contribution Form post-submission

After submitting the Business Contribution Form, effective management is vital. pdfFiller provides a robust cloud-based system for storing and accessing completed forms, ensuring you can retrieve documents whenever necessary.

Troubleshooting common issues with the Business Contribution Form

While using the Business Contribution Form, users may encounter challenges that could hamper the process. Understanding common issues can facilitate quicker resolutions.

Thus, having a troubleshooting guide handy can save time and assist in understanding how to use the tools effectively.

FAQs about the Business Contribution Form

Frequently asked questions can provide clarity on common concerns surrounding the Business Contribution Form.

Final tips for a smooth Business Contribution experience

To ensure a seamless experience when completing and submitting the Business Contribution Form, adhering to best practices is essential. Make sure to review all entries, utilize the tools provided by pdfFiller effectively, and communicate transparently with all stakeholders involved.

Additional tools and features from pdfFiller

pdfFiller not only simplifies the Business Contribution Form but also offers various additional forms and templates related to business contributions. These resources can significantly expedite the documentation process and improve workflow efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business contribution form to be eSigned by others?

How can I get business contribution form?

Can I create an electronic signature for signing my business contribution form in Gmail?

What is business contribution form?

Who is required to file business contribution form?

How to fill out business contribution form?

What is the purpose of business contribution form?

What information must be reported on business contribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.