Get the free Life & Disability Solutions

Get, Create, Make and Sign life amp disability solutions

How to edit life amp disability solutions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out life amp disability solutions

How to fill out life amp disability solutions

Who needs life amp disability solutions?

Life and Disability Solutions Form - How-to Guide

Understanding life and disability solutions

Life and disability insurance are essential components of financial planning. These types of insurance provide protection against unforeseen events that could disrupt your income or the financial stability of your family. Life insurance ensures that your loved ones have financial support after your death, while disability insurance offers income replacement if you're unable to work due to a disability. Understanding these products is critical, not only for your personal financial security but also for the well-being of those who depend on you.

Forms play a crucial role in applying for these insurance products. They collect vital information needed by insurers to assess risks and determine coverage eligibility. Proper completion of these forms can significantly influence the approval process and the benefits you'll receive.

Introduction to the life and disability solutions form

The life and disability solutions form is designed to gather comprehensive information necessary for underwriting life and disability insurance. The primary purpose of this form is to assess the applicant's risk level while ensuring that insurers can provide tailored coverage options. Individuals facing life changes such as marriage, parenthood, or a new job are particularly encouraged to consider this form as part of their financial planning.

This form is particularly useful for anyone seeking to secure their financial future or that of their dependents. The primary users include individuals, families, or business owners who want to protect their livelihood. Key benefits of using the life and disability solutions form include streamlined processing, potential cost savings on premiums, and the ability to customize insurance policies according to specific needs.

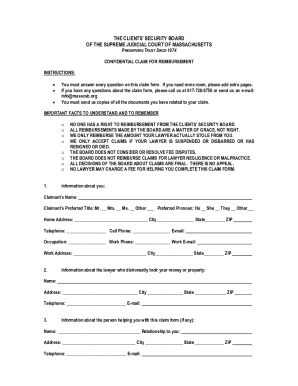

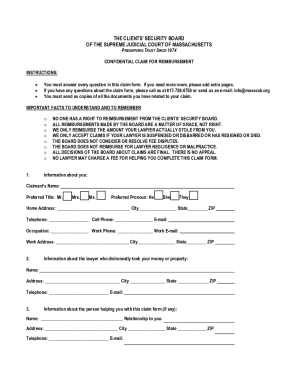

Preparing to fill out the life and disability solutions form

Before diving into the completion of the life and disability solutions form, it's important to gather certain information and documentation. Having these details at hand will expedite the process and ensure accuracy. Required personal information typically includes your full name, date of birth, and address. Additionally, you'll need to provide information regarding your coverage preferences, such as the amount of coverage you desire and any specific options that might suit your lifestyle.

Common challenges faced during this process include remembering specific health-related details or estimating your coverage needs accurately. To overcome these challenges, consider consulting with financial advisors or insurance professionals who can provide valuable insights tailored to your situation.

Step-by-step guide to filling out the life and disability solutions form

The life and disability solutions form can be broken down into several key sections. Each section is important in providing insurers with a complete view of your needs and circumstances. Start with entering your personal details accurately, followed by selecting the coverage options that best fit your lifestyle and financial goals.

Best practices for ensuring accuracy include double-checking all entered information, using straightforward language, and avoiding technical jargon. When filling out the form, consider common questions that may arise, such as what to do if you're unsure about a health condition or how to estimate your life insurance needs.

Editing, signing, and submitting the form

Once you have completed the life and disability solutions form, the next step involves editing, signing, and formally submitting the document. pdfFiller offers a user-friendly platform to assist with this process. You can easily edit the form online to ensure all information is accurate and complete.

When it comes to submission, you have several options. Many companies now offer online submission methods that are quicker and more efficient. However, if you prefer traditional methods, understand the protocol for printing and submitting the form by mail. Always ensure to confirm submission requirements with your insurance provider.

Managing your life and disability solutions documents

Post-submission, staying informed about your application status is crucial. Tracking your application allows you to anticipate any additional information requests from insurers or changes in processing status. Understanding the next steps after submitting your form ensures you're prepared for potential outcomes, like receiving coverage approval or needing to resubmit additional documents.

Utilizing secure cloud storage solutions or apps like pdfFiller can help you manage your documents effectively and safeguard against data loss or unauthorized access.

Resources for further support

For individuals seeking additional support with life and disability insurance, various resources are available. Government and private programs offer supplementary benefits and guidance tailored to specific situations. Utilize links provided by your insurance provider to access relevant resources.

Engaging with communities can further enhance your understanding of insurance options and claims processes, making your experience smoother and more informed.

Frequently asked questions about life and disability solutions forms

Navigating the expectations surrounding life and disability insurance can often give rise to numerous questions. Common inquiries may focus on clarifying policy terms and conditions or troubleshooting issues that arise while completing forms.

Utilizing support services can prove beneficial in resolving such challenges, ultimately leading to a smoother application process.

Success stories: How life and disability solutions make a difference

Real-life testimonials shed light on how life and disability solutions impact individuals and families. Hearing from others who have successfully navigated their insurance claims can be inspiring and informative. For example, many people recount scenarios where life insurance provided financial security for their families during times of loss.

These stories not only illustrate the importance of correctly filling out the life and disability solutions form but also reinforce the reassurance that comes with being prepared.

Getting started with pdfFiller

To fully utilize the benefits of pdfFiller in managing your life and disability solutions documents, creating an account is your first step. With a straightforward signup process, you can quickly access an array of tools designed for document handling.

By leveraging pdfFiller’s cloud-based platform, you can enhance your experience and streamline document management, all while ensuring the security of your sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life amp disability solutions for eSignature?

How do I make changes in life amp disability solutions?

Can I sign the life amp disability solutions electronically in Chrome?

What is life amp disability solutions?

Who is required to file life amp disability solutions?

How to fill out life amp disability solutions?

What is the purpose of life amp disability solutions?

What information must be reported on life amp disability solutions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.