Get the free Coordinated Expenditures Made by Party

Get, Create, Make and Sign coordinated expenditures made by

Editing coordinated expenditures made by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coordinated expenditures made by

How to fill out coordinated expenditures made by

Who needs coordinated expenditures made by?

Coordinated Expenditures Made by Form: A Comprehensive Guide

Understanding coordinated expenditures

Coordinated expenditures refer to political spending that is made in conjunction with a candidate's campaign, and is often designed to support or promote that candidate. Unlike independent expenditures, which are made without any coordination with the campaign, coordinated expenditures may be subject to different legal conditions and limits. These expenditures are a critical component of campaign finance, shaping the landscape of political spending and influencing voter perceptions.

The importance of coordinated expenditures in campaign finance cannot be understated. They allow for a more structured approach to funding political efforts, ensuring that resources are directed efficiently and effectively. Additionally, understanding the rules governing these expenditures is essential for compliance with federal and state laws, which helps maintain the integrity of the electoral process.

Types of coordinated expenditures

Coordinated expenditures can be categorized into several key types, each with distinct processes and rules. One primary category includes individual contributions, which are often the backbone of many political campaigns. Individuals can contribute money to a campaign through specific forms that need to be correctly filled out for compliance with the law.

Organizational contributions represent another form of coordinated expenditures. These can come from non-profits or businesses actively supporting a candidate. The structures for these contributions can often be more complex, requiring detailed documentation and clear reporting lines to ensure transparency and legal compliance.

Finally, expenditures from state and national committees play a significant role in financial strategies during political campaigns. While there are differences in regulations at local versus national levels, committees must adhere to forms and templates that ensure appropriate documentation. Understanding these types helps in navigating the intricacies of campaign financing.

Practical steps for coordinating expenditures

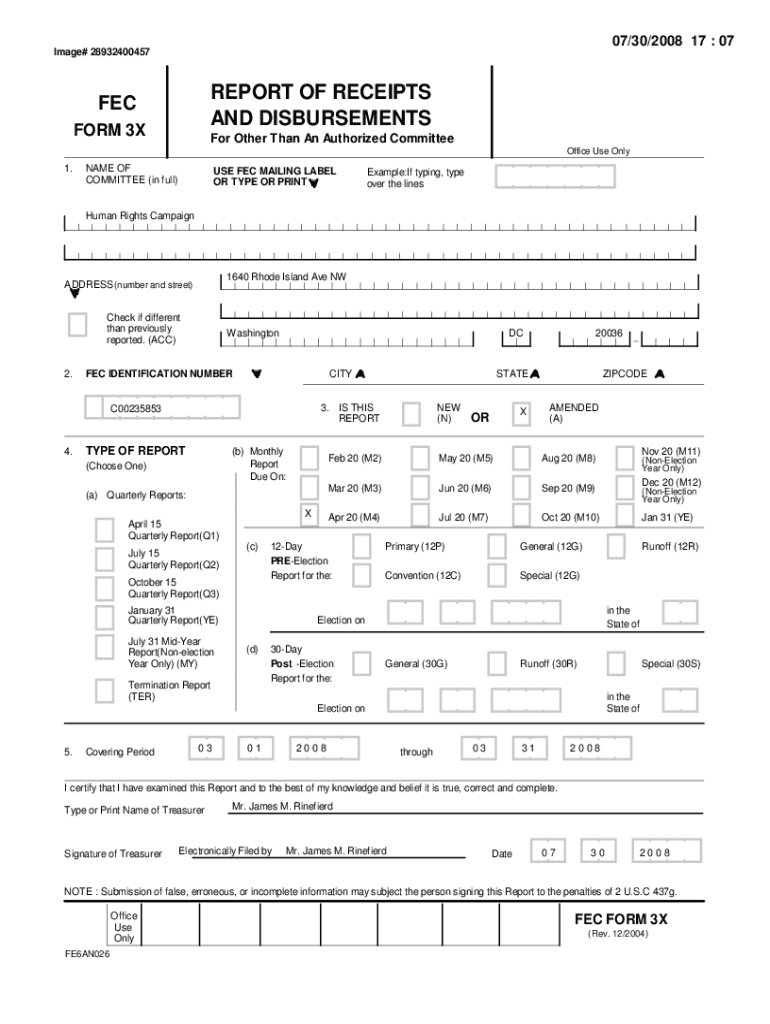

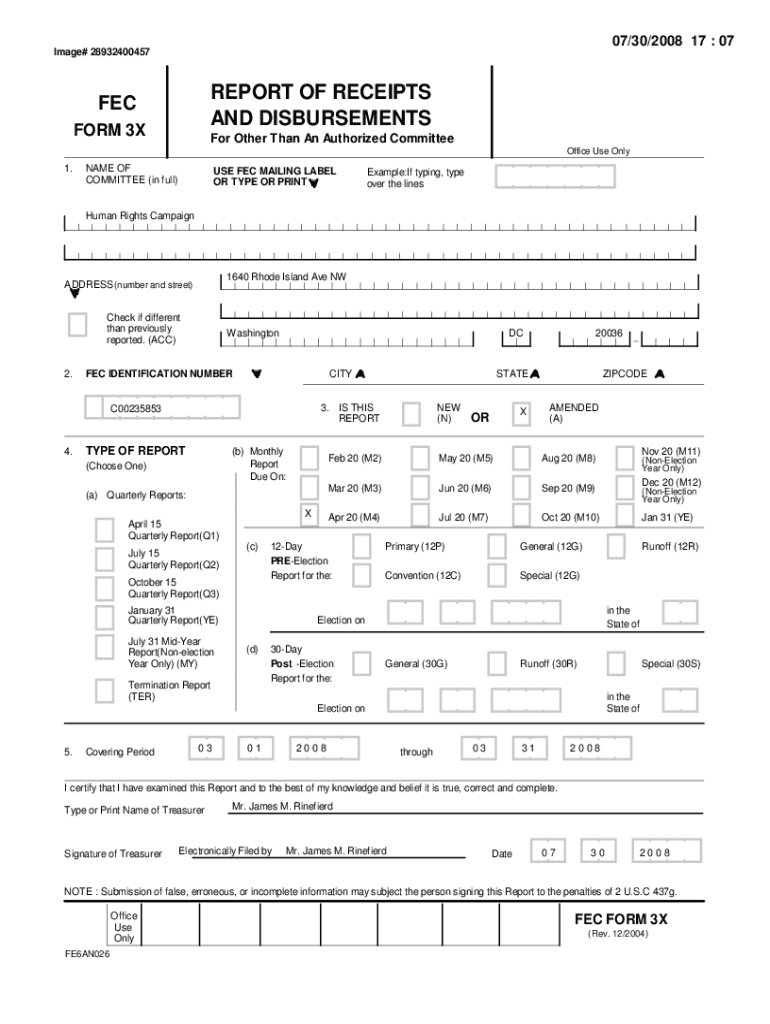

To effectively manage coordinated expenditures, the initial step involves gathering all necessary information. This includes essential documents such as contribution records, meeting minutes, and financial statements. Teams should work collaboratively to gather all relevant data, ensuring comprehensive and accurate reporting.

Once the necessary information is collected, completing the expenditure forms accurately becomes the priority. A step-by-step guide for filling out these forms includes noting the source of the funds, specifying their intended use, and following compliance requirements. It’s vital to watch out for common mistakes like incorrect dates or misspelled names, as these can lead to complications down the line.

After submitting forms, tracking and managing expenditures becomes crucial. Utilizing interactive tools, such as those provided by pdfFiller, facilitates the management process. Setting reminders for deadlines can streamline compliance and ensure that expenditure reports are submitted in a timely manner.

Legal implications & requirements

Understanding the legal implications associated with coordinated expenditures is fundamental for any political campaign. Compliance with federal and state laws governing campaign financing is non-negotiable. Key regulations must be well understood, including limits on contributions and requirements for transparency in financial reporting. Non-compliance can lead to substantial legal penalties, damaging both the campaign's reputation and financial viability.

When attributing expenditures correctly, campaigns must include specific details in their forms. Accuracy is crucial, especially in multi-state campaigns where laws differ. Failing to attribute expenditures properly may lead to inadvertent violations, ultimately affecting election outcomes.

Analyzing expenditure limits

Campaign spending is subject to various limits, especially for federal office candidates. Understanding these dollar limits on contributions and expenditures is essential for strategic planning. Current limits may change due to factors like inflation and cost-of-living adjustments; staying informed about these changes is crucial for ensuring compliance.

Additionally, candidates using personal funds often face different limits compared to regular contributions. Historical context adds a layer of understanding to these regulations, highlighting the evolving nature of campaign finance laws and their implications for individual candidates.

Strategic use of coordinated expenditures

To optimize campaign gains, the strategic use of coordinated expenditures is necessary. Best practices include identifying target demographics and tailoring expenditures to maximize impact. Campaigns can benefit significantly from analyzing successful case studies where coordinated expenditures played a pivotal role in election outcomes.

Further integration of coordinated expenditure forms with a broader campaign strategy allows for cohesive messaging and effective use of resources. Collaboration among campaign teams enhances the overall impact, ensuring that all efforts align with defined goals.

Resources for coordinated expenditure management

To effectively manage coordinated expenditures, resources and tools can simplify the documentation process. pdfFiller offers a variety of tools and templates tailored for coordinating expenditures, making it easier to create compliant forms. Users can access these templates and utilize interactive features to fill out forms efficiently, ensuring accuracy and compliance.

Moreover, support channels are available for those seeking assistance within pdfFiller. Additional training resources can be provided, focusing on campaigns' unique needs and ensuring the highest standards of compliance are met.

Future trends and considerations

The landscape of campaign finance is continually evolving, making it imperative for campaign teams to anticipate changes in laws and regulations. Understanding these future trends will prepare teams for upcoming election cycles, allowing them to adjust their strategies accordingly.

Technology's impact on expenditure management is profound, offering avenues for improved coordination and reporting. Leveraging cloud-based platforms, such as pdfFiller, enhances transparency and efficiency in tracking expenditures and managing documentation, which is vital for maintaining compliance in an ever-changing regulatory environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit coordinated expenditures made by in Chrome?

How do I fill out the coordinated expenditures made by form on my smartphone?

How do I complete coordinated expenditures made by on an Android device?

What is coordinated expenditures made by?

Who is required to file coordinated expenditures made by?

How to fill out coordinated expenditures made by?

What is the purpose of coordinated expenditures made by?

What information must be reported on coordinated expenditures made by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.