Get the free Assessment Section - Kauai County, HI

Get, Create, Make and Sign assessment section - kauai

How to edit assessment section - kauai online

Uncompromising security for your PDF editing and eSignature needs

How to fill out assessment section - kauai

How to fill out assessment section - kauai

Who needs assessment section - kauai?

Comprehensive Guide to the Assessment Section - Kauai Form

Understanding the Assessment Section of the Kauai Form

The assessment section of the Kauai form is crucial for ensuring that property assessments are accurate and reflective of current market values. This section serves as a comprehensive data collection point for property details, ownership, and tax implications, playing a significant role in how local government calculates property taxes.

Accurate data entry is imperative to avoid discrepancies that could affect tax obligations. Errors in this section can lead to over-assessment or under-assessment, each of which has serious implications for homeowners and real estate investors alike.

Navigating the Kauai Assessment Form

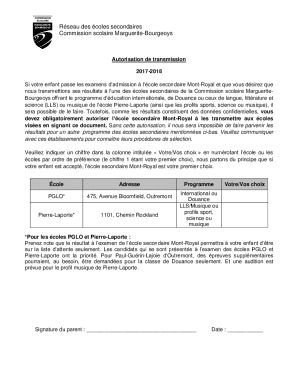

Understanding the layout of the Kauai Assessment Form helps users fill it out efficiently. Typically, the form includes several sections that need to be addressed, such as personal information, property details, and any applicable exemptions. Familiarity with the layout allows for a smoother completion process.

Key sections often include:

Filling Out the Assessment Section

Filling out the assessment section requires attention to detail. Begin by entering your personal identification data accurately—this includes your full name, mailing address, and taxpayer identification number, as such data establishes your identity as the property owner.

Next, move on to property information. This part necessitates details such as the address of the property, parcel number, and a description of the property type (e.g., residential, commercial, etc.).

Common mistakes to avoid include inaccuracies in the taxpayer identification number and incomplete sections, which can lead to delays in processing. Taking your time to review this data is crucial.

Editing the Assessment Section

Using pdfFiller to edit your document is straightforward. Once you have filled out the assessment section, take advantage of the editing tools available on the platform. This allows you to make necessary adjustments without starting over.

To ensure clarity and precision, follow these tips:

Examples of properly filled assessment sections can serve as references for new users and can typically be found integrated within the pdfFiller interface.

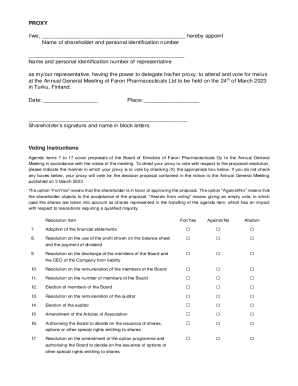

Signing the Kauai Assessment Form

The signing process of the Kauai Assessment Form can be managed effectively using pdfFiller’s eSigning capabilities. Users can electronically sign the document, which streamlines the submission process and eliminates the need for physical signatures.

When using digital signatures, it is essential to understand their legal validity in Hawaii. The state recognizes electronic signatures as having the same weight as traditional signatures, provided that the signer intends to sign. This is particularly beneficial for forms requiring multiple parties to sign, as it allows for easier coordination.

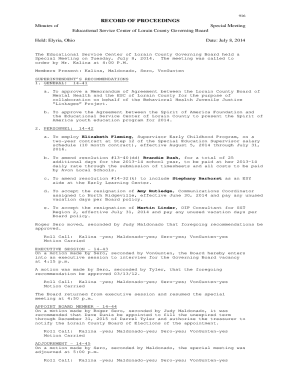

Collaborating on the Assessment Section

Collaboration on the Kauai Assessment Form is made easier with pdfFiller’s collaborative features. Users can share the form with team members or stakeholders and enable real-time editing and commenting. This improves the overall accuracy and ensures that all necessary information is included.

Consider utilizing these features to enhance your workflow:

Managing Your Completed Assessment Forms

Once the assessment form is completed and submitted, proper management of the document becomes crucial. Saving and storing your forms in the cloud enables easy access whenever needed. pdfFiller offers cloud storage, ensuring your documents are securely preserved.

Organizing your completed documents can also help streamline your processes. Consider implementing the following strategies:

Common Issues and Troubleshooting

Users may encounter several issues while filling out the assessment section of the Kauai Form. Common obstacles can include form submission errors or misunderstandings about required fields.

To troubleshoot these issues effectively, consider the following steps:

Additional Considerations

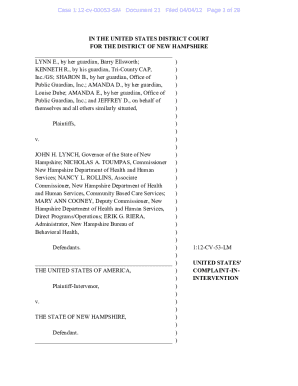

Filling out the Kauai Assessment Form is also tied to legal requirements and compliance issues. Being aware of these guidelines can help prevent any ramifications later. It is essential to understand submission deadlines to avoid late penalties.

If you find a need to make amendments post-submission, be familiar with the procedures for correcting errors without facing legal backlash. Regularly check local resources for updates on these requirements.

Related Documents and Additional Forms

In addition to the Kauai Assessment Form, other documents related to property assessments may be necessary. Familiarity with these forms can make the assessment process smoother.

Explore links to relevant online resources for detailed information regarding other real estate and tax-related documents.

Enhancing Your Tax Knowledge

Staying informed about tax relief options is essential for any property owner. Understanding what exemptions are available and their applicability can lead to significant savings on property taxes. Local governments often provide resources detailing these exemptions, and engaging with professionals can further enhance your knowledge.

Keeping up with changes in tax regulations is equally important, as policies can evolve year to year.

Engaging with the Community

Participation in local tax workshops can provide valuable insights into the property assessment process. These workshops often cover essential topics, from filling out forms correctly to understanding local tax codes.

Feedback opportunities regarding the assessment process allow community members to voice their concerns and suggestions, potentially driving improvements in local policies and procedures.

Utilizing Interactive Tools on pdfFiller

pdfFiller provides interactive tools that enhance your experience when filling out the assessment section of the Kauai Form. Accessing online calculators for property value assessments can aid in providing accurate figures, ensuring that values reported are in line with current market trends.

Leveraging these tools can facilitate precise data entry, minimizing errors and expediting the overall process.

Frequently Asked Questions about the Kauai Assessment Section

When dealing with the Kauai Assessment Section, users often have several questions. Common queries might revolve around data requirements, submission processes, or troubleshooting issues.

Having a compilation of frequently asked questions along with comprehensive answers can serve as a valuable resource, guiding users through the process effectively.

Contacting pdfFiller for Support

Should you need assistance with any aspect of the assessment section of the Kauai Form, contacting pdfFiller's support is vital. They provide customer support that can address your specific document issues.

To request help, use the contact information available on their website or support portal. Quick responses and assistance can alleviate many frustrations related to document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete assessment section - kauai online?

How do I fill out the assessment section - kauai form on my smartphone?

How do I complete assessment section - kauai on an Android device?

What is assessment section - kauai?

Who is required to file assessment section - kauai?

How to fill out assessment section - kauai?

What is the purpose of assessment section - kauai?

What information must be reported on assessment section - kauai?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.