Get the free Form 1095-A- Health Insurance Marketplace Statement

Get, Create, Make and Sign form 1095-a- health insurance

How to edit form 1095-a- health insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1095-a- health insurance

How to fill out form 1095-a- health insurance

Who needs form 1095-a- health insurance?

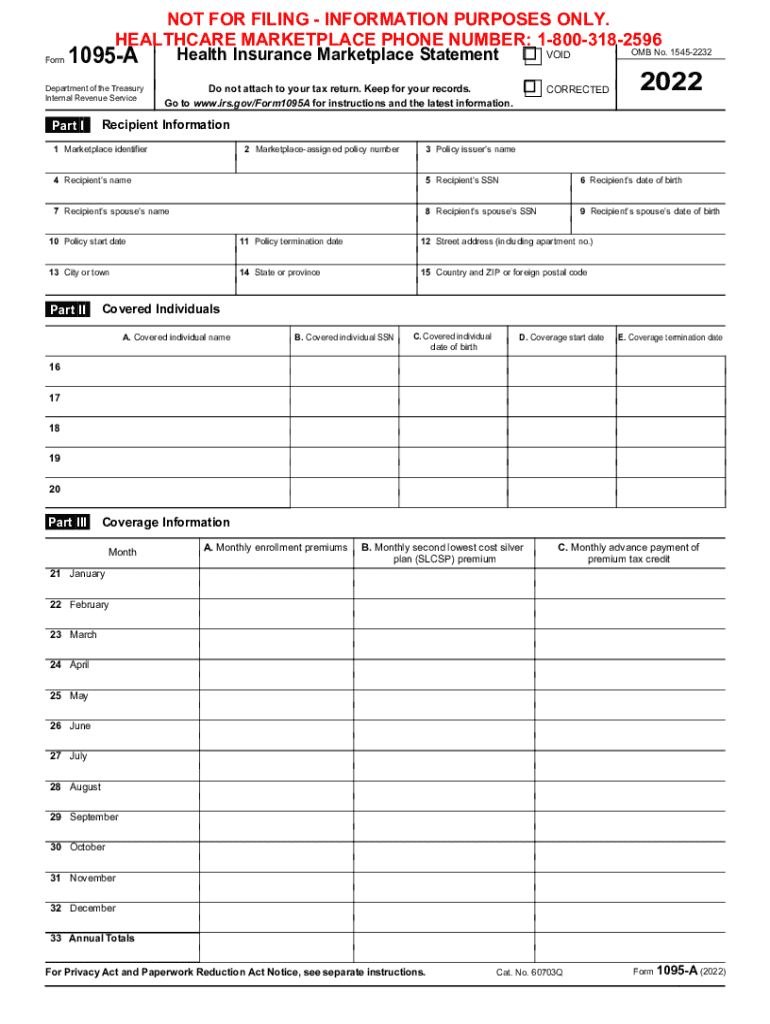

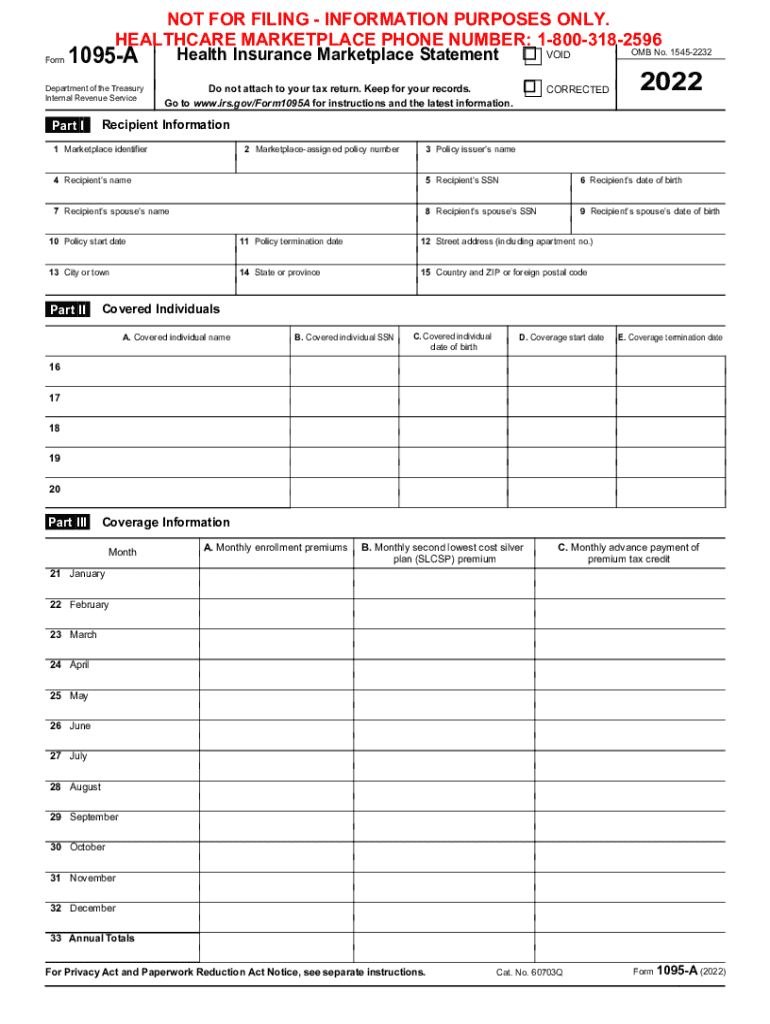

Comprehensive Guide to Form 1095-A: Health Insurance Form

Understanding Form 1095-A: Health Insurance Basics

Form 1095-A serves as a critical document in the reporting of health insurance coverage, specifically for those who obtain their insurance through the Health Insurance Marketplace. This form provides essential details about your coverage, making it indispensable when filing your taxes. As part of the Affordable Care Act (ACA), it illustrates whether you met the required health insurance coverage, impacting your eligibility for premium tax credits.

Individuals who purchase health insurance through the Marketplace will receive Form 1095-A. Moreover, anyone who has taken advantage of premium tax credits will be particularly affected by this form, as it determines their tax obligations. Accurate completion of Form 1095-A is crucial for the proper filing of your income tax return, and it may also help avoid any unexpected tax liabilities.

Who issues Form 1095-A?

Form 1095-A is issued by the Health Insurance Marketplace, which is a platform established to help individuals and families find and enroll in affordable health insurance. If you have enrolled in a health plan through the Marketplace, you will receive this form from the specific provider that manages your coverage. Insurance providers are responsible for supplying accurate information to the Marketplace, ensuring that the data captured in Form 1095-A is correct and complete.

Importance of Form 1095-A for tax filing

As tax season approaches, understanding the role of Form 1095-A becomes surplus to requirements. This form is essential when determining eligibility for premium tax credits, which help lower the cost of insurance premiums for many individuals and families. Moreover, the presence or absence of this form can significantly influence your tax obligations, with potential credits reducing taxable income and ensuring compliance with ACA regulations.

Filing your income tax return without this form can lead to complications, including delays, audits, or penalties. Since the form includes details about the insurance coverage period and the subsidies received, it’s critical to have it ready when preparing your taxable income.

Breakdown of Form 1095-A sections

Form 1095-A comprises three primary parts, each holding essential details regarding your health insurance coverage. Understanding these sections will aid in filling out your tax returns accurately.

Part : Recipients of Coverage

This section lists the individuals who were covered under the health insurance plan during the reporting year. Here, you’ll find your name and the names of any dependents. Ensure that these details are correct, as any discrepancy could affect your coverage verification.

Part : Coverage Information

Part II provides detailed information about the coverage period, the type of insurance plan selected, and the premium amounts for that period. This section is vital as it dictates whether you have maintained adequate coverage throughout the year, which meets ACA requirements.

Part : Premium Tax Credit

In Part III, details regarding the premium tax credit are provided. This section includes information about the 'Second Lowest Cost Silver Plan', which factors into your eligibility for potential tax credits. Understanding this information is crucial, as it affects how much of a refund you may be entitled to when you file your tax return.

Navigating common issues with Form 1095-A

While Form 1095-A is straightforward, complications can arise. Being aware of these common issues will help ensure a smoother experience during tax filing.

What if my 1095-A contains incorrect information?

In the event of incorrect information on your Form 1095-A, the first step is to contact your health insurance provider. They can initiate corrections with the Marketplace. It's crucial to resolve these discrepancies promptly, as they can lead to problems when filing your taxes.

What should do if didn’t receive advanced premium tax credits?

If you believe you were supposed to receive advanced premium tax credits but didn’t, review your application details submitted to the Marketplace. Double-check that all information was accurate. If no issues are found, consider reaching out to the Marketplace directly for clarification.

What if received excess tax credits?

Receiving excess tax credits can complicate your tax situation. If your income changes significantly during the year, you may owe some of that credit back. Keeping track of your income and adjusting your subsidy through the Marketplace is vital. Consult a tax professional if you're unsure how to proceed.

Tax filing without reporting advanced premium tax credits

Failing to report advanced premium tax credits on your tax return can result in an inaccurate filing. It's recommended to review your Form 1095-A carefully and make sure you're including all relevant details. This can help avoid penalties and issues with the IRS.

Additional forms related to health coverage

While Form 1095-A is critical, other forms may also be necessary depending on your health coverage situation.

Do need Form 1095-B if have Medicaid coverage?

Form 1095-B pertains to minimum essential coverage, which includes Medicaid among several other types of health coverage. If you only have coverage through Medicaid, you won't receive Form 1095-A, but you may receive Form 1095-B instead. This form confirms that you have maintained minimum essential coverage.

Tips for filling out Form 1095-A

Filling out Form 1095-A doesn’t have to be a daunting task; here are several tips to simplify the process.

With the right tools, such as pdfFiller, completing Form 1095-A can become a hassle-free experience. pdfFiller offers PDF editing features that simplify the necessary documentation processes, making it easier to manage.

Resources for help and support

If you face challenges in understanding or filling out your Form 1095-A, multiple resources are available to assist you.

How to get help: IRS and tax preparers

The IRS provides extensive resources and guides for understanding Form 1095-A and other tax-related questions. Additionally, contacting a tax preparer can provide personalized assistance tailored to your specific situation, ensuring you navigate the complexities of health insurance documentation efficiently.

Frequently asked questions

Common queries about Form 1095-A revolve around its purpose, how to correctly interpret the information it contains, and what to do when encountering issues. It's recommended to consult the FAQs on the IRS website or schedule a session with a tax professional if uncertainties persist.

Navigating changes in health coverage

Changes in your health coverage can affect how you report information on Form 1095-A. If you switch plans or experience a change in your financial status, reporting these changes promptly and accurately is crucial.

How changes in coverage affect your Form 1095-A

If there are changes during the year, such as changing jobs, losing or gaining coverage, or changes in household income, it is essential to ensure they are accurately reported on Form 1095-A. Each change could potentially affect your premiums and tax credits, making it vital to stay diligent about updates.

Yearly updates to healthcare legislation and what to expect

The landscape of healthcare legislation can evolve, impacting the forms and requirements for tax filing. Staying informed about any changes each year is crucial in avoiding misunderstandings. Taxpayers should regularly check for updates from the Marketplace or IRS, ensuring that all information remains current and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 1095-a- health insurance?

Can I create an electronic signature for the form 1095-a- health insurance in Chrome?

Can I create an eSignature for the form 1095-a- health insurance in Gmail?

What is form 1095-a- health insurance?

Who is required to file form 1095-a- health insurance?

How to fill out form 1095-a- health insurance?

What is the purpose of form 1095-a- health insurance?

What information must be reported on form 1095-a- health insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.