Get the free Building Materials Exemption Certificate Report

Get, Create, Make and Sign building materials exemption certificate

How to edit building materials exemption certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out building materials exemption certificate

How to fill out building materials exemption certificate

Who needs building materials exemption certificate?

Building Materials Exemption Certificate Form: A Comprehensive Guide

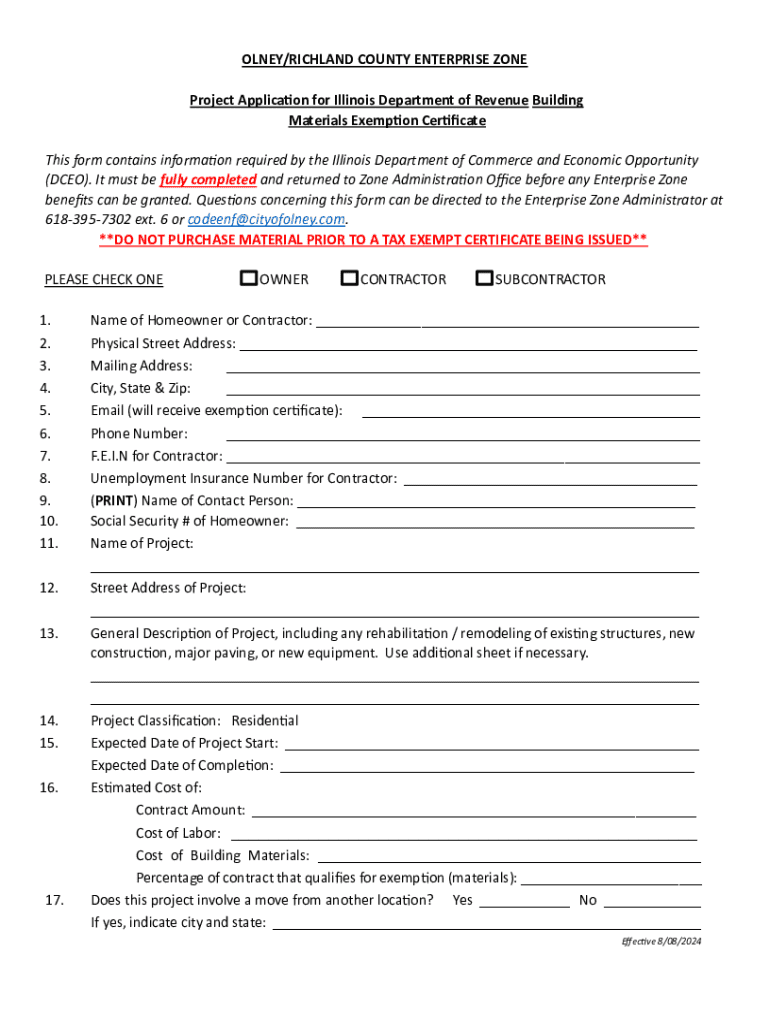

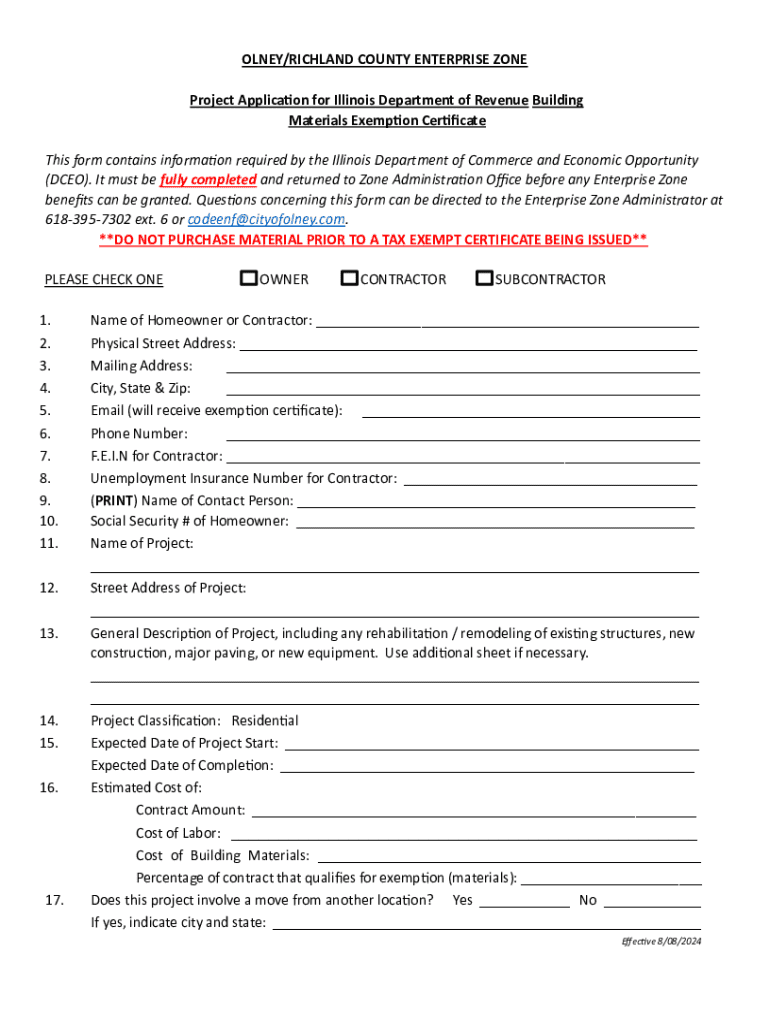

Overview of the building materials exemption certificate

The building materials exemption certificate is a crucial document that allows eligible organizations to purchase building materials without having to pay state sales tax. This exemption aims to alleviate the financial burdens of specific entities engaged in qualifying construction projects, enhancing their capacity to execute these initiatives effectively.

Understanding the purpose of this certificate is vital for organizations seeking to benefit from cost savings. Construction projects often require significant financial investment, and the exemption certificate can reduce the overall cost of materials, thereby improving project feasibility.

Who should apply for a building materials exemption?

Certain entities are eligible to apply for the building materials exemption certificate, primarily including local governments, non-profit organizations, educational institutions, and other qualifying exempt entities. For instance, municipalities embarking on public infrastructure improvements, or non-profits constructing community centers can benefit from this exemption.

Eligibility criteria are typically defined by state regulations and may vary, so it is essential for applicants to review specific requirements in their jurisdiction. For example, local laws may require that projects provide a clear benefit to the public or fall within specific categories like housing, education, or health care.

Preparing to apply for the exemption

Before applying for the building materials exemption certificate, it is crucial to gather essential documentation that proves your organization’s status and project details. Documentation may include proof of non-profit or governmental status, project plans illustrating the scope of work, and any purchase orders or invoices related to the materials intended for exemption.

Understanding state-specific regulations is equally important. Navigating the complexities of local laws can ensure a smoother application process and help applicants adhere to necessary guidelines. Researching local statutes will allow organizations to prepare adequately and avoid last-minute pitfalls in their submission.

The application process

Applying for the building materials exemption certificate involves several steps, beginning with accessing the appropriate form. Most states provide these forms on their official websites, where you can locate and download the necessary application.

Completion of the form is a critical phase. It's essential to fill in all required sections meticulously, including applicant information, a precise project description, and a clear outline of the materials to be exempted. Common errors often stem from incomplete or incorrect information, so careful attention is paramount.

Submit the application according to your state’s guidelines, whether online or via postal service. Each method may have its own set of requirements and deadlines, which need to be closely followed to ensure timely processing.

After application submission

Once the application for the building materials exemption certificate is submitted, applicants often wonder about what happens next. Typically, processing times can vary, but organizations can expect updates regarding their application status within a few weeks. Notifications may come via email or official correspondence, and keeping an eye on these communications is essential.

For those eager to track their application status, many states provide online tools where applicants can input their information and retrieve updates. Alternatively, it may be necessary to contact the relevant administrative office directly for inquiries regarding application statuses.

Managing your exemption certificate

Once an organization receives the building materials exemption certificate, understanding how to utilize it effectively is crucial. The exemption can be applied to future purchases of materials, allowing for continued budget efficiency in ongoing or future projects. However, it’s imperative to maintain accurate records and ensure all purchases are documented appropriately.

Annual reporting requirements may also apply depending on your state’s regulations. Organizations should familiarize themselves with the types of reports needed and adhere to specified submission timelines to remain compliant. Keeping organized documentation will simplify this process and help to avoid complications during audits.

Addressing challenges during the application process

Challenges can arise during the application process, such as delays or potential denials. If an application is denied, applicants should seek clarity on the reasons for denial and determine the necessary steps for appeal. Often, jurisdictions allow for a review or re-submission if initial criteria are not met.

Frequently asked questions typically revolve around specific issues like application completeness and required follow-ups. Providing comprehensive responses to these inquiries not only aids prospective applicants but also helps to streamline the process for all parties involved.

Additional insights on building materials exemption

The building materials exemption can significantly impact project budgets, often providing organizations the financial relief they need to undertake substantial projects. Through strategic planning and proper application, organizations can leverage these exemptions to enhance their community contributions.

Real-life examples and testimonials illustrate the success of effective applications. Many entities have expanded their capabilities and improved project outcomes by navigating the exemption certificate process effectively.

Leveraging pdfFiller for your form needs

pdfFiller offers a comprehensive solution for managing the building materials exemption certificate form from start to finish. Users can easily edit and customize their PDF documents, ensuring that they meet the specific requirements of their application.

Collaboration features within pdfFiller allow teams to work together seamlessly on the application, providing tools for e-signatures, comments, and live document sharing. The cloud-based platform ensures that users can access necessary documents from anywhere, making it easier to keep track of submissions and updates.

Conclusion on the importance of compliance

Staying informed about changes in legislation regarding the building materials exemption certificate is essential for organizations to maintain their eligibility for these benefits. Regularly reviewing local laws and requirements ensures that entities do not miss critical updates that could affect their exemptions.

Ultimately, adhering to compliance not only enhances an organization’s ability to execute vital projects but also fosters transparency and accountability within the community, which is essential for building trust and ongoing support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify building materials exemption certificate without leaving Google Drive?

Can I sign the building materials exemption certificate electronically in Chrome?

How can I fill out building materials exemption certificate on an iOS device?

What is building materials exemption certificate?

Who is required to file building materials exemption certificate?

How to fill out building materials exemption certificate?

What is the purpose of building materials exemption certificate?

What information must be reported on building materials exemption certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.