Get the free payee-w-9-form.pdf

Get, Create, Make and Sign payee-w-9-formpdf

Editing payee-w-9-formpdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payee-w-9-formpdf

How to fill out payee-w-9-formpdf

Who needs payee-w-9-formpdf?

Understanding the Payee W-9 Form and Its Management

Understanding the Payee W-9 Form

The W-9 form, officially known as the 'Request for Taxpayer Identification Number and Certification,' serves a crucial role in the tax reporting ecosystem. This IRS form allows individuals and entities to provide their correct taxpayer identification number (TIN) to a requester, typically a payer or employer. It empowers payees, ensuring that they receive correct reporting of their income while also assisting payers in meeting their tax filing obligations.

The significance of the W-9 cannot be overstated; it safeguards the interests of both parties involved in any financial transaction. Payees need to ensure they are accurately identified for tax purposes, while payers must collect the correct information to report income to the IRS and avoid potential penalties.

Who needs to fill out the W-9 form?

Understanding who should fill out the W-9 is essential. Generally, any individual or business entity receiving income that must be reported to the IRS needs to complete a W-9. This includes freelancers, independent contractors, rental property owners, and corporations, among others. Moreover, specific scenarios, such as receiving payment for services rendered or rent collected, also necessitate the completion of this form.

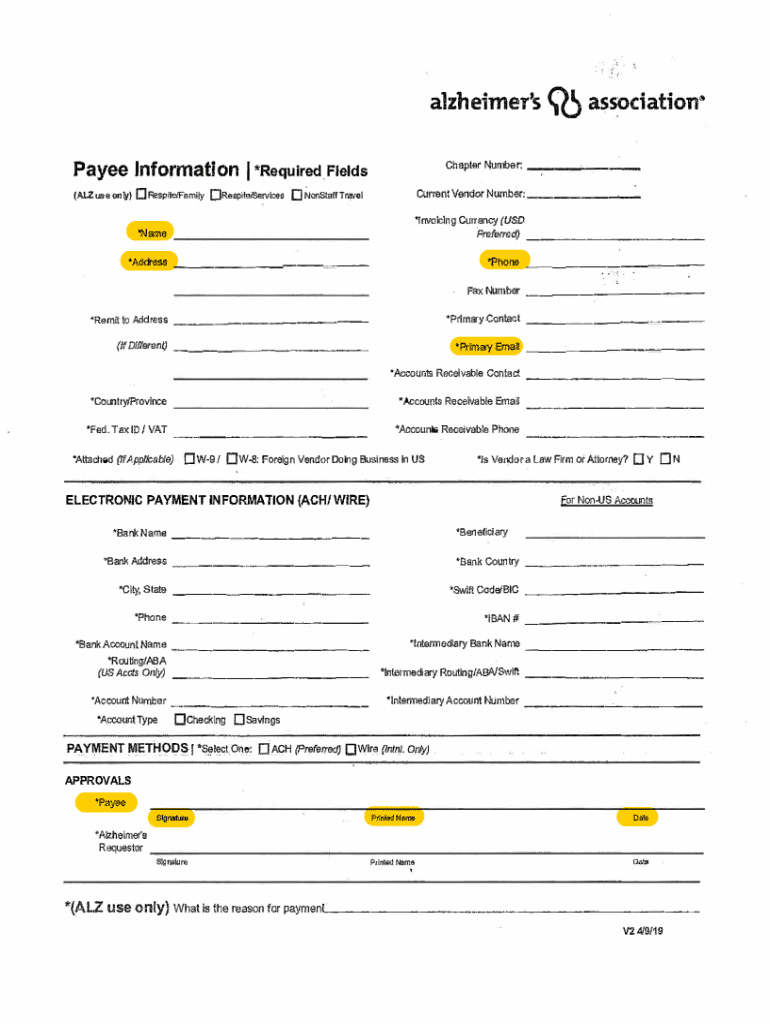

Detailed breakdown of the W-9 form

The W-9 form consists of several key sections that require careful attention when filling out. Understanding each component of the form is crucial for compliance and accuracy in reporting.

Key sections of the W-9 form

Common pitfalls when filling out the W-9

Filling out the W-9 correctly is imperative to avoid delays or compliance issues. Common mistakes include providing the wrong TIN, failing to sign the form, or selecting incorrect tax classification. Each of these errors can lead to complications, such as incorrect tax filings or notice from the IRS.

Consequences of inaccurate information not only complicate the payer's responsibilities but can also place extra scrutiny on the payee, potentially resulting in fines or the necessity to file corrected forms. Hence, careful attention is essential.

Step-by-step guide to completing the W-9 form

Completing a W-9 form might seem daunting, but breaking it down into manageable steps simplifies the process. Here’s how to do it effectively.

Step 1: Gathering necessary information

Before jumping to fill out the form, gather your essential documents. This includes your Social Security card, business license (if applicable), and any prior W-9 forms you have. Having this information at hand ensures accuracy and compliance.

Step 2: Filling out each section

Start filling out the form by first entering your name and business name (if applicable). Next, choose your tax classification from the provided options. Ensure all information is accurate as you enter your address and TIN. Finally, remember to sign and date the form, affirming that the details provided are true and correct.

Step 3: Reviewing your submission

Before submitting your W-9, take a moment to review the entire form. Check for common errors like typos in your TIN or slips in your address. Validate that all sections are complete and accurately filled out to avoid delays or rejections.

Digital management of the W-9 form

In today’s digital age, managing your W-9 digitally not only streamlines the process but also adds layers of security and accessibility. Using platforms like pdfFiller enhances your experience when handling these forms.

Why go digital? Benefits of using pdfFiller for W-9 forms

Adopting digital solutions for your W-9 forms significantly increases flexibility. The ability to access your forms from anywhere and at any time means you can quickly respond to payer requests. Additionally, cloud storage capabilities safeguard your documents, minimizing the risk of loss. Enhanced security measures, like encryption and password protection, ensure that sensitive information remains private.

Editing and eSigning the W-9 form with pdfFiller

pdfFiller simplifies the process of editing and signing your W-9. With user-friendly tools, you can easily fill out fields, add electronic signatures, and share your completed form with payers. For teams, collaboration features allow multiple stakeholders to review and edit the form effortlessly, facilitating a smoother process overall.

The W-9 form process after submission

Once you submit your W-9 form, understanding what happens next is critical. The payer will use this information to report your income accurately to the IRS and send you a 1099 form at the end of the tax year if applicable.

What happens after you submit a W-9 form?

You typically can expect the payer to review the form within a short time frame. If there are any discrepancies or issues, they will likely reach out for clarification. Once approved, your details will be securely stored, easing future interactions and tax reporting.

Tracking the status of your W-9

To ensure compliance, you can follow up with the payer to confirm receipt and acceptance of your W-9. Keeping open lines of communication is crucial, especially for ongoing projects or long-term engagements to avoid any disruptions in payment.

Best practices for W-9 form management

Proper management of W-9 forms is essential for both payees and payers. Following best practices helps streamline processes and protects sensitive information.

How often should you obtain W-9 forms?

It's advisable to request a new W-9 form any time there is a change in the payee's status or if significant time has passed since the last form was submitted. Keeping a fresh record yearly ensures that your tax filing remains accurate and compliant.

Maintaining privacy and security

Safeguarding the information contained within a W-9 form is paramount. Use secure methods for sharing the form, such as encrypted email or platforms like pdfFiller. Additionally, always store sensitive documents in protected locations to prevent unauthorized access. Regularly remind staff about the importance of information security.

Additional tools and resources

Harnessing additional tools can greatly enhance your efficiency in managing W-9 forms. Using interactive platforms helps streamline processes and ensures accuracy.

Interactive tools for creating and managing the W-9 form

With pdfFiller, users have access to robust features designed for creating and managing W-9 forms. From customizable templates to automated reminders for obtaining updated forms, users can ensure they are always compliant with IRS regulations.

Helpful guides and FAQs

Additionally, pdfFiller provides extensive resources, including guides and FAQs, addressing typical questions that arise during the W-9 process. This support is invaluable for individuals and teams seeking clarity and assistance as they navigate their documentation needs.

Contacting support for W-9 related queries

While managing W-9 forms can be straightforward, certain scenarios could necessitate seeking assistance. For complex tax situations or if you encounter issues with form completions, reaching out for guidance is recommended.

When to seek assistance

Common situations requiring help include confusion over tax classifications, errors noticed after submission, or if payers reject your form. Addressing these concerns proactively can prevent complications down the line.

How to get help from pdfFiller

pdfFiller offers multiple support channels, including live chat, email, and extensive FAQs. Engaging with their support team can resolve queries efficiently and provide users with the confidence needed to complete their W-9 forms accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the payee-w-9-formpdf electronically in Chrome?

How can I edit payee-w-9-formpdf on a smartphone?

How do I edit payee-w-9-formpdf on an Android device?

What is payee-w-9-formpdf?

Who is required to file payee-w-9-formpdf?

How to fill out payee-w-9-formpdf?

What is the purpose of payee-w-9-formpdf?

What information must be reported on payee-w-9-formpdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.