Get the free W9 - All Documents - Willis Towers Watson

Get, Create, Make and Sign w9 - all documents

Editing w9 - all documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w9 - all documents

How to fill out w9 - all documents

Who needs w9 - all documents?

W-9 - All Documents Form: A Comprehensive Guide

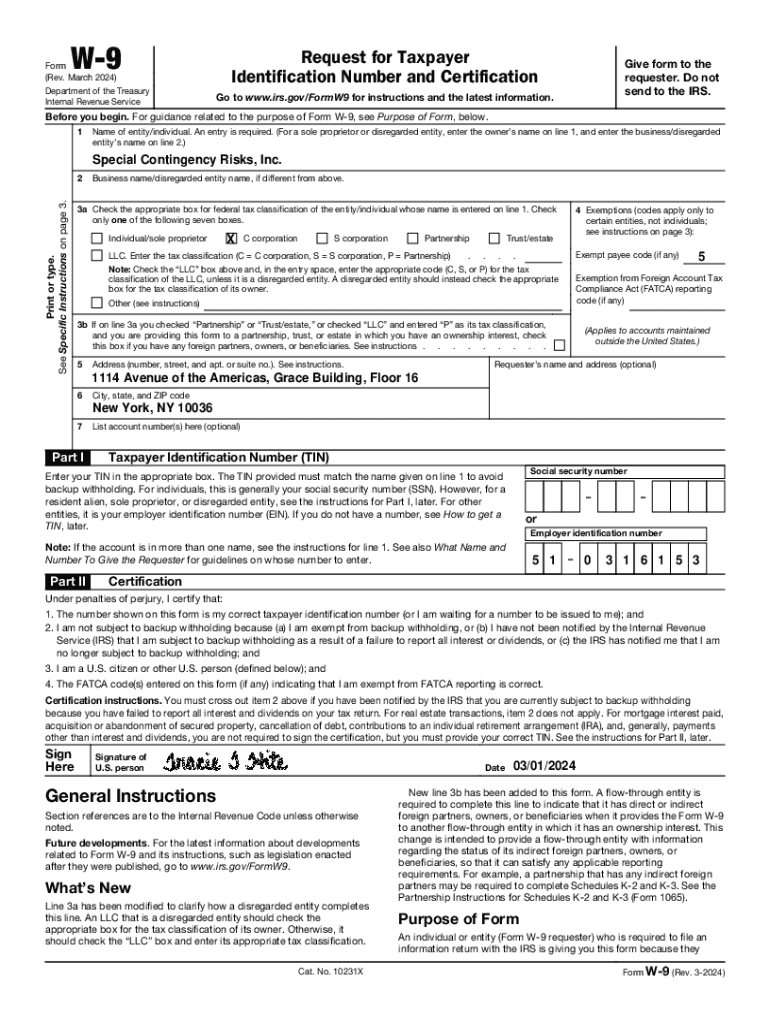

Overview of Form W-9

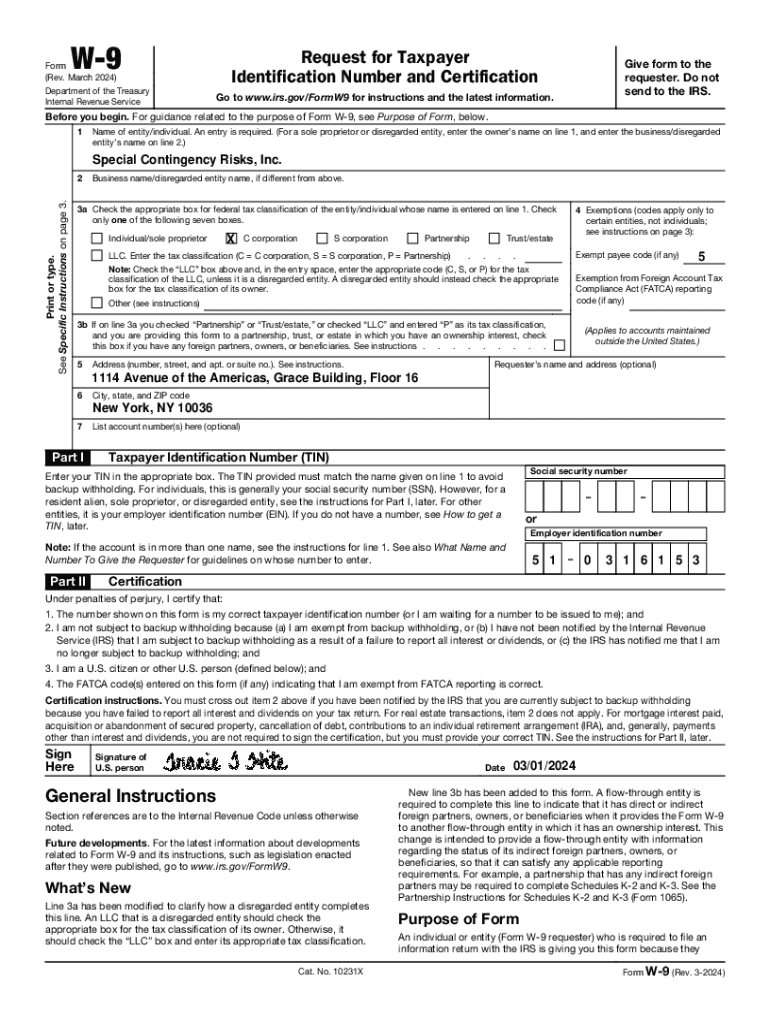

Form W-9, also known as the Request for Taxpayer Identification Number (TIN) Certification, is an essential document utilized primarily in the United States. It plays a crucial role in tax reporting for both individuals and organizations, providing the necessary TIN to report income paid to independent contractors, freelancers, and vendors. Understanding the significance of the W-9 form is important for compliance with IRS regulations and for maintaining accurate tax records.

Understanding the importance of the W-9 form

The W-9 form is instrumental in fulfilling tax reporting responsibilities. By collecting the correct TIN, businesses can fulfill their tax obligations to the IRS while ensuring that independent contractors are properly classified for tax purposes. Situations such as hiring a contractor for a project, receiving interest payments, or post-sale settlements often necessitate the completion of a W-9.

Non-compliance with W-9 requirements can lead to potential fines and penalties, significantly impacting both individuals and businesses. Moreover, businesses may face implications regarding tax withholding; if a proper W-9 is not submitted, payers may be required to withhold taxes at a higher rate when processing payments.

Detailed breakdown of W-9 sections

Filling out the W-9 form involves several critical sections, each requiring specific information. Firstly, the personal information section requests your name and a business name if applicable, along with address fields that help verify identity and tax residency status.

Tax classification is another important section where individuals must indicate whether they are a sole proprietor, corporation, or other structure. Choosing the correct classification is essential as it defines how income is reported and taxed. Additionally, the Taxpayer Identification Number (TIN) section allows you to provide either your Social Security Number (SSN) or Employer Identification Number (EIN), which are vital for the IRS's tracking and reporting purposes.

Step-by-step guide to completing Form W-9

Completing the W-9 form requires preparation. Start by gathering necessary documents, including your SSN or EIN, and reviewing your business classification. Accuracy is crucial; a small mistake can lead to complications with tax reporting.

To fill out each section correctly, follow the format provided on the form. For personal information, ensure that your name matches your tax identification document. In the tax classification section, check the box that fits your situation. When providing your TIN, ensure it is the complete number without spaces or dashes.

After filling out the form, take a moment to review it for any errors. Once finalized, submit it to the requester who demanded the form, ensuring they know you have completed it accurately.

Electronic submission and signatures

Utilizing digital platforms for W-9 submission offers multiple advantages, including convenience, accessibility, and speed. Cloud-based solutions simplify the process of filling out, signing, and managing documents without the need for paper.

One such platform is pdfFiller, where users can easily sign their W-9 form electronically. Following IRS standards for electronic signatures is crucial to ensure that your document holds legal validity. Here’s how to do it using pdfFiller:

Best practices for managing W-9 forms

Properly managing your W-9 forms is critical to maintaining sensitive information securely. It's recommended to store W-9 forms in a secure digital format, utilizing encrypted cloud storage to prevent unauthorized access. Additionally, ensure that these forms are easily retrievable for future reference or audits.

Regular updates to your W-9 information are also necessary. Collect new forms whenever there are changes to tax classification, such as a change from a sole proprietor to an LLC. Keeping your records current prevents complications during tax reporting and ensures compliance with IRS guidelines.

W-9 form usage scenarios

W-9 forms are frequently requested in a variety of situations. For instance, businesses often request a W-9 when engaging independent contractors to ensure proper tax classification. Similarly, financial institutions may require a W-9 when clients open accounts or apply for loans to report interest income accurately.

When responding to a request for a W-9, professionalism is key. Ensure you understand the requester’s need for the document and if unsure, clarify its purpose. If the request comes from a company you’ve not worked with previously, it’s wise to verify their legitimacy.

Resources for W-9 form completion

Completing a W-9 form accurately is vital, and leveraging official IRS resources can provide clarity. The IRS website offers guidelines and FAQs for individuals and businesses regarding the completion and submission of the W-9 form.

Additionally, pdfFiller provides interactive tools that make the process easy and efficient. Users can access an editable W-9 template that guides them through the necessary steps, ensuring they complete the form correctly.

Frequently asked questions about Form W-9

Common concerns surrounding the W-9 often include: what to do if you lose a W-9, and how to handle errors after submission. If you lose your W-9, it’s advisable to request a new one from the original sender to maintain compliance.

Handling errors post-submission can be tricky, but it's essential to correct mistakes as soon as possible. Update the requester immediately upon discovering an error to mitigate any potential issues with the IRS concerning tax reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit w9 - all documents from Google Drive?

How do I execute w9 - all documents online?

Can I edit w9 - all documents on an Android device?

What is w9 - all documents?

Who is required to file w9 - all documents?

How to fill out w9 - all documents?

What is the purpose of w9 - all documents?

What information must be reported on w9 - all documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.