Get the free CRT-61 Certificate of Resale. Sales Tax

Get, Create, Make and Sign crt-61 certificate of resale

How to edit crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Understanding the CRT-61 Certificate of Resale Form

Understanding the CRT-61 certificate of resale form

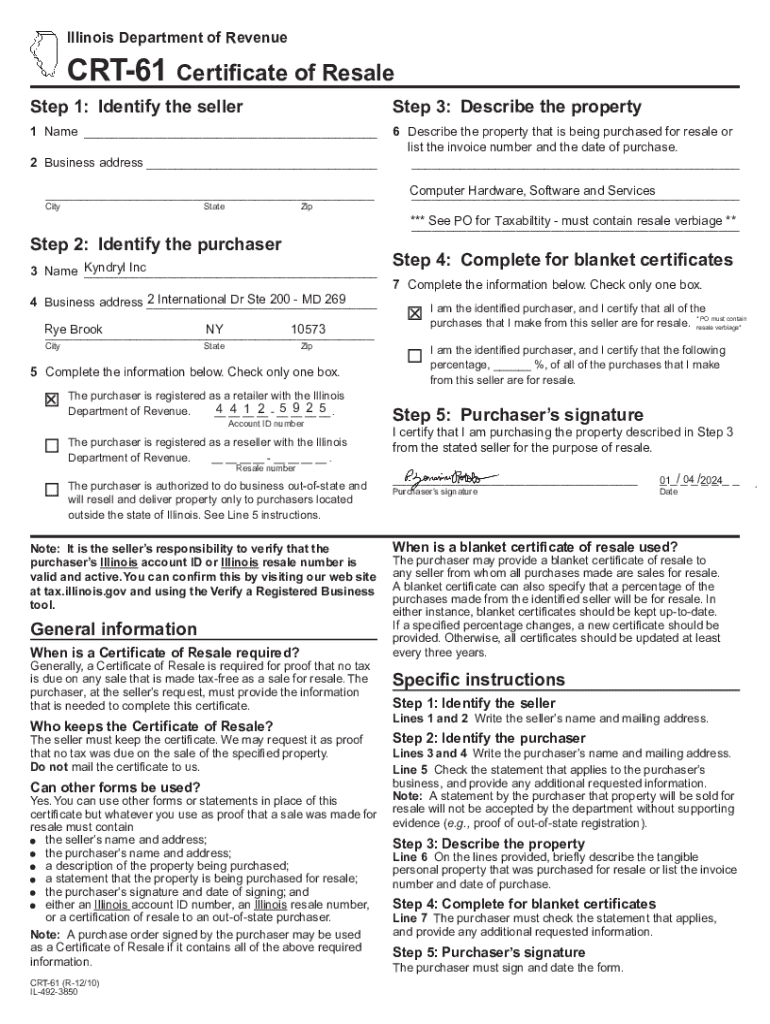

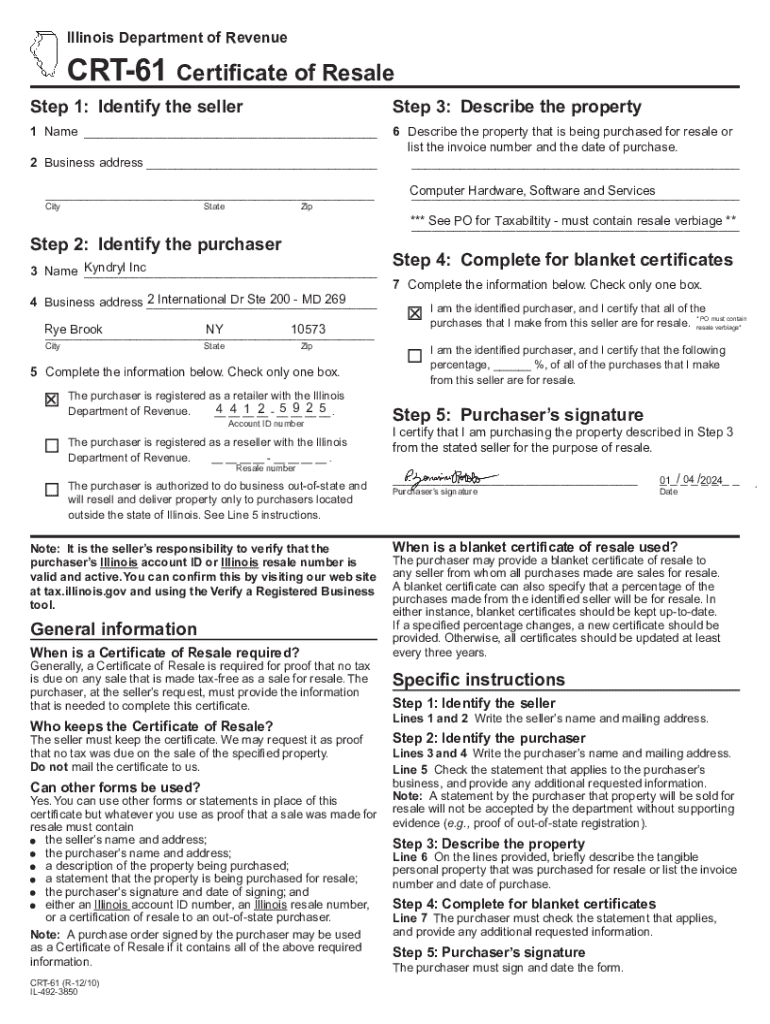

The CRT-61 Certificate of Resale Form is an essential document for businesses looking to purchase goods for resale without incurring sales tax. It acts as a powerful tool that provides tax exemption to vendors purchasing merchandise that will be resold, facilitating smoother transactions and compliance with tax regulations.

The primary purpose of the CRT-61 form is to simplify the sales process between sellers and buyers. By presenting this certificate, buyers can avoid paying sales tax at the point of sale, provided the item is intended for resale. This not only streamlines financial operations for the buyer but also ensures that sellers do not inadvertently collect tax on items that should be tax-exempt.

In summary, the CRT-61 Certificate of Resale Form is crucial in the world of business and retail, underlining the importance of resale certificates in maintaining tax compliance and promoting efficient transactions.

Who needs a CRT-61 certificate of resale?

The CRT-61 Certificate of Resale is particularly necessary for businesses and individuals who buy products specifically for resale. Generally, this includes wholesalers, retailers, and distributors across various sectors. If you sell or intend to sell products, acquiring this certificate is often a prerequisite for your operations.

Eligibility for obtaining a CRT-61 certificate typically extends to: stores, e-commerce businesses, and service providers who purchase materials or products to incorporate into their sales offerings. Additionally, organizations in industries such as construction, food service, or electronics frequently rely on this certificate.

In scenarios where a resale certificate is necessary, failure to provide the CRT-61 can result in the buyer being charged sales tax, adding unnecessary costs to their operations.

Getting started with the CRT-61 form

Locating the CRT-61 Certificate of Resale Form is straightforward. This document is often available from your state's revenue department website or can be accessed online through platforms that facilitate document management, such as pdfFiller.

To access the CRT-61 Certificate of Resale Form via pdfFiller, follow these steps:

By utilizing pdfFiller for accessing the CRT-61 form, users benefit from seamless online document editing capabilities, making it an efficient choice for individuals and teams who require a reliable, accessible solution.

Detailed instructions for filling out the CRT-61 form

Filling out the CRT-61 Certificate of Resale Form accurately is crucial to ensure your exemption status and avoid auditing issues. The form consists of various sections that require comprehensive attention.

The sections of the CRT-61 form include:

Common mistakes to avoid when filling out the CRT-61 include: neglecting to sign the certificate, providing incomplete or incorrect descriptions of the purchased items, or failing to provide your business tax ID.

To ensure accuracy and compliance, double-check all entries, make sure your business information aligns with your tax documents, and supply valid justifications for your exemption requests.

Editing the CRT-61 form with pdfFiller

Once you have accessed the CRT-61 Certificate of Resale Form through pdfFiller, editing and customizing the document is straightforward. The platform comes equipped with a variety of tools designed to enhance your experience.

Some features available for editing the CRT-61 form include:

By mastering the editing tools in pdfFiller, you can ensure your CRT-61 Certificate of Resale Form meets all necessary requirements and accurately represents your business.

Sign and manage your CRT-61 certificate of resale

After completing your CRT-61 Certificate of Resale Form, it’s vital to properly sign and manage the document. Here’s how you can effortlessly do that using pdfFiller.

To eSign the CRT-61 form, follow these steps:

Furthermore, pdfFiller provides options for secure document storage and management. You can easily organize your certificates, share them with vendors and suppliers, and ensure they are readily accessible for future reference.

Using and accepting the CRT-61 form

For businesses, understanding how to properly use and accept a CRT-61 Certificate of Resale is crucial. Proper handling ensures compliance and ease of transactions. Here are some guidelines:

Recording and retaining resale certificates are also important for compliance with state regulations, as improper handling could lead to penalties or audits.

FAQs about the CRT-61 certificate

Many common questions arise regarding the CRT-61 Certificate of Resale. Here are responses to some frequently posed inquiries:

Important links and resources

For further exploration into sales tax and resale certificates, useful resources include links to state-specific sales tax information and access to additional forms related to resale certificates.

If you need assistance with the CRT-61 form, do not hesitate to reach out to your local revenue department or consult tax professionals who specialize in sales tax regulations.

Related topics

Understanding sales tax regulations is essential for any business. Related topics include exploring sales tax exemptions by state, managing sales tax exemption certificates effectively, and ensuring vendors keep resale certificates up-to-date.

Additionally, comprehending the implications of economic nexus on resale certificates is vital for out-of-state transactions and compliance.

Popular posts and additional insights

Navigating complex sales tax issues can be challenging. Exploring popular posts on document management collaborative strategies can enhance your operational efficiency, especially when working in teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute crt-61 certificate of resale online?

How do I make edits in crt-61 certificate of resale without leaving Chrome?

Can I create an electronic signature for the crt-61 certificate of resale in Chrome?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.