Assessment Appeals Clerk of Form: A Comprehensive Guide

Overview of assessment appeals process

An assessment appeal is a formal request made by property owners to dispute their property tax assessment. This process is vital because it allows homeowners to challenge the assessed value of their properties, potentially leading to lower property taxes. In many regions, assessments may not accurately reflect current market values, making the appeals process a crucial step for taxpayers seeking fairness.

Filing an assessment appeal can significantly impact a homeowner's budget. Timely appeals can lead to substantial savings, but they require awareness of key deadlines. Depending on the jurisdiction, these deadlines for filing an appeal may vary, often falling shortly after property tax assessments are released, usually within 30-60 days.

Understand local property tax laws.

Gather evidence supporting your appeal.

File your appeal within the specified deadline.

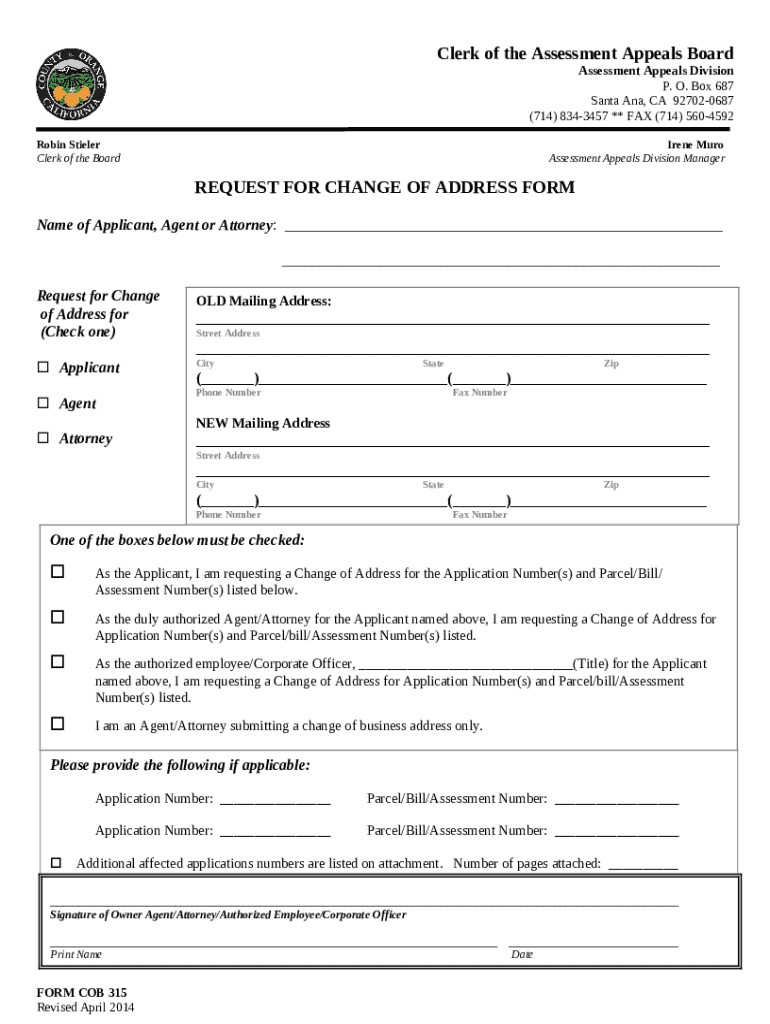

Understanding the role of the clerk in assessment appeals

The Clerk of the Board plays a pivotal role in the assessment appeals process. This official is responsible for managing the incoming appeals, ensuring they are complete and filed properly. Their duties include maintaining records of all submitted appeals, scheduling hearings, and notifying involved parties of dates and outcome information.

Additionally, the clerk facilitates the appeal process by providing crucial information about filing procedures, required documentation, and relevant timelines. They act as a liaison between property owners and the assessment appeals board, helping to clarify procedures and answer questions that might arise during the appeals.

Essential forms for assessment appeals

Successful appeals begin with understanding what forms are required for filing. These forms vary by jurisdiction, but typically, at least three essential documents are necessary. Familiarity with these forms ensures a smoother filing process.

This form initiates the appeal and provides the basic details about the property and the owner's intent.

This form collects detailed information about the property in question, including recent sales and physical characteristics.

This checklist helps ensure that all necessary documentation is included when submitting the appeal.

To make the process easier, pdfFiller offers downloadable versions of these forms, ensuring that users can access them easily and fill them out without hassle.

Step-by-step guide to completing the assessment appeal form

Completing the assessment appeal form involves collecting necessary information, starting with the property's Identification Number (APN #). This identification is crucial for tracking and processing your appeal. Along with the APN, gathering evidence that supports your claim, such as recent comparable sales ('comps'), is vital.

Accuracy is key when filling out the form. Each section should be completed thoughtfully. Typos or incorrect details can result in delays or even dismissal of the appeal. Common mistakes to avoid include failing to attach required documentation or misrepresenting property details.

Ensure your APN # is accurate.

Attach all necessary evidence including comps.

Double-check the form for typos and missing information.

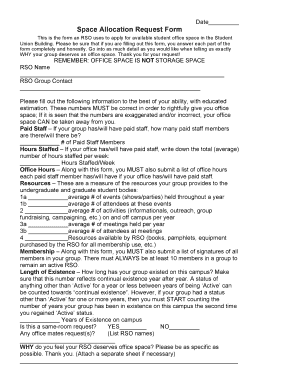

Filing your assessment appeal

Once your appeal form is completed, the next step is submission. Various options are typically available for filing your assessment appeal. Understanding these methods will help facilitate a smoother process and ensure timely submission.

A convenient option that allows for instant submission and tracking.

Submitting by mail may take longer but is often preferred by individuals who want physical records.

An often overlooked method that can expedite the process if urgent.

In addition to these options, it's essential to be aware of associated fees. Some jurisdictions may charge a fee to file an assessment appeal, while others may waive it depending on the circumstances.

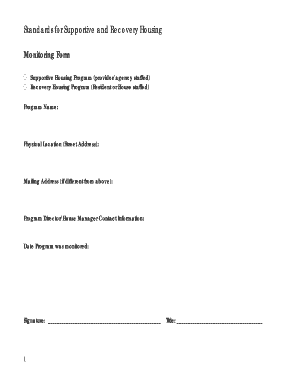

Hearing process and what to expect

The hearing process is integral to assessment appeals. Once an appeal is filed, a hearing will be scheduled where the evidence will be reviewed. Understanding the difference between an Assessment Appeals Board and a Hearing Officer can clarify the process for appellants. Boards usually consist of appointed officials, while Hearing Officers may include trained professionals tasked with reviewing cases.

Preparation for the hearing is critical. This includes organizing evidence and rehearsing presentations. Be ready to explain your case clearly. Depending on your jurisdiction, hearings may be conducted in-person or remotely, so be prepared to adapt to either format.

After you file: what happens next?

Once you’ve submitted your appeal, it’s essential to understand what happens afterward. The timeline for consideration can vary by jurisdiction, but applicants should expect notification of hearing dates within a few weeks. Keeping track of these dates will help ensure you are prepared for the subsequent proceedings.

Following the hearing, written findings of fact will be issued to inform you of the decision. This documentation will detail the outcome of your case and is crucial for any potential further actions or appeals.

FAQs about assessment appeals

Navigating the assessment appeals process raises numerous questions. A frequently asked concern is whether property taxes must be paid while the appeal is pending. Generally, taxes are due regardless of pending appeals, but some jurisdictions allow for payment plans while awaiting decisions.

Another common inquiry involves the necessity of hiring an agent or attorney. While not required, professional representation can enhance your chances of success. If a deadline is missed, consult your clerk's office immediately, as late appeals may be uncontested based on specific circumstances. Lastly, property owners may wonder whether they should invest in formal appraisals; this is often unnecessary for appeals but can provide strong support if obtaining one.

Do I have to pay property taxes while my appeal is pending?

Is hiring an agent or attorney necessary for my appeal?

What if I miss a deadline?

Do I need to pay for a formal appraisal?

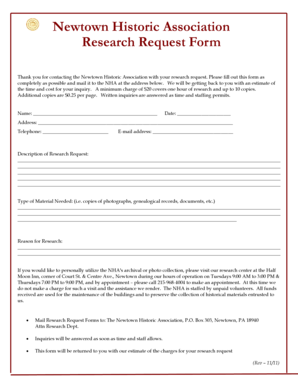

Resources and support for assessment appeals

Accessing the necessary resources for your assessment appeal is crucial. The Clerk’s Office remains the primary point of contact for questions or guidance on appeal procedures. It’s recommended to visit their website regularly for updated information, downloadable forms, and detailed instructions tailored to your jurisdiction.

Additionally, seeking community forums or support groups can be beneficial. These platforms allow you to connect with other property owners who have navigated the appeals process and can provide valuable firsthand advice.

Leveraging pdfFiller for your assessment appeals

pdfFiller simplifies the assessment appeals process by offering a cloud-based platform for filling out, editing, and signing your forms. Users can seamlessly collaborate with team members, ensuring that all necessary information is gathered and formatted correctly before submission.

Utilizing pdfFiller also provides users the flexibility to access and manage documents from anywhere, making it easier to meet deadlines and stay organized throughout the appeals process.

Case studies: successful assessment appeals

Reviewing successful case studies can offer insights into the best practices for conducting assessment appeals. For instance, a homeowner in California successfully reduced their property taxes by providing strong evidence of recent sales in the area that supported a lower market value. Such examples underscore the importance of thorough preparation and clearly presenting evidence.

These case studies serve as valuable learning opportunities. By understanding what worked for others, new appellants can adopt similar strategies, approaching their own appeals with confidence and clarity.

Accessibility and assistance

Ensuring that the assessment appeals process is accessible to everyone is crucial. Many Clerk’s Offices are committed to making their services available to individuals with disabilities. This includes offering assistance in completing forms, understanding requirements, and attending hearings.

Website accessibility certifications should be prominently displayed, signaling the office's commitment to inclusivity. It’s imperative that all users are given equal opportunity and support throughout the appeals process.