Get the free Tax Invoice / Registration Form

Get, Create, Make and Sign tax invoice registration form

Editing tax invoice registration form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax invoice registration form

How to fill out tax invoice registration form

Who needs tax invoice registration form?

Tax Invoice Registration Form: A Comprehensive How-to Guide

Understanding the tax invoice registration form

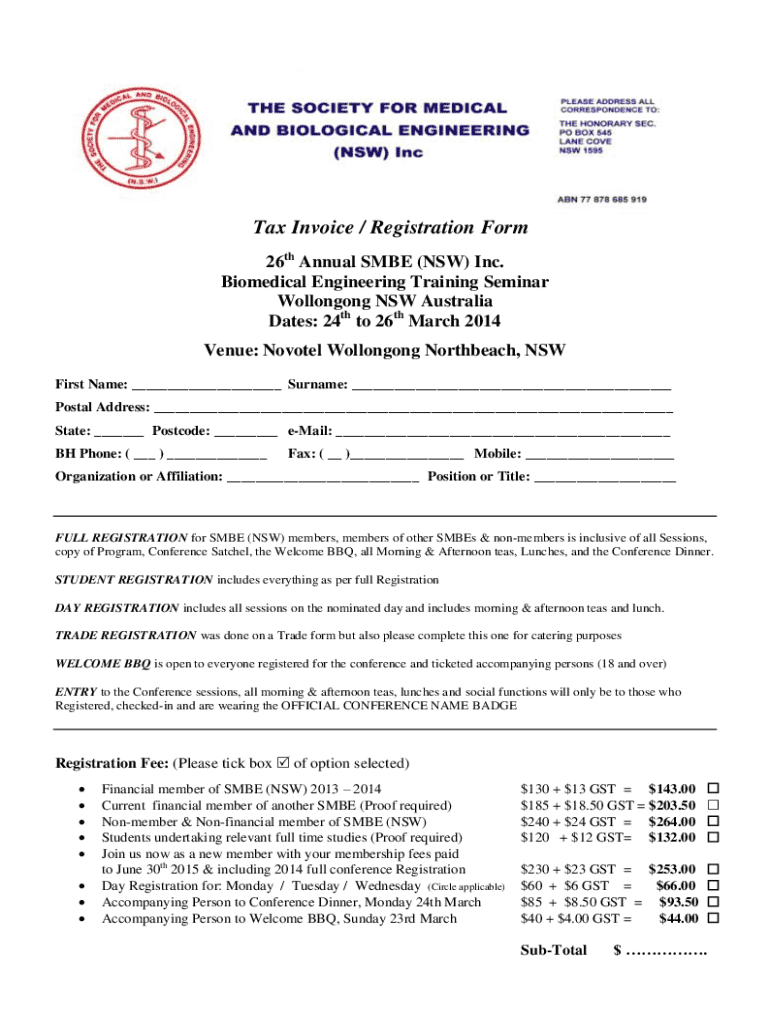

The tax invoice registration form is a critical document when it comes to documenting business transactions that involve goods and services subject to taxation. Its primary purpose is to ensure compliance with local tax laws, especially those dealing with Goods and Services Tax (GST) in countries like Australia. This form facilitates the proper declaration of tax liabilities and aids the government in revenue collection.

Proper registration is vital for businesses. It prevents challenges during tax audits, helps avoid penalties, and ensures that businesses can claim input tax credits efficiently. Unlike general invoices, which may not specify tax-related information, tax invoices must display specific details such as the seller's tax identification number, the specific tax rate applied, and the total tax amount charged.

Who needs to fill out a tax invoice registration form?

Typically, both businesses and individuals engaged in taxable sales need to fill out a tax invoice registration form. Individuals selling goods or services that are subject to taxation are also required to comply. Moreover, different jurisdictions may have specific requirements depending on local laws governing taxation. For instance, businesses registered for GST in Australia must adhere to strict invoicing regulations.

Preparing to complete your tax invoice registration form

Before starting the registration, it’s essential to gather all necessary information. Key details such as the business name, address, and contact information are fundamental. Additionally, providing your Australian Business Number (ABN) is pivotal for operating within the GST framework. Notably, ensuring that all information matches what’s registered with the Australian Tax Office (ATO) will help avert complications.

Furthermore, it's crucial to have supporting documents on hand. Proof of identity and evidence of business activities can help substantiate your application. For example, utility bills in the business name can serve as proof of address, and bank statements might demonstrate ongoing business operations.

Step-by-step guide to filling out the tax invoice registration form

Filling out the tax invoice registration form can be straightforward when approached systematically. Below is a breakdown of the essential sections of the form:

To avoid common mistakes, double-check all entries for accuracy, ensuring that the figures align correctly with the items sold and the tax obligations.

Editing and managing your tax invoice registration with pdfFiller

After submitting your tax invoice registration form, you may need to make changes or updates. pdfFiller offers an intuitive platform for managing these documents. Users can easily access their completed forms through the cloud and make necessary modifications without hassle.

Signing your tax invoice registration form securely

The signing process for a tax invoice registration form is crucial, as it legitimizes the document for legal scrutiny. By utilizing e-signature capabilities, users can ensure that their forms meet compliance requirements based on local e-signature laws. pdfFiller provides a step-by-step guide for implementing secure e-signatures, ensuring your consent is formally recognized.

Tax invoice registration form samples

Understanding how to fill out a tax invoice registration form can be more manageable with real examples. Sample filled-out forms illustrate how each section should appear and clarify potential questions users may have. For instance, a mock tax invoice may highlight the key components like taxation amounts, scheduled payment timelines, and authorized signatures.

Common queries about tax invoice registration

Business owners and individuals often encounter questions regarding the tax invoice registration process. What happens if a tax invoice is rejected? Or how can one amend a registered invoice? Knowing the answers to these queries can clarify the processes involved in tax invoice management.

Related documentation and record keeping

Maintaining accurate records of tax invoice registrations is crucial for any business. A well-organized approach to documentation not only aids in compliance but also enhances efficiency during audits. Businesses should retain copies of issued tax invoices, payment confirmations, and any correspondence regarding tax matters.

FAQs surrounding the tax invoice registration process

Frequently asked questions provide valuable insights into the nuances of the tax invoice registration process. Many individuals want to know what steps to take if they lose a registered tax invoice, how registered invoices affect tax filings, and whether it's possible to register an invoice after the transaction date.

Exploring further with pdfFiller

pdfFiller not only provides functionalities for filling out tax invoice registration forms but also offers a suite of features for complete document management. Users can integrate the software with other applications, facilitating a seamless workflow across platforms. Subscription options are available to suit varying needs, from individuals to large teams, making document creation accessible for everyone.

Expanding your knowledge on related tax topics

It's essential for users to understand the broader context of taxation, especially regarding GST and its relation to tax invoices. Familiarizing yourself with the invoicing landscape within your jurisdiction allows for better compliance and financial planning. Resources for tax education are available, paving the way for informed decision-making in your business operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax invoice registration form?

How do I execute tax invoice registration form online?

How do I complete tax invoice registration form on an Android device?

What is tax invoice registration form?

Who is required to file tax invoice registration form?

How to fill out tax invoice registration form?

What is the purpose of tax invoice registration form?

What information must be reported on tax invoice registration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.